Skip to comments.

Why Democrats should love the FairTax

Boston Globe ^

| February 24, 2008

| Laurence Kotlikoff

Posted on 02/25/2008 12:51:24 PM PST by Man50D

SUPPOSE A presidential candidate proposed taxing wealth and using the proceeds to reduce taxes on workers and provide a rebate large enough to cover taxes paid by poor workers. Such a candidate would be hailed by the left and reviled by the right.

Thus, it's remarkable that so many Democrats, with the exception of presidential candidate Mike Gravel, oppose the FairTax and so many Republicans, particularly presidential candidate Mike Huckabee, support it. In fact, the FairTax, which replaces all federal taxes with a federal retail sales tax and provides a rebate, represents a way to tax wealth, reduce taxes on wages, and disproportionately redistribute money to the poor.

A sales tax effectively taxes wealth?

It does. When we buy goods and services in a sales tax world, part of the payment goes to sales taxes. So we end up with fewer real goods and services.

Take Mr. Megabucks, who is sitting on $65 million and wants to buy a jet like Oprah Winfrey's - a 10-passenger, $50 million Global Express XRS. Under the FairTax, the jet costs him an extra $15 million because of the 30 percent sales tax. Mr. Megabucks gets the jet, but the extra $15 million, which he had budgeted for Beluga caviar, Dom Pérignon, and other flight snacks, goes to Uncle Sam.

(Excerpt) Read more at boston.com ...

TOPICS: News/Current Events

KEYWORDS: 110th; fairtax

Navigation: use the links below to view more comments.

first previous 1-20 ... 101-120, 121-140, 141-160, 161-179 next last

To: Your Nightmare

The Tax Foundations numbers are based on the flawed Arthur D. Little study from the 1980s!There you go again! Dismissing something out of hand that you have little or no understanding of!

If it is actually flawed show us HOW it is flawed and the scholarly work that supports your claims if you please!

141

posted on

02/25/2008 7:06:25 PM PST

by

Bigun

(IRS sucks @getridof it.com)

To: Your Nightmare

Hell, they estimate it takes the average person 3.8 hours to fill out a 1040EZ!No they don't! That estimate includes all the time it take to gather and compile the information necessary to be able to fill out the form as well.

I personally think the estimate is too low!

142

posted on

02/25/2008 7:10:41 PM PST

by

Bigun

(IRS sucks @getridof it.com)

To: Bigun

Sure! It seems pretty elementary to me but for you I will do it. They were asked the question, "What would you do in your long-term planning if the United States eliminated all taxes on capital and labor and taxed only personal consumption?", and eighty percent - that's four hundred out of five hundred - said that they would build their next plant in America. The remaining 20 percent - the other hundred companies - said that they would relocate their business to America altogether.

What do you mean "they were asked." How do you ask a corporation anything? Was it the CEO? The CFO? And did somebody just call up 500 of them informally? Or was this a picnic with 500 international corporations and everyone that would move their company to the US just raised their hand. That sound pretty informal.

You can call it whatever you like but the fact remains that Chairman Archer referred to it often and I doubt seriously that he was not telling the truth.

Yet there is no other evidence that this

informal survey of 500 international companies ever happened.

To: Bigun

No they don't! That estimate includes all the time it take to gather and compile the information necessary to be able to fill out the form as well.

They list 0.1 hours for record keeping. They list 1.7 hours for education (1.7 hours

every year to figure out the EZ?!?). Another 1.7 for form prep. And still another 0.3 hours for "packaging and sending" - I guess they think it takes people 20 minutes to hit send on their computer.

Again, I did all of my 1040A in half that time - including record keeping. I filed it electronically and didn't even have to write a check for the $35 I owed.

How long did it take you to do your taxes?

To: Your Nightmare

While your at it you can debunk this as well.

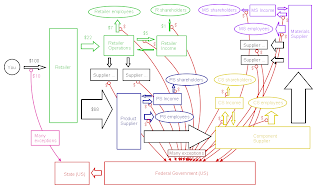

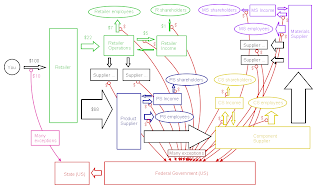

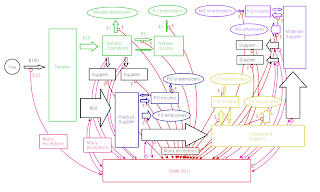

Taxation in the US

The following diagram illustrates taxation in the American economy.

