Posted on 04/13/2012 4:44:55 AM PDT by MsLady

Has anyone else gotten this email from the WH. My gf sent this to me. I copied the link off the email. Looks like it'll track you if you click on the link.

What's your Buffett number? Just enter a few pieces of information about your taxes, and see how many millionaires pay a lower effective tax rate than you.

Then under it is a calculator and it says 33,400 millionaires paid a lower effective tax(whatever the heck that is) in 2009 then someone making $45,000 a year.

maybe we need an interactive that shows how many jobs a millionaire creates or supports, versus Buffets secretary

My number is ONE BILLION>>>>It’s the same as what he owes in back taxes and won’t pay.

What an excellent idea!!!!

http://www.politicalmathblog.com/

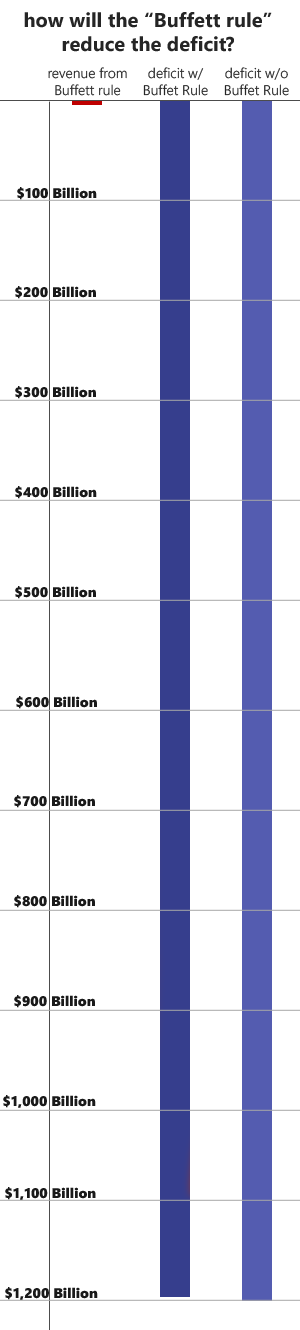

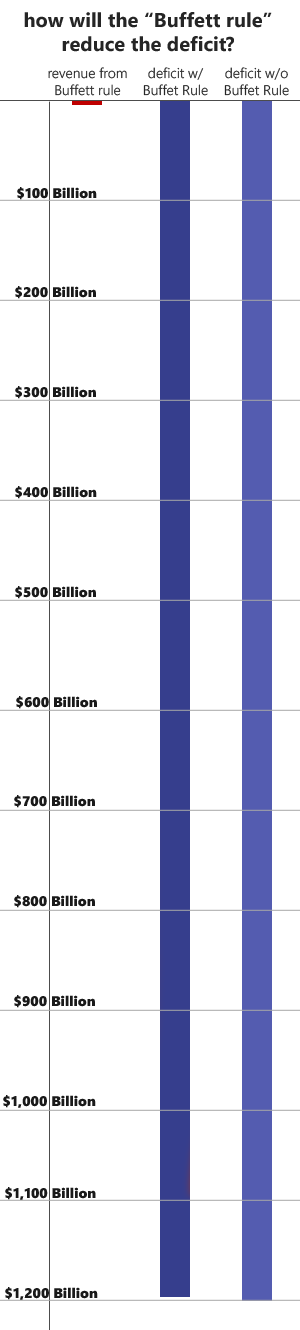

Go to this site and scroll down to the second graph. It will blow you away how much difference the Buffet Rule will make in the deficit.

We need to get this info out and about. If I knew how to copy and paste it I would.

More disingenuous confusion foisted upon us by Obama. Let me ask a question: What is a millionaire?

Buhler? Buhler? Anyone?

A millionaire is someone who has accumulated assets in excess of one million dollars. It is not (necessarily) someone who earns in excess of one million dollars a year. In accounting terms, an amount of assets is a balance sheet number, as opposed to an earnings statement number.

There are many people in this country who are now retired who, primarily by purchasing a home several decades ago, are "millionaires." The home that they bought in 1975 for $100,000 is, in many areas, worth 5 or 6 times that in today's dollars. Counting other assets--stocks, bonds, mutual funds, etc., it is not that rare an occurrence for someone who had a relatively successful career (but is not anywhere near being a "one percenter") to now have total assets that exceed a million dollars.

