Posted on 07/23/2011 10:14:25 AM PDT by Kaslin

Yes, an actual trust, with an actual fund.

No, not the one we have now — which is neither a “trust” nor a “fund.” My idea is an actual trust, with an actual fund.

Here is the way the current “trust fund” works, based on the official explanation on the Social Security website: all money is “invested” on a daily basis in “special issues” of the U.S. Treasury, which are not marketable securities like other Treasury securities but supposedly provide “the same flexibility as holding cash” since they can be redeemed at any time — assuming the Treasury can later borrow enough money to pay them, since the government immediately spends the money and no longer has it when the time for repayment comes.

When your taxes are paid into the “trust fund,” the cash actually (in the words of the website) “goes into the general fund of the Treasury and is indistinguishable from other cash in the general fund.” Translation: there is no Social Security “fund,” much less one held in “trust” by trustees complying with normal fiduciary standards in protecting your retirement assets. The federal government gives the money to itself, spends it, and promises it will pay it back later.

You might think a shorter way to describe the Social Security “trust fund” would be as a mere accounting device, a paper account simply holding IOUs. The government apparently gets a lot of questions about this, because it shows up on the Social Security Administration’s FAQ page:

Q. Why do some people describe the “special issue” securities held by the trust funds as worthless IOUs? What is SSA’s reaction to this criticism?

A. Far from being “worthless IOUs,” the investments held by the trust funds are backed by the full faith and credit of the U. S. Government. The government has always repaid Social Security, with interest. The special-issue securities are, therefore, just as safe as U.S. Savings Bonds or other financial instruments of the Federal government.

This answer reminds me of the one a friend of mine gave that got him off jury duty. One of the defense lawyers questioning him as a prospective juror said: “This is a lawsuit against my client, which is a large insurance company — do you think you would be unduly prejudiced against such a defendant?” My friend thought for a moment and answered: “Unduly prejudiced — no, I don’t think so.” He was dismissed.

When the Social Security trust fund gives its money to the government, which spends it and provides simply a promise to repay, does the trust fund only get “completely worthless IOUs” to hold? No, not completely.

But they are IOUs just the same, just like any other IOU of the federal government (except that, unlike public debt, they cannot be sold on the open market by the “trustees”). When there is a problem — say a debt ceiling that can’t be exceeded, or a downgrading of government debt that makes it hard for the government to borrow much more (including amounts necessary to pay the “special issues”), or a limit is reached to the taxes the government can impose on the people to fund prior obligations — Social Security recipients suddenly find out that their “trust fund” is at risk, and that they are running risks no different than your average Chinese creditor.

It turns out neither Grandma nor the Chinese has a trust fund. Grandma has only a website that tells her: “I took your money and spent it, but don’t worry — I replaced it with an IOU and I will hold my IOU for you in trust. Don’t let anyone tell you it’s worthless — I’ll borrow some money from some other people later on to repay it. And I can keep doing this indefinitely.”

The federal government is fortunate it is not bound by generally accepted accounting principles (GAAP), or by the Sarbanes-Oxley law, or by the criminal statutes relating to Ponzi schemes. If it were, the Social Security “trustees” would be in jail. One can only imagine the cross-examination of the “Managing Trustee of the Trust Funds” (currently Timothy Geithner) on how he gave the money to the secretary of the Treasury (currently Timothy Geithner) in exchange for Geithner’s promise to repay Geithner, who won’t be around when the repayment comes due.

So here’s my idea: an actual trust, and an actual fund. Instead of the federal government “investing” in the federal government, invest the money in the Social Security fund in the securities of American companies, through publicly-traded mutual funds. It would be a balanced approach (which should be sufficient to get President Obama’s backing for this idea): an equal mixture of stock and debt in publicly-traded companies on the New York Stock Exchange.

There are many advantages to this idea, beyond the obvious one that it would put actual assets into the fund that the government could not get its hands on: First, it would mean that the federal government, instead of investing in itself or simply spending the money, would be investing in America.

Second, the federal government would be putting more money into the country’s capital markets, instead of borrowing from them in ever-increasing amounts.

Third, the federal government might become a little more sympathetic to the need for tax relief for American companies, currently paying one of the highest corporate tax rates in the world, and for relief from burdensome regulations, and the continually increasing costs of simply hiring employees. If the government invested in funds holding the stock and debt of those companies, it might be more concerned about the need for those companies to prosper and grow, even if it took a lower tax rate, less federal mandates, and a few corporate jets to make it happen.

Fourth, the history of investment returns indicates that anyone investing long-term in a balanced mixture of stock and debt of American companies has generated significantly greater returns than simply investing in the debt of the federal government. The Social Security trust fund would have more money to provide for the retirement of Americans — which was the original purpose of the fund before it became a cash cow for other goals.

In 2004, President Bush proposed that younger people have the right to invest a portion of their Social Security taxes in a private investment account for their retirement. Both Democrats and Republicans in Congress rejected that idea. They thought it wouldn’t be prudent to let people control their own accounts. They feared it would take away from other things they wanted to do with the money until “the out years.” They liked the “trust fund” the way it was, especially its reassuring name, although some proposed it be renamed a “lockbox” to provide further assurance.

My idea is to let the taxes remain with the government, but require them to be placed in investments that will be better for everyone, and keep the fund honest in the process. Think of it as an actual fund, held in actual trust, for the benefit of the beneficiaries, rather than the government.

Here’s an idea: The government cannot be trusted to tell the truth about anything on any given day. Stop trusting them to care for you when you are old and sick.

Phase Social Security out over time.

Leave me the hell alone to take care of myself.

Stop doing things “for me” or “for my own good”.

Here is a Idea how about,rounding up everyone who touched it, then charge them with a capitol crime,Punishable by the needle!

These are nothing but Terrorists.

[ Here’s an Idea: How About a Real Social Security Trust Fund? ]

Because!... Social Security is pure socialism.. NOT like socialism BUT pure died in the wool socialism..

thats WHY?..

Capitalism creates wealth and rotates it, socialism uses that wealth up..

Simply really...

Congress should pass a law forcing the federal government to comply with GAAP and the others; I would love to watch the Dems go crazy opposing it for the government while insisting on it for Wall Street.

Instead of the federal government “investing” in the federal government, invest the money in the Social Security fund in the securities of American companies, through publicly-traded mutual funds.

IOW, The author proposes we move from a system of Fascism where the government controls the means of production to full out Socialism where the government owns the means of production.

How about I just manage my own retirement and let the government run the court system and the military?

Howabout a way to opt out of SS all together?

“My idea is to let the taxes remain with the government, but require them to be placed in investments that will be better for everyone, and keep the fund honest in the process.”

Actually, whether we have a retirement is not the government’s business. But since everybody thinks it is, what if everybody contributed to their personal 401k where they could control how it’s invested? Why must the government be involved at all? The government has shown they can’t have money lying around without “borrowing” it. It’s like living with a cocaine addict and having your retirement fund in cocaine sitting on the coffee table. They’ll borrow it until it’s gone.

Lock box!

This talk of honesty and transparency regarding the government and anything it does is the most hilarious line of the piece.

Ha! You beat me to it.

A specific example of smaller local units of government choosing to opt out of Social Security to design their own pension plans occurred in 1981, when Congress still allowed government units to make that choice. The three Texas gulf coast counties of Brazoria, Galveston, and Matagorda selected a private investment firm to manage their employees’ retirement plans with a guaranteed annual return of 6.5 percent.

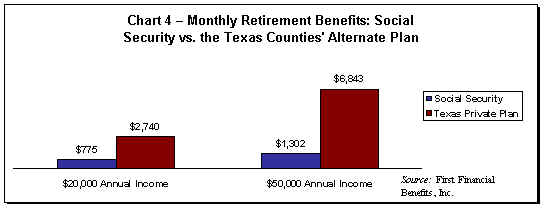

By 1996 the results were in, and county employees’ retirement benefits were triple what would have been paid by Social Security for a worker who earned $20,000 per year and over five times the Social Security benefits for a worker whose pay was $50,000 (see Chart 4, next page). Congress closed the local government opt-out window in 1983 with major Social Security reform legislation that raised taxes and effectively reduced benefits by raising the eligible retirement age after 2015

My monthly SSI is $1400 I would rather the $6,843!

Will NEVER happen!

This classroom discussion ignores that politicians love using this piggy bank for funding vote buying schemes.

Income tax rates would ALL go up 7% (Gross) if they put the SSI treasure out of reach.

How about this idea (guaranteed to provoke some interesting responses from professional pols)

We have a choice of whether to put the Social Security “tax” in our own private trust fund or let the .gov hold it for us. Of course, we would be required to prove to the .gov that we had in fact put that money aside, and would not be allowed to borrow against it without strict requirements for payback, with interest.

Those who felt unable to manage their own “Social Security” would always have the ,gov option, right?

And when the government is the majority stockholder in every huge corporation do you think Chuck Schumer or Dick Durbin could keep their fingers off of them?

I’d rather the gov’t butt-out of retirement planning, but if we must have some intervention, I like the Chilean plan better. They have the option to have the gov’t set it aside or put to it in low-risk investment portfolios.

There’s no such thing as a “lock-box” or “trust fund” with the way our monetary system works. SS contributions are just FRN taken out of circulation by taxation. Even if a “trust fund” account were established to offset them on the other side of the transaction, the effect is the same as rolling it over into the general budget.

The real problem with SS is that it’s an unworkable ponzi, and was never intended to be anything but a slush fund for gov’t spending. SS came into being when the average life expectancy was 60, and the age to collect was 65. You do the math on how much the gov’t actually expected to pay out. Now the average life expectancy is 80. Not gonna work.

This is the real solution, just allow opt out on an individual voluntary basis. No more gunpoint ponzi schemes and the politicos could blame it on the will of the people, thereby removing them from blame. No more “third rail” to fear.

Those who want to stay in can just divy up the procedes and get what they can from each other. Problem solved.

My guess is that at least half would opt out, thus reducing the unfunded liability by a huge amount.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.