When you buy a $100 product, you observe being directly taxed only by the state, assuming there's a local sales tax. What you don't observe, however, is that the remaining $90 you are paying for the product has a lot of other tax built in.

How much tax in total?

Over the past 15 years, total US government receipts - federal, state and local - have summed up to about

33% of GDP (

OECD, 'Tax&Non-TaxReceipts').

According to the US GPO, based on data for the year 2000, "total Federal spending accounts for

20% of the gross domestic product, while total state and local spending account for

12%".

The federal government collects a large majority of its revenue through the personal income tax (10-35%), corporate income tax (35-39%), social security (12.4%), and payroll tax (2.9%). The states get some of their revenue from the federal government, while collecting the rest through sales taxes (0-10%) and piggybacking on the federal income tax (0-10%).

Current federal budget deficits are about $480 billion, about 3.8% of GDP. This means that the federal government spends about 20% of GDP, but collects only about 16.2% in taxes. A majority of the remaining 3.8% is borrowed from the private sector, while a minority is taken from the economy as an invisible tax, by the government simply printing the money.

You don't see these taxes when you buy a product in a retail store. But out of every $100 you spend for a product, some $29 on average are taken by the government, at some point or another in the process of the product's production. Some $16 are taken by the federal government, and some $12 are taken by the states.

Due to special interests and their lobbying, there are numerous exceptions, and the effective tax level is different for every individual product and service.

The fact that they collect this money at so many different points, and using such a complex tax code with so many special cases and exceptions, imposes a large

compliance burden nationwide. The Tax Foundation estimated that this burden was

$265 billion in 2005 - about 2% of GDP. This likely means that the US would experience an immediate one-time GDP growth spurt of 2% if income taxation was eliminated, just from not having to comply with the income tax alone.

There would almost certainly be another, permanent 2% or so increase in annual growth because the government would stop

taxing investment to spend it on consumption.

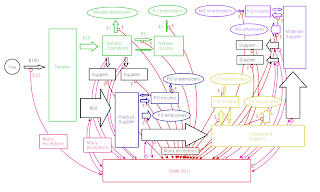

Taxation in the EU

If you think the US has it bad, look at the following diagram for Europe.

So you thought the US rescued Europe from fascism in WWII, eh?

No such luck.

To understand, take a minute to meditate on this quote from

The Big Book of Fascism by our friend

Benito Mussolini:

Anti-individualistic, the fascist conception of life stresses the importance of the State and accepts the individual only insofar as his interests coincide with those of the State, which stands for the conscience and the universal will of man as a historic entity.... The fascist conception of the State is all-embracing; outside of it no human or spiritual values can exist, much less have value.... Fascism is therefore opposed to that form of democracy which equates a nation to the majority, lowering it to the level of the largest number.... We are free to believe that this is the century of authority, a century tending to the 'right', a Fascist century. If the nineteenth century was the century of the individual (liberalism implies individualism) we are free to believe that this is the 'collective' century, and therefore the century of the State.

And so it is across Europe today. Just compare this sentiment to the diagram you see above. The

State is everywhere.

In addition to the personal and corporate income tax, payroll tax, and social security taxes which are present in the United States, most EU countries impose the Value Added Tax, which performs essentially the service of a sales tax. The difference, as you can see from the diagram above, is that the VAT is much more convoluted, raising compliance costs across the EU and opening opportunities for

scamsters to abuse the system, forcing the EU to lash back at them by raiding and closing otherwise perfectly good offshore banks.

Additionally, EU personal and corporate tax levels are higher than in the United States, bringing total government receipts of Euro area countries to a whopping

45% of GDP. Mussolini would be pleased.

