Posted on 12/17/2011 2:22:10 PM PST by thackney

The Alaska Department of Revenue’s fall forecast, released Dec. 15 as Petroleum News was going to press with this issue, shows a sharp decrease in forecast production compared to the spring forecast, with Alaska North Slope crude oil volumes dropping below 600,000 barrels per day beginning in the current fiscal year, 2012. In the spring forecast, Revenue was projecting production of more than 600,000 bpd through fiscal year 2017.

Production is projected to average 574,000 bpd for FY 2012, dropping below the 500,000 bpd mark in FY 2020.

In his cover letter to the governor, Revenue Commissioner Bryan Butcher said North Slope production declined 6.3 percent in fiscal year 2011 and a decline of another 4.7 percent is expected in FY 2012, “assuming that the oil production included in the ‘under development’ and ‘under evaluation’ layers of our production forecast come to fruition.”

Without those layers, the FY 2012 decline could be as high as 9.1 percent, he said. For FY 2012, Revenue shows 26,000 bpd under development and 1,000 bpd under evaluation.

In a press release on the forecast Butcher said, “Alaska’s revenue outlook is strong and relatively stable this year due mostly to continued high oil prices,” but warned of the impacts of steadily declining oil production.

New oil is a crucial part of the department’s ANS forecast, accounting for 4.6 percent in FY 2012 and rising steeply to 47.2 percent of ANS production in FY 2021.

Butcher contrasted production forecasts by Revenue in fall 2007, shortly after the passages of ACES, or Alaska’s Clear and Equitable Share, when Revenue was projecting “that ANS production in 2012 would be 675,000 barrels per day. Four years later our production forecast has changed, with 100,000 fewer barrels per day anticipated in FY 2012,” he said.

Spring vs. fall

There is also a difference between what Revenue projected last spring and its fall forecast. The final year of the spring forecast, FY 2020, shows production of 530,000 bpd; the fall forecast shows projected production dropping to 486,000 — the first projection below 500,000 bpd — in FY 2020.

One change between spring and fall is when production is expected from BP Exploration (Alaska)’s Liberty prospect east of Endicott and from ConocoPhillips Alaska’s west side CD-5 project in the National Petroleum Reserve Alaska.

In the spring, Liberty production was shown as beginning in FY 2013. The fall forecast wraps Liberty into an offshore category which includes Northstar, Liberty, Nikaitchuq and Oooguruk, and while Liberty isn’t noted separately, the first uptick in production from the offshore category comes in FY 2016, peaking in 2017. The spring forecast showed a similar pattern, with Liberty production beginning in one year and peaking in the next and the uptick volumes are similar to standalone Liberty forecast from the spring forecast, which showed a peak of 39,000 bpd.

NPR-A production, shown in the spring forecast as beginning in FY 2015, is shown in the fall forecast as beginning in 2017 and peaking in FY 2019.

Kuparuk production the same

For producing fields, only the Kuparuk forecast remains the same, 87,000 bpd in FY 2012, dropping down through 83,000 and 81,000 bpd in FY 2014, with some differences in the out years, but nothing substantial. Prudhoe Bay stood by itself in the spring forecast; in the fall forecast it includes production from Milne Point, so while Prudhoe numbers would appear to be up, they are actually down compared to the combined Prudhoe-Milne spring forecasts.

Prudhoe is forecast to produce 276,000 bpd in FY 2012, down from 297,000 in the spring forecast. The FY 2013 fall forecast shows 269,000 bpd, down from 284,000 in the spring forecast; the downward trend (both overall and compared to the spring forecast) continues through 2020, the last comparison year.

Prudhoe Bay satellites are also forecast to produce less in the fall forecast, from 37,000 bpd in 2012 to 16,000 bpd in 2020 in the spring forecast down to 36,000 bpd for 2012 in the fall forecast and dropping off to 18,000 bpd in 2020 in the fall forecast compared to 27,000 bpd in the spring forecast.

ANS price up

While Revenue’s production forecast is down from last spring, the price forecast is up. In the spring, Revenue projected Alaska North Slope on the West Coast at $94.70 a barrel for fiscal year 2012; the fall forecast estimates $109.33.

Revenue’s ANS West Coast price forecast is $109.47 a barrel for FY 2013 (compared to $95.79 in the spring); this fall’s forecast continues above the level forecast in the spring through FY 2016, when the trend reverses and the fall forecast drops below the spring forecast through FY 2021, the end of the forecast period shown in the fall forecast.

The fall West Texas Intermediate price forecast is below the spring forecast with the exception of FY 2014.

Four years later the production forecast has changed, with 100,000 fewer barrels per day anticipated in FY 2012.

What would you posit as the cause of that?

Do you know offhand how much oil the Trans-Alaska Pipeline needs to remain operational?

At least partial due to the impact of higher taxes resulted in few dollars spent on improving and maintaining production rates.

What options do they(we) have to increase production there ?..

The last projection I saw was they would switch to natural gas in 20 years and run that for 40+ years. That is IF no new exploration areas are opened, then the need a second pipeline to carry gas.

They are only drilling a 25 mile by 50 to 65 mile section of what is a +/-900 mile by 200 mile field. The Dems have so far blocked further opening of new areas.

The field started at 1.4 million barrels per day...

Maintenance is another factor. The facilities have reached the design life and are being refurbished during temporary down times. That negatively effects the production rates when they are not running because of repairs.

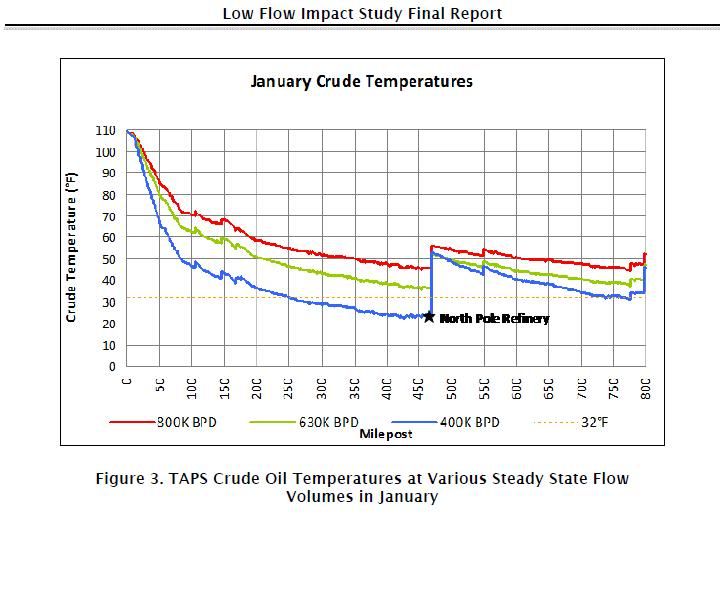

Alyeska has completed a comprehensive Low Flow Impact Study (LoFIS) on behalf of the TAPS owners. The study evaluated the potential risks associated with declining throughput and lower oil temperatures and identified mitigation measures.

The LoFIS identified potential challenges with throughput levels between 600,000 and 300,000 barrels per day (BPD). Potential challenges include:

Water, present in oil as small droplets, is expected to separate out in a layer at the bottom of the pipe at 500,000 BPD and lower. Separated water will increase the potential for ice formation and corrosion.

Wax build up in the pipeline is present at current throughput levels and will continue to increase as throughput declines.

As throughput drops below 550,000 BPD, oil temperature will have the potential to drop below the freezing point of water and form ice in the pipeline during the winter months. Ice could damage pumps and equipment.

Crude oil temperatures at 350,000 BPD could allow soils surrounding buried sections of the pipeline to freeze, which would create the potential for ice lenses. Ice lenses could cause movement and damage the pipeline via frost heaves.

Mitigation measures recommended in the study include:

- Minimize the impact of temperature decline by adding heat and insulation.

- Modify the water and temperature specifications for crude oil entering TAPS.

- Adjust the pipeline pigging program as throughput declines

http://www.alyeska-pipe.com/Inthenews/LowFlow/LowFlow.html

Unacceptable pipe displacement limits and possible overstress conditions in the pipe would be reached at a flow volume of 300,000 BPD.

Lots more detail available at the link.

What options do they(we) have to increase production there ?..

Dump Obama for starters :)

Don’t forget the AGIA pipeline!!

Bring state taxes to be more competive with the rest of North America.

When the same money invested in Texas, North Dakota or Canada results in far more return than in Alaska, Alaska is going to be on the low end of the investments.

I've worked in Alaska designing production facilities on the Alaskan North Slope.

What 900 mile long field are you thinking of?

Logical.. thanks..

Fix this problem by drilling in the lower 48! There is so much oil/NG in the lower 48 then we’ll ever use!

Don’t try to tell me ANY different, PLEASE.

They have found oil and gas from the Canadian border around to the Bering Sea Coast. It looks like there is oil in all the shallow waters north well into the Artic Ocean.

I’ve done the outage repair work up there the last three years. I’ve worked GC1, GC3, FS3, GPMA, the BOC poo plant, the FS2 refinery, and estimated work in other areas.

The problem is low flow rates in the Alaskan Pipeline. More drilling in the L48 will NOT bring more oil through the Alaskan pipeline.

Is your suggestion to abandon the Alaskan Pipeline and leave the remaining North Slope oil unproduced?

Active drilling in the lower 48 is at a rather high rate:

http://files.shareholder.com/downloads/BHI/1569845165x0x529196/458366F8-E50A-4B9C-BC0C-8E91304939E7/na_charts_121611.pdf

There are multiple fields with pockets of oil and gas, but it isn't one 900 mile long field.

I hate HTML... That is why I don’t post more.

It almost is if you count the various depths they have found in the last few years.

That is not oil. Methane Hydrates are pure natural gas traped inside a latice of ice. There have been limited attempts to produce them on the North Slope. But with the successful production of the shale gas fields, they do not compete economically with gas from the lower 48.

These are typically found at the bottom edge of the permafrost in this area. BP has completed a production test; ConocoPhillips have done one as well. They were at least partially funded by us taxpayers on a government program.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.