Nor is it anthropogenic environmental damage.

It most certainly is not "overpopulation." Neither is it "peak oil." Nor is it food shortages.

The greatest threat facing mankind is, however, "anthropogenic."

Because the greatest threat facing mankind is the general failure of mankind to reproduce:

And the primary means by which mankind has stopped reproducing are abortifacient hormonal contraceptives and abortion itself.

Fewer tells a monumental human story, largely ignored, but which promises to starkly change the human condition in the years to come. Never before have birth and fertility rates fallen so far, so fast, so low, for so long, in so many places, so surprisingly. In Fewer, Ben Wattenberg shows how and why this has occurred, and explains what it means for the future. The demographic plunge, he notes, is starkly apparent in the developed nations of Europe and Japan, which will lose about 150 million people in the next half century. Starting from higher levels, but moving with geometric speed, the demographic decline is also apparent in the less developed nations of Asia, Africa, and Latin America. Only the United States (so far) has been exempt from the birth dearth, leaving America as more than "the sole super-power." Perhaps it should be called the global "omni-power." These stark demographic changes will affect commerce, the environment, public financing, and geo-politics. Here Wattenberg lists likely winners and losers. In Wattenberg's world of "The New Demography" readers get a look at a topic often chattered about, but rarely understood.

You’ve heard about the Death of the West. But the Muslim world is on the brink of an even greater collapse. WILL WE GO DOWN IN THE IMPLOSION? Thanks to collapsing birthrates, much of Europe is on a path of willed self-extinction. The untold story is that birthrates in Muslim nations are declining faster than anywhere else—at a rate never before documented. Europe, even in its decline, may have the resources to support an aging population, if at a terrible economic and cultural cost. But in the impoverished Islamic world, an aging population means a civilization on the brink of total collapse— something Islamic terrorists know and fear. Muslim decline poses new threats to America, challenges we cannot even understand, much less face effectively, without a wholly new kind of political analysis that explains how desperate peoples and nations behave. In How Civilizations Die, David P. Goldman—author of the celebrated “Spengler” column read by intelligence organizations worldwide—reveals how, almost unnoticed, massive shifts in global power are remaking our future.

Remarkably, most conventional wisdom about the shifting balance of world power virtually ignores one of the most fundamental components of power: population. The studies that do consider international security and demographic trends almost unanimously focus on population growth as a liability. In contrast, the distinguished contributors to this volume—security experts from the Naval War College, the American Enterprise Institute, and other think tanks—contend that demographic decline in key world powers now poses a profound challenge to global stability. The countries at greatest risk are in the developed world, where birthrates are falling and populations are aging. Many have already lost significant human capital, capital that would have helped them innovate and fuel their economy, man their armed forces, and secure a place at the table of world power. By examining the effects of diverging population trends between the United States and Europe and the effects of rapid population aging in Japan, India, and China, this book uncovers increasing tensions within the transatlantic alliance and destabilizing trends in Asian security. Thus, it argues, relative demographic decline may well make the world less, and not more, secure.

Overpopulation has long been a global concern. But between modern medicine and reduced fertility, world population may in fact be shrinking--and is almost certain to do so by the time today's children retire. The troubling implications for our economy and culture include:* The possibility of a fundamentalist revival due to the decline of secular fertility* The threat to the free market as the supply of workers and consumers declines* The eventual collapse of the American health care system as inordinate expenses are incurred by an aging populationPhillip Longman's uncompromisingly sensible solutions fly in the face of traditional ideas. State intervention is necessary, he argues, to combat the effects of an aging population. We must provide incentives for young families, and we cannot close our eyes and hope for the best as an entire generation approaches retirement age.The Empty Cradle changes the terms of one of the most important environmental, economic, and social debates of our day.