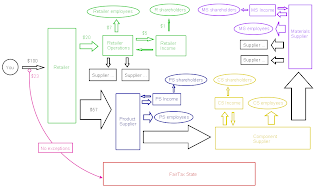

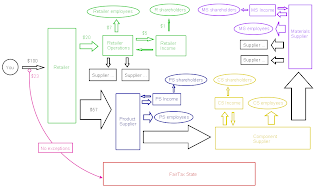

The FairTax

Finally, here is the diagram for the FairTax proposal.

Simple, eh? Instead of collecting taxes bit by bit, at every conceivable point where there is any kind of financial transaction, the FairTax government would focus its collection in a single place: where the consumer purchases a product or a service.

The FairTax rate of 23% is calculated to replace only federal taxes. Various US states have different approaches to taxation, and it is up to them to keep their existing systems or change to an additional sales tax on top of the FairTax.

However, if you recall that US federal taxes collect about 16.2% of gross domestic product (the remaining 3.8% is borrowed or printed), it should be apparent how a 23% FairTax rate is enough.

With a federal government that taxes about 16.2% of what the people of the United States produce; and with US consumption at 86% of GDP; a 23% consumption tax works out to 23% x 86% = 20%. Subtract the FairTax prebate - a sum of about $480 billion, or again about 3.8% of GDP - and the result is 16.2%, exactly the amount collected by current federal taxes.

Source

145

posted on

02/25/2008 7:23:37 PM PST

by

Bigun

(IRS sucks @getridof it.com)

To: groanup

Can you find it from any source not promoting the FairTax?

To: Bigun

There you go again! Dismissing something out of hand that you have little or no understanding of!

Haven't I done this before? Jeez. (You might even try doing a little research of your own.)

The first clue should have been they based how long they thought it would take someone to fill out a form on the number of words in the instructions!! And these days with software, you fill out forms you never even see! Hell, most of my data was imported directly into TurboTax from online sources. It literally took me less than an hour. The IRS gave up the ADL study years ago.

To: Your Nightmare

Can’t refute the data, so you attack the source? Not surprising, really.

148

posted on

02/25/2008 8:54:36 PM PST

by

Tatze

(I'm in a state of taglinelessness!)

To: Bigun

You can call it whatever you like but the fact remains that Chairman Archer referred to it often and I doubt seriously that he was not telling the truth.

Right. He was the one that was going to pull the tax code out by it's roots...then he added 800 pages just before going to work for PWC...not exactly consumption tax advocates...

But I'm sure on that one occasion he was telling the truth though... Never mind that there still has never been one name of one of those companies or CEO's informally surveyed...not one...ever.

149

posted on

02/25/2008 9:14:43 PM PST

by

lewislynn

(What does the global warming movement and the Fairtax movement have in common? Disinformation)

To: Your Nightmare

The IRS gave up the ADL study years ago.LOL! I wonder why!

150

posted on

02/25/2008 9:31:39 PM PST

by

Bigun

(IRS sucks @getridof it.com)

To: Tatze; Your Nightmare

Can’t refute the data, so you attack the source?This has LONG been the MO of some posters here.

Glad to see that others recognize it.

151

posted on

02/25/2008 9:35:52 PM PST

by

Bigun

(IRS sucks @getridof it.com)

To: lewislynn

Never mind that there still has never been one name of one of those companies or CEO's informally surveyed...not one...ever.So what?

He says that it was done and I believe him. If you don't then so be it.

152

posted on

02/25/2008 9:38:47 PM PST

by

Bigun

(IRS sucks @getridof it.com)

To: Bigun

you think trading on personal information on FR helps your case?

How’s your buddies Turret Gunner and BayBabe doing?

153

posted on

02/26/2008 2:47:31 AM PST

by

xcamel

(Two-hand-voting now in play - One on lever, other holding nose.)

To: lewislynn

That adage comes true again:

FT: Having to implicitly believe in that which you have never believed in before.

154

posted on

02/26/2008 3:25:58 AM PST

by

xcamel

(Two-hand-voting now in play - One on lever, other holding nose.)

To: Tatze

Can’t refute the data, so you attack the source? Not surprising, really.

I haven't been able to find the data from anyone not promoting the FairTax!

(And actually, I've never seen any hard data from any source. I seriously doubt it was exactly 500 companies and they broke exactly 80/20. And what exactly was the question? This is just another example of FairTaxers hearing something that fits their world view and accepting it without question.)

