Skip to comments.

Who Really Owns the U.S. National Debt?

Townhall ^

| 01/21/2013

| Political Calculations

Posted on 01/21/2013 7:07:05 AM PST by SeekAndFind

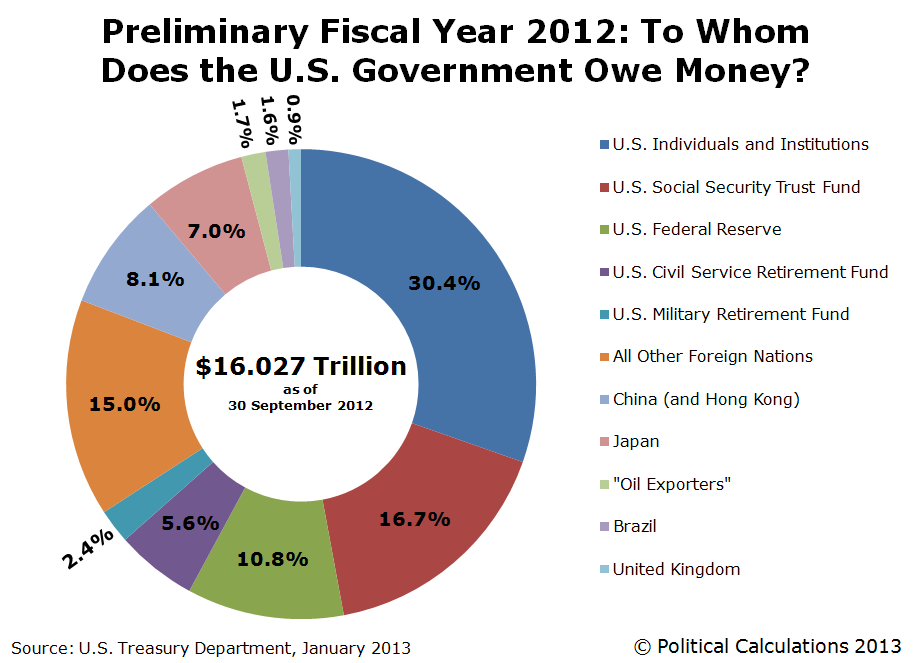

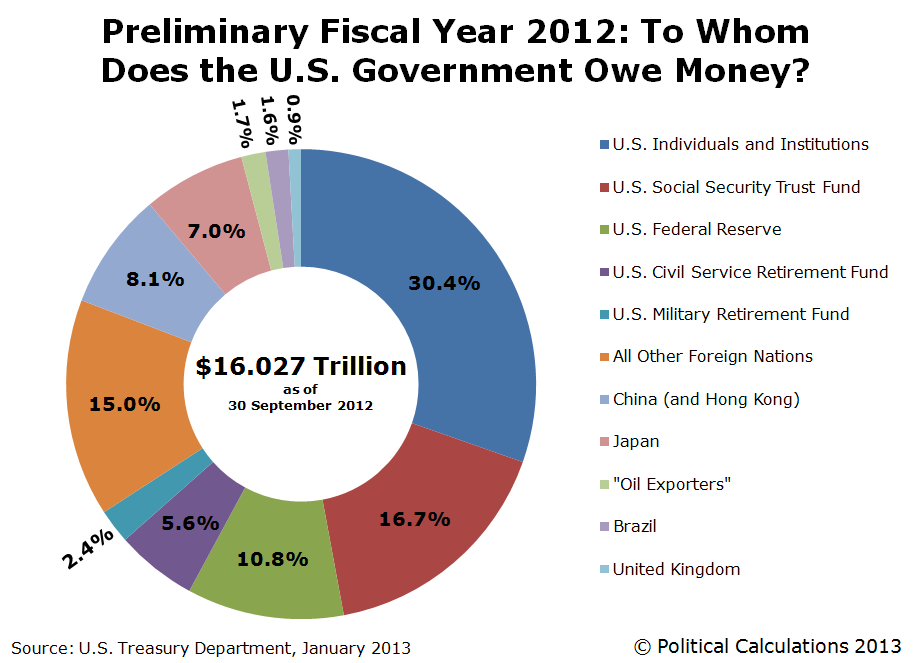

Today, we're taking a preliminary look at just who owns all the debt issued by the U.S. federal government through 30 September 2012 - the end of the U.S. government's fiscal year. Our chart below visualizes what we found.

The information presented in our chart above is preliminary, as the U.S. Treasury typically revises its foreign entity debt ownership data in March of each year.

Overall, U.S. entities own just 65.8% of all debt issued by the U.S. federal government. Ranking the major U.S. entities from low to high, we find that:

- The U.S. government's military retirement fund owns 2.4% of the national debt.

- The U.S. government's civilian employee retirement fund accounts for another 5.6% of the nation's debt.

- The U.S. Federal Reserve, thanks to its quantitative easing programs of recent years, has racked up holdings equal to 10.8% of the total U.S. national debt.

- The U.S. Social Security Trust Fund claims 16.7%.

- U.S. individuals and institutions, which includes regular Americans, banks, insurance companies and other government entities, own 30.4% of the nation's debt.

Meanwhile, foreign entities own 34.2% of all U.S. government-issued debt, with the following nations' individuals and institutions representing the five biggest holders of that debt, again ranked from low to high:

- United Kingdom: 0.9%

- Brazil: 1.6%

- "Oil Exporters", which includes Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait,Oman, Qatar, Saudi Arabia, Algeria, Gabon, Libya, Nigeria and the United Arab Emirates: 1.7%

- Japan: 7.0%

- China (including Hong Kong): 8.1%

All other nations hold approximately 15% of the U.S. outstanding national debt.

The Role of Quantitative Easing in Offsetting Foreign Ownership of the U.S. National Debt

The Federal Reserve's various quantitative easing programs of recent years, where the U.S. government-chartered central bank has purchased large quantities of U.S. government-issued debt in its attempts to keep the U.S. government's spending elevated and the U.S. economy stimulated by lowering long-term interest rates, are especially interesting in the degree to which they've succeeded in offsetting the share of the U.S. national debt owned by foreign interests.

Here, the Fed boosted its holdings of U.S. Treasury securities from a low of $474 billion on 18 March 2009 when it launched QE 1.0 to a peak of $1.684 trillion on 21 December 2011, which fell back to $1.676 trillion by 26 September 2012 - just before the end of the U.S. government's 2012 fiscal year.

The Fed also boosted its holdings of other federal agency debt securities from $48 billion on 18 March 2009 to a peak value of $169 billion on 10 March 2010, which has slowly declined to $83 billion as of 26 September 2012. All told, the Federal Reserve held an additional $1.21 trillion of the U.S. national debt compared to what it did before it began its quantitative easing programs.

As a result, the U.S. Federal Reserve has gone from holding 4.7% of all U.S. government-issued debt as of 18 March 2009 to holding 10.8% of it as of the end of the U.S. government's Fiscal Year 2012. During the peak of the program, the Federal Reserve crowded out almost every other purchaser of U.S. government-issued debt.

Assuming that other U.S. entities would have been unable to accumulate more of the U.S. national debt than they did during this period and that the U.S. government would have spent as much money as it did, if not for the Federal Reserve's quantitative easing programs, the share of the U.S. national debt held by foreign entities would have increased to 41.7%, with the bulk of the foreign acquisitions going to China.

As it stands, a little over 1 out of every 3 dollars borrowed by the U.S. federal government is now owned by foreign interests.

Data Sources

U.S. Federal Reserve. U.S. Treasury securities held by the Federal Reserve: All Maturities. Accessed 14 January 2013.

U.S. Federal Reserve. Federal agency debt securities held by the Federal Reserve: All Maturities. Accessed 14 January 2013.

U.S. Treasury. Major Foreign Holders of Treasury Securities. Accessed 14 January 2013.

TOPICS: Business/Economy; Culture/Society; Government; News/Current Events

KEYWORDS: debt; nationaldebt

Navigation: use the links below to view more comments.

first 1-20, 21-23 next last

Political Calculations

Political Calculations is a site that develops, applies and presents both established and cutting edge theory to the topics of investing, business and economics.

To: SeekAndFind

So 16.7% is owned by the SS trust fund? They used SS monies to pay down the debt so they could borrow more money to blackmail the tax payers into borrowing more money. Any businessman that tried this would be hung.

2

posted on

01/21/2013 7:12:51 AM PST

by

mountainlion

(Live well for those that did not make it back.)

To: SeekAndFind

3

posted on

01/21/2013 7:16:02 AM PST

by

PMAS

(All that is necessary for the triumph of evil is that good men do nothing)

To: SeekAndFind

RE :”

The U.S. Federal Reserve, thanks to its quantitative easing programs of recent years, has racked up holdings equal to 10.8% of the total U.S. national debt.

The U.S. Social Security Trust Fund claims 16.7%”

I notice that Republicans on TV always say it is the Chinese we must beg for money from for dramatic effect.

4

posted on

01/21/2013 7:16:42 AM PST

by

sickoflibs

(Losing to O is NO principle!)

To: SeekAndFind

>>•United Kingdom: 0.9%

•Brazil: 1.6%

•”Oil Exporters”, which includes Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait,Oman, Qatar, Saudi Arabia, Algeria, Gabon, Libya, Nigeria and the United Arab Emirates: 1.7%

•Japan: 7.0%

•China (including Hong Kong): 8.1% <<

Big question: How much do these countries owe US?

5

posted on

01/21/2013 7:23:27 AM PST

by

NTHockey

(Rules of engagement #1: Take no prisoners)

To: mountainlion

Oh yes they did.

Step 1: Make it illegal for the SS Trust fund to have excess cash on hand.

Step 2: Use excess cash to buy US Debt (called an ‘Imtragovernmental Transfer’ to make us feel better about it)

Step 3: Use said trickery to declare a surplus in the Clinton years

Step 4: Liberals scream from the rooftops that SS is not broke, since the government owes it money....pretending the government has its own source of funds, other than confiscation.

SS is now running in the red, and it has zero cash on hand. It all mist come from the general fund. Its time for Peter to pay Paul. But wait...Paul is now robbing money from his grandchild named Mary, rather than make tough budgetary decisions.

6

posted on

01/21/2013 7:25:25 AM PST

by

lacrew

(Mr. Soetoro, we regret to inform you that your race card is over the credit limit.)

To: SeekAndFind

Most of the entities that own most of it (central banks, large banks, investment funds) have globalism’s (the international banker cartel) footprints all over their boards of directors.

What’s most important, however, is that the Treasury markets its debt through a short list of mega banks and the Federal Reserve, which are the all controlled by the cartel. Without them, the Treasury can’t borrow, because they need to borrow so much that small banks and individuals would never buy that much in Treasury bonds. Every man, woman and child in the U.S. would need to buy $3,000 in Treasuries every year to come up with 1 trillion every year. Every U.S. President picks up the phone when men like Jamie Dimon call. Not only does the Treasury need their bankster for spending cash, the cartel controls both parties so the cartel wins every election regardless of which party wins; almost every President since Wilson has been a cartel man, and every administration has been loaded with cartel men.

Compare the names on their boards with Rockefeller, Carnegie foundations, Harvard and Yale boards, Harvard and Yale alumni, the Federal Reserve, throw in Stanford for good measure.

7

posted on

01/21/2013 7:39:06 AM PST

by

PieterCasparzen

(We have to fix things ourselves)

To: SeekAndFind

If the latest Gold Bar rumors are to be believed, I believe the Germans may own it (albeit unwittingly).

To: lacrew

Step 1: Make it illegal for the SS Trust fund to have excess cash on hand. Actually, all deposits into the SSTF from payroll taxes must be immediately converted into USG securities, i.e., T-bills. Benefits are then paid when the T-bills are redeemed. We now have about $2.7 trillion in T-bills, but since SS has been running in the red since 2010 and will continue to do so permanently, the T-bills are being used to make up the shortfall. They will run out in 2031/32 and by law, SS can only pay out in benefits what it receives in revenue meaning a cut of about 25% for all SS beneficiaries,

Of course, in order to redeem the SSTF T-bills, the General Fund must borrow 42 cents of every federal dollar spent. So we are borrowing money to pay SS benefits and despite what Pelosi and the Dems say, SS is contributing to our national debt.

