Skip to comments.

The Falling Market

Vanity

| 2/6/2018

| EBH

Posted on 02/06/2018 5:28:24 AM PST by EBH

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-76 next last

To: EBH

The Stock Market and The Greater Fool Theory:

“The greater fool theory states that the price of an object is determined not by its intrinsic value, but rather by irrational beliefs and expectations of market participants. A price can be justified by a rational buyer under the belief that another party is willing to pay an even higher price. In other words, one may pay a price that seems “foolishly” high because one may rationally have the expectation that the item can be resold to a “greater fool” later.”

21

posted on

02/06/2018 5:48:44 AM PST

by

donaldo

To: EBH

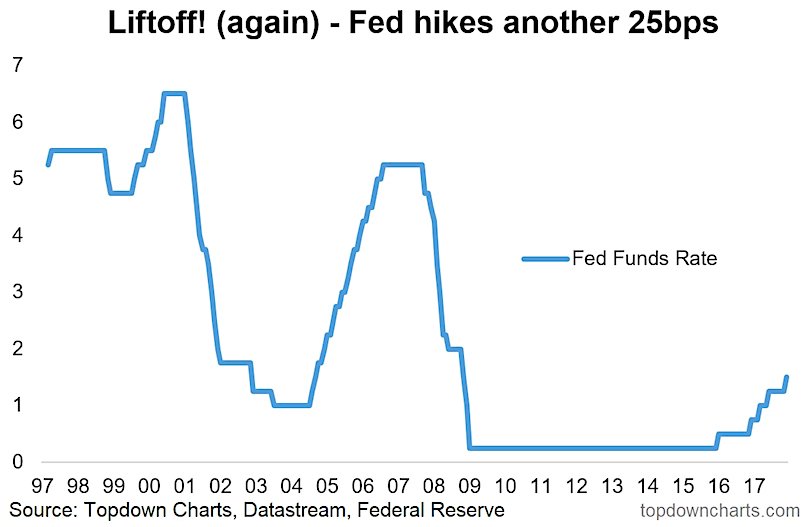

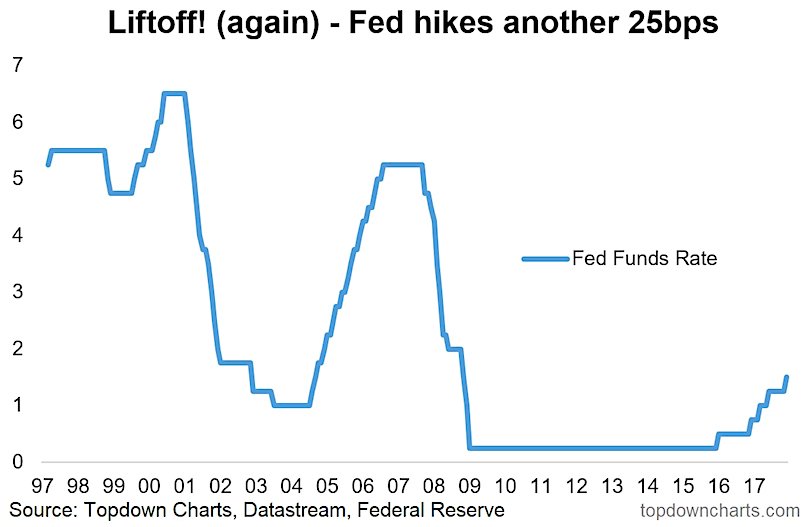

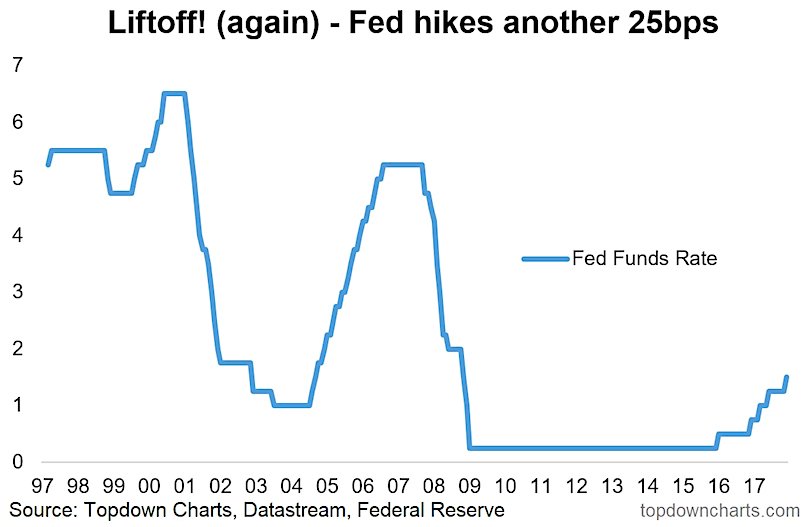

The Fed kept interest rates near zero for all of Obama’s 8 years.

Here you can see that only in 2017 (The start of the Trump presidency) can you see the Fed raising rates at a very steep angle. There is no need to raise rates as inflation is very low.

The Fed will continue raising rates as they have SAID they will . They want to crash the stock market and real estate market to cause a recession to destroy Trump.

22

posted on

02/06/2018 5:48:54 AM PST

by

Democrat_media

(Mueller doing coup vs Trump. Obama was adding 97,000 pages of government regulations /year)

To: EBH

Noticed there is an absence of market analyst saying what a great buying opportunity this is.