To: Bigun

LOL! I wonder why!

They did commission it back in the 80s and used it for almost 15 years. But it was obvious almost from the beginning the ADL methods and the results was flawed. The IRS had IBM do a replacement in the last few years but since it doesn't do time by form anymore (it doesn't make sense when people are using computers to do their taxes) the

Tax Foundation decided to keep using the old method!

To: gleeaikin

...illegal immigrants, they would not get that monthly payment, but would have to pay the 23% on everything new they purchased.And how long would that last? They were not supposed to get Welfare, Medicare, or Social Security, either.

Why have a prebate in the first place?

If you can determine what the essentials are well enough to prebate back the 1/12 of the poverty line amount in taxes paid on them each month, you can damn well exempt the essentials entirely and do away with the entire bureaucracy needed to issue prebates and track the position, presence/affiliation, and bank account numbers of every American citizen on at least a monthly basis.

Or is the whole deal just not going to sell unless you can give the impression that the government is giving away money?

If that is the case, it is part of the problem (the Government giving away our money), and doing more of it is not the solution.

157

posted on

02/26/2008 3:53:41 AM PST

by

Smokin' Joe

(How often God must weep at humans' folly.)

To: Smokin' Joe

If you can determine what the essentials are well enough to prebate back the 1/12 of the poverty line amount in taxes paid on them each month, you can damn well exempt the essentials entirely

There are two problems with exemptions:

1. The more income a person has the more they tend to spend including necessities. Consequently wealthier people tend to spend more on these items than poorer people. The result being the wealthy would benefit more from exemptions.

2. Exemptions exist thanks to the thousands of lobbyists who distort the tax code. Exempting certain items will cause lobbyists in other industries to demand exemptions. In the end many items at the very least would be exempt.

Fair Tax FAQ #4

158

posted on

02/26/2008 4:11:08 AM PST

by

Man50D

(Fair Tax, you earn it, you keep it!)

To: Man50D

We have been here before, but who cares if rich people spend $200 on an ounce of fish eggs while someone else spends $2.00 on a fish sandwich?

Either way, the money will go around the economy and be taxed somewhere else, anyway.

If I shoot a deer, will I be taxed on the meat?

If I raise a feeder calf, and butcher it?

How about chickens? If they lay eggs, do I get to keep and eat them, or do I have to pay tax on them?

Well, if I don't have to pay taxes, people are gonna scream about how that is unfair, because the food isn't used (it is new), and I'm not paying taxes on it.

So no matter what happens, you are going to have to exempt people who produce their own food, (or whatever), anyway, or...You are going to have to find a way to tax that, too.

The basics are simple enough: food, primary residence (shelter), energy for heating, cooling lighting and transportation (you'd still pay taxes on your choice of vehicle), and medical care (which different people will require in differing amounts--there is no way to say what is "fair" for everyone). Spend what you want on them, it is up to you.

Exempt those, with a broad brush, and there is nothing to lobby about.

And forget issuing checks, and even better, forget the totalitarian notion of keeping tabs on every American Citizen, of any age, from cradle to grave on a month to month basis and all the expense which will go with it.

159

posted on

02/26/2008 4:26:50 AM PST

by

Smokin' Joe

(How often God must weep at humans' folly.)

To: longtermmemmory

nonsense, you have people avoiding mere single digit sales taxes using the internet. Nonsense, yourself. There are millions that don't have a computer and millions more with computers that do not trust internet shopping, banking, etc.

The same will be done as sure as night follows day when it is 23% or 30%.

Or you can buy used to avoid taxation under the FairTax.

The bottom line is people that really don't want to pay taxes ain't gonna pay taxes and a income tax or sales tax or any other kind of tax ain't gonna stop. The FairTax debate isn't about a few outliers that will be outliers regardless of the tax system, it's about eliminating a tax system that is abusive, intrusive and oppressive.

160

posted on

02/26/2008 5:30:28 AM PST

by

cowboyway

("No damn man kills me and lives." -- Nathan Bedford Forrest)

Navigation: use the links below to view more comments.

first previous 1-20 ... 101-120, 121-140, 141-160, 161-179 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson