Help End The Obama Era In 2012

Your Monthly and Quarterly Donations

Help Keep FR In the Battle!

Sponsoring FReepers are contributing

$10 Each time a New Monthly Donor signs up!

Get more bang for your FR buck!

Click Here To Sign Up Now!

Posted on 08/09/2012 9:59:40 AM PDT by blam

GARY SHILLING: Bonds Are Great, Stocks Are About To Plunge 40%

Henry Blodget

Aug. 9, 2012, 12:51 PM |

It's hard to find anything in investing that everyone agrees on, but one thing almost everyone agrees on right now is the theory that bonds are terrible investment because interest rates are about to soar.

In fact, over the last several years, a parade of respectable economists and strategists have made the seemingly obvious observation that "interest rates have nowhere to go but up," suggesting that anyone who is dumb enough to buy bonds will get killed.

And, so far, they've all been wrong.

One strategist who has not been wrong about bonds is Gary Shilling of A. Gary Shilling & Co.

Shilling has been pounding the table on 30-year Treasury bonds for years, even as almost every other strategist dismissed this view as loony. And, for years, 30-year Treasury bonds have delivered spectacular returns.

Well, Gary Shilling is still banging the drum for 30-year Treasury bonds.

Instead of going up, Shilling says, interest rates will continue to go down. And his projected move, from a 2.6% yield on the 30-year Treasury to a 2.0% yield, would deliver another very compelling return.

How about stocks?

Shilling is negative on stocks, especially in light of the recent rise. He's not predicting an absolute calamity, but he thinks the U.S. is headed into recession and earnings on the S&P 500 could fall to about $80, versus the current projection of $100+. This, combined with a "bear-market price-earnings multiple of 10X," Shilling argues, could send the S&P 500 plunging to 800.

(Okay, maybe that is, in fact, a calamity. The S&P 500 is trading at 1,400 right now. A fall to 800 would be a 40% plunge.)

(snip)

(Excerpt) Read more at businessinsider.com ...

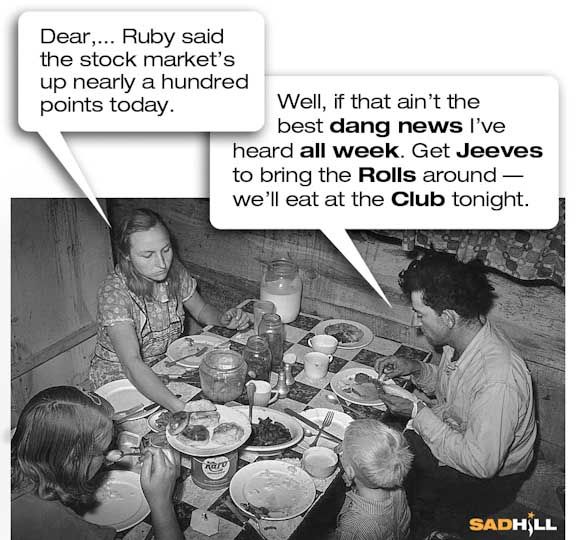

I read 3 or 4 of these doom and gloom forecasts a week here and yet stocks keep holding their own or going up.

Nonsense. My “BUY IT ALL” call, made on this forum in February 2009 (recommended AAPL and BIDU, among others, check the archive) still stands firm. The markets climb a wall of worry, and these doom-and-gloomers just keep adding fuel.

Do you understand why they are going up?

—I read 3 or 4 of these doom and gloom forecasts a week here and yet stocks keep holding their own or going up.—

Yup. I think they will skyrocket for the same reason they are up now: Inflation. i.e. stocks are not going up. The dollar is just losing value.

You read 3 doom and gloom articles each week, and I read 3 stocks are going to soar articles each week.

Can’t say how many times I bought or sold stock on some seemingly solid prediction and then watched the opposite happen. IOW they don’t know.

It is a bit of a scam because at some point they will be right and then they tout that “prediction” forever.

I understand that automated trading now drives the market and that participation by individual investors has declined. I also understand that the market has decoupled from the economy and is driven by excess capital being pumped into banks by the Fed. However, I’ve been reading these forecasts for over a year now and if you listened to them you would miss out on the market run up in recent years.

I also believe that if Romney is elected the market is going to take off.

I’ve ridden them up and down for 25 years. Almost got back to where I was before the fall of 2008. Someone on FR told me to get out of the market November 2007. Wish I had listened.

I bailed this time July 1 2012. I’ve missed about a 4% upswing since then.

I asked if you understood why the markets are going up, because I don’t see any rational reason for them to be going up. Unless they are feeling optimistic about Mugabe Hussein getting yanked out of the white house.

60+ billion have come out of stock based mutual funds this year. Maybe it is time to jump back in? I’m starting to feel like Charlie Brown. Lucy’s going to hold the football again for me.

Many believe that trying to time the market is a losing proposition.

Get in, or get out

I have been “in” since 1987.

To argue that stocks are generally quite high and could tumble (even considerably) is reasonable, if only because the “free, newly-printed” Federal Reserve money being put into the banking system is largely being spread into the stock market (perceived as less risk then many forms of lending in today’s anti-business political climate). This constitutes a “fake” (and rather large) layer of demand, which could come back on the stock market at any time. BUT to argue that everyone should rush out and buy bonds from already-bankrupt government(s), or buy almost any kind of bond with today’s super-low rates of return, is, I believe, imprudent. When (not if) interest rates return to market (not politically-dictated) levels again, bond prices will inevitably tumble. And, many of the borrowers (on bonds) you would not invest in (because they are either the broken government or else firms which cannot do well under the thumb of the anti-business administration) could well have difficulty repaying their lenders (meaning, bond investments are — generally speaking — not nearly as safe in today’s market as many people may think). Just my 2 cents worth (in cash, if that has any value remaining?) or you can have 2 flakes of gold dust for it.

Stocks usually go up in an election year, because the majority’s preferred candidate is always likely to win. Thus the consumer psychology that things will get better is almost inevitable.

Stocks usually go up in an election year. . .

___________________________________________________________

Stocks often go down after a presidential election.

Stocks are artificially high because of the corrupt Obama administration pumping money into the hands of the Wall Street people.

I got out of the market several years ago and bought real estate instead. It was right when the market tanked for real estate. My money is making more now than it ever did in stocks and I still have my money, not a lot of risk and all the expenses to keep it, insurance and maintenance are tax deductible. I’m lovin it.

The only reason we don’t have super high inflation right now is because no body is spending money. There is a ton of money out there to be spent by the people that got all that stimulus money. When it is spent there will be incredible inflation. The only thing that could be worse is if the dollar loses its reserve currency status. When all the dollars flood back they will be absolutely worthless.

I tell everybody I know, get your money into something, anything that has real intrinsic value, do it now before the election. We should be safe until then but after that, lets say I’m running scared.

I say silver and real estate are the safest place to keep money. Of course if you do this you have work on your hands, rental properties require a ton of patience and business attitude.

Only thing is, these vehicles are a prime place for politicians to buy votes. ‘Cash in your IRA for college, or to buy a new home, or..’ The number of methods that can create a run on these funds is counted by the number of politicians there are. If any of these funds have to immediately get out of a position, you'll see the target stock fall like a rock - there's just no one to pick up the slack in the market anymore - nor anyone who really wants to.

Prudent investing in the market, even leveraging those investments through options, can yield good results, and even over time, yield slightly better than inflation. But for the amount of investment of time and energy it would take to do this properly, I'd think most would be better suited to invest their money in other opportunities.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.