9

posted on

01/21/2013 7:42:53 AM PST

by

kabar

To: NTHockey

Depends what you mean.

If you mean “owe the U.S. Federal government”, probably precious little since the Federal government doesn’t have a sovereign wealth fund (though a few “Red” states do, Alaska, Alabama and Wyoming) unless it’s to U.S. Federal pension funds. If you mean “owe Americans” probably a fair bit, as most of us with properly diversified investment portfolios either individually held or managed by someone else on our behalf, us being pension beneficiaries, hold some foreign government bonds, though nothing comparable to the Federal debt.

On the other hand, once one starts looking at things beyond the Federal government on that side of the balance, one needs to look at the same on the “we owe them” side as well: how much in state and municipal bonds are held by foreigners? how much in U.S. corporate bonds do foreigners hold? How much do we collectively (all levels of government, corporations, individuals) hold of comparable foreign-issued debt?

10

posted on

01/21/2013 7:43:53 AM PST

by

The_Reader_David

(And when they behead your own people in the wars which are to come, then you will know...)

To: SeekAndFind

foreign entities own 34.2% of all U.S. government-issued debt

**********

Rather than get paid back with a debased currency, as some point they must just decide that it’s better to acquire outright our real estate and businesses (i.e., don’t loan to the US, own the US).

To: mountainlion

"They used SS monies to pay down the debt so they could borrow more money to blackmail the tax payers into borrowing more money. Any businessman that tried this would be hung." In today's New Normal, that businessman would more than likely be praised for skillful use of leverage. Eventually though, there will be a day of reckoning.

12

posted on

01/21/2013 7:55:39 AM PST

by

buckalfa

(Tilting at Windmills)

To: Starboard

The Japanese tried that and it didn’t work out too well.

13

posted on

01/21/2013 8:02:24 AM PST

by

kabar

To: mountainlion

You got it. Raided, then spent, then re-borrowed at the penalty of fines or imprisonment.

That tree of Liberty is getting parched.

14

posted on

01/21/2013 8:10:51 AM PST

by

wac3rd

(Somewhere in Hell, Ted Kennedy snickers....)

To: mountainlion

You got it. Raided, then spent, then re-borrowed at the penalty of fines or imprisonment.

That tree of Liberty is getting parched.

15

posted on

01/21/2013 8:11:43 AM PST

by

wac3rd

(Somewhere in Hell, Ted Kennedy snickers....)

To: kabar

Right you are. As I recall they bought several US landmarks at the peak but wound up holding the bag when prices dropped. I do think this time could be a little different however as the US economy is struggling now and there are probably some good value plays to be had. That of course depends on what kind of economic future we have. Right now it doesn’t look too bright (unless you happen to be amongst the Takers).

To: mountainlion

Any businessman that tried this would be hung.

*******

Washington makes decisions on a political basis, not a sound financial or business basis. Therein lies the problem. They do things for all the wrong reasons.

To: SeekAndFind

Sell California to China for $18 Trillion and run a surplus.

18

posted on

01/21/2013 8:35:25 AM PST

by

csmusaret

(I will give Obama credit for one thing- he is living proof that familiarity breeds contempt.)

To: mountainlion

Try to find a PAC or a republican TV advertisement, similar to the type run by Sierrra Club or anti frackign liberals, that promote a message as well as the one you posted just now...not going to happen.

19

posted on

01/21/2013 9:38:52 AM PST

by

q_an_a

(the more laws the less justice)

To: SeekAndFind

Who owns it?

Everyone with a Social Security number!

20

posted on

01/21/2013 9:47:26 AM PST

by

Jack Hydrazine

(It's the end of the world as we know it and I feel fine!)

Navigation: use the links below to view more comments.

first 1-20, 21-23 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson