As the global economy became increasingly unstable during 2010, investors all over the world flocked to precious metals such as gold, silver, copper and platinum. The price of gold set an all-time record high last year, and gold investors were euphoric. Many analysts are projecting that prices for gold, silver and other precious metals will continue to soar throughout 2011. But does that mean that everyone should just suddenly jump into gold and silver? No, it does not. Precious metals are not for everyone. Just like any other kind of investing, it is absolutely crucial that you get educated before you get involved. Investing in precious metals is very different from other kinds of investments. There are significant hazards and pitfalls to watch out for. But if you take the time to do it right, investing in precious metals can be very rewarding, and it can potentially be a great way to protect your wealth against the tremendous inflation that is coming in the years ahead.

As the global economy became increasingly unstable during 2010, investors all over the world flocked to precious metals such as gold, silver, copper and platinum. The price of gold set an all-time record high last year, and gold investors were euphoric. Many analysts are projecting that prices for gold, silver and other precious metals will continue to soar throughout 2011. But does that mean that everyone should just suddenly jump into gold and silver? No, it does not. Precious metals are not for everyone. Just like any other kind of investing, it is absolutely crucial that you get educated before you get involved. Investing in precious metals is very different from other kinds of investments. There are significant hazards and pitfalls to watch out for. But if you take the time to do it right, investing in precious metals can be very rewarding, and it can potentially be a great way to protect your wealth against the tremendous inflation that is coming in the years ahead.

The following are ten key things that you should know before jumping into gold and silver....

#1 Precious Metals Markets Are Highly Manipulated

Big financial institutions, and even governments, openly manipulate the precious metals markets. This is an open secret that you should know if you plant to invest in precious metals. Those who think that they can jump in and out of gold or silver and make a killing usually end up learning a very painful lesson. Investing in precious metals should be done for the long-term unless you really, really know what you are doing.

So why is long-term investing safer? Well, as we have seen over the past few years, the short-term manipulation of gold and silver prices usually gets trumped by the long-term trends in the end.

But that doesn't mean that gold, silver and other precious metals won't take some very significant short-term tumbles.

The following "mini-documentary" does an excellent job of examining some of the strange things that we have seen in the precious metals markets recently....

#2 The Long-Term Trends Are Very Favorable For Precious Metals

As the U.S. dollar has declined, gold, silver and other precious metals have been going up, up, up over the past decade. Investors all over the globe have been flocking to the safety and stability that they provide.

Just check out the following chart which shows how the price of gold has risen dramatically over the past decade. In fact, this chart is a little out of date. At one point during 2010, the price of gold exceeded $1400 an ounce. As you can see, those who have been investing in gold for the long-term have been doing very, very well....

Many analysts are extremely bullish on gold right now. For example, Peter Schiff believes that the price of gold is going to eventually hit $5000.

So does that mean that what Schiff is saying is actually going to happen?

Nobody can tell you for sure what is going to happen.

But one thing is for sure - we are entering uncharted territory in world financial markets. At this point, just about anything is possible.

#3 Gold Holds Value Over Long Periods Of Time

In ancient Rome, an ounce of gold would buy you a nice suit. A hundred years ago, an ounce of gold would buy you a nice suit. Today, an ounce of gold will buy you a nice suit.

Meanwhile, the U.S. dollar has lost well over 95 percent of its value over the last 100 years.

So which is better to hold on to for the long-term - U.S. dollars or gold?

#4 The Value Of The Dollar Is Going Down

Usually (but not always) when the value of the dollar goes down, the value of gold goes up. As the U.S. government and the Federal Reserve have been flooding the system with new dollars, investors across the globe have been flocking to precious metals.

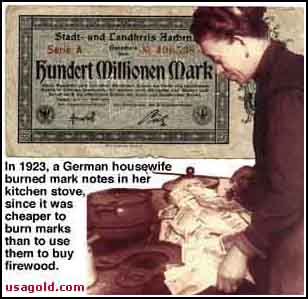

At some point in the years ahead we are going to be facing some very, very serious inflation. When that time arrives, U.S. dollars are not going to be worth a whole lot. But all of that gold and silver you have stored up still will be.

#5 Physical Gold Is Preferable To Paper Gold

When investing in gold, it is much more preferable to actually take possession of the physical gold than it is to have a piece of paper that says that you have invested in gold. Someday when the financial system crashes, you may find that your "piece of paper" is not going to do you much good.

#6 Diversification Is Key

When investing in precious metals, it is important to diversify. This spreads out your risk. Some investors accumulate as many different precious metals as they can. Others diversify by getting precious metals from a variety of dealers or by accumulating it in different forms - coins, bars, jewelry, etc.

It is always wise not to put all of your "eggs" in one basket.

#7 Accumulate Different Denominations If You Can

In the future, if you actually need to spend your precious metals you don't want them all to be of the same denomination if possible. For example, if you need to buy a little bit of food, you don't want to only have high value coins. Variety is a good thing, and accumulating different coin denominations is another way that you can diversify.

#8 You Cannot Eat Precious Metals

Investing in precious metals should be done only after you have gathered together an adequate emergency food supply. If the global economy completely shatters, having gold and silver is not going to be good enough. You are going to need lots of food for you and your family. So be sure to take care of the necessities before you invest in precious metals.

#9 Do Not Advertise That You Are Accumulating Precious Metals

Don't go around telling everyone that you are storing up precious metals. That is just going to make you a target. Investing in precious metals is something to be done quietly.

#10 Get Educated

I cannot stress this point enough. If you want to invest in precious metals, you need to get educated. People that do not know what they are doing are at much greater risk of getting burned. Be smart enough to realize what you do not know. Don't be too proud to ask for advice. Seek out reputable dealers. If you take the time to do things right, then you will have the best chance for success.

The following video contains some more facts and figures about investing in gold. I do not know anything about the organization that put this video together, but this video is well produced and it presents a lot of important information about gold in an entertaining manner....

CLICK ABOVE LINK FOR THE VIDEO