Posted on 02/15/2012 1:52:36 PM PST by Razzz42

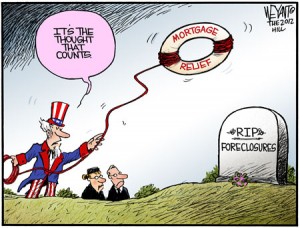

It is official. State and federal governments have condoned forgery, perjury and fraud in what’s been called the “robo-signing” foreclosure debacle. Last week, the five biggest banks in America signed on to a $26 billion deal that, basically, lets them off with a slap on the wrist for fraudulently foreclosing on homes in the last few years. I am not going to go on and on about how unfair and unjust this deal was or how the rule of law has been thrown down the stairs. I am going to focus on the fallout of this morally corrupt deal.

There is $700 billion in negative home equity with nearly half (11 million) of all houses underwater. Meaning, more is owed on the mortgage than the home is worth. This settlement may help a few folks, but it is a drop in an ocean of debt. Now that the deal is done, look for the pace of foreclosures to pick up speed and home values to take another cliff dive. If you thought the negative equity problem was at the bottom–forget it. The plunge in real estate prices is far from over, and it’s not going to turn positive anytime soon. Consider the latest Case-Shiller report where year-over-year declines in home values averaged 3.7% nationwide. This is despite 30-year mortgage rates at or below 4% and a big slowdown in foreclosures because federal and state governments were negotiating a deal for the past 16 months.

Banks are desperate for cash, and they are going to unlock all they can as fast as they can. After all, people can’t live in a house forever without paying. The banks are not going to enter a new age of morality when they just got a “get out of jail free” card from prosecutors. Rolling Stone’s Matt Taibbi wrote last week, “The only acceptable foreclosure deal had to bring about a complete end to robosigning and the other similar corrupt practices that grew up around it (like for instance gutter service, the practice of process servers simply signing affidavits saying they delivered summonses, instead of really doing it). But this deal not only doesn’t end robosigning, it officially makes getting caught for it inexpensive.” (Click here for the complete Taibbi post.)

The Obama administration said, last week, this deal will be good for “struggling homeowners.” It will be good if you are a speculator looking for a deal, but it won’t help out homeowners who have equity and pay their mortgage on time. Last week, a Bloomberg report said, “A surge of home seizures may drive down values, at least for a while, in a fragile market. The number of new foreclosure filings fell 34 percent last year, according to RealtyTrac, resulting in a backlog that now may flood the market with low- cost properties. About 1 million foreclosures will be completed this year, up 25 percent from 2011, according to the firm.” (Click here for the complete Bloomberg story.)

The new flood of foreclosures will depress prices, and more and more people will figure out they are sunk and will stop paying for a submerging investment. I say the fall will not be temporary. Declining prices will be the prevailing trend, especially when interest rates begin to rise. Mortgage interest rates cannot remain at these cut-rate levels forever and won’t. The Huffington Post reported last week, “. . . Amherst Securities Laurie Goodman noted that with our current housing trajectory, we can expect up to 10 million more defaulted mortgages over the next decade. These foreclosures impacts housing values, reduce consumer purchases, and costs municipalities money.” (Click here for the complete Huffington Post article.)

Housing prices are headed down. Most people cannot fathom year after year of declining prices. But, that’s what’s coming, and I see nothing that will stop the slide. Not only does this deal hammer home prices but pension funds and mutual funds that invested in mortgage-backed securities. Small investors and homeowners everywhere are stuck on the same bus staring down a steep hill, and this so-called “robo-signing” settlement just cut the brake lines.

Between demographics and a declining standard of living alone make this predictable.

ML/NJ

BS!!!! They are swimming in liquidity (cash and near cash instruments) because loan demand is not there. Like most banks I know, my bank is the most liquid in its history.

Can someone tell the author that when you default on your mortgage, you should expect your home to be foreclosed on. You should not be rewarded with a blackmailed extortion from the lender who seeks to recover the property that you were able to buy with the lender’s money.

As long as there is high unemployment, a recession/depression, a weak dollar, global uncertainty and a marxist dicator in the White House, the real estate market will remain where it is and perhaps sink lower.

Housing prices are headed down. Most people cannot fathom year after year of declining prices. But, that’s what’s coming, and I see nothing that will stop the slide.

FOUR MORE YEARS!!!!

/MS

There are a lot of fishy issues with this article.

- $26 billion is hardly a “slap on the wrist”. Sounds like another Obama shakedown.

- My understanding is the “robo-signing” is a ficticiuos term.

- If it is a real term, how does one “robo-sign” a foreclosure...I thought that the term applied to mortgage approvals, if it applies to anything at all.

The fraud was committed by the Federal and state governments who went after the banks because they did not follow foreclosure procedures precisely enough. The issue never was that these foreclosures weren’t justified. These were mortgage borrowers who had DEFAULTED on their mortgages. The default rates were so high that the banks were cutting corners in order to process the mountain of foreclosures. Guess who is going to be paying these billions of dollars. It will not be the banks. The cost will be recovered by raising fees on bank customers, most of whom did not default on their mortgages.

