Please bump the FReepathon thread

Support FR today!

Posted on 10/21/2011 12:10:06 PM PDT by Cincinatus' Wife

[snip]

“Any flattening of the tax rates would have distributional consequences across income classes,” wrote CRS economics specialist Jane Gravelle.

Of course, to many flat tax proponents, that is part of the point of such a system. Nobel prize-winning economist Milton Friedman, the modern father of the flat tax, challenged progressive taxation as inherently unfair.

After all, even under a flat tax, the wealthy pay more, as they have more income, noted Friedman. To increase the percentage of their burden is to use the tax system as a means to redistribute income, in his view.

“This seems a clear case of using coercion to take from some in order to give to others and thus to conflict head-on with individual freedom,” wrote Friedman in his book, “Capitalism and Freedom.”

Liberal economists reject this libertarian view. For one thing, the burdens of supporting society should fall in proportion to the ability to bear them, they argue. For another, a dollar is worth more to the poor, who have fewer of them, than it is to the rich. In this way its value is not constant across income levels, they say.

[snip]

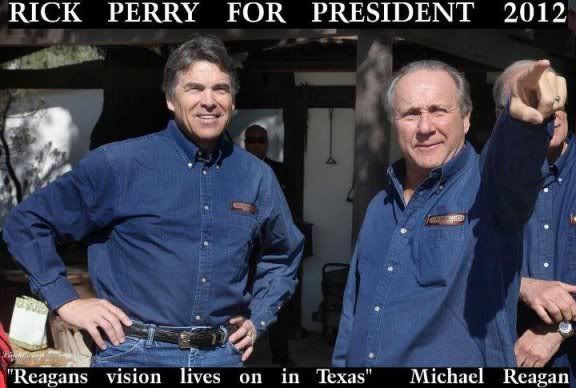

Will Perry’s proposal help him with GOP primary voters? That remains to be seen of course. But one thing it may do is draw a distinction between him and once-and-current frontrunner Mitt Romney.

According to the Associated Press, in 1996 Romney bought a $50,000 newspaper ad in Boston that said Forbes’ flat tax proposal would primarily benefit the rich. The flat tax “is a bad idea for the Republican Party,” wrote Romney at the time.

(Excerpt) Read more at csmonitor.com ...

When Steve Forbes proposed the Flat Tax in the 1990s, Mitt Romney got so upset about it, he decided to put an ad out attacking the proposal. Romney’s capital gains rate cutoff is very “unflat tax” and locks in place our current progressive-tax complexity and burden. If Perry makes the Flat Tax the centerpiece of his economic plan, he can contrast with Romney, and then bring in other bold-yet-realistic conservative agenda items to round out a full economic program:

* Tax reform – a flatter, fairer system via the Flat Tax.

* Energy independence via drill now and ‘all of the above’ energy policies.

* Entitlement Reform via Social Security choice.

* Balancing the budget and controlling spending via BBA, and ‘cap and balance’.

* Reassert Federalism by returning money and decisions to states.

* Regulation and federal tort reform – repeal Dodd-Frank, etc.

* Healthcare reform – repeal Obamacare, replace with Healthcare Freedom Act (MSAs, buy insurance across state lines, etc.)

http://powerwall.msnbc.msn.com/politics/the-campaign-whisperers-1704229.story

IF you'd rather NOT be pinged FReepmail me.

IF you'd like to be added FReepmail me. Thanks.

*****************************************************************************************************************************************************

I support a flat tax, but I can’t support Perry.

Here's a link to a Townhall article titled “Design Your Own Flat Tax”:

The article has a link to a tool that calculates the effects of any flat tax formula you chose — both on yourself, and on the national budget. Here's the direct link to that fascinating tool:

http://politicalcalculations.blogspot.com/2011/09/design-your-own-flat-income-tax.html

You can model Cain's tax proposals with it — or you can use it to come up with a better set of numbers.

If the rates are flat, that doesn't mean that people with higher incomes will actually pay more money ~ again, they will simply hire on more accountants and lawyers to figure out how they can avoid paying more.

We have rich people who pay no taxes. We have poor people who pay taxes.

The problem may be insoluable short of sending around Finance Police to collect from high earners.

That’s really cool.

I actually end up almost even (a little worse off) on a 9% with no deductions whatsoever than with 22.5% with individual tax credit of $2400.

Of course, I have a big family. Individuals with small families are way better under 9-9-9 by 8%. Assuming they have a household of 2, don’t spend more than 90% of their income on new goods, they’d be ahead under 9-9-9.

So the more kids you have, the worse off you are under 9-9-9 vs. a flat tax with an individual tax credit.

I agree. While I don’t like Perry, I think he could come back if he plays the foil to both Cain and Romney. It’s how Clinton played the 92 election. He claimed to be between the two “crazies” of GHWB (internationalist) and Perot (protectionist). He wasn’t. He very strictly enforced the economic policies GHWB espoused.

That’s the rub for the voter. Will Perry play as he says he will, or will he slide back into his old “take the easy road” character? With folks like Palin, Cain and the Tea Party constantly talking, I’m not sure he’d have an easy time of backsliding.

Either way, he’s better than Romney and I think his flat tax may give him a pretty good shot at the goal.

Everyone from Texas knows: Perry can’t debate, but, boy, can that guy campaign.

Bump!!!

Maybe but it's a LOT flatter than it is now as only brackets are 0 percent and whatever other rate is chosen.

In fact, you can make the argument that it really isn't progressive at all as the same rate and same exemption applies to everyone regardless of income.

It certainly is a fair system.

All this talk of a “flat tax” is BS.

That’s just a catch phrase.

What they’ll really end up doing is saying “well, it’s a flat percentage, but we exclude the first x dollars of income, etc.”.

Ok. Then it’s not flat anymore.

Since RATs, RINOs and liberals are big on “choice”, let everyone choose- flat or progressive.

Thank you for the links.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.