Posted on 08/02/2012 3:20:07 PM PDT by blam

Gold Priced For Collapse

Commodities / Gold and Silver 2012

Aug 02, 2012 - 02:32 PM

By: Peter Schiff

Where is the gold price today? If you're like many Americans, you have no idea whether it went up, down, or sideways. Fortunately, I know my readers to be more informed - you likely know that after falling from almost $1900, gold has been trapped around $1600 since early May. But you may still be curious why despite continued money-printing and abysmal US economic reports, gold hasn't been able to hit new highs.

Here's the truth: gold is currently priced for collapse. Many investors believe the yellow metal has topped out and are selling into every rally.

Nerves of Tin

Being a gold investor is tough business. The last thing any government or corrupt big bank wants is to have a bunch of people putting their savings into hard assets - and gold is one of the hardest of all. So we're constantly up against tides of propaganda saying that gold has no value or is the refuge of doomsayers.

The effect of this is that even heavy gold investors are always waiting for the other shoe to drop. When house prices were rising, no one was worried that the market had peaked or prices were unsustainable. No one was asking whether all the thin-walled McMansions going up would actually be worth anything in a generation. But for gold, Wall Street has been shorting it all the way up!

Nowhere is this pessimism more evident that in gold mining stocks. Rising inflation has driven production costs higher, but the mistaken belief that inflation is contained and Treasuries are a safer haven is keeping a lid on gold prices. As such, many of the major producers have missed their earnings projections, and their share prices have been punished. This has placed a cloud over the entire sector. In fact, the P/E ratios of major gold miners are near record lows. Stock prices reflect future earning expectations, and judging by the low P/Es, Wall Street expects future earnings to plummet. This likely reflects their bearish outlook for gold, which is generally viewed as a bubble about to pop.

Chronic Memory Loss

Unfortunately, there is no public validation for those who have proved the gold doubters wrong. A couple of years ago, I predicted gold would cross $1500 and even my own staff thought the call was too risky, too extreme. But I knew then, as I know now, that at the end of the day the gold price is not a mystery - it's a proxy for dollar weakness.

Since most investors do not truly understand gold's economic role, they assume the 10-year bull market must be a mania. But manias show parabolic growth detached from any fundamental driver. The definition of a mania is the bidding up of an asset quickly and beyond all long-term justification.

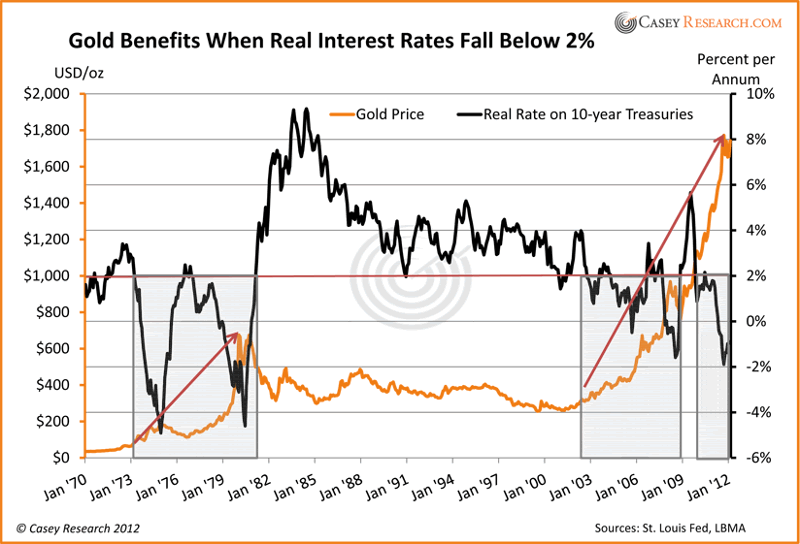

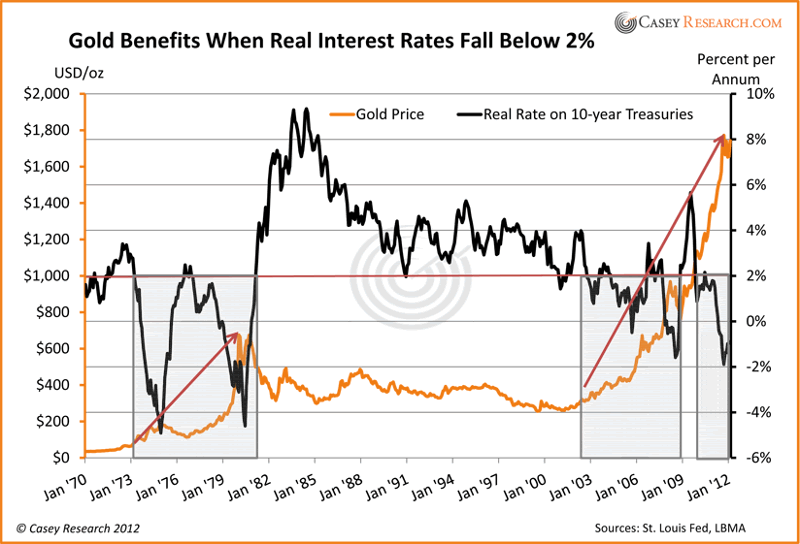

Gold, however, has grown steadily in inverse correlation with real interest rates, as explained by Jeff Clark and Mark Motive in past issues of this newsletter. As a reminder, here's a chart detailing the correlation:

The Opportunity of the Decade

After spending the previous fall and winter testing new nominal highs above $1800, future investors may come to view spring and summer 2012 as the opportunity of the decade. Gold has shown its strength and retreated. While most investors will take that as a signal that the market has topped, some will take advantage of the general trepidation to add to their positions at hundreds of dollars off the highs.

While I think gold is a bargain at $1900 considering today's circumstances, the market phobia of a price collapse is allowing us to buy at well under established highs. It's as if you already wanted to go swimming, but you found out when you got there that the pool was heated.

What Happens Next

I've seen markets like this before, and by making some reasonable inferences, I have a good picture of how this could play out. Gold will continue testing the $1600 barrier until it surprises to the upside. This could be spurred by the announcement of QE III, a calming of fears in Europe, or any shock to the Treasury market. Treasuries have temporarily overtaken gold as the primary safe-haven asset. Once that dynamic is broken, I believe the counterflow into gold will be tremendous.

Right now, there is a haze over investors. Frightful news from Europe and a slowdown in Asia have shaken confidence in any asset that doesn't have the steady track record of US debt. But as I often remind my clients, past performance doesn't guarantee future results. Any news that wakes investors up to the coming collapse of the Treasury market will likely trigger a rush into the one asset with a track record as long as civilization itself.

Prepare For Collapse

The key to this market is to understand that a price collapse is coming - but not for gold. Instead, the market for US dollars and dollar-denominated debt is headed off a cliff, which will send the price of precious metals soaring.

Now is a time for uncommon confidence. Everyone knows Treasuries to be safe, just as they knew house prices would always rise. Then as now, gold's value and utility are doubted. But my readers know better.

"Jon Hilsenrath, the world's best central bank reporter, says that the conclusion from this week is that the world's big central banks (the Fed and the ECB, natch) are on 'red alert' over the state of the US economy. "

From the headline I thought it meant Gold was about to drop drastically.

Yes, you need to read this article very carefully before you make any investment decisions based on it.

My belief is that gold will cross $3,500/oz before this is over. My opinion is that it will cross $5,000.

I could be wrong, do your own DD.

Misleading headline.

Same old, same old:

Gold at record levels but going higher (take my word for it).

Buy now and avoid the SHTF rush.

"The true refuge is Gold & Silver, the constant over the ages, which will return to the core center of banking and trade. The justice meted out will be trade systems dictating to banking reserve systems, or else face obsolescence. "

For prices to rise somebody has to have the money. If Europe is collapsing and America is heading into another major recession where will the money come from to buy gold at a higher price? Our entire economy has become over-inflated and I suspect prices across the board are headed downward when the dam breaks.

I thought the same thing about the tone of the article.

I know human nature and government arrogance so I will hold onto my gold - Thank you very much.

We are losing the WOT and when the battle comes here gold will be denominated not in US dollars but in some third world denominated currency...you cant eat the stuff.

To invest in gold you have to believe that some how things will never get that bad and the US will somehow muddle through.. as much as I wish I could I cant accept that premise.

The folks peddling gold will always try to get conservatives to buy gold but there are far better uses for your dollars today if, like me, you see the future as bleak..

I’m hearing 5-figure gold.

Some custodians seem to be leaking info that allocated gold at some of the central banks (gold which is supposed to be in the inventory and held for customers) has been leased out in a price suppression scheme, and replaced by paper.

If “paper gold” was gold, they’d call it gold.

Until you hold it in your hands, it’s just paper. Not gold.

All this aside, I still think the best investment is baked beans!

I would say that 1500 is the new absolute floor and the sky is the limit when measured in a fiat currency doing what every fiat currency must inevitably do.

Oh, there’s money out there! Way, way, way more than you think!

TENS, if not HUNDREDS OF TRILLIONS of dollars (nominative, face value) in derivatives and hedge funds.

If ten percent of that was to flow into the metal funds, gold would probably hit over $100,000 an ounce.

Seriously.

Actually, it isn’t the “same old same old”, because unlike in the past, the dollar has hit it’s ~ 1 generation after detachment from backing. 1 generation is the average time from the detachment of a currency from a backing unit and it’s collapse. I think the informational age nature of now will possibly let the dollar eek out a year or two more, but that currencies collapse after withdrawal of backing media is about as fundamental as water flowing down hill...

The same place all of our dollars came from; U.S. government printing presses.

I certainly don't claim to be an expert on this, but I do have an opinion.

First, let me ask you a question; How much of this last year's federal deficit was financed by having the Federal Reserve exchange newly printed dollars in exchange for debt certificates bearing almost record low interest rates?

How about a follow on question; If the Federal Reserve had not been buying U.S. debt, what interest rate would investors insist upon before buying such debt?

And some final questions:

Who will be buying U.S. debt over the next four years?

What interest rate will be paid on that debt?

What will happen to the present value of debt certificates that bear low interest rates when identical instruments become available bearing much higher rates?

If the Federal Reserve must continue buying U.S. debt in order to maintain the low interest rates, what must happen to the value of printed dollars?

In 1966 I could buy gasoline for about 20 cents per gallon. Today gasoline costs about $3.50 per gallon. Not coincidentally, at today's silver prices, that is about two silver dimes per gallon.

Any good brands you can recommend? I like those expensive Bushes Beans that come already souped up in different flavors.

Buy dried beans that you can plant in the ground and they will multiply.

Expect Obama and the Rats to claim responsibility when the Repubs take the WH and

people start investing again because of that.

Bushes are good! But all I can recommend is the best you can buy IN BULK.

Look at what’s happening, The drought in US has destroyed the corn crop. Corn is used in a thousand more products than corn flakes, In fact most corn I grew up near was nothing that a person would eat, but animals loved the stuff,

Meats will rise,

Ok.... It’s late.

So here is my recommendation:

Go to the store.

Buy every split pea you can afford

Factor in you would be wise to buy some canned ham at the same time.

And note that I said everything above without mentioning the reactors in Japan...

Meanwhile, for your listening pleasure:

http://www.youtube.com/watch?v=JBwy5y_tdQk

Good luck!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.