Many such "millionaires" are now living on social security, plus the income generated by their portfolios, and, in some cases, a pension from their former place of employment. The total of such payments is often fairly pedestrian, and could easily be below the $45,000 level cited by Obama.

If they want to tax assets (the accumulation of which is what defines "millionaire") then they should talk about a wealth tax, rather than comparing what you earn to what someone else has accumulated. Of course, to the left, the term "millionaires and billionaires" includes anyone making over $200,000.

Thank you so much for the info. I knew whatever the WH was pushing was a lie. I just have no idea what effective tax was. I figured it was like a small business. The really big fish like Warren will hide their money or spend millions fighting the IRS over a billion dollars in taxes. It’s worth it to spend 20 or 30 million to save a billion. Warren is a hypocrite and he makes me sick, him and his rich secretary(yea, like all secretaries....NOT). And no, I’m not begrudging her salary. She should make a good living, she’s a high powered secretary, probably works many hours and under a lot of stress. But, the hypocrisy makes me want to puke.

I heard about it yesterday. I think it’s like over a 10 year period it’ll give the fed. gov spending money for a week.

How about a web site that shows:

How many people in the grocery store are having their groceries paid for by you and other hard working tax payers?

and

How many people on Public Assistance drive a nicer car than you?

Based upon projected Federal spending for 2012 ($3.7 trillion), the additional tax revenue received from applying the "Buffett rule" (using static revenue assumptions, mind you) would be spent by the Federal government in.... wait for it..... eight hours.

Not FoundERROR: 404 - The requested URL was not found on this server. |

It looks like they shut down your link. You are supposed to read it and just obey, not critically evaluate it.

The White House website now has a “Buffett Rule Calculator” that invites Americans to quickly figure how many U.S. millionaires pay a less effective federal tax rate than they do.

http://www.whitehouse.gov/blog/2012/04/12/whats-your-buffett-number

I am impressed. I would have done this but don’t know how! Thanks!

“It looks like they shut down your link. You are supposed to read it and just obey, not critically evaluate it.”

Typical...they don’t expect anyone to REALLY evaluate ANYthing.

To quote Charles Krauthammer today:**The Buffett Rule redistributes deck chairs on the Titanic, ostensibly to make more available for those in steerage. Nice idea, but the iceberg cometh. The enterprise is an exercise in misdirection — a distraction not just from Obama’s dismal record on growth and unemployment but, more importantly, from his dereliction of duty in failing to this day to address the utterly predictable and devastating debt crisis ahead.**

PFFFT on this sham!

| Tax rate | millionaires with lower effective tax rate |

|---|---|

| 35% or more | 236900 |

| 34% | 236600 |

| 33% | 234200 |

| 32% | 225000 |

| 31% | 208600 |

| 30% | 187100 |

| 29% | 130300 |

| 28% | 130300 |

| 27% | 106700 |

| 26% | 88000 |

| 25% | 74900 |

| 24% | 66800 |

| 23% | 61000 |

| 22% | 56300 |

| 21% | 52400 |

| 20% | 48700 |

| 19% | 45500 |

| 18% | 41600 |

| 17% | 37600 |

| 16% | 33400 |

| 15% | 28100 |

| 14% | 22300 |

| 13% | 16400 |

| 12% | 13500 |

| 11% | 11800 |

| 10% | 10600 |

| 9% | 9400 |

| 8% | 8500 |

| 7% | 7400 |

| 6% | 6500 |

| 5% | 5700 |

| less than 5% | 5200 |

Since we are developing tax policy based on the eeeeeeevil rich who only pay capital gains (or even give it the Full Kerry and invest mainly in tax free municipal bonds), we are creating a third income tax system (after the main one and the increasingly hostile alternative minimum tax) to fix the "problem" caused by 28,100 people. And how many of those are "millionaires" for one year only from selling a primary residence and are able to exclude up to $500,000 of the capital gain?

That’s it!!! Wonder how many gulli-a-bull people will buy this lie?

Charles is awesome!!! That hits the nail right on the head.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.