Posted on 10/25/2010 7:18:22 AM PDT by blam

Guaranteed Hyperinflation: Expect Another Big Year for Precious Metals

by: Hyperinflation

October 24, 2010

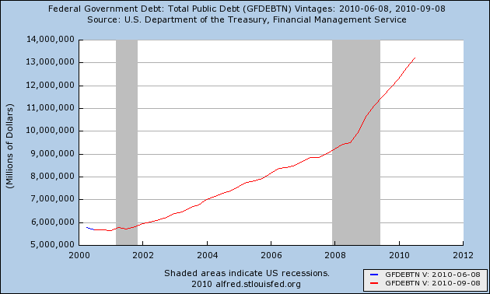

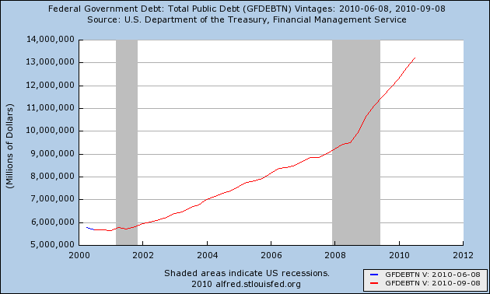

Earlier this year, the senate passed a 1.1 trillion dollar increase in government spending, increasing the budget for healthcare, education, law enforcement and defense, among other appropriations. If our mounting record budget deficits weren't enough, the proposed increase in our already dangerously large debt ceiling (13.3 trillion) will most certainly have catastrophic consequences in the near future. The new ceiling will be approximately 14 trillion, a number that will be reached by early to mid-2011 if debt accumulation continues at the rate seen in 2009-2010.

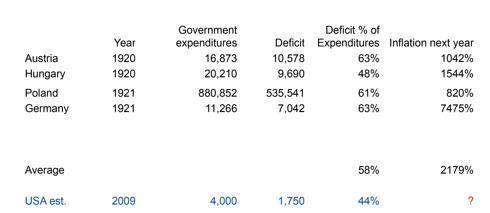

We are all but guaranteed a hyperinflationary great depression (hyperinflation with unemployment exceeding 25%). This is becoming eerily similar to the hyperinflation in Weimar, at least as fiscal recklessness goes. As far as money printing goes, we will most likely see QE2 announced before year end. Though this will likely differ from QE1, I think it will be many times more dangerous. This time around the Fed has hinted at more asset purchases, namely U.S Treasuries. Monetizing our debt is nothing short of a pure injection of inflation into the economy. If this is combined with more fiscal stimulus, QE2 could be the straw that breaks the camel's back.

Echoes from Weimar

The early stages of the hyperinflation were characterized by large influx of foreign capital. Weimar was financially and economically depleted due to the war, more specifically as a result of the Treaty of Versailles. The U.S., on the other hand, is financially and economically depleted due to its lack of manufacturing base, lack of consumer savings, which fuels capital formation (real economic growth and viable job creation are only possible because of this), enormous trade and budget deficits, destructive monetary policy, etc.

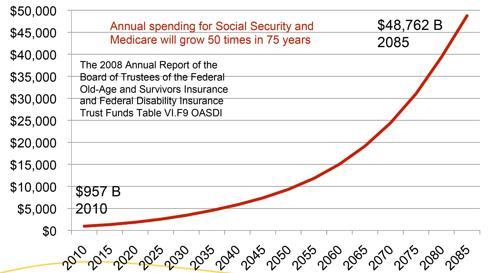

Of course the U.S. has been able to print and squander trillions without any immediate consequences because they maintained world reserve currency status, delaying the inevitable consequences of such actions to a later date. This will be greatly exacerbated as each year passes. The NPV (net present value of all our unfunded liabilities) is currently around *200 trillion(!) with these know-nothing politicians just wanting to spend more.

This is most certainly a recipe for disaster, with the only remedy being to default. This is very unlikely to happen, however, as Barack Obama ran on the slogan "change". Not to mention that he knows nothing about economics nor do his advisors. He has actually convinced himself that he can create jobs by spending more and more money. It does make sense, considering that he exemplifies socialism to the utmost degree. Instead of being responsible and cutting social security (now in the red), Medicare, Medicaid and defense, Obama and his cronies want more spending. His slogan should be "we will spend our way to prosperity".

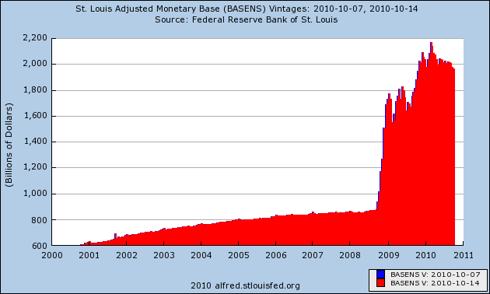

By taking a brief look at the chart above, one could argue that there is still time to repair this damage. But 2010-2011 will see that the deficit as a percentage of expenditures shoot up over 52%. To think that this is the damage created through fiscal policy alone should scare most people into putting at least 10% of their assets in gold or silver or other commodities, which will rise faster than inflation.

Expect another big year for the precious metals in 2011 as the following are some catalysts to fuel continued price appreciation:

If the debt ceiling is raised again. QE2 is announced. Another round of bailouts - specifically the FHA. Increase in mortgage defaults - something to watch in 2011 as ARMS reset.

Aside from owning physical precious metals, futures are the ideal way to profit from the resumption in the commodity bull market (which will be driven more by inflation than demand as all industrialized countries around the world have fallen prey to Keynesian doctrine, making this a worldwide currency crisis). Other vehicles for those wishing to avoid futures include ETFs holding the physical assets (though many have questionable auditing), such as silver (SLV) or gold (GLD). A great way to get leverage to the price of gold or silver is through mining companies or the gold miners ETF (GDX). Precious metal royalties have reduced mining risk but leverage the underlying commodities, providing some middle ground between physical metals and the metal ETFs vs. futures. Some gold royalty companies are Royal Gold (RGLD), Franco-Nevada (FFNVF.PK), while Silver Wheaton (SLW) is the only legitimate silver royalty companies. For long-term investors these vehicles have the overlooked advantage of being inflation resistant as far as input costs go. Individual miners, on the other hand, will have rising energy (oil) and capital equipment prices.

Another similarity to Weimar is the massive increase not only in the money supply but the monetary base (pictured below). This tool will keep the banks afloat and will allow them to begin lending again. Remember, the real definition of inflation is an unnecessary increase in the supply of money and credit.

*- according to the congressional budget office

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.