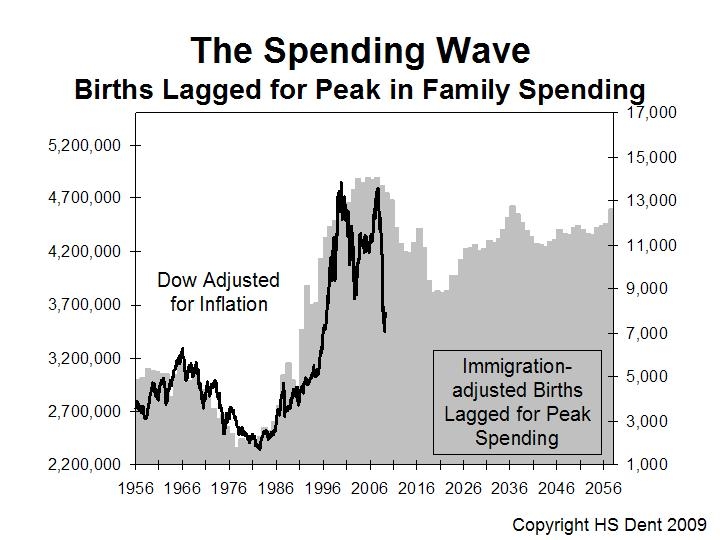

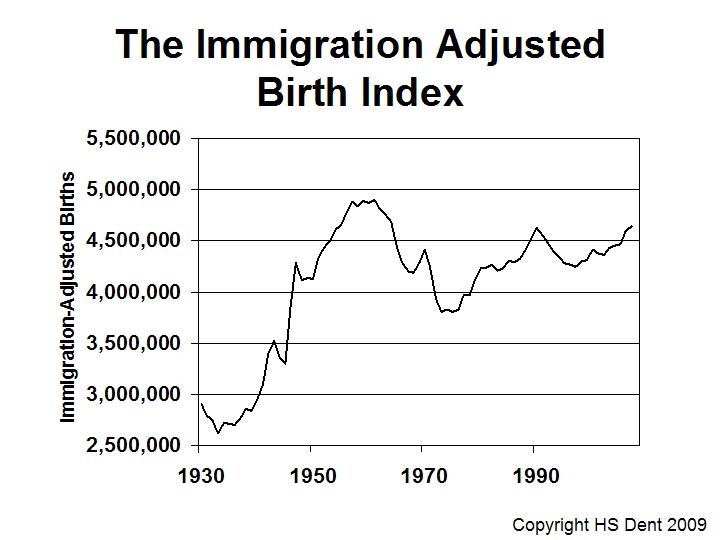

The world's population is still growing, thanks to rising longevity. But fertility rates - the average number of children born per woman - are falling nearly everywhere. More and more adults are deciding to have fewer and fewer children. Worldwide, reports the UN, there are 6 million fewer babies and young children today than there were in 1990. By 2015, according to one calculation, there will be 83 million fewer. By 2025, 127 million fewer. By 2050, the world's supply of the youngest children may have plunged by a quarter of a billion, and will amount to less than 5 percent of the human family. The reasons for this birth dearth are many. Among them: As the number of women in the workforce has soared, many have delayed marriage and childbearing, or decided against them altogether. The Sexual Revolution, by making sex readily available without marriage, removed what for many men had been a powerful motive to marry. Skyrocketing rates of divorce have made women less likely to have as many children as in generations past. Years of indoctrination about the perils of "overpopulation" have led many couples to embrace childlessness as a virtue. Result: a dramatic and inexorable aging of society. In the years ahead, the ranks of the elderly are going to swell to unprecedented levels, while the number of young people continues to dwindle. The working-age population will shrink, first in relation to the population of retirees, then in absolute terms. A world without children will be a poorer world - grayer, lonelier, less creative, less confident. Children are a great blessing, but it may take their disappearance for the world to remember why.

Demographic Winter: Decline of the Human Family (DVD/ Documentary) by Rick Stout

Product Overview One of the most ominous events of modern history is quietly unfolding. Social scientists and economists agree - we are headed toward a demographic winter which threatens to have catastrophic social and economic consequences. The effects will be severe and long lasting and are already becoming manifest in much of Europe.

A groundbreaking film, Demographic Winter: Decline of the Human Family, reveals in chilling soberness how societies with diminished family influence are now grimly seen as being in social and economic jeopardy.

