Posted on 07/24/2012 4:29:25 PM PDT by markomalley

Several senior House Democrats warned that passing a bill from Rep. Ron Paul (R-Texas) requiring a full audit of the Federal Reserve Board's monetary policy decisions will allow Congress greater leverage to put political pressure on these decisions, which they said would cause serious problems in the U.S. and global financial markets.

The Federal Reserve Transparency Act, H.R. 459, was expected to come up for a vote Wednesday, and seemed poised for passage given its 270 co-sponsors, including nearly four dozen Democrats. Nonetheless, many Democrats used the Tuesday floor debate to warn about the chances that Congress might use the audit to politicize monetary policy decisions.

"This bill would instead jeopardize the Fed's independence by subjecting its decisions on interest rates and monetary policy to GAO audit," said House Minority Whip Steny Hoyer (D-Md.). "I agree with [Fed] Chairman [Ben] Bernanke that congressional review of the Fed's monetary policy decisions would be a 'nightmare scenario,' especially judging by the track record of this Congress when it comes to governing effectively.

"Unfortunately … we in Congress have shown too frequently our inability in a political environment to make tough choices," Hoyer said.

House Financial Services Committee ranking member Barney Frank (D-Mass.) said that while he doubts the bill would ever become law, raising the prospects of congressional interference with the Fed could create significant uncertainty for participants in the financial markets.

"They will see it as political interference, not with the contracting procedures, not with the budget, not with how many cars they have, but with how they decide on interest rates," he said. "And the perception that the Congress is going to politicize the way in which interest rates are set will in itself have a destabilizing effect."

Frank and Rep. Mel Watt (D-N.C.) also accused Republicans of using the audit to attack the Fed's legal mandate to maintain a low unemployment rate, as well as stable interest rates.

Some Democrats, such as Reps. Dennis Kucinich (D-Ohio) and William Clay (D-Mo.), sided with Republicans, who argued that the bill would bring transparency to the Fed's decision and give all Americans a greater understanding of the Fed's activities. While the 2010 Dodd-Frank financial reform law expands the auditing of the Fed, it does not apply to the Fed's monetary policy decisions, which the GOP said is a shortcoming.

"GAO remains restricted under the current law from conducting a broader audit of the Fed that includes, for instance, a review of the Fed's monetary policy operations, and its agreements with foreign governments and central banks," said House Oversight and Government Reform Committee Chairman Darrell Issa (R-Calif.).

"In recent years, the Fed's extraordinary interventions into the economy's fiscal markets have led some to call into question its independence," he added. "We do not ask for an audit for that reason, we ask for an audit because the American people ultimately must be able to hold the Fed accountable, and to do so, they must know at least in retrospect what the Fed has done over these many years."

Rep. Paul, the bill's sponsor, rejected the argument that more information would politicize the Fed.

"To say that we should have secrecy and say that it's political to have transparency … well, it's very political when you have a Federal Reserve that can bail out one company and not another company," Paul said. "That's pretty political.

"I think when people talk about independence and having this privacy of the central bank means they want secrecy, and secrecy is not good," Paul added. "We should have privacy for the individual, but we should have openness of government all the time, and we've drifted a long way from that."

Would you say that a fair reading of that graph is to say that the difference between red & blue is how much ‘real’ inflation has been taking place?

Based on what?

Chuckie Schumer did exactly that when he tole "The Ben Bernank" to "get to work."

Audit but terminate the Reserve. This is the biggest scam in world history, creating MOOTA (Money Out Of Thin Air). If you gave me the _right_ to loan money which I didn’t even have; I should be rich quickly or be dumb. Dumb like so many are to allow this high crime to continue.

Congress is told to own USA money as coinage by USC (period).

“That is to say, under the old way any time we wish to add to the national wealth we are compelled to add to the national debt.

Now, that is what Henry Ford wants to prevent. He thinks it is stupid, and so do I, that for the loan of $30,000,000 of their own money the people of the United States should be compelled to pay $66,000,000 that is what it amounts to, with interest. People who will not turn a shovelful of dirt nor contribute a pound of material will collect more money from the United States than will the people who supply the material and do the work. That is the terrible thing about interest. In all our great bond issues the interest is always greater than the principal. All of the great public works cost more than twice the actual cost, on that account. Under the present system of doing business we simply add 120 to 150 per cent, to the stated cost.

