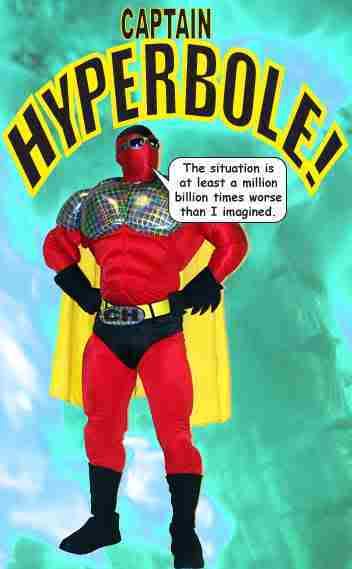

Ahhhh...I was missing the Captain. Glad he could make an appearance!

Hank

Posted on 02/09/2008 5:31:32 PM PST by palmer

Most definitely not a normal business cycle. There are no more gimmicks left to juice up the US economy such as the dotcom/telecom/NASDAQ boom and the housing bubble. Nothing is left but a jarring return to honest work and buying a lot less imports

It’s still an abstraction for you. Wait until it becomes real.

Not so! BurnYankee has 300 whole basis points left with which to kiss it and make it all better. Mommy!

My response is an anecdote: I joined a small credit union around 1993. In 2003, my credit union was bought by a CUINO (Credit Union In Name Only). I voted against the buyout of course even with the little I knew about the buyer. The offered CD rates immediately dropped about a point and the loans rates went up a little. Where before I got almost 5% on a CD, and could get a car loan for 7%, I was offered 4% CD's and 7.5% car loans (although home loan rates went down). The new CUINO steered funds to their stock investment "partner" which was for-profit unlike the CUINO. Likewise, loans were sold on the secondary market as opposed to being self-funded.

In short the credit union was smashed and replaced with an ABS and stock market scheme. I gladly invest in stocks, but anyone in general funds especially index funds right now is not paying attention. And as the ABS market seizes up, so does the source of funds for the CUINO loans. Do you really think the small mutual credit market that they destroyed can be put back together again?

Plus lots of these "securitized assets" were fobbed off on Europeans. They got burned and will not be buying crappy US paper for years. Plus lots of this lousy paper got rated much too high by the bond rating companies. I'll bet there were lots of bribes and kickbacks to make this happen. Fat Swiss bank accounts

Read it all at www.jsmineset.com

It is worth thanking you again for posting an eye-opening must read. Thank you.

Japs had their interest rates at zero or near zero for years ..... lot good that did

He is definitely right, folks. From 1930 to 1940, the Market did indeed right itself!

Please DO NOT be confusing the sheeple with facts in evidence. Ostriches need their dreams to be peaceful.

Perhaps I am missing your point, but please point out any exaggerations in the article.

The only US law regulating rating agencies, the Credit Agency Reform Act of 2006 is a toothless law, passed in the wake of the Enron collapse. Four days before the collapse of Enron, the rating agencies gave Enron an “investment grade” rating, and a shocked public called for some scrutiny of the raters. The effect of the Credit Agency Reform Act of 2006 was null on the de facto rating monopoly of S&P, Moody’s and Fitch.Made me think of the following comment (from a different article):The European Union, also reacting to Enron and to the similar fraud of the Italian company Parmalat, called for an investigation of whether the US rating agencies rating Parmalat has conflicts of interest, how transparent their methodologies were (not at all) and the lack of competition.

....The raters under US law were not liable for their ratings despite the fact that investors worldwide depend often exclusively on the AAA or other rating by Moody’s or S&P as validation of creditworthiness, most especially in securitized assets. The Credit Agency Reform Act of 2006 in no way dealt with liability of the rating agencies. It was in this regard a worthless paper. It was the only law dealing with the raters at all.

As von Schweinitz pointed out, “Rule 10b-5 of the Securities and Exchange Act of 1934 is probably the most important basis for suing on the grounds of capital market fraud.”

Of course, there's a potentially dangerous side to dark pools, which have become controversial because there's no transparency and orders are hidden....There are other potential drawbacks to dark pools. Few things anger a trader more than seeing inaccessible market prints while actively trading in a particular security. Buy-side traders for mutual fund empires, pension funds and banks see dark pools as the most likely place for information leakage.

The Securities and Exchange Commission has officially encouraged the creation of dark pools to compete with the dominant NYSE and Nasdaq exchanges to offer the best price competition. Indeed, dark pools are the direct result of an SEC rule allowing the private National Market System to be formed.

He doesn’t have a point; he is here but to mock, ridicule, and deride those who refuse to sell out America for globalism and your 30 pieces of silver.

He is definitely right, folks. From 1930 to 1940, the Market did indeed right itself!

LOL! You need a dark sense of humor to appreciate that one...

Yeah, it’s all just a big joke, Hank. Things were never better!

Hank’s right. The economy has never been better. Consumers are saving. The dollar is strong. The markets are rising while unemployment is falling...

Bullish!

We are not going to grow our way out of debt, we will default (and cause recession) and we will inflate. Some combination of those two things.

According to the Mortgage Brokers’ Association for Responsible Lending, a consumer protection group, by 2006 Liars’ Loans were a staggering 62% of all USA mortgage originations. In one independent sampling audit of stated-income mortgage loans in Virginia in 2006, the auditors found, based on IRS records that almost 60% of the stated-income loans were exaggerated by more than 50%.

Nice. I'd call them "Illegal Aliens' Loans" instead - the idea being to "let 'em in and give 'em loans so the ski jumper that is Wall Street can stay out over the tips of his skis"...for if he ever has to straighten up, he'll start flailing his arms like Eddie the Eagle and crash. ;)

Emigration to New Zealand or Chile is starting to look like a very attractive option.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.