Skip to comments.

CHART OF THE DAY: There's No Link Between Capital Gains Tax Rates and GDP

Business Insider ^

| Nov. 28, 2012, 8:27 AM

| Sam Ro

Posted on 11/28/2012 11:53:15 AM PST by ExxonPatrolUs

The prospect of higher investment tax rates (on capital gains and dividend income) is on every investors' mind lately.

As it stands, Bush era tax cuts will expire by the end of the year sending the long-term capital gains tax to 25 percent from 15 percent and the dividend income tax to north of 39 percent.

Conventional conservative wisdom suggests higher taxes would be bad for the economy.

But the empirical evidence is less clear. Societe Generale writes about it in a note to clients today:

In terms of the macro impact, the dollar amounts involved are small and will have no meaningful influence on disposable income over the course of the year. Furthermore, most of the investment income tends to accrue to high-income earners who arguably have lower spending multipliers. We therefore don’t anticipate any meaningful impact on aggregate demand in the short- and medium-term. As for the long-term impact, traditional arguments against capital gains and dividend taxes claim that they are detrimental to investment and therefore to long- term growth. Yet, empirical evidence suggests a very weak link between effective tax rates on capital gains and GDP. This was a conclusion of a recent report by the Center on Budget and Policy Priorities, a well regarded independent policy think-tank.

Here's SocGen's chart showing almost no correlation.

(Excerpt) Read more at businessinsider.com ...

TOPICS: Chit/Chat

KEYWORDS: capital; gains; gdp; tax

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

To: ExxonPatrolUs

Almost no correlation? 1985 and following looks a little different than the previous period.

2

posted on

11/28/2012 11:57:54 AM PST

by

DBrow

To: ExxonPatrolUs

Figures do not lie, but liars figure.

This dude is trying to defy common sense. If more money is confiscated from anyone’s capital gains, one has less left to invest or spend.

What the idiot is essentially saying is that private spending is no better than government spending. Tell that to the socialist countries and ask them how prosperous they are.

3

posted on

11/28/2012 12:02:16 PM PST

by

entropy12

(The republic is doomed when people figure out they can get free stuff by voting democrats)

To: ExxonPatrolUs

He is saying there is no correlation no the macro level between gdp growth and capital gains tax rate. I think the chart suggests that, but I think it shows things are better when investors know what a stable tax structure is, which for the last few decades, they don’t.

4

posted on

11/28/2012 12:08:08 PM PST

by

DonaldC

(A nation cannot stand in the absence of religious principle.)

To: ExxonPatrolUs

It is not a place to necessarily look for an immediate link. The damage is long-term. For assets held a long time, what happens is that there is an actual confiscation of Capital, itself; as much or even all of the "gain" in dollar pricing, may merely reflect the declining value of the dollar--i.e., monetary inflation.

See Capital Gains Taxation.

This form of taxation reflects the basic Socialist hostility to private reserves; private resources. But it is the healthy private reserves, that Americans managed to accumulate from colonial days on, that made it possible for us to once out-produce everyone else on earth, both in total & per capita. Those capital reserves, are the vehicle that enables the entrepreneur to obtain the funds for meeting a human need or aspiration, with an idea that draws investment.

