Posted on 11/30/2012 4:07:25 AM PST by blam

Silver Price Forecast 2013: Silver Will Perform Like Gold on Steroids

Commodities / Gold and Silver 2013

Nov 29, 2012 - 10:35 AM

By: Money Morning

Peter Krauth writes: This past March, I asked a highly successful investment advisor what he thought about gold. Since he deals almost exclusively with very high net-worth individuals, his point of view was especially intriguing.

He confided to me that many of his clients had been asking for gold and gold-related investments over the past few years. I can't say that I was surprised.

But what he told me next simply shocked me.

"Gold's much too volatile, it's too risky", he said. "Sure it's up, but I try to discourage my clients from investing in it."

It simply floored me that he thought gold was too volatile. Gold is only up 580% since it bottomed in 2001, without a single losing year to date.

That's not something you can say about the stock market or any other type of investment.

I can hardly imagine what he must think of silver, as silver prices are up by 725% since 2001.

Today, silver is trading around $34, but our 2013 silver price forecast now has the shiny metal going much, much higher.

What will power that rise?

Since it's slaved to its richer cousin, all the fundamentals for higher gold would apply.

I wrote about them yesterday in my 2013 gold price forecast.

As history has shown, silver moves almost in sync with gold, but exaggerates its movements, both on the up and down sides. That's why I like to think of silver as "gold on steroids".

2013 Silver Price Forecast

For 2013 I think silver, like gold, will set a new all-time nominal price record, likely reaching as high as $54 an ounce.

Despite silver's dependency on gold, it does have some distinct fundamentals, too.

In fact, here are my key drivers for silver prices in 2013:

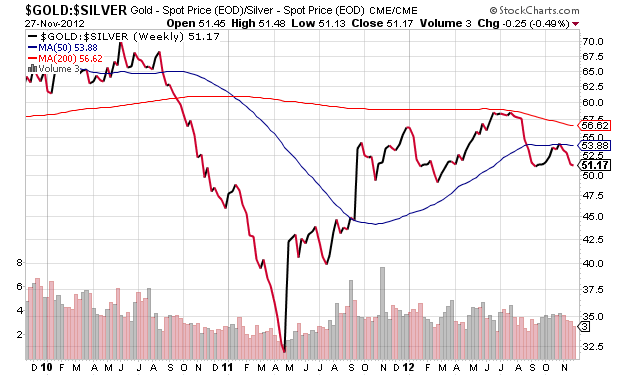

1.The Gold/Silver Ratio: Before the financial crisis, the gold/silver ratio was around 50 (meaning an ounce of gold would buy you 50 ounces of silver) and trending downward. In late April last year silver exploded higher, pushing the ratio down below 30.

That was short-lived, as silver's dramatic rise was unsustainable. I had said so at the time. The ratio recently returned to a high level near 60. In 2013, look for the ratio to head back down again, meaning silver will rise faster than gold.

On a long-term basis, I think we'll see this ratio move down closer to 20. So right now, silver is looking rather undervalued relative to gold.

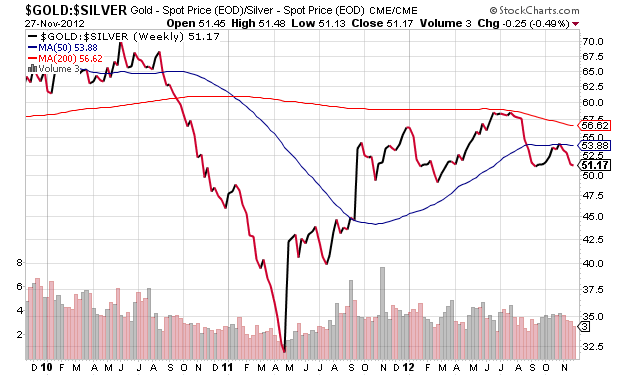

2.Four More Years of Obama: The President has been very good for silver prices. In fact, he was so good, he helped make silver the best-performing major financial asset during his first term.

Now that Obama has earned another four years, and Federal Reserve Chairman Ben Bernanke's still in place and relying heavily on the printing press, I'm fully expecting a repeat performance. Thanks, guys, for more of the same.

