GDP "Growth" is being entirely driven by Deficit Spending

All improvements are illusory

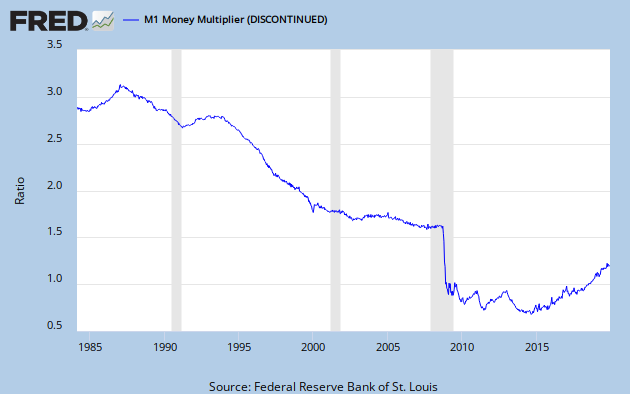

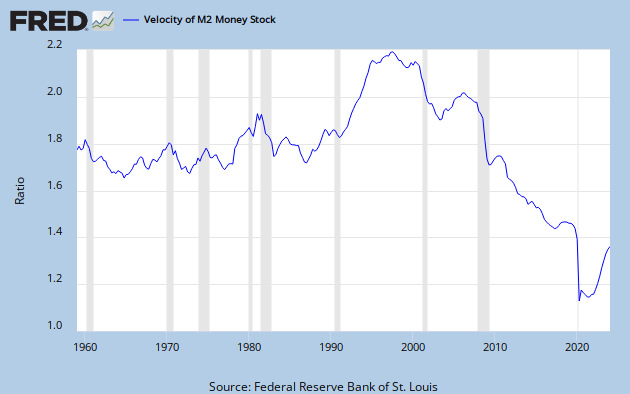

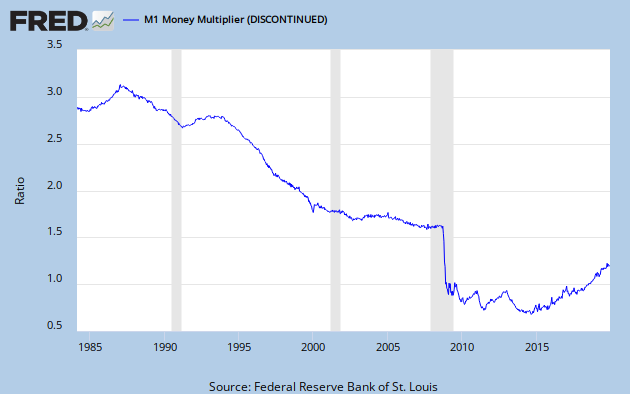

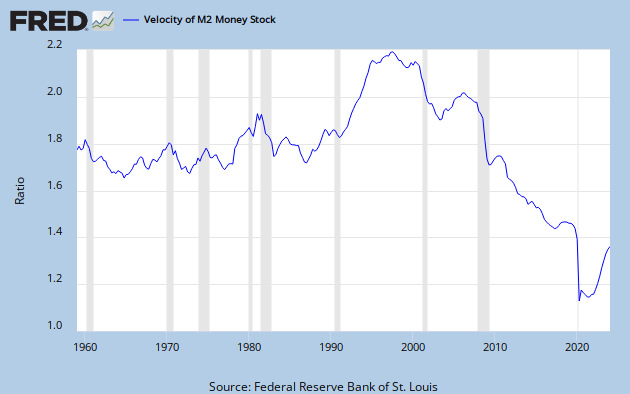

Gross Domestic Product / St. Louis Adjusted Monetary Base or Aggregate Monetary Velocity

Posted on 12/01/2012 6:01:14 AM PST by ExxonPatrolUs

No matter what we do, no matter how often we do it, above trend GDP growth isn't happening.

Over the past few days we got the latest gross domestic product figures for the third quarter and we saw that GDP grew at a 2.7% seasonally adjusted annual rate (SAAR). The first estimate came out in October and had growth pegged at 2% SAAR. This clip from the Bureau of Economic Analysis' press release tells us why:

The "second" estimate of the third-quarter percent change in GDP is 0.7 percentage point, or $21.9 billion, more than the advance estimate issued last month. This primarily reflects upward revisions to private inventory investment and to exports that were partly offset by downward revisions to personal consumption expenditures (PCE) and to nonresidential fixed investment.

So the revision was a result of inventory build heading into the fourth quarter, along with export growth. That makes sense since most of that inventory build was probably seasonal in preparation for the holiday shopping season.

And the early reports on the holiday shopping season have been mixed. The consensus explanation is that Hurricane Sandy hurt retail sales for November. But that probably isn't the whole story. Explanations are rarely as simple and neat as we'd like them to be. This Los Angeles Times story asks if the Sandy story is all there is to the November explanation:

"A lot of retailers are using Sandy as a very convenient excuse to dismiss their poor sales performance. Not all these retailers have all their stores situated in just the Northeast," said Britt Beemer, a retail expert at America's Research Group. "A lot of retailers are going to have to admit that Black Friday, as incredible as it was," favored merchants offering enormous discounts.

This has been part of a pattern that retailers have been following for years, but with this last recession they have only gotten more aggressive in their Black Friday promotions. What's really in it for retailers? They're keeping stores open longer with more cheap deals and hurting their own margins in the process. More expense for less revenue isn't a viable strategy.

Snip

Layaway purchases allow you to make payments over time, but you're not using credit to make a purchase. Plus, it's a total “me, here, now” behavior: If you miss your layaway payments, what's the worst that can happen? You don't get your stuff from the store, the store restocks the merchandise, and life moves on. There's no FICO score impact, no pesky calls from a collector about money you owe. It's freeing.

And homemade gifts are all about saving money. Both of these behaviors are by-products of a reduced desire to accumulate debt. And that's bad news for the Fed because the only thing the Fed can affect is the cost of money (i.e. interest rates). They can't make people borrow it.

Here's a hypothesis I'd love to see tested, but never will be: How would the market and overall economy react if at the next Fed meeting, the statement came out that the Fed was throwing in the towel on QE? The consensus reaction would be horrible and markets would collapse.

But what if it didn't? What if the world just kept turning? What if people kept getting out of bed each day, doing the stuff they did the days and weeks before? Because, let's face it: The crisis was over in early '09. The Fed quelled the panic and since then, what have we seen? A slow, 2%-ish recovery with deleveraging, increased multifamily housing in more densely populated neighborhoods, and an emphasis on grass-roots growth driven by small businesses.

So add it all together and what do you see? Hopefully a macro backdrop that looks better five years from now than what it does today. But we need to resist the tirades and longing for a debt-fueled, high-consumption world that no longer exists.

No. This is what the left wants us to believe. They know redistributive policies will slow economic growth but they don’t want to admit it. Put people at each others throats promise them free condoms lull them into complicacy with a complicit media and viola! You have folks accustomed as in Europe to a lower standard of living. We now have children who have never seen boom times soon to be adults.

As Romney vainly tried to tell the country “ It doesn’t have to be this way”

Or as Paul Ryan tried to tell a hopium sedated youth “This isn’t what a recovery looks like”

The economy is trying to correct for the bubble. The Fed is trying to keep the bubble inflated by printing paper money.

The net effect is that the wealth of the country is being inflated out of existence. They call it monetizing the debt. If you are a senior they are stealing your retirement funds.

The laws of economics are like the laws of gravity, they will prevail. After the Fed has destroyed the dollar, the economy will correct and the markets will collapse.

If we had let the correction happen naturally we would have taken our medicine and been over it by now. All we have been protecting is the paper profits of the bubbles.

Gross Domestic Product / St. Louis Adjusted Monetary Base or Aggregate Monetary Velocity

Nice charts. So effectively, a Democrat congress under Bush Jr and our powerful new ruler, Obama have slammed on the economic breaks?

The SHTF in 2008

It cannot be stopped without

increasing work and decreasing expenditures

Capitals are increased by parsimony, and diminished by prodigality and misconduct. By what a frugal man annually saves he not only affords maintenance to an additional number of productive hands†but†he establishes as it were a perpetual fund for the maintenance of an equal number in all times to come.

- Adam Smith

An Inquiry into the Nature and Causes of theWealth of Nations, bk.2, ch.3.

Maybe all we can do now is wait for private savings to be depleted and then its game over man?

Maybe, there are several scenarios that can play out

We are currently in a classic Liquidity Trap

https://en.wikipedia.org/wiki/Liquidity_trap

This wil not end until Entrepreneurs project

a greater than zero ROI for Injected Capital

The Economy is profoundly distorted and, in balance,

Entrepreneurs are sitting on Capital resources

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.