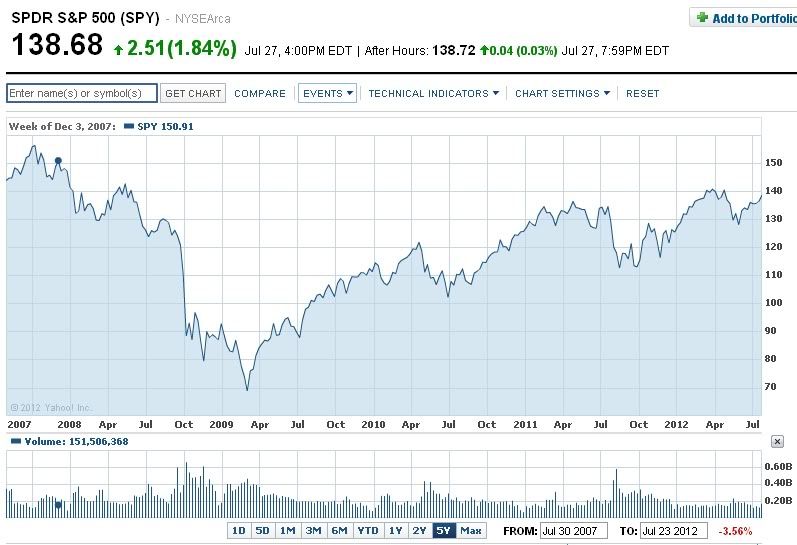

Probably the best snapshot proxy for overall NYSE volume is SPYders. Here's a 5 year chart showing volume. Volume down? Yeah, a little, not gargantuan.

I think you have to consider the investing alternatives, and you also have to consider various market dynamics. For example, IMO there are very few forces in the market stronger than "performance envy" among hedge funds (and, conventional mutual funds) seeking to attract and keep capital. Bonds, paying poor coupon, are very unattractive, it would be easy to call them bubble-like. Who wants to earn 1.4% on a ten year bond? Yet the bond market is said to be 3x the size of the stock market, so it doesn't take much of an exit from bonds to pump the stock market pretty well. And there is the perception that Bernanke simply HAS to keep a floor under the market lest a widespread perception set in that his policies have failed.

The investor's task is not so much to assess where things are and how much those things reflect a current perception of reality; but to assess where things will be next, next, and next-next. I agree with what I *think* you are saying, which is that looking forward, the market appears quite fully valued and thus is less than attractive as far as putting in new money for returns down the road. That's of course a very general statement, but we are making general statements. I find the market not that attractive for new investment on a value basis, but the market has absorbed and begun to run its game on new elements. The market eagerly awaits the next infusion of Fed easing---as if it's an entitlement. Europe looks like crap, so lots of Euro money is flowing over here. I've said before in several posts here and there that there are a baffling array of moving parts going on in the world economy and politico scene, completely forgetting the screaming frauds perpetrated by MFGlobal and PFGBest that have scared people (justifiably) out of the market...as well as the flash crash and let's not forget that little episode circa 2008-2009 when the market dropped to HALF its current value. The markets are skittish now, that much can be said. We just got what, the TWENTIETH Euro rescue?