But here is the point: If our nation can issue a dollar bond, it can issue a dollar bill. The element that makes the bond good makes the bill good.”

— Thomas Edison, via NYT

Paul is an idiot.

The Federal Reserve already is audited by Deloitte & Touche. Every dollar is accounted for.

Congress doesn't need to be looking over the shoulder of the FED second guessing their policy decisions.

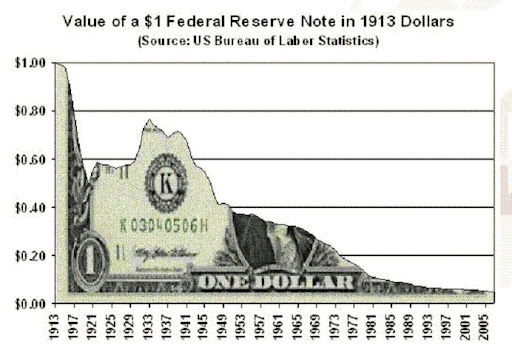

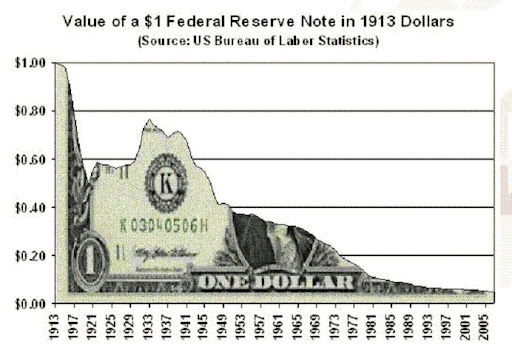

The FED has kept year to year fluctuations in the dollar far more stable than year to year fluctuations under the gold standard which sometimes fluctuated 20% in a year.

The Fed has also avoided deflation which is associated with depressions, by targeting a small amount of inflation each year, which works well for business and everyone except those that want to hoard dollar bills in their mattress for 50 years instead of invest them.

Finally, the Fed didn't cause the debt, Congress did.

Any loan creates money. It’s not the Federal Reserve. Every bank ever individual that loans creates money.

It works like this.

Sam has $200.

He loans it to Fred.

Sam now has a receivable of $200 and Fred has cash of $200 and a debt of $200. Voila Sam’s Receivable of $200 and Fred’s cash total $400, you’ve just printed money out of thin air.

Not even. The Reserve does not have the money it loans. Duh.

Sure it does. It's got loads of money due to the bank reserve requirement. Plus it collects interest on the money it loans and makes an enormous profit each year, which it turns over to the Federal Treasury.

And the Fed's annual report with audited financial statments (Auditors statement pg 341)

To say we don’t see eye-to-eye is an understatment. This is the most important secular issue of our lives. You may believe what you wish, but the crisis which is engulfing the earth is MOOTA; i.e., sovereign debt. Many are going to have to find out the hard way.

“Lenin was certainly right, there is no more positive, or subtler, no surer means of overturning the existing basis of society than to debauch the currency ... The process engages all of the hidden forces of economic law on the side of destruction, and does it in a manner that not one man in a million is able to diagnose.”

— John Maynard Keynes, economic adviser to FDR

But the Federal Reserve didn't create that debt, congress did. The Federal Reserve is the only group up there doing exactly what they are supposed to be doing and what the country needs from them.

The Federal Reserve doesn't buy federal securities so congress can run up the debt. They started buying them only once unemployment started soaring, and then to bring interest down, to get the economy back on track. Not doing so, would kill the patient in order to show congress they shouldn't have run up the debt like that.

Congress, the President, and the Judiciary have lost sight of our values.

And if you think Congress won't continue to borrow money on a gold standard and promise that your children will repay foreigners with gold, you better think again.

Of course! When the government borrows money, they shouldn't have to pay interest. You should lend them your money, right away!

It is beyond belief that such a special group of people exist. They loan money they don't have and it must be paid back in real money. Let me see, if the _reserve_ rate is say %5, they have made 95%, even without the interest. Completely anti-Bible. If I tried to loan this way I'd be put in jail, so should they.

So? Do it anyway.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.