23

posted on

02/06/2018 5:49:51 AM PST

by

DocRock

(And now is the time to fight! Peter Muhlenberg)

To: Smittie

Its about percentages! If the stock market has a record high, you can expect a “record correction” ... but in percentages they are relatively normal.

24

posted on

02/06/2018 5:49:56 AM PST

by

ThePatriotsFlag

(We are getting even more than we voted for!)

To: EBH

“”due to profit taking by liberal democrats””

HA! That would mean politicians as according to them, the middle class has been decimated by Republicans for years and they have nothing.....no investments/no profits!

To: E. Pluribus Unum

I agree.The Fed propped up Obama and now the Fed is out to destroy the economy and Trump. audit and get rid of the Fed.

26

posted on

02/06/2018 5:50:52 AM PST

by

Democrat_media

(Mueller doing coup vs Trump. Obama was adding 97,000 pages of government regulations /year)

To: EBH

There was no fundamental reason for the drop, ergo it was a technical drop most likely due to trading algorithms (the internal workings of which no one truly knows or understands) and due to stop loss orders set by naive investors to protect new purchases. Note that for such a big drop, the volume wasn't all that great.

BTW, once the price begins to slide downward through stop loss trigger prices, there is a quick buildup of sale orders which chase prices downward.

I never use stop loss orders for that reason.

As the market stands right now, I think traders are going to be testing the market for a bottom so they can jump in a pick up some bargains.

27

posted on

02/06/2018 5:51:37 AM PST

by

RoosterRedux

(Onward Christian Soldiers!)

To: EBH

Soros at work? I have no idea how he manipulates markets and currencies but I’m sure he is at work - not even behind the scenes anymore - with Schiff as his puppet! Don’t even pretend to understand any of it except to know that there’s a whole lot of corruption going on!

To: EBH

Sudden markets drop happen when people stop expecting a drop, all caution is thrown aside and everyone gets on the band wagon. What we’re seeing is a herd panic. This drop will be sharp but short, and the market will “catch its breath”. This is how healthy markets behave.

To: dp0622; RKV

To: EBH

Come on guys. It is simple enough. The Schiller price earnings ratio index had a recent max of reached 33 at the peak a couple of weeks ago. It normally trades in the range of 10-20. Rising interest rates and there is a lot of downside risk with very little upside potential [very positive earnings growth was already built in to stock prices].

In the business of buying cheap and selling dear, stock prices had become very very dear.

To: EBH

Just sell everything today, and buy it back next week.

32

posted on

02/06/2018 5:57:47 AM PST

by

fruser1

To: E. Pluribus Unum

Uh no, guess you didn’t read far enough of what I wrote.

Let me rephrase,

That bubble is going to need to deflate, I am grateful President Trump has taken steps to institute tax cuts and bring work back home as mitigating factors.

33

posted on

02/06/2018 5:57:48 AM PST

by

EBH

( May God Save the Republic)

To: babble-on; EBH

"An enormously expensive market does not need a catalyst for a drop. It just drops." In all markets prices change depending on supply and demand. In free and healthy markets this is understood and accepted. In manipulated markets, whether by government or cabals, prices are manipulated artificially and it hard to discover the "real and true" value of a thing. Even in fair and open markets there are times when the price discovery/corrections get out of whack due to the emotional nature of people. Focus on fundamentals and this too shall pass.

34

posted on

02/06/2018 5:58:18 AM PST

by

outofsalt

(If history teaches us anything it's that history rarely teaches us anything.)

To: EBH

I’ve heard several theories & no one thinks it’s just one thing.

One theory is that it’s a correction and will level off, another is the market reacting to possible rising inflation, another is that a new Federal Reserve Board Chairman was sworn in Monday, another is that investors are reacting to the market drop last week causing a big sell-off. I’m sure there are more. Whatever it is, the market hit 20,000 on Jan 25, 2017 and it’s now 24,340. We’re still way ahead of the game. The European markets are tumbling because of Wall St. so the market will react to that & is expected to go down again today.

Hang in there

35

posted on

02/06/2018 5:58:52 AM PST

by

nuconvert

( Khomeini promised change too // Hail, Chairman O)

To: babble-on

Well, this time it was supposed to be different. It isn’t. High P/Es and very low but rising interest rates. There is only one direction for stock prices as we see over and over again. With a strong underlying economy after a correction to normal valuations - whatever that means - things should be fine.

To: allendale

I agree that course isn’t going to be easy these first 4 years with President Trump. And none of it will be his fault either. As I see it, it will all fall on the democrats heads as they are the one’s who created the bubble.

37

posted on

02/06/2018 6:01:03 AM PST

by

EBH

( May God Save the Republic)

To: outofsalt

Ah, but you can tell when it is getting pricey. Look at the

Chart of the Schiller P/E indexThere are two other times in history it has peaked this much, 2000, and 1929. Remember what happened next.

To: dila813

The supply is fine but the credit markets are going to charge more interest. A lot of people buy stocks with loans (leverage) and are selling to pay off their margin accounts before the interest rates go up. This is part of the over supply of stocks with real buyers waiting to find the bottom before stepping up.

39

posted on

02/06/2018 6:03:39 AM PST

by

outofsalt

(If history teaches us anything it's that history rarely teaches us anything.)

To: allendale

A lot of the irrational exuberance is the consequence of the QE put in place to ensure nothing bad happened that would interfere with the inevitable election of Her Holy Highness.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-76 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson