Posted on 11/08/2007 7:37:31 PM PST by kojak

---------- Forwarded Message ---------- Click here to add your name: "The richest tycoons on Wall Street shouldn't pay a lower tax rate than the rest of us. Congress should close the mother of all tax loopholes."

Sign the petition

How much more do you pay?

See how much more you're paying in taxes than you would if you paid the same rate as Wall Street investors! Try our calculator:

Dear MoveOn member,

If the richest tycoons on Wall Street get their way, you'll face a significant tax hike this year so they can buy another tropical island. Sound fair?

Here's the deal: An obscure provision called the "alternative minimum tax" is going to end up raising taxes for tens of millions of middle-class households—maybe even yours—unless Congress acts quickly.1

Democrats want to cancel this tax increase for the middle class—and pay for the shortfall by closing a massive new loophole that's allowing the richest investors on Wall Street to pay lower tax rates than you or I do.2 (Want to see how much more you pay in taxes than you would if you paid the same rate as Wall Street tycoons? Click the link below to try our calculator.)

The bill is coming up for a vote tomorrow, and super-rich investors are making big campaign contributions and lobbying hard to keep their loophole. They could kill the proposal—Congress needs to hear from the rest of us right away. Can you sign our petition to close the mother of all tax loopholes? Click here to add your name—and see how much more you're paying:

http://pol.moveon.org/loopholecalc/o.pl?id=11644-3234195-HWHn_E&t=4

Here's the petition text: "The richest tycoons on Wall Street shouldn't pay a lower tax rate than the rest of us. Congress should close the mother of all tax loopholes."

We're all paying billions of dollars a year for this tax loophole. Please forward this email to your friends, family, and co-workers. We'll email everyone who signs with the phone number for their member of Congress.

Some investment tycoons are raking in more than $1 billion a year, but they get away with paying a lower tax rate than you and me. The "carried interest" loophole lets them pay just 15% instead of the 35% most upper-income people pay—or even the 25% most middle-income people pay.3

The result: Our country is shortchanged by billions every year—and the rest of us shoulder an unfair tax burden. If we close this tax loophole, we'll be able to afford to fix the alternative minimum tax so middle-class families don't face a big tax hike this year.

These well-heeled investors will stop at nothing to hang onto their billions, including massive political contributions. Predictably, Republicans are trotting out anti-tax rhetoric to defend tax breaks for wealthy financiers.4 Yet even President Bush's former top economic adviser says the tax loophole is unfair.5

This is exactly what we sent Democrats to Washington to do—fight for the people they represent. But closing this loophole isn't popular with some of the wealthiest political donors—and some Democrats are nervous about this bold move.2 We need to show the Democrats we'll have their backs when they fight for economic justice.

Can you sign our petition to close the mother of all tax loopholes? Clicking here will add your name:

http://pol.moveon.org/loopholecalc/o.pl?id=11644-3234195-HWHn_E&t=5

Thank you for all you do.

–Noah, Marika, Matt, Jennifer, and the MoveOn.org Political Action Team Thursday, November 8th, 2007

P.S. Good news! MoveOn members in Kentucky celebrated Tuesday after helping unseat Gov. Ernie Fletcher, a Republican backed by Mitch McConnell. They knocked on over 25,000 doors before Election Day and helped test our newest get-out-the-vote tools for 2008. Congratulations, Kentucky MoveOn members!

Sources: 1. Letter to Congress from 300+ organizations in support of closing the loophole, September 5, 2007 http://www.ctj.org/pdf/carriedinterestsignon080707.pdf

"Alternative Minimum Tax Likely to be Large Issue in 2007," OMB Watch, December 5, 2006 http://www.ombwatch.org/article/articleview/3656

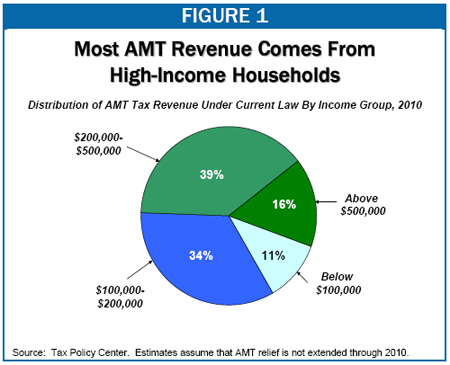

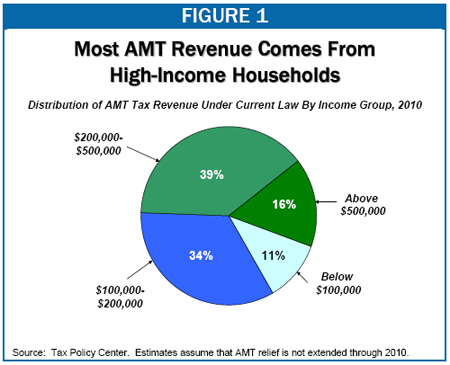

"The Individual Alternative Minimum Tax," Tax Policy Center," November 10, 2006 http://www.moveon.org/r?r=3143&id=11644-3234195-HWHn_E&t=6

2. "Democrats Split Over Bill Affecting Backers," Washington Post, November 7, 2007 http://www.moveon.org/r?r=3148&id=11644-3234195-HWHn_E&t=7

Video of Warren Buffett interview, NBC Nightly News, November 6, 2007 http://www.youtube.com/watch?v=Cu5B-2LoC4s

3. "Understanding the 'Carried Interest' Issue," TPM Cafe, June 26, 2007 http://www.moveon.org/r?r=3142&id=11644-3234195-HWHn_E&t=8

4. "GOP calls Rangel tax plan a 'gift'," The Hill, October 26, 2007 http://www.moveon.org/r?r=3149&id=11644-3234195-HWHn_E&t=9

5. "Mankiw: Raise taxes on venture fees," Baltimore Sun, July 19, 2007 http://www.moveon.org/r?r=3150&id=11644-3234195-HWHn_E&t=10

Support our member-driven organization: MoveOn.org Political Action is entirely funded by our 3.2 million members. We have no corporate contributors, no foundation grants, no money from unions. Our tiny staff ensures that small contributions go a long way. If you'd like to support our work, you can give now at:

http://political.moveon.org/donate/email.html?id=11644-3234195-HWHn_E&t=11

PAID FOR BY MOVEON.ORG POLITICAL ACTION, http://pol.moveon.org/ Not authorized by any candidate or candidate's committee.

This bill must be effecting them at MoveOn....

Can you fix the typo in the title?

“I can’t believe MoveOn.org really is for taxpayers”

AMT should be adjusted up.

Why should hedge fund managers be allowed a gimmick to pay at substantially lower rates than other billionaires?

MoveOn is correct.

It is the Republicans who seem to be stalling the AMT adjustment.

It is the Democrats who are protecting the Hedge Fund managers. Kucinich controls the committee that does that. In the last debate he sidestepped the issue brilliantly. He was asked a direct question about special HF manager tax rates, and did not answer it at all but played it out as a general rant about HF practices. I doubt your average Move OnEr caught that.

Hedge Fund manager money is very important for Democrats this cycle. Carbon credit money too.

Funny how those Dims get all interested in cutting taxes only when rich East Coast liberals start getting hit BY ONE OF THEIR OWN TAX PLANS!

It’s just a bonus, as far as MoreOn.org is concerned, that they can ALSO use this as an excuse to raise taxes on someone else!

Nobody making under about $200K a year (for a married couple) gets hit by the AMT.

If they want to cut AMT taxes, let them do so WHILE MAKING THE BUSH TAX CUTS PERMANENT.

“Nobody making under about $200K a year (for a married couple) gets hit by the AMT.”

That is a big lie. I got hit with it this year, and I don’t make anything close to that. You need to review your accounting law.

“I got hit with it this year, and I don’t make anything close to that.” ($200,000 for a couple)

Me too.

And me neither.

Your chart expired in 2006.

I know they say it’s a projection to 2010, BUT that assumes that the 2006 law continues to be ‘patched’ with COLAs each year.

Without the current-year ‘patch’ that was in the “passed but vetoed” bill this month the numbers jump big-time:

The exempted income for a married couple drops from ~$58K to ~$40K, and the rate applied is 26-28%.

That means an *additional* tax liability of ~$4680 to $5040. for 2007 alone, with no increase in their household income.

And you DO know that the IRS has been steadily eliminating the itemized deductions you can still claim on the AMT form calculations, right?

No deduction for Standard vs Itemized, none for any mortgage interest paid for refis above original amount vs $100K in regular taxes, none for State taxes paid, none for property taxes paid, none for State disability insurance paid, none for extraordinary medical expenses paid, and the big kicker for families with more than a few kids is no deduction for the personal exemptions from income.

Of course, if you are lucky enough to have Capital Gains with the lowered tax rate, that’s great, right?

Except the IRS ADDS the dollars to your income for AMT purposes FIRST, then lets you run the numbers, then you use the lower % for the CG portion- net math result is the CG money pushes you into owing AMT almost every time.

They wanted to eliminate your mortgage interest altogether in 2006, and ran into a buzzsaw of political resistance, and a good thing too:

If an average family deducts 7500.00 in mortgage interest a year, that is $7500.00 higher income for AMT purposes, and you CAN’T not pay it.

This is like the grim reaper shadowing many families just going about their business, with no idea it is looming over them waiting to strike.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.