Posted on 02/29/2012 2:27:34 PM PST by blam

Why U.S. Gov't Confiscated Gold In 1933. Can It Happen Again?

Commodities / Gold and Silver 2012

Feb 29, 2012 - 01:54 PM

By: Julian DW Phillips

More and more investors are asking this question. Many observers and commentators have ridiculed this idea as archaic with the conditions that led to the confiscation being so different as to leave such a possibility as remote as the return of the dinosaurs.

In this the first part of a series on the subject we look at the picture that led to the confiscation and look at factors that caused the confiscation to see if there are reasons why it can happen again, today!

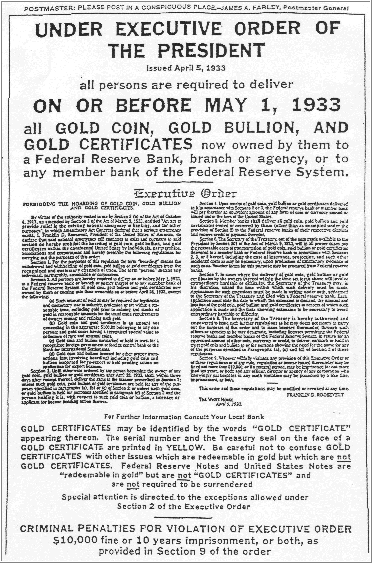

At the left, you will see the actual executive order in which U.S. citizens lost the right to own gold. From May 1st 1933 until 1974, U.S. citizens could no longer hold gold as a protection against paper money, which also lost its gold backing at the same time.

Foreign central banks could continue to exchange the U.S. dollars that came into their possession -known as Eurodollars for decades--for gold and did so particularly when the U.S. dollar was devalued and then floated against the gold price in 1971.

Why?

The "why" is critical to our understanding of the current, global monetary system! There were two distinct phases to the process that began in 1933.

The U.S. monetary and banking system contributed to a large extent to the depression. As Mr. Ben Bernanke has aptly demonstrated by his Quantitative Easing, a reduction in the money supply shrinks economic activity significantly and breeds deflation. After four years of such shrinkage, it was realized that a huge increase in the money supply was needed to invigorate the U.S. economy and make assets preferable to cash.

The monetary system was based on the Gold Standard, a system that set the gold price at a fixed level against the dollar and other currencies across the developed world. One gets the wrong perspective if you look at the gold price as having been subsequently raised as opposed to the reality that it was the U.S. dollar that was devalued.

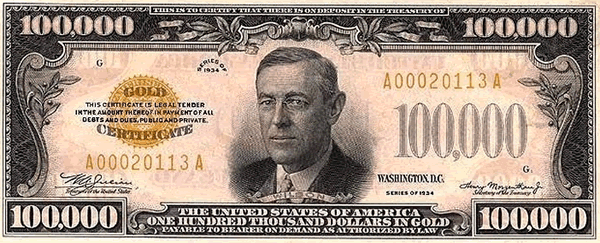

In an instant, the money supply of the U.S. was increased by 75% in 1935 when the gold price was raised from $20 per ounce to $35 per ounce. This was a devaluation of the dollar. It brought a tsunami of liquidity to the banking system that saw deposits leave the banks and flow into industry again. We stress that this was not a gold event, but a money event -gold being money at the time. As you can see on these dollar notes where gold was an integral part of the money system then.

The second phase of the confiscation of gold was to place gold under the control of government out of the hands of private holders, as storm clouds gathered over Europe. Government was then in a position to control the recovery and direct funds to where government felt they would be best put to use.

Despite the proliferation of dollars in the system, confidence in it remained high as it remained linked to gold. The belief that, somehow, this restrained the issue of money also remained inexplicably strong. So long as confidence remained in currencies the value of the dollar remained solid.

Had gold been left in the hands of individuals and private institutions, such an issue of money may well have led to it being sold for foreign-held gold. This would have defeated the government's purpose in devaluing the dollar. The U.S. government had to confiscate the gold of its citizens to ensure the focused success of the increase in the money supply.

The success of dollar devaluation and the "governmentization" of gold was successful as it fueled a recovery that was also invigorated by export demand for U.S. goods ahead of the Second World War.

Fixed Exchange Rates, then "Floating" An ingredient that is often overlooked today is that the world back then was a world of fixed exchange rates only. That's why it took one government decree to change the quantity of money. That hasn't changed! Today, Quantitative Easing does the same.

