Posted on 03/16/2013 7:13:07 AM PDT by blam

U.S. Government Investigation Of Gold Price Manipulation

Commodities / Gold and Silver 2013

March 15, 2013 - 04:16 PM GMT

By: Midas Letter

Yesterday, the Commodity Futures Trading Commission, the regulator who ostensibly regulates the banks and major financial institutions who participate in the futures and commodities trading business, announced they were going to examine whether prices are being manipulated in the “world’s largest gold market”, according to a story in the Wall Street Journal.

For long time observers of the gold price and the fundamental and not-so-fundamental influences on its price movements, the announcement might have elicited a gasp of delight in the spirit of “It’s about time!”

No such excitement or relief will be long-lived, however. According to the Wall Street Journal piece, “The CFTC is looking at issues including whether the setting of prices for gold—and the smaller silver market—is transparent.”

Gold and Silver Spot Price

They’re referring to the process whereby twice daily, in the case of gold, and once daily, in the case of silver, the spot prices for those metals is set by teleconference by representatives from each of five banks: Barclays, Deutsche Bank AG, , HSBC Holdings, Bank of Nova Scotia, andSociété Générale. The silver pricing involves Bank of Nova Scotia, Deutsche Bank and HSBC.

While that process may indeed be compromised in terms of legitimacy to some degree (what process involving a major financial institution is not?), barring the revelation of large scale collusion and outright arbitrary price setting, it is not expected to unveil any major irregularities. That’s because the manipulation of the prices for precious metals is not a case of overt nominal manipulation. The prices set by the participants in the daily teleconferences is set by an examination of the existing orders to buy physical gold, versus orders to sell. More sellers than buyers, the price goes down, and vice versa.

The whole exercise is an opportunity for the perception management team at the banks to prove that, “Hey! See? The spot price of gold isn’t manipulated!” Well nobody is pointing to the setting of the spot price and saying that it has ever been manipulated. That’s a Red Herring of the first order, and this whole charade will be nothing more than a PR stunt that will feed media and justify mainstream media skepticism for years to come.

Futures Market Needs to be Regulated

It is the persistent unlimited origination of contracts for both gold and silver in the futures market for future purchase and sale of gold and silver many times the possible global supply that constitutes manipulation, in that they influence the demand for physical gold and silver by signaling future price direction. Which is contrary to the original function of futures markets, which was to provide a framework whereby banks could determine how much to lend a farmer for seed and equipment in the spring by estimating the price for the crops he would sow when harvested in the fall.

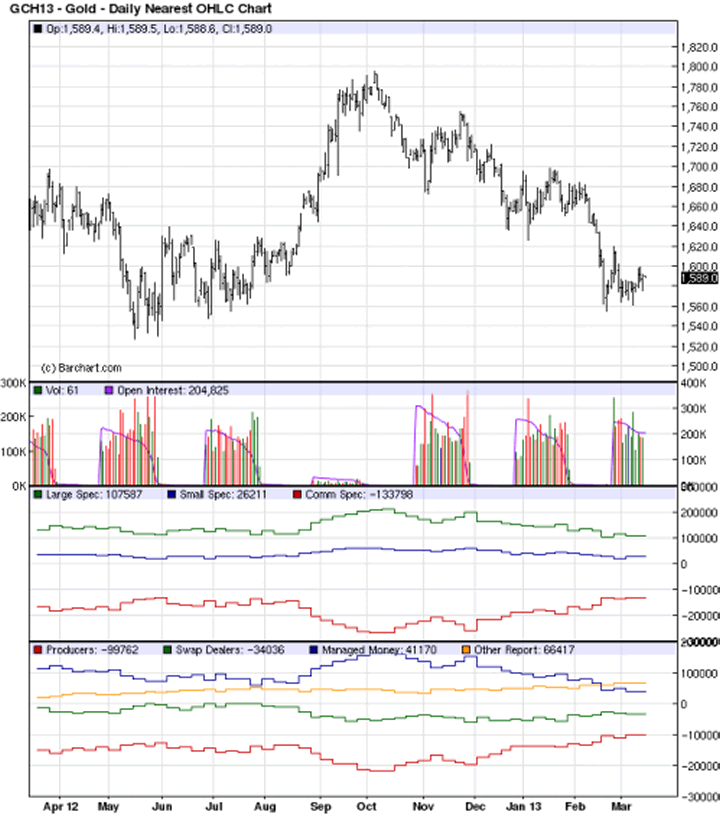

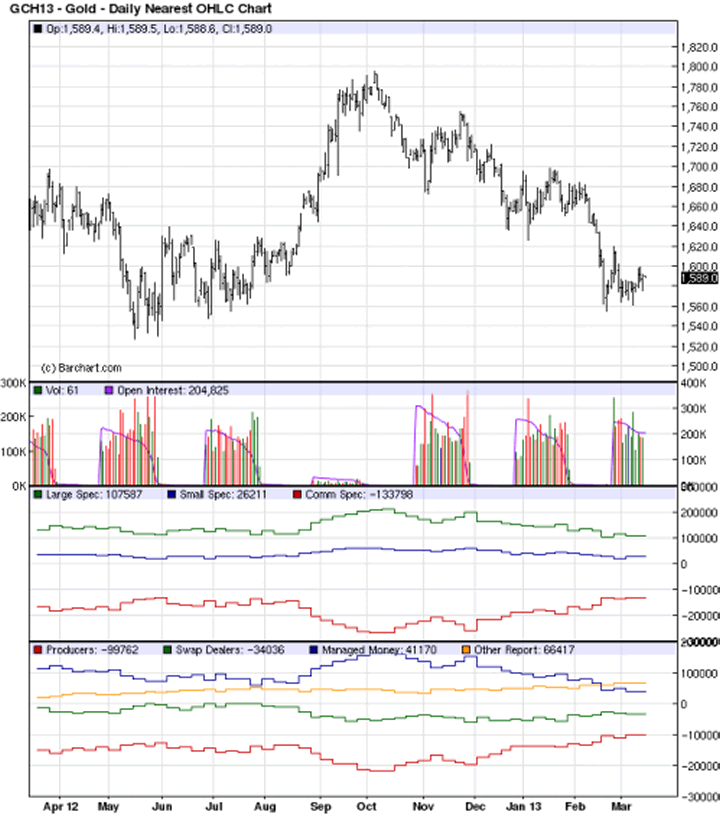

Amount of open interest was at an all year low at the end of August, which set the stage for physical demand to take the price higher.

The mechanism was maintained as a future price discovery tool by the existence of limits on the amount of commodity that could be traded in the future market based on what the total possible future market supply could be. Futures markets in wheat, for example, pre-empted by regulation any end-user, or buyer from issuing contracts to sell or to buy more wheat than could be produced in a given year.

Historically, the futures contract price for wheat was determined, simplistically, by a model that incorporated total world demand for wheat at time of sale versus total world availability of wheat relative to the cash price for wheat now. The participants were the farmer (supply) and the bank (financier), as well as the baker (demand). The financier’s role was limited to figuring out how much to safely lend the farmer, and also how much he could back the baker’s commitment to future delivery of wheat a set price. These were culturally governed roles where the interests of all participants was aligned toward mitigating loss and maximizing profit by offsetting risk.

As the futures exchanges evolved, and banking became more of a predatory profession as opposed to a facilitative one, the futures contracts themselves have become the objects of a gambling casino, and one where the house is the banks, as they originate and “roll over”, or negotiate a new contract sale or purchase instead of making good on a failed transaction. The commodities exchanges became gambling houses, where punters could buy and sell contracts without any intention of actually delivering or taking delivery.

The modern gambling hall is NYMEX and COMEX, where, with the cooperation of the CFTC and other government regulators, the rules governing the establishment and sale of futures contracts have been stripped down to the point where, today, futures contracts are originated with no requirement to reflect the actual supply and demand of any given commodity. They create the supply in paper form, and collude with each other to roll over contracts and swap losses in various further derivative instruments, and the net effect is a complex system of wagering and hedging that lets the banks drive spot commodity demand by generating as much paper supply as they require. Purchasers of the physical commodity are thus induced into selling, or refraining to buy, gold, silver, oil and any other commodity such a racket can be set up around.