Demographic Winter draws upon experts from all around the world - demographers, economists, sociologists, psychologists, civic and religious leaders, parliamentarians and diplomats. Together, they reveal the dangers facing society and the world’s economies, dangers far more imminent than global warming and at least as severe. These experts will discuss how:

The “population bomb” not only did not have the predicted consequences, but almost all of the developed countries of the world are now experiencing fertility rates far below replacement levels. Birthrates have fallen so low that even immigration cannot replace declining populations, and this migration is sapping strength from developing countries, the fertility rates for many of which are now falling at a faster pace than did those of the developed countries.

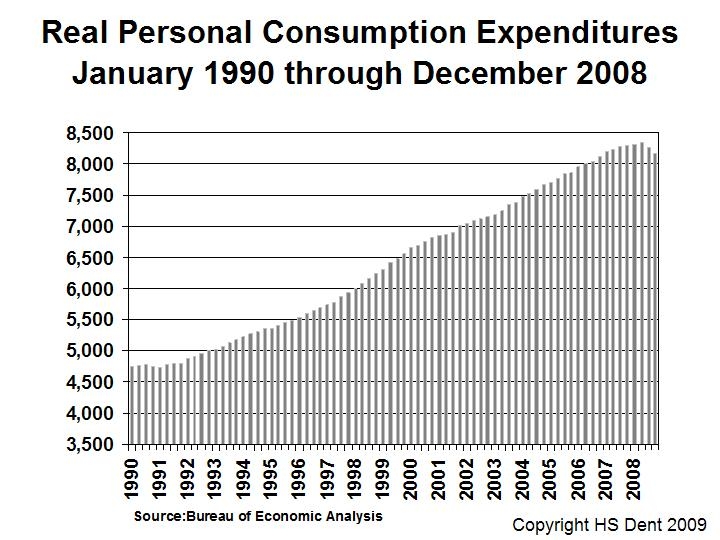

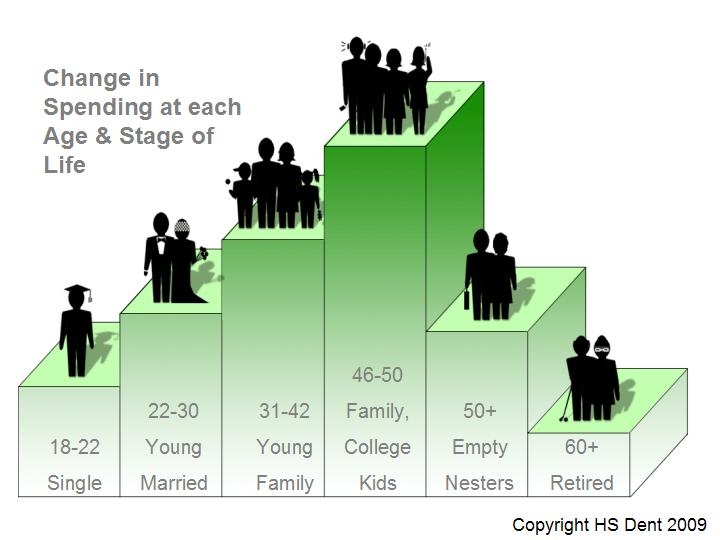

The economies of the world will continue to contract as the “human capital” spoken of by Nobel Prize winning economist Gary Becker, diminishes. The engines of commerce will be strained as the workers of today fail to replace themselves and are burdened by the responsibility to support an aging population.

Government programs will slow-bleed by the decrease in tax dollars received from an ever shrinking work force. The skyrocketing ratio of the old retirees to the young workers will render current-day social security systems completely unable to support the aging population.

Our attempts to modernize through social engineering policies and programs have left children growing up in broken homes, with absentee parents and little exposure to extended family, disconnected from the generations, and these children are experiencing severe psychological, sociological and economic consequences. The intact family’s immeasurable role in the development and prosperity of human societies is crumbling.

The influence of social and economic problems on ever shrinking, increasingly disconnected generations will compound and accelerate the deterioration. Our children and our children’s children will bear the economic and social burden of regenerating the “human capital” that accounts for 80% of wealth in the economy, and they will be ill-equipped to do so.

Is there a “tipping point”, after which the accelerating consequences will make recovery impossible without complete social and economic collapse? Even the experts can’t tell us how far we can go down this road, oblivious to the outcomes, until we reach a point where sliding into the void becomes unpreventable.

Only if the political incorrectness of talking about the natural family within policy circles is overcome will solutions begin to be found. These solutions will necessarily result in policy changes, changes that will support and promote the natural, intact family.

Just as it took the cumulative involvement of activist organizations, policy makers, the business world and the media to create the unintended consequences we are beginning to experience, so it will take the holistic contribution of all of these entities, together with civic and religious organizations, to change the hearts and minds of all of society to bring about a reversal.

It may be too late to avoid some very severe consequences, but with effort we may be able to preclude calamity. Demographic Winter lays out a forthright province of discussion. The warning voices in this film need to be heard before a silent, portentous fall turns into a long, hard winter.

Demography is destiny. But not always in the way we imagine, begins Pearce (When the Rivers Run Dry) in his fascinating analysis of how global population trends have shaped, and been shaped by, political and cultural shifts. He starts with Robert Malthus, whose concept of overpopulation—explicitly of the uneducated and poor classes—and depleted resources influenced two centuries of population and environmental theory, from early eugenicists (including Margaret Sanger) to the British colonial administrators presiding over India and Ireland. Pearce examines the roots of the incipient crash in global population in decades of mass sterilizations and such government interventions as Mao's one child program. Many nations are breeding at less then replacement numbers (including not only the well-publicized crises in Western Europe and Japan, but also Iran, Australia, South Africa, and possibly soon China and India). Highly readable and marked by first-class reportage, Pearce's book also highlights those at the helm of these vastly influential decisions—the families themselves, from working-class English families of the industrial revolution to the young women currently working in the factories of Bangladesh.

What is the impact of demographics on the prospective production of military power and the causes of war? This monograph analyzes this issue by projecting working-age populations through 2050; assessing the influence of demographics on manpower, national income and expenditures, and human capital; and examining how changes in these factors may affect the ability of states to carry out military missions. It also looks at some implications of these changes for other aspects of international security. The authors find that the United States, alone of all the large affluent nations, will continue to see (modest) increases in its working-age population thanks to replacement-level fertility rates and a likely return to vigorous levels of immigration. Meanwhile, the working-age populations of Europe and Japan are slated to fall by as much as 10 to 15 percent by 2030 and as much as 30 to 40 percent by 2050. The United States will thus account for a larger percentage of the population of its Atlantic and Pacific alliances; in other words, the capacity of traditional alliances to multiply U.S. demographic power is likely to decline, perhaps sharply, through 2050. India's working-age population is likely to overtake China's by 2030. The United States, which has 4.7 percent of the world's working-age population, will still have 4.3 percent by 2050, and the current share of global gross domestic product accounted for by the U.S. economy is likely to stay quite high.

Martin Luther called the "Sin of Onan" marital sodomy. In the Judeo-Christian and Natural Law tradition, any sex act made deliberately infecund is no better than sodomy.

So in considering the greatest threats facing mankind, one must also consider this:

by Dr. Jeff Mirus, September 7, 2004

The Bible mentions only four sins which cry out to God for vengeance. Considering the source and the emphasis, we have little choice but to examine our consciences on these points. A cursory examination will not do; we must cast off our cultural preconceptions to see beyond the obvious.

Homicide

And the Lord said, “What have you done? The voice of your brother’s blood is crying to me from the ground.” (Gn 4:10) It is hardly suprising that Cain’s murder of Abel provides the first instance of one of these sins that cries out for Divine vengeance. While all sins disrupt the natural order in some way, those enumerated as crying out to God appear to be chosen because they strike at nature’s root.

It is easy to see how murder fits into this category. The unjust termination of the life of another is a profound violation of “how things should be” precisely because our very nature compels us to regard our own lives as precious. To take a person's life is to terminate in another what we instinctively regard as our own highest good.

Sadly, the ease with which we understand the foulness of murder may be conditioned more by our culture than by Divine Revelation. We must take care that we do not find it abhorrent only insofar as we are creatures of society, rather than creatures of God.

Abortion is a case in point.