3.Higher Investment Demand: Physical silver investment demand is growing. Despite a number of existing silver ETFs, the Royal Canadian Mint is launching its own. That has suddenly removed 3 million ounces from the physical market.

The Sprott Physical Silver Trust (NYSE: PSLV) is expanding its size as well, likely having bought 7.5 million ounces of silver to accomplish this. That's over 10 million ounces in a single month. Meanwhile, the U.S. Mint has sold more silver coins versus gold coins so far this year than in any since the coin program started.

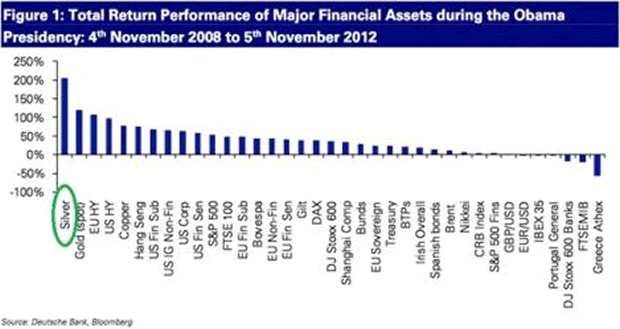

4.Higher Industrial Demand: Solar panel demand is exploding and silver is used to make them, of which the average panel requires about two thirds of an ounce. Since 2000 the adoption of solar panel technology has meant a 50% annual increase in silver usage each year, going from 1 million ounces in 2002 to 60 million ounces last year, representing nearly 11% of all industrial demand. Adding fuel to the fire, Japan has recently offered to pay utilities three times the price for electricity generated from solar versus conventional methods.

Unlike gold, silver has a wide range of industrial uses. There's currently growing demand from an increasing number of industrial applications, including lighting, electronics, hygiene and medicine, food packaging, and water purification, to name but a few. That's bullish for silver.

So for these reasons, as well as silver's historical role as an inflation hedge/monetary asset, look for silver prices to keep rising in the years ahead.

That being said, 2013 is likely to be pivotal for the more affordable precious metal. Now that gold has set and surpassed its own all-time highs, look for silver to be next.

It now looks like $54 is the next price target in silver's relentless and historic climb.

I stopped reading when he wrote gold is volatile when compared to silver.

Silver has always been a whipsaw ride. I have both and silver is always the one that provides the agita.

I knew there was a reason for me hanging on to my collection of mostly common date Franklin half dollars.

I have found this website to be a very useful source of information on the economy, gold, and silver.

http://goldismoney.info/forums/

not a bad investment after all

and not too late to keep adding to your “junk silver” stash

From your link - the most intrinsically worthless coins (as % of face value):

Susan B Anthony Dollar

Sacagawea Dollar

And at the bottom of the list:

2007-2012 Presidential Dollar

Can’t make this stuff up!

http://www.tfmetalsreport.com/

Another good site to keep up on precious metals. There is a pretty even mix of conservatives/liberals posting here.

Yeah, I was surprised too... that both sides could agree on anything. But the need to “stack” due to the coming end of the Keynesian experiment appears to cross all party lines.

even my kids have gotten wise to scouring change for coins minted 1964 or earlier!

Thanks for this timely thread!

Two words, pumpity & dumpity!

For later

“Even my kids have gotten wise to scouring change for coins minted 1964 or earlier”

Do they ever find any? Four or five years ago I found a 40% silver wartime Jefferson nickel, but that was it.

I had a number of silver coins at one time, but my Dad and I sold them when silver briefly hit fifty dollars an ounce back in 1980.

I’m hoping to pay off my mortgage in a couple years with the silver dollar in my safe.

He wrote “silver is gold on steroids”. Meaning that silver is far more volitile than gold. Perhaps you should have not stopped reading. -grin-

Drink that Coffee FRiend.

3 hours and 16 posts and not one “But you can't eat gold or silver” or “duuuh if Gold and silver are so valuable why are they selling it?” post

Definitely a record here on Freerepublic

Oops. I guess I need to BTFD.

It’s funny for the couple of years I have been putting away the same amount every two weeks. I duy a 1/10 oz eagle, and then spend the rest on silver. So I guess I am covered coming and going.....

I had a lot of silver, then I melted it down to make firearms. Then I took them out on my boat. Dang it.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.