Posted on 07/08/2012 9:51:19 PM PDT by STARWISE

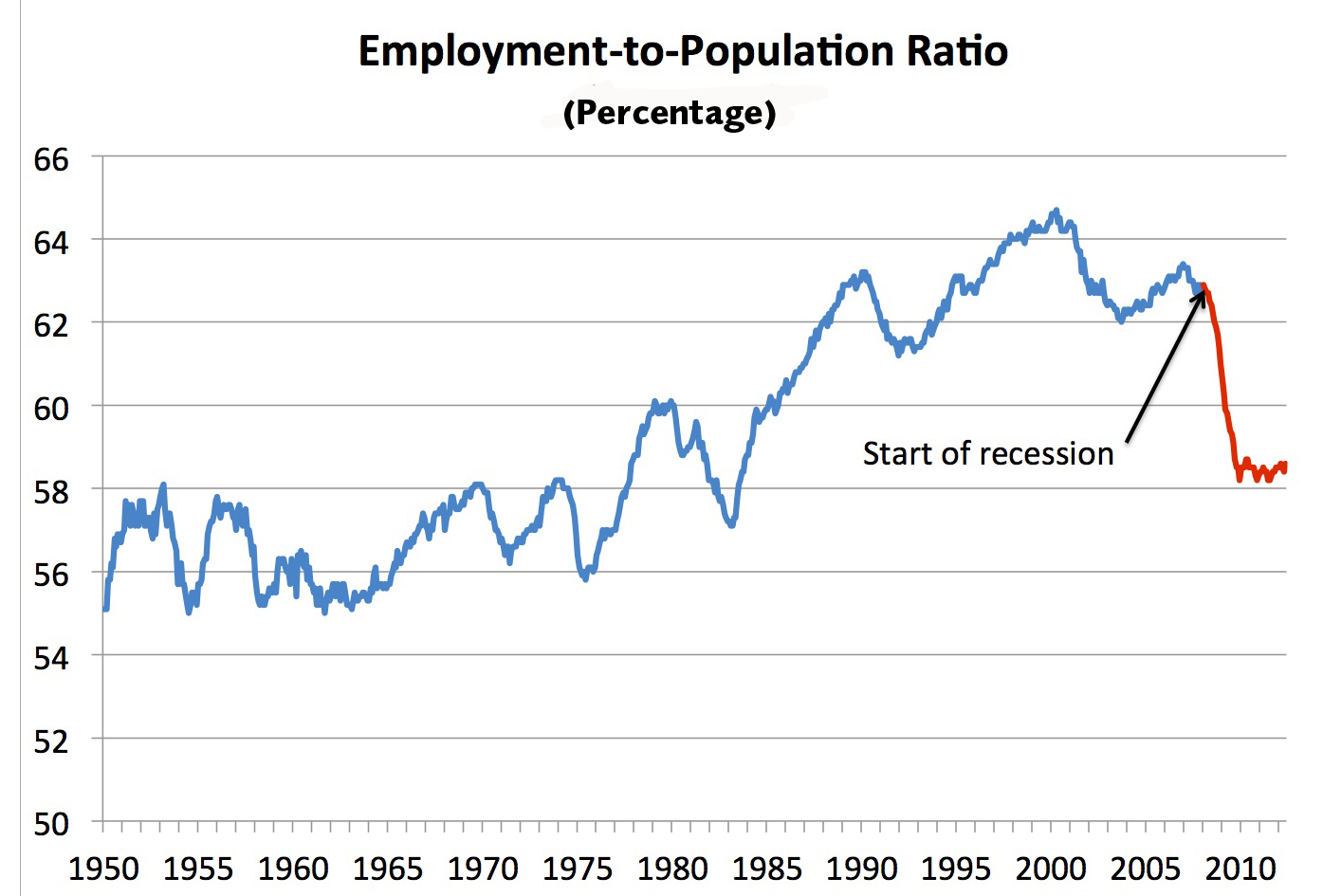

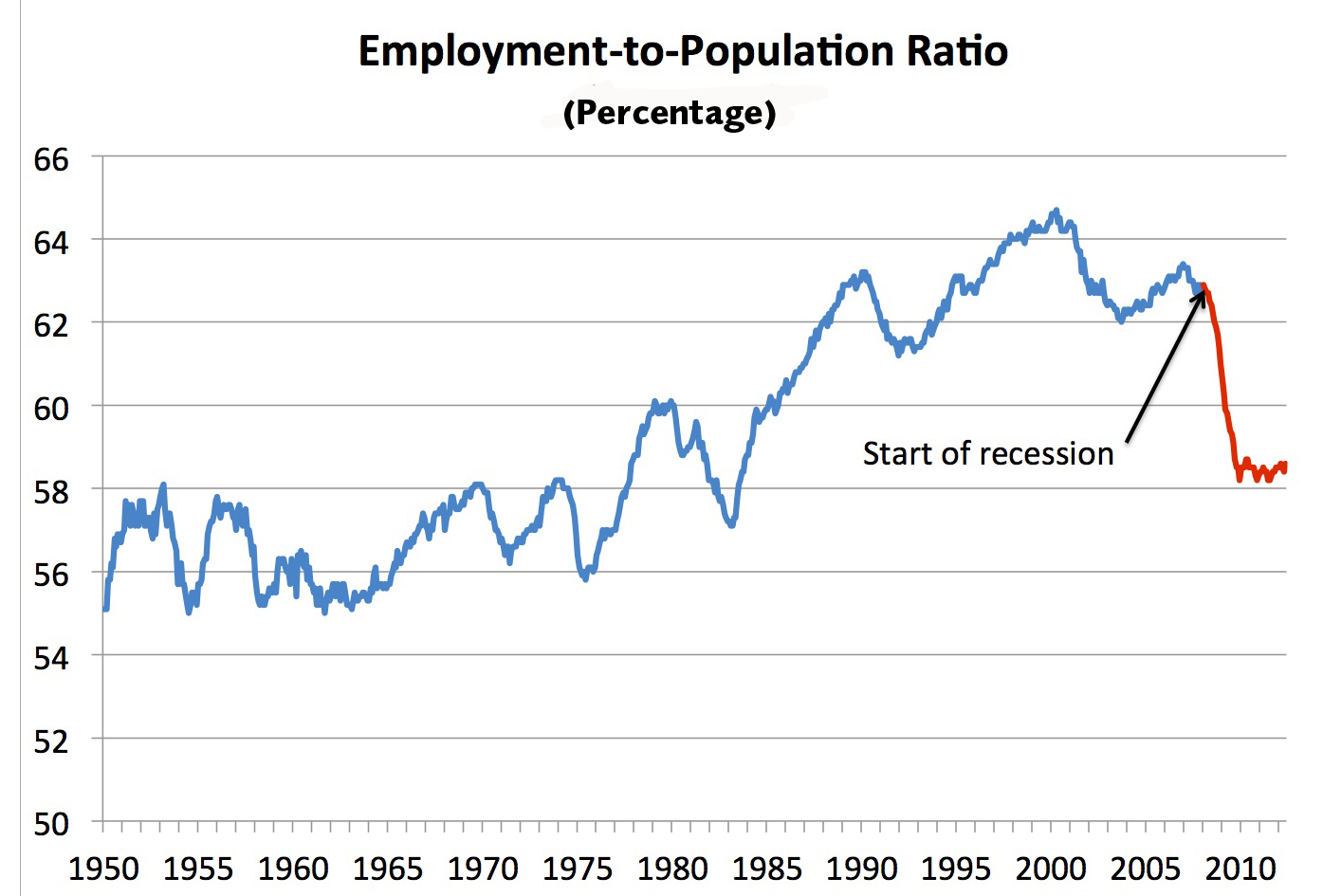

The release of the June labor market data marks the third anniversary of the official end of the recession that began in June 2009. Thus, this is a good moment to look at the single best indicator of U.S. labor market health. As is so often the case, it is also one of the simplest: the employment-to-population ratio.

In essence, this tells us what share of the working-age population (16-years old and above) has a job. When the ratio goes up, things are getting better. When it doesn’t, the labor market is not recovering.

To know what kind of job growth we need for economic recovery, we must first realize that the United States is still a growing nation. Each month, the working-age population grows by an estimated 180,000 people. Simply to support this growing population, we need to add at least 130,000 new jobs.

With anything less, we fall further behind. No matter what the other economic data indicates, a true labor market recovery requires job growth strong enough to consistently raise the employment-to-population ratio.

This would mean adding at least 250,000 new jobs per month, every month, for years.

Good point. I’m encouraged you are not deceived, beginning to think American’s are buying this Obama crap when the polls are still so close. I should have said they are trying to deceive us all.

BKMK

I deal mostly with small businesses and I am seeing many spouses “working” for the husband’s (or wives’) company for no pay because they lost their job. Better than just sitting on your butt.

...”We were in a recovery in late 2009 and early 2010.”....

Says who? The BLS, “independent economists”, the WH, others? I think the GDP data can be fudged, just like the BLS data are fudged. I believe the US economy has not come out of the recession, but in fact I believe it is deepening. The Obama Administration is being criminally aided and abetted by liberal bureaucrats, and by the criminally complicit media that are covering up for it. Don’t believe any of it!