Sodomy

Then the Lord said, “Because the outcry against Sodom and Gomorrah is great and their sin is very grave, I will go down to see whether they have done altogether according to the outcry which has come to me.” (Gn 18:20-21) The inhabitants of Sodom and Gomorrah were guilty of homosexual activity. So far gone were they in this vice that the men of the town would not even accept heterosexual license with Lot’s daughters, both virgins, as a means of sating their lust (see 19:8-9).

Here we have another case in point for cultural conditioning. It is far more difficult for our contraceptive culture to see how contrary to nature homosexuality is. Those of us who instinctively feel its deep unnaturalness rightly react to homosexual activity with disgust, but logical arguments are unlikely to produce the same reaction in those whose instincts are damaged, blunted or rationalized away.

It is precisely in such situations that Divine Revelation is so very useful, for we cannot trust our feelings when they run counter to reality. We require a better guide. Sodomy strikes at the root of human nature because of its perversion of the procreative impulse, without which the race must die. But in case we don’t see it, God does.

Oppression of Widows and Orphans

“You shall not afflict any widow or orphan. If you do afflict them, and they cry out to me, I will surely hear their cry.” (Ex 21-23) There is a deep truth in this passage about the relationships of husbands to wives, and of parents to children, and about how vulnerable wives and children become when their natural protection is removed.

Very probably all of us can see that it would be gravely sinful to take advantage of the weakness and vulnerability of either a widow or an orphan, and we can readily imagine the financial burdens and solicitation of “favors” with which either can be afflicted. It is much easier in every way to abuse a boy or girl who has no father and to intimidate a woman who has no husband.

Once again, however, we must remove our social blinders to see the great evil in our culture which turns so many into widows and orphans in the first place. The grave sin of divorce, by which natural protection is ripped away from women and children, surely tops the list of horrors under this heading.

Cheating Laborers of Their Due

“You shall not oppress a hired servant who is poor and needy, whether he is one of your brethren or one of the sojourners who are in your land within your towns; you shall give him his hire on the day he earns it, before the sun goes down (for he is poor, and sets his heart upon it); lest he cry against you to the Lord, and it be a sin in you.” (Dt 24:14-15) Here we come to a principle of sound social order: those in positions of authority and wealth have serious obligations to those who depend on their decisions for their well-being. Fortunately, we live in a very wealthy society.

But does our very wealth cause this sin to appear irrelevant? Free enterprise is an excellent system, but too often it carries the completely unnecessary baggage of a callous attitude toward employees, regarding them as commodities. The social teachings of the Church have attempted to address this concern (without pointing at all toward socialism) for over a century.

Yet the latest trend, at least in the United States, is constant mergers and buyouts which throw hundreds of thousands out of work while enriching an elite few. Even temporary unemployment is both a bank-breaker and a heart-breaker. Working under an abusive or negligent boss can be a living nightmare. And most of us are well-shielded from adults who must work for a minimal wage. The Israelites were urged to remember their days in Egypt, and treat others accordingly.

Together and In Order

All of these sins cry out to God, but the four are not equal. The sequence in the text suggests a hierarchy of value, and it is a tightly linked hierarchy. One sin leads to another, from the gravest to the least, as we make objects out of persons and treat them accordingly, subverting all our natural relationships. For this reason, we cannot assuage our consciences by attending to the fourth sin while ignoring the first, or by claiming virtue on the third and closing our eyes to the second. If these sins cry out to God for vengeance and we still commit them or do nothing to restrict them in others, we mock God to His face. Of course, when we’re wearing our usual cultural blinders, it often appears to us that we can mock God with impunity. But isn’t this something else we know from Revelation—in case we cannot see it for ourselves?

The Obama administration would do well to recall these foundational principles before trying to force the only Church in the world still fighting for the future of humanity, and against this greatest threat to it, to cave in and pay for contraception and abortifacients:

Obama administration is taking a wrong-headed line with the church

Forcing contraception insurance coverage goes too far

NEW YORK DAILY NEWS

Sunday, January 22 2012, 4:10 AM

Louis Lanzano/AP

Archbishop Timothy Dolan has lambasted the Obama administration for putting health policy ahead of moral teachings.