Why is consolidating all European currencies into one a political, and not economic, project, and consolidating all North American currencies into one an economic, and not political, project?

Posted on 11/28/2006 6:10:53 AM PST by Kimberly GG

In an interview with CNBC, a vice president for a prominent London investment firm yesterday urged a move away from the dollar to the "amero," a coming North American currency, he said, that "will have a big impact on everybody's life, in Canada, the U.S. and Mexico."

Steve Previs, a vice president at Jefferies International Ltd., explained the Amero "is the proposed new currency for the North American Community which is being developed right now between Canada, the U.S. and Mexico."

The aim, he said, according to a transcript provided by CNBC to WND, is to make a "borderless community, much like the European Union, with the U.S. dollar, the Canadian dollar and the Mexican peso being replaced by the amero."

Previs told the television audience many Canadians are "upset" about the amero. Most Americans outside of Texas largely are unaware of the amero or the plans to integrate North America, Previs observed, claiming many are just "putting their head in the sand" over the plans.

CNBC asked Previs whether he thought NAFTA was "working and doing enough."

He replied: "Until it created a lot of illegal immigrants coming across the border. I don't know. You get the pros and cons on NAFTA. For some people it is a good thing, and for other people it has been a disaster."

The speculation on the future of a new North American currency came amid a major U.S. dollar sell-off worldwide that began last week.

Yesterday, the dollar also reached new multi-month low against the euro, breaking through the $1.30 per euro technical high that had held since April 2005.

At the same time, the Chinese central bank set the yuan at 7.0402 per dollar, the highest level since Beijing established a new currency exchange system in 2005 that severed China's previous policy of tying the value of the yuan to the U.S. dollar.

Many analysts worldwide attributed the dramatic fall in the value of the U.S. dollar at least partially to China's announcement last week that it would seek to diversify its foreign exchange currency holdings away from the U.S. dollar. China recently has crossed the threshold of holding $1 trillion in U.S. dollar foreign-exchange reserves, surpassing Japan as the largest holder in the world.

Barry Ritholtz, chief market strategist for Ritholtz Research & Analytics in New York City, in a phone interview with WND, characterized today's downward move of the dollar as "wackage," a new word he coined to convey that the dollar is being "whacked" in this current market movement.

Ritholtz told WND that yesterday's downward move "was a major market correction that points to the risk of subsequent downside to the dollar."

Asked whether he would characterize the dollar's downside move as signaling a possible collapse, Mr Ritholtz told WND, "Not yet."

Ritholtz pointed out market professionals had long looked at a dollar collapse as a "low probability event," but the recent fall suggests "the probabilities have increased of a major dollar correction, or even of a collapse."

U.S. trade imbalances with China have hit a record $228 billion this year, largely reflecting a surging flow of containers from China with retail goods headed for the U.S. mass market.

Secretary of Commerce Carlos Gutierrez is in Bejing leading a trade delegation of more than two dozen U.S. business executives.

"The future should be focused on exporting to China," Guiterrez told reporters in Bejing, noting that this year, U.S. exports to China are up 34 percent on a year-to-year basis, surpassing last year's gain of 20 percent.

One way to improve the U.S. trade imbalance may be to ease up on restrictions of exporting high-tech products and allowing technology transfers to China, a move likely to be politically charged in the U.S.

The decline in value of the dollar will also make U.S. exports more attractive and Chinese exports to the U.S. more expensive.

In February 2007, a virtually unprecedented top-level U.S. economic mission is scheduled to travel to China. Included in the mission are Treasury Secretary Henry Paulson, Jr., Secretary of Commerce Carlos Gutierrez and Federal Reserve Chairman Ben Bernanke.

Previs declined to be interviewed for this article, telling WND in an e-mail he did not want to be quoted directly in any article that may express a political point of view.

Why is consolidating all European currencies into one a political, and not economic, project, and consolidating all North American currencies into one an economic, and not political, project?

