Posted on 01/11/2012 10:21:31 AM PST by SeekAndFind

"2) Did the companies he restructured give significant equity to unions?"

You will have to ask him. He is the one who made the comparison between what he did and what Obama did.

Good post!

Good point. The term vulture is used because of the nice wood play - vulture, venture. However, jackal capitalism would be more accurate.

WOULD “Undertaker” be more acceptable?

From Forbes, hmmmm, Forbes is very credible. If Forbes goes after Romney on this Romney is in trouble. hmmm

IPOs That Give Little Guys a Shot at Venture Returns Offerings Give Small Investors a Way to Buy into Lee, Bain Deals

Boston Globe - Boston, Mass.

Author: Bailey, Steve; Syre, Steven

Date: Mar 4, 1998

Start Page: D.1

Text Word Count: 857

Abstract (Document Summary)

The Thomas H. Lee Co., Boston's biggest buyout firm, says it has had an annual compound return, before fees, of 101 percent over its history. Its crosstown rival, Bain Capital Inc., says its compound annual return is somewhere north of 100 percent — and when annual returns get that enormous, says Bain chief executive Mitt Romney, why do you need to say more?

There is one way to buy into the Lee and Bain deals: the initial public offerings that both firms regularly kick out.

The answer, we found, is that while the later public investors did nowhere near as well as the earlier, private investors, they have fared extraordinarily well compared with the stock market at large. One point worth noting: Lee's IPOs have fared well, Bain’s deals even better.

(snip)

//

(no link)

CHALLENGERS TAKE ON ENTRENCHED INCUMBENTS \ ROMNEY PUTS HEAT ON

Worcester Telegram & Gazette (MA) - Sunday, October 16, 1994

Author: Brian S. McNiff; Telegram & Gazette Boston Bureau

BUSINESS BACKGROUND

He tells potential constituents that he wants to bring his business background to government. But he finds the practices of some of the businesses he's invested in under fire from the Kennedy campaign - an attack that some surveys show has blunted his momentum.

Workers on strike against an Indiana factory owned by Bain Capital Inc., the firm where Romney is a managing partner, came to Massachusetts to demonstrate and make TV spots for Kennedy. The unionized workers protested the fact that when Bain took over Ampad, a stationery company, employees were let go and some were then offered their jobs back at lower wages with reduced benefits.

Romney insists that Bain is not a union-buster and professes ignorance of the issues the strike involves, while expressing the hope that it can be resolved.

He says his company has invested in firms that have created more than 10,000 jobs. Sometimes the number he cites is as high as 17,000.

//

(no link)

Romney backers, foes spar over plant closing

Boston Herald (MA) - Tuesday, February 21, 1995

Author: TOM MASHBERG

If payback is sweet, then Mitt Romney enjoyed his with extra icing last week when the 250 Indiana unionists who helped scuttle his Senate bid finally saw their own jobs go under.

The firings, which were expected, prompted irate cross fire from laborites and Romney -ites - a sign of the sourness sure to linger on both sides if Romney stays in the political arena.

“It's too bad these 250 workers were manipulated by the Kennedy campaign and the union bosses and now have been abandoned by both,” said Charlie Manning, Romney ‘s ex-campaign spokesman. “ Mitt ‘s a job-creator. That’ll be his legacy.”

Joseph C. Faherty, head of the state's AFL-CIO, feels otherwise, indicating that the political payback could keep going around, and coming around.

” Romney has exacted the final retribution against Ampad workers,” he said. “Should he decide to seek office in the future, we will be there to expose his record for the sham it is.”

(snip)

Ampad still dogs Mitt Romney

January 6, 2012

From “The Making of Mitt Romney,”

Boston Globe, June 26, 2007

http://www.massresistance.org/romney/ampad_062607/index.html

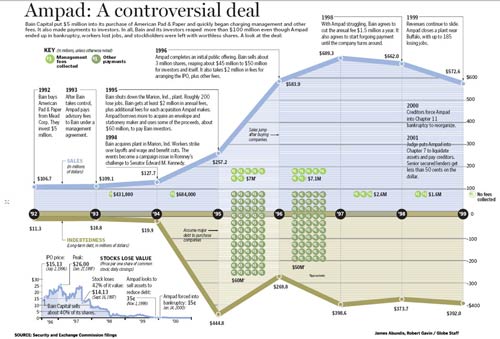

In 1992, Bain Capital acquired American Pad & Paper, or Ampad, from Mead Corp., embarking on a ‘’roll-up strategy’’ in which a firm buys up similar companies in the same industry in order to expand revenues and cut costs.

Through Ampad, Bain bought several other office supply makers, borrowing heavily each time. By 1999, Ampad’s debt reached nearly $400 million, up from $11 million in 1993, according to government filings.

Sales grew, too - for a while. But by the late 1990s, foreign competition and increased buying power by superstores like Bain-funded Staples sliced Ampad’s revenues.

The result: Ampad couldn't pay its debts and plunged into bankruptcy. Workers lost jobs and stockholders were left with worthless shares.

Bain Capital, however, made money - and lots of it. The firm put just $5 million into the deal, but realized big returns in short order. In 1995, several months after shuttering a plant in Indiana and firing roughly 200 workers, Bain Capital borrowed more money to have Ampad buy yet another company, and pay Bain and its investors more than $60 million - in addition to fees for arranging the deal.

Bain Capital took millions more out of Ampad by charging it $2 million a year in management fees, plus additional fees for each Ampad acquisition. In 1995 alone, Ampad paid Bain at least $7 million. The next year, when Ampad began selling shares on public stock exchanges, Bain Capital grabbed another $2 million fee for arranging the initial public offering - on top of the $45 million to $50 million Bain reaped by selling some of its shares.

Bain Capital didn't escape Ampad’s eventual bankruptcy unscathed. It held about one-third of Ampad’s shares, which became worthless. But while as many as 185 workers near Buffalo lost jobs in a 1999 plant closing, Bain Capital and its investors ultimately made more than $100 million on the deal.

(snip)

Learned a couple of things.

1. Bain owns Huntsman's fathers company...strange bedfellows. Clear Channel—Rush Hannity is also owned by Bain (think we knew that)

2. There are two companies at the same address. Mitt has been head of both. Is this cricket?

Finally got to hear FOX Sunday program. Anti-Mitt made the same point that bothered me this AM. 1999 given by company but paper work is different date, make one question why the discrepancy.

What is he hiding by not disclosing his financial records? Does he still own stock? Still making$$? What is he hiding and why?

Even Chocola, the pro-Romney person said they had some problems with Willard, but Chris didn't ask what.

Newt came out this afternoon that he was disclosing his financial record and ask Willard to do the same. Sarah was adamant that he open his records.

You can bet the BO has the goods on him...Coffee cup indeed.......Wake up America!

ping

thanks, hm

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.