Chairman Ben Bernanke is a scholar on those times. He used his knowledge of those days to forge the policy he follows today to avoid either deflation or depression. So far it has worked to the extent that the U.S. economy has entered neither. It's clear though that he needs the vigorous support of a very focused U.S. government and the U.S. citizens to turn positive, before he can see his policies produce a convincing recovery. He has neither!

But something fundamental has also happened that will allow for the confiscation of gold, but not for the purpose of a simple devaluation of the dollar and increase in the money supply.

We now live in a global world of supposedly floating exchange rates. Exchange rates are driven by market forces to reflect their value against other currencies. Central Bank intervention does happen on a wide front, either directly through exchange rate management or the supply of currencies between governments to 'manage' exchange rates, almost behind the scenes.

After all, it would be far too expensive an exercise to let currencies find a free market level in the global, competitive world we now live in. But there is a point where market forces are strong enough to defy government wishes, through falling confidence.

Such falls in confidence can and will affect the exchange rate of a currency in the face of the best efforts of central banks to counteract such "management" of currencies. This is when it needs the support of its gold and foreign exchange reserves. The argument that gold cannot be used because it would have a deflationary impact on the monetary system, ignores the ingenuity of monetary authorities.

We feel that, contrary to nearly all the work we have seen on gold's role in the monetary system, a floating gold price would have the flexibility to prevent its price from having a deflationary impact!

The U.S. Dollar Controls Money

The U.S. dollar is the least vulnerable to a proper reflection of its true value in major exchange rate changes and small nation's currencies, the most vulnerable to them. With the currency world having the shape of a tree, with the U.S. dollar as its trunk, it will take far more than falling confidence in the U.S. economy to make the dollar tumble.

We've seen that confidence in the U.S. dollar fall heavily over the last few years but remains as the pivot point for the world of currencies. As the only oil currency of note (only a small part of the oil market prices itself in other currencies) the U.S. is in a position to ensure its use and the need for it in the global currency system.

There's a point where this'll change radically. We're seeing this change now. With Asia up and coming, and sucking the wealth of the West into itself through direct competition, it's only a matter of time before the U.S. pivotal position in the monetary system changes.

One of the first signs of this will be China taking a significant role in the I.M.F. while the voting power of the U.S. reduced to below the point at which it has a controlling vote. (Currently, the U.S. has 16.8% of the votes and the I.M.F. needs an 85% majority to pass any resolution.)

The next sign will be when China prices its goods in the Yuan and not in the USD. Then the USD will slip back to the role of any other leading currency, where its value reflects its Balance of Payments.

To prevent a massive drop in the U.S. dollar exchange rate, the U.S. economy will need to restructure, exporting more than it imports on the trade front, while attracting foreign surpluses through the value foreigners will get from their dollar holdings. This is far from the case now!

They won’t confiscate it, but they’ll tax its use, prohibit certain transactions in it, demand its registry, etc. etc.

They won't confiscate 401k's IRA's and Labor because they won't have to. The currency is being inflated so they will be worthless.

Everybody is complaining that gasoline prices are going up. Nonsense. The dollar is going down.

In 1947, 1 ounce of gold bought 16 barrels of oil. As of today's price, 1 ounce of gold buys 16 barrels of oil.

first they’d probably raise they official price of gold which is around 42 bucks an ounce.

I disagree. That would make the US fiscally *stronger*, which obviously is the last thing they want.

The article makes one good point which is that, because of its international reserve status, the U.S. Dollar is always overvalued. Despite our huge debts and massive Fed-inflation, the world needs dollars to serve as central bank reserves and to buy oil.

This overvaluation is, in large part, what keeps our exports uncompetitive and our imports high. There is also the fact -- take China as an example -- that, keeping the dollars they've earned instead of spending them on our exports, serves an important economic function for them.

As long as the dollar is the reserve currency, we will always run trade deficits. If the day comes when it is no longer the reserve currency, our economy will restructure quite quickly (given the proper political environment) to a more even balance between imports and exports.

Fox News this morning Dick Morris had a good comparison of why gas is at $4.00+ per gallon. He said in 1948 a gallon of gas cost $0.20, the value by weight of the silver in two dimes. At the price of silver today the equivalent weight of silver in solid silver dimes will still buy a gallon of gas. Thus, the dollar has lost value where the price of oil has not changed based on the exchange value of precious metals that once backed the US dollar’s value.

Bookmark

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.