Welcome.

The bit about the dollar taking a beating in the markets over the last week is largely true, but I think that the transition sentence "The speculation on the future of a new North American currency came amid a major U.S. dollar sell-off worldwide that began last week." is an incoherent connector between the fact about the dollar's slip and the dubious idea of a displacement of the dollar for the "amero".

Congratulations. It's a grand feeling, one that we know.

Whoever thought,'In God We Trust' would be written so small on our new one dollar coin, you have to use a magnifying glass to even see it. Beginning of the end for that phrase? The first step in removing God from our money?

I don't know where you were googling, Ivan, but I found plenty of hits for both.

If you keep nattering on things of which you're only marginally acquainted, someone is going to kick you in the arse for it.

Ivan

I repeat - anyone who says you're ditching the dollar for the Amero anytime soon is a fantasist or a liar.

Ivan

For the record, that is not a statement by the Bank of Canada but an article from their periodical Bank of Canada Review*, written by David Laidler who is described at the bottom as follows:

David Laidler is Fellow in Residence at the C. D. Howe Institute and Professor Emeritus at the University of Western Ontario.*Bank of Canada Review: "A quarterly publication featuring articles related to the Canadian economy and to central banking."

Furthermore, the fundamental truth that American policy makers are not interested in monetary union has not been challenged on this thread with any evidence remotely like the one I've posted. All I've seen is idiotic justifications for paranoia.

One other element to consider is that in order for monetary union to take place, all 3 currencies - Canadian Dollar, US Dollar and Mexican Peso would have to be on equal footing, including part of continuous linked settlement systems. The Mexican peso is not.

The European experience is also telling - it took nearly 10 years for it to occur successfully, and a lot of money spent on infrastructure, public awareness and so on.

To conclude - there is no will at present to do this, there are no plans in place to do this, and it could not be achieved in the dead of night through some conspiracy of governments.

Ivan

Is it clear now?

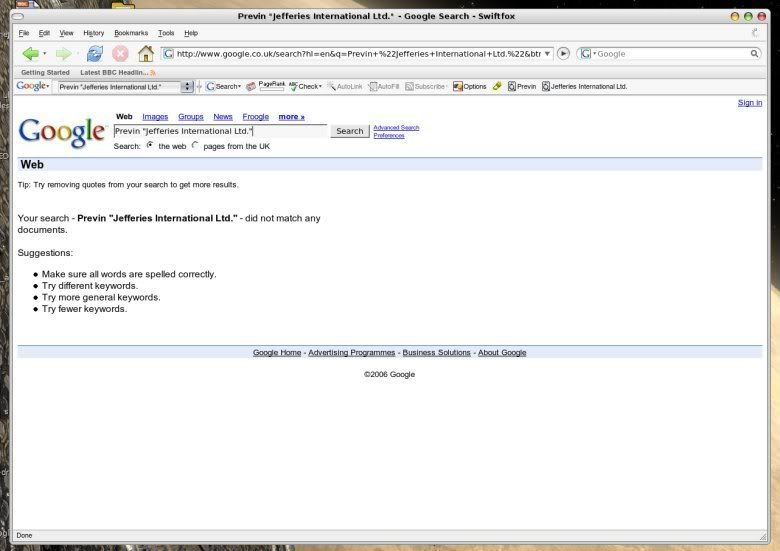

>>Jefferies is real, but Steve Previs could be a kook masquerading as a board member, a mythical fart in the wind, or something else entirely.

Funny... I got over 20 hits for Steve Previs and Jeffries, at Forbes.com alone.

http://www.google.com/search?hl=en&lr=&q=+site:www.forbes.com+steve+previs

There's only on Steve Previs mentioned in Forbes... the one that is with Jeffries. Follow the link.

Did YOU do the search with Previs and Jeffries separately, or TOGETHER?

It's a simple question and demands a SIMPLE answer!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.