The root cause of the 2008 recession was a government policy, that everyone should be able to own a house whether he could afford it or not. The government forced banks to lend money at artificially low interest rates to poor people who could not afford to keep up their mortgage payments (sub-prime loans). As a result, banks big and small were stuck with bad loans that could not be paid off. The market value of these loans fell to such a low level that large banks were forced to declare bankruptcy. Of course, Bush was declared the villain, as he happened to be President when the scheiss hit the fan. But the issuing of sub-prime loans had its roots in something called the Community Reinvestment Act which was passed during the Carter administration and implemented under Clinton.

The stock market started to recover in March 2009, after extensive examination by bean counters concluded that the banking system had stabilized. By that time, businesses had laid off their inexperienced and less productive and non productive departments.

Weak businesses ceased to exist. Businesses and people got out of debt and saved their cash. This process normally sets the stage for a recovery, and that’s what we got in late 2009 and early 2010. All he had to do was to keep doing nothing, and the economy would have kept going onward and upward. Obama would have been declared a genius and would have been a cinch for re-election, just the way Clinton landed on his feet in 1996 after Gingrich forced Clinton to balance the in spite of his worst instincts.

Unfortunately, Obama squandered stimulus and other taxpayer money by lavishing it on non-productive enterprises like public union pension funds and entitlements, and there went the recovery.

With Obamacare and promises of large business tax and income tax hikes in 2013 staring at them, potential investors like banks and small businessmen are still wisely sat on their cash as they well should, still waiting for a second chance at a recovery. If that ever happens, it won’t be under Obama.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.