My wife and I are counting on the current depression (correction?) in the housing market to make our own dream of home ownership a reality.

Went and looked at 5 $30K houses today, more tomorrow.

Nonsense.

Fraud is fraud is fraud. You can't foreclose on something you dont own! I can't forclose on your house if I don't own the title!

Then you try to forge documents to kick them out of the fraudulent house!

The bigger problem with this is that we are creating a GENERATION of people who will not be credit worthy. How are the banks going to make money then? They will have to wait till the next generation comes along. Will they go bankrupt in the meantime? Not likely. That would not be good for America, now would it? {sarcasm}

In most areas, housing prices are just now getting back to where they would have been had we not had an insanely overheated real estate bubble. That's a GOOD thing in the long run.

It's too bad about those folks who bought homes in 2005 and are now taking a major haircut, but that is what happens to those who buy at the top of the market.

And you need to read carefully the stories about the forlorn foreclosed. In many cases they had lots of equity and a low payment before they took out big refinances and lines of credit, spending the money on bling bling. People in that situation rank about 364,988th on my sympathy list.

Toxic Assets Relief Program. I thought these mortgages were “toxic assets”.

This program, as I understand it, will make the banks lower the principle and refinance people who are behind in their payments. I’m in the middle of refinancing and the principle stays the same. Not behind on payments,,,,yet.

Evict all of the deadbeats. They just don’t want to work. Cut residential real estate prices by 4/5.

We’re only 3.5 years into this mess. It took some areas of the country 20+ years to bound back from 1929, including a world war in the process.

95% of all bank house loans during the bubble years were sold to Wall Street. Wall Street bundled the loans and sold them to investors, leaving the original loaning bank only being able to service the loan i.e. collect the mortgage payment, taking a small fee for doing so and then sending the remaining balance to Wall Street for investor’s share.

Banks never told the homeowner/mortgage payer or filed with the local County Recorder’s Office that the deed had changed hands. Then Wall Street never bothered with listing all the investor’s name on the note since they all (the investors) now owned part of the property.

In the meantime, banks, real estate agents and appraisers are all happily selling homes right and left to whoever shows up to sign the paperwork with ‘stated income documents’ (the paperwork where nothing is verified and taken at face value) all this with the approval or even behest of Congress as no one is left behind when applying for a loan.

The housing bubble pops the crash starts and foreclosures begin, except there is no note to foreclose on, it is no where to be found.

Enter MERS...from Wikepedia

“Mortgage Electronic Registration Systems, Inc. (MERS) is an American privately held company that operates an electronic registry designed to track servicing rights and ownership of mortgage loans in the United States.[1] MERS is owned by holding company MERSCORP, Inc.

The real estate law and real estate transactions in the US are subject to state regulations and county level recordation requirements, since the time of the establishment of the US as an independent country.[citation needed] That made it quite cumbersome for financial companies to develop a smooth operation of a market based on US mortgages in the early 1980s.[says who?] This is because every time a financial instrument containing mortgages is sold, various state laws may require that the sale of each such mortgage (or deed of trust) be recorded in the local county courts in order to preserve certain rights (e.g., the right to foreclose non-judicially), which triggers an obligation to pay corresponding recording fees.[citation needed] So, the financial industry, eager to trade in mortgage-back securities, needed to find a way around these recordation requirements, and this is how MERS was born to replace public recordation with a private one.[citation needed]. By 2007, MERS registered some two-thirds of all the home loans in the US.[2]

The company asserts to be the owner (or the owner’s nominee) of the security interest indicated by the mortgages transferred by lenders, investors and their loan servicers in the county land records. MERS maintains that its process eliminates the need to file assignments in the county land records which lowers costs for lenders and consumers by reducing county recording fee expenses resulting from real estate transfers[3] and provides a central source of information and tracking for mortgage loans.[4] The company’s role in facilitating mortgage trading was relatively uncontroversial in its early days a decade ago but continued fallout from the subprime mortgage crisis has put MERS at the center of several legal challenges disputing the company’s right to initiate foreclosures. Should these challenges succeed, the US banking industry could face a renewed need for capitalization...”

So now investors out their investment, counties are out the transfer fees, cities are out the property taxes, neighborhoods suffer the blight of abandoned houses and falling values, taxpayer’s paid full price for these mortgages via the GSEs (frannie, freddie, FHA, etc.) that bought all the banks bad paper at par as part of TARP and other bailouts, MERS is now outlawed, courts are ignoring simple contract law and banks settled with States and throw a bone to underwater homeowners that the bank’s and Congress’s actions caused.

But you are worried about some loser that might stay in a house for free for a year or asks to see the proper paperwork when it comes to a foreclosure.

That’s tough about not lowering the loan value and you probably won’t qualify for help after trying to jump through all the hoops because this settlement only sets aside a small amount of money for helping underwater homeowners.

At least interest rates are at historic lows, this helps when refinancing. Make sure you cover all the bases of possible avenues of refi but avoid paperwork that signs your life away on missed payments. IRS might want their cut on a downward loan adjustment as they look at it as you making money on the deal but things are changing so quickly it is hard to keep up. I’m sure the banks enjoy the confusion.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.