William Flax

5

posted on

11/28/2012 12:16:47 PM PST

by

Ohioan

To: ExxonPatrolUs

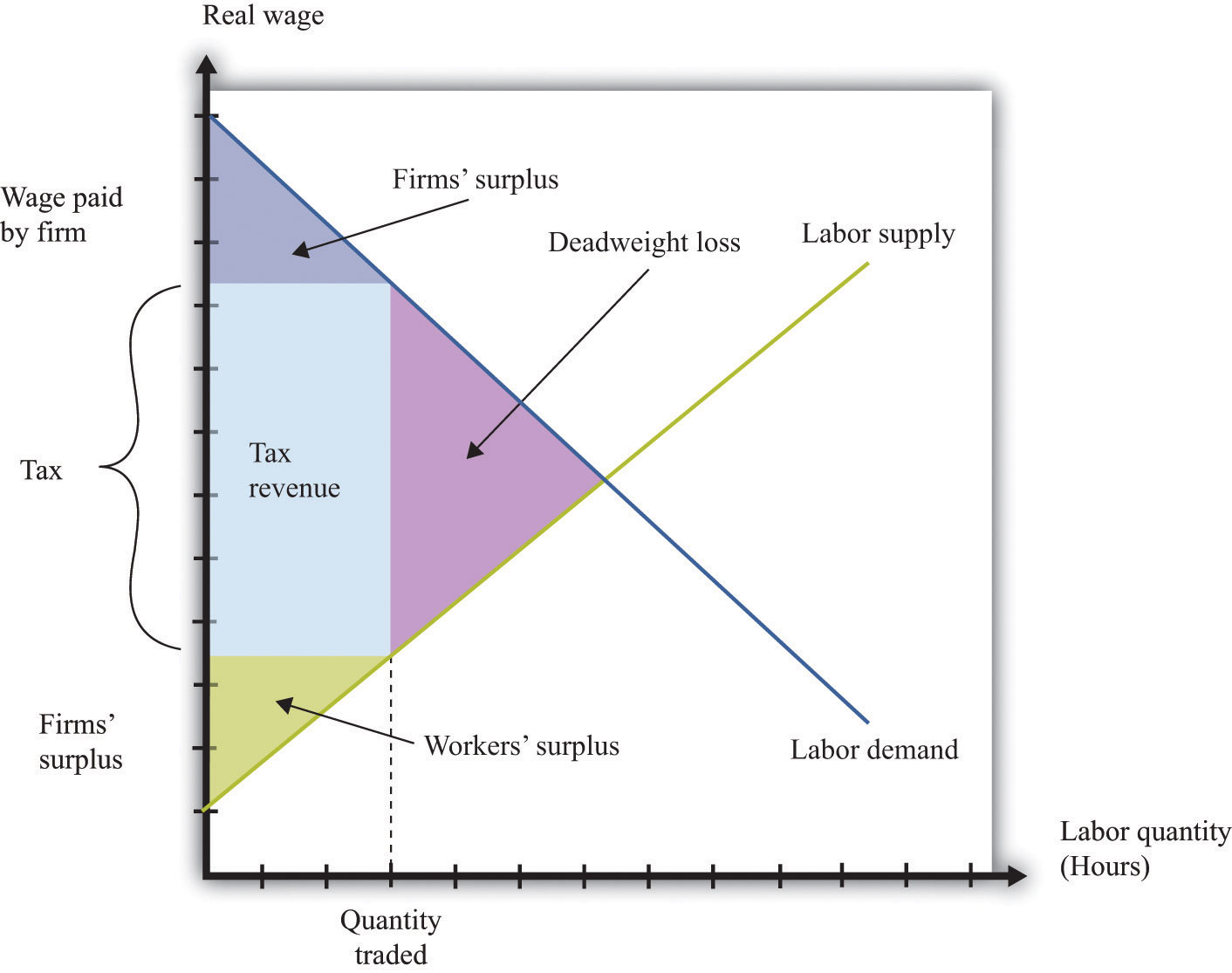

Let's review Econ 101:

Taxes have a "Wedge Effect" between Supply and Demand, which causes a "Deadweight Loss" for the economy, shared between producer and consumer depending on the elasticity of supply and demand respectively.

Raising taxes always has this effect, regardless of what form they take. Businesses will always try to pass on tax increases to customers, and customers will balk at the higher prices. NO MATTER WHAT. So, it is impossible by definition for a tax not to have an adverse impact on the volume of goods and services an economy produces.

6

posted on

11/28/2012 12:17:37 PM PST

by

Uncle Miltie

(Working is for suckers.)

To: Uncle Miltie

7

posted on

11/28/2012 12:18:50 PM PST

by

Uncle Miltie

(Working is for suckers.)

To: Uncle Miltie

Here's a great one, to show who is going to bear more or less of the brunt of a tax depending on their elasticity of supply (producer) or demand (consumer).

8

posted on

11/28/2012 12:21:49 PM PST

by

Uncle Miltie

(Working is for suckers.)

To: ExxonPatrolUs; ksen

Arthur Laffer laughs:

The lower the Capital Gains Tax Rate, the higher the revenues (Capital Gains Realizations) to the Treasury!

9

posted on

11/28/2012 12:28:32 PM PST

by

Uncle Miltie

(Working is for suckers.)

To: Uncle Miltie

And, to pre-answer an objection, of course it’s true that taxpayers change the nature of their income streams, and defer capital gains realizations depending on the tax climate.

Which kinda goes to show how incredibly sensitive the economy and its actors are to marginal tax rates, whether Capital Gains or Income Tax rates.

10

posted on

11/28/2012 12:30:52 PM PST

by

Uncle Miltie

(Working is for suckers.)

To: DBrow

Nearly every rise in the rate is followed by a subsequent drop, but I’d bet if the government spending portion of GDP was removed it would show up a lot better. As a matter of fact, I bet the moderation or delay in the drops is due to greater government spending growth in years subsequent to rate increases...

11

posted on

11/28/2012 12:31:56 PM PST

by

Axenolith

(Government blows, and that which governs least, blows least...)

To: Uncle Miltie

"So, it is impossible by definition for a tax not to have an adverse impact on the volume of goods and services an economy produces." Thank you Uncle Miltie for your excellent interpertation and charts.

12

posted on

11/28/2012 12:34:10 PM PST

by

Mr Apple

To: ExxonPatrolUs

It's the

marginal rate that has the impact.

Effective rates less so.

Marginal rates can most certainly be shown to have a strong negative correlation with GDP in the first years of a change.

To: Uncle Miltie

Ok, that’s a good illustration for capital gains . . . now do it again with marginal income tax rates. ;)

14

posted on

11/28/2012 12:38:05 PM PST

by

ksen

To: Uncle Miltie

omg, please ignore my previous post. I thought I was in a different thread . . . carry on!

15

posted on

11/28/2012 12:44:22 PM PST

by

ksen

To: ksen

No worries. It's still a good question, so I'll answer it:

Mainly, people modify how much they work, how hard they try to avoid taxes, and how they present their income to the tax man to achieve the same approximate effect for the Treasury.

Interestingly, I've polled all my friends about what a reasonable TOTAL TAX RATE is for all levels of government. The result is astounding. The more liberal someone is, the lower the rate they specify. My most liberal acquaintances say 10%, and my most conservative say 25%. The fact that it's around 40% is the horror.

16

posted on

11/28/2012 12:55:35 PM PST

by

Uncle Miltie

(Working is for suckers.)

To: Uncle Miltie

Here's a fun one! Every wonder why jobs are off-shored?

17

posted on

11/28/2012 12:59:15 PM PST

by

Uncle Miltie

(Working is for suckers.)

To: ExxonPatrolUs

I wouldn’t use GDP as a measure of effectiveness of investment income, but if I did, I wouldn’t expect to see appreciable change for 24-36 months on the reduction side, and 9-16 months on the increase side.

So what is a good indicator of how capital gains tax affects things?

18

posted on

11/28/2012 1:00:27 PM PST

by

Usagi_yo

To: Ohioan

It is not a place to necessarily look for an immediate link. The damage is long-term. For assets held a long time, what happens is that there is an actual confiscation of Capital, itself;Precisely. This country would never have been the economic engine it is without investment of capital over a long period of time. The capital gains tax rate has everything to do with the original investment decision. The Commie Rats are working overtime to destroy capital through high taxation (tax rates, high capital gains taxes, estate taxes), exploding regulatory compliance costs and inflation. I am about to start referring to local Democrats as Communists to their faces.

19

posted on

11/28/2012 1:03:11 PM PST

by

RatRipper

(Self-centeredness, greed, envy, deceit and lawless corruption has killed this once great nation.)

To: Uncle Miltie

I think that graph is a good example of Hauser’s Law but it really doesn’t illustrate the Laffer Curve. In fact it seems to contradict the Laffer Curve since it shows that as marginal rates decline so to does tax revenues. Unless I’m reading the graph incorrectly.

20

posted on

11/28/2012 1:10:17 PM PST

by

ksen

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson