Posted on 08/02/2012 3:20:07 PM PDT by blam

Gold Priced For Collapse

Commodities / Gold and Silver 2012

Aug 02, 2012 - 02:32 PM

By: Peter Schiff

Where is the gold price today? If you're like many Americans, you have no idea whether it went up, down, or sideways. Fortunately, I know my readers to be more informed - you likely know that after falling from almost $1900, gold has been trapped around $1600 since early May. But you may still be curious why despite continued money-printing and abysmal US economic reports, gold hasn't been able to hit new highs.

Here's the truth: gold is currently priced for collapse. Many investors believe the yellow metal has topped out and are selling into every rally.

Nerves of Tin

Being a gold investor is tough business. The last thing any government or corrupt big bank wants is to have a bunch of people putting their savings into hard assets - and gold is one of the hardest of all. So we're constantly up against tides of propaganda saying that gold has no value or is the refuge of doomsayers.

The effect of this is that even heavy gold investors are always waiting for the other shoe to drop. When house prices were rising, no one was worried that the market had peaked or prices were unsustainable. No one was asking whether all the thin-walled McMansions going up would actually be worth anything in a generation. But for gold, Wall Street has been shorting it all the way up!

Nowhere is this pessimism more evident that in gold mining stocks. Rising inflation has driven production costs higher, but the mistaken belief that inflation is contained and Treasuries are a safer haven is keeping a lid on gold prices. As such, many of the major producers have missed their earnings projections, and their share prices have been punished. This has placed a cloud over the entire sector. In fact, the P/E ratios of major gold miners are near record lows. Stock prices reflect future earning expectations, and judging by the low P/Es, Wall Street expects future earnings to plummet. This likely reflects their bearish outlook for gold, which is generally viewed as a bubble about to pop.

Chronic Memory Loss

Unfortunately, there is no public validation for those who have proved the gold doubters wrong. A couple of years ago, I predicted gold would cross $1500 and even my own staff thought the call was too risky, too extreme. But I knew then, as I know now, that at the end of the day the gold price is not a mystery - it's a proxy for dollar weakness.

Since most investors do not truly understand gold's economic role, they assume the 10-year bull market must be a mania. But manias show parabolic growth detached from any fundamental driver. The definition of a mania is the bidding up of an asset quickly and beyond all long-term justification.

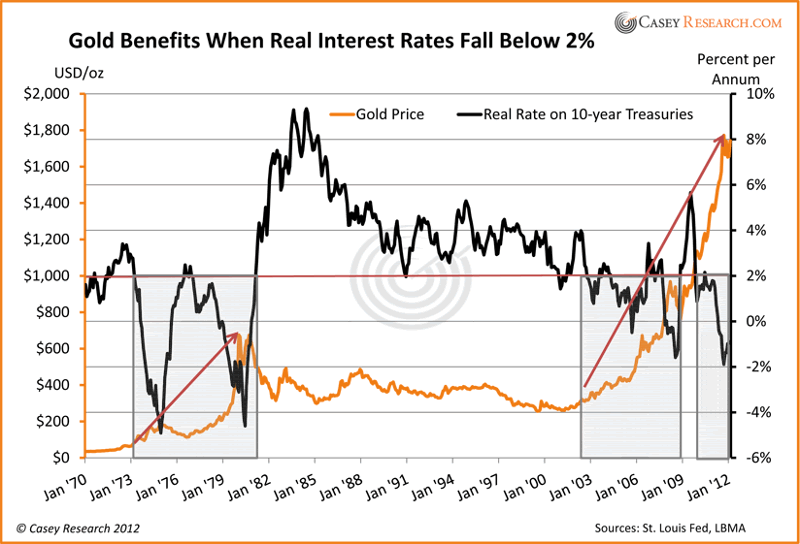

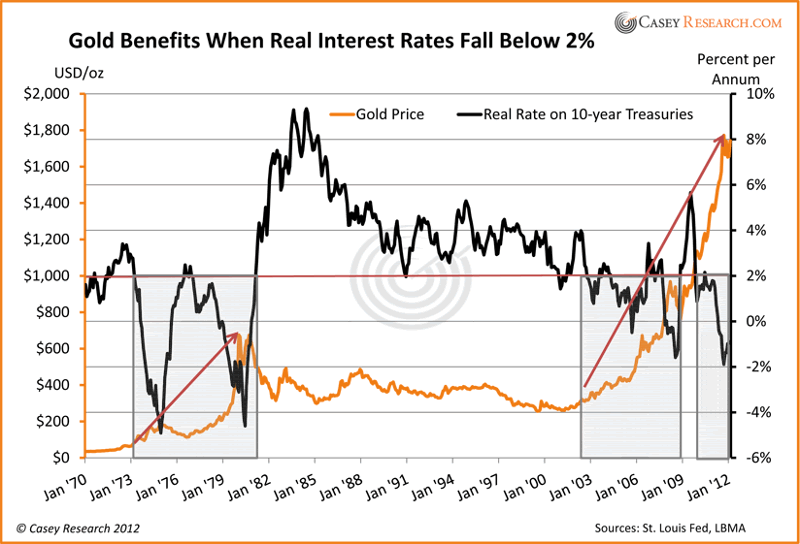

Gold, however, has grown steadily in inverse correlation with real interest rates, as explained by Jeff Clark and Mark Motive in past issues of this newsletter. As a reminder, here's a chart detailing the correlation:

The Opportunity of the Decade

After spending the previous fall and winter testing new nominal highs above $1800, future investors may come to view spring and summer 2012 as the opportunity of the decade. Gold has shown its strength and retreated. While most investors will take that as a signal that the market has topped, some will take advantage of the general trepidation to add to their positions at hundreds of dollars off the highs.

While I think gold is a bargain at $1900 considering today's circumstances, the market phobia of a price collapse is allowing us to buy at well under established highs. It's as if you already wanted to go swimming, but you found out when you got there that the pool was heated.

What Happens Next

I've seen markets like this before, and by making some reasonable inferences, I have a good picture of how this could play out. Gold will continue testing the $1600 barrier until it surprises to the upside. This could be spurred by the announcement of QE III, a calming of fears in Europe, or any shock to the Treasury market. Treasuries have temporarily overtaken gold as the primary safe-haven asset. Once that dynamic is broken, I believe the counterflow into gold will be tremendous.

Right now, there is a haze over investors. Frightful news from Europe and a slowdown in Asia have shaken confidence in any asset that doesn't have the steady track record of US debt. But as I often remind my clients, past performance doesn't guarantee future results. Any news that wakes investors up to the coming collapse of the Treasury market will likely trigger a rush into the one asset with a track record as long as civilization itself.

Prepare For Collapse

The key to this market is to understand that a price collapse is coming - but not for gold. Instead, the market for US dollars and dollar-denominated debt is headed off a cliff, which will send the price of precious metals soaring.

Now is a time for uncommon confidence. Everyone knows Treasuries to be safe, just as they knew house prices would always rise. Then as now, gold's value and utility are doubted. But my readers know better.

Why just split-pea?

Never said just split pea.

I said start with seeds and nuts that might keep you alive,

Good advice....that I've already taken.

I’ve thought about adding canned ham to my stash...where is that found in the supermarket, and how long does it keep? Thanks!

-—— where will the money come from to buy gold at a higher price?-——

The author uses the interesting phrase “ the counterflow into gold “ while writing about US Treasuries already paying nothing. That means that when the foreign money pouring into US Treasuries and saving Obama’s ass gets spooked by the continuing devaluation of the US$, the place the money will counter flow to is into gold.

Obama has always blamed his poor performance on his predecessor. He will have the opportunity to set up his successor with some kind of trap worse than the mess he has already created. It will be revenge of the worst sort. It will exacerbate the counter flow

If that is the future, gold stocks with a low P/E are a bargain

Good thing I'm wearing boots this morning. The real propaganda comes from the mouths of these gold hucksters who rank significantly lower on the credibility scale than insurance salesmen, used car salesmen, and personal injury lawyers.

Gold has a reputation as the "refuge of doomsdayers," because that's the in-your-face message that gold hucksters use to sell gold. To paraphrase a gold ad that I recently heard on Glen Beck radio: Europe is burning, America is on the verge of civil war, for thousands of years people have turned to gold in the face of Armageddon... You should too." Gold has a reputation as a "refuge for doomsdayers" because the hucksters selling gold have advanced that reputation as the primary selling point.

In my opinion, approximately 90% of gold's value comes from doomdayers' demand as opposed to industrial, cosmetic, artistic, or institutional uses. Gold has no intrinsic value. It's incapable by itself of having significant value separate from demand. There is no real shortage of gold, rather the demand is artificially created through fear marketing and that demand is what drives and inflats the price. At some point, however, everyone foolish enough to buy gold as an investment is already in the market and there is insuffucient demand to sustain the price. The hucksters have already made their money by selling gold on fear and driving the price up and then using the rising price to sell more gold. As the price begins to fall, "investors" start to cash out, which causes the bubble to burst and the price to fall through the floor, and that's when the gold hucksters bottom feed and replenish their inventories at a deep discount so that they can start the hustle all over again.

Sure, some of the doomsdayers will make money if they buy in early enough and sell at just the right time. But the vast majority of these suckers who buy gold as a long-term investment, hedge against inflation, whatever the reason they are duped to buy, will lose money as measured against more traditional investments such as a well- diversified portfolio of equities and debt instruments.

Which would you rather own: 1,000 oz. of gold or 100,000 shares of GM stock?

all depends on gas prices

FYI

If you take exit 232 off I 40 to Sevierville Tennessee, you travel a pleasant country highway through rolling farmland with the Great Smokey Mountains as a backdrop. Unexpetedly, you come upon a fairly large manufacturing plant and lots of trailers. Then there is another even larger plant.

The first is Ball manufacturing, a maker of cans. The second is the Bush cannery. Across the street from the cannery is a large, old building that has been spiffed up. It is the Bush cannery visitors center. In the corner of a stair landing is an antique corner cabinet wrapped in chains and displaying a large padlock. There are red lasers pointing in all directions guarding the cabinet. Inside, visible through the glass doors is a huge leather bound book entitled....... Bush Family Baked Bean Recipe

Like what? I'm being serious.

Food, shelter and water.

And the means to protect them and the means to replace them as they are consumed.

I'm curious to know what you believe will be the result of this coming election, allowing for the possibility that either Obama or Romney might win.

If Obama wins we get (just rough guesses):

U.S. government revenue: $2.4 trillion

U.S. government spending: $4 trillion

U.S. government borrowing: $1.6 trillion

Federal Reserver purshasing of U.S. debt: $800 billion

What do you expect to have happen if Romney wins? I don't see much change from the scenario above. I can't figure out what keeps the Dow Jones average as high as it is while so many western nations are faced with insurmountable and growing debt.

I see no shortage of printing presses and ink for nations willing to print currency.

I agree with you...completely.

I'm hedging my bet and since I gained value there was no loss for getting out of silver.

I sold my gold six months ago.

Peter: After the deception and scheming of Extortion-Care passage, don’t under estimate the Hillary (Hillary Romney) Gang, to begin securing all these non-collateralized phoney so called “instruments”, through funneling Extortion-Care. Anyway they can leverage it. They’re exempt remember.

Peter: After the deception and scheming of Extortion-Care passage, don’t under estimate the Hillary (Hillary Romney) Gang, to begin securing all these non-collateralized phoney so called “instruments”, through funneling Extortion-Care. Any way they can leverage it. They’re exempt remember.

HaHaHaHa, thank you very much! That dog’s not talking either!

Thanks, brilliant thinking and will do today

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.