This probe is meaningless, and a mere publicity stunt.

Bart Chilton Strikes Again

The idea was put forward by CFTC commissioner Bart Chilton, who said, “The idea that pervasive manipulation, or attempted manipulation is so widespread, it should make us all query the veracity of the other key marks. What about energy, swaps, the gold and silver fixes in London and the whole litany of ‘bors’?” he said, referring to Libor, Euribor and other benchmarks.

Bart’s last investigation into specific irregularities in silver trading, announced in 2008, was never formally concluded and no results have ever been announced. It appears to have been quietly swept under the rug, as the New York Times requests for comments were not responded to.

Until the regulatory deficiencies that permit exponentially excessive contract volume in futures and forwards, collusion among the major market participants, and no limit on positions by speculators are addressed, all of the misguided and sham investigations the CFTC can muster will have the same predictable outcome – business as usual for the futures markets participants who inflate, confound, and thus manipulate the prices of gold, silver and every other commodity they choose.

The one that continues to devalue the currency demands answers. Just pathetic.

Everyone is buying gold. What is so hard to understand about that?

Unstable governments always influence gold prices,were on one step away from being Greece.

I think I have found a new business, selling whitewash.

Goldbug ping.

ping

Not everyone in USA where only 1% of population owns gold, silver or their mining stocks. The biggest buyers today are central banks of places such as China, Brazil, Russia and some others. Also the Indian and Chinese people are large buyers in the form of jewelry (India) or coins/bullion (China)

A more interesting question is why the CFTC is looking at the question now. The best guess is that the inquiry will give the appearance of the Feds "doing something" while giving the banksters who are manipulating the markets at the behest of the government itself (in order to (1)hide ongoing monetary debasement, and (2)prevent systemic market failure by triggering tens of trillions of dollars in PM derivatives) legal cover by offering them the old "you can't sue us because the issue at hand is already under Federal investigation" defense.

The same individuals putting forth the above theory believe that the inquiry will drag on for years, or until the markets collapse, whichever comes first, at which point legal action against the robber barons becomes pointless (i.e. hyperinflation has reduced monetary damage claims to a pile of worthless paper).

The 10 Countries Sitting On The Biggest Piles Of Gold

1. USA

2. Germany

3. Italy

4. France

5. China

6. Switzerland

7. Russia

8. Japan

9. Netherlands

10. India

Aside from the Trading Places movie, I'm not surprised some kind of cover-up/blowing smoke is going on now; probably the customer complaints are too much to ignore.

But I am a bit surprised that the WSJ lays it right out for all to see. Maybe the WSJ execs are overextended on their gold purchases and figure it's high time for prices to reflect the fundamentals.

Thank you....ill go on being stupid as to why I buy every now and again...Its my insurance...

for a poor guy...I'm over insured...*W*

You think???...lol...they must think its real money....(I steal alil bit of it every time they try to convince us...like last week)

I rest my case Your Honor...

Real money? Now you get it!!! (but you got it before) Even better!!>>>>>> It is widely speculated that the traditional central banks that we know and grew up with. Those in USA UK and Europe that a lot of their AU is irreparably leased out for JPMorgan etc to use to jam the AU price downward as best they can. And that this Fed Reserve etc gold could never be taken back in a timely fashion. Evidence being how long it is taking Germany to get its gold back...will take 7 years and it is stored in the sub sub sub basement of the NY Federal Reserve Bank. Same gold store that was attempted to be robbed in the Bruce Willis movie. Comex is also dealing in paper gold as is the largest gold ETF called GLD. Comex also screws with silver this way

So real physical gold at $1600 is slowly migrating from the central banks of the West to the Central banks of the East. West being USA/UK/Europe and East being Russia/China/Brazil/ Iran?/SKorea/India and others who see 0bama’s Kenyan style fiat money becoming as useless as Mugabe’s Zimbabwe currency.

That USA gold might be very hypothetical and not really be there as in there is no there, there. Or 25-50-75% not really being there whether in Fort Knox or under the NYC Federal Reserve.

BTW who actually owns our national gold? The USG or the FR? Of course a minor concern to 99.99% of the American sheeple

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.