Skip to comments.

Daily finance & investment thread (4-2-13 edition)

4-2-13

Posted on 04/01/2013 11:02:07 PM PDT by dennisw

Daily finance & investment thread (4-2-13 edition)

Trying to focus on the markets for today and each day and the economic news

This is where you can impart some investment wisdom to your fellow freepers. You can vent about the big one that got away. You can

chime in how Obama is out to wreck American capitalism.

If you see another FR economic thread you like and want to link to it here, please do

Post your favorite economic site links. Your favorite economic blogs and precious metals blogs and sites

Apmex.com is a solid place with good reputation to buy precious metals and has great presence on ebay for easy quick impulse buys

such as a gift for a college boy's graduation. College Girls too! Even high scoool.

Kitco is the best site for gold and silver charts and other precious metals information

Ping list -- on or off let me know here or via freep-mail. If I missed you then Freep-mail me

I might ping you to other interesting economic threads a few times a week. One per day maybe

Sites that posters have reccommended ------ zerohedge turdferguson

TOPICS: Business/Economy

KEYWORDS: dfi

Navigation: use the links below to view more comments.

first 1-20, 21-27 next last

1

posted on

04/01/2013 11:02:07 PM PDT

by

dennisw

To: chuckles; Diana in Wisconsin; Boogieman; BipolarBob; yldstrk; nodakkid; Aquamarine; BenLurkin; ...

2

posted on

04/01/2013 11:02:47 PM PDT

by

dennisw

(too much of a good thing is a bad thing--- Joe Pine)

To: dennisw

Where does the roller coaster go today?

3

posted on

04/02/2013 3:53:38 AM PDT

by

NonLinear

(Giving money and power to government is like giving whiskey and car keys to teenage boys.)

To: dennisw

Abby Joseph Cohen: Here's Why You Still Have To Be Bullish On This Market

Bloomberg Television

Top Goldman strategist Abby Joseph Cohen is on BloombergTV talking stocks with Tom Keene.

Cohen is known for being generally bullish, and she is not disappointing today.

She is bullish on US stocks, despite stocks being at record highs.

She says that contrary to popular belief, the real economy has actually roared back more than the stock market has.

And furthermore, for the first time since the crisis ended, the US economy has found momentum, suggesting in her view that the next recession is "pretty far off into the future."

If you've missed this rally, she doesn't suggest jumping in all at once, but engaging in a diversification process, trimming down cash and bond exposure.

Read more: http://www.businessinsider.com/abby-joseph-cohen-bullish-2013-4#ixzz2PJ5I0PSQ

4

posted on

04/02/2013 5:03:48 AM PDT

by

Wyatt's Torch

(I can explain it to you. I can't understand it for you.)

To: Wyatt's Torch

The economy has ‘roared’ back, huh???

Pardon my French, but I say bullshtein, AJC! Even the cooked GDP numbers don’t tell that story.

Bloomberg’s going down the road of CNN. A propaganda machine.

5

posted on

04/02/2013 5:25:34 AM PDT

by

MichaelCorleone

(A return to Jesus and prayer in the schools is the only way.)

To: MichaelCorleone

MC...

She is not in the world I am in. Passed to many 1/2 empty strip malls the other day and small businesses that were Tier Suppliers for the big three that are now vacant the other day.

Have you seen this :-)...

https://www.youtube.com/watch?v=RQu3XN-Ce5w

6

posted on

04/02/2013 5:35:21 AM PDT

by

taildragger

(( Tighten the 5 point harness and brace for Impact Freepers, ya know it's coming..... ))

To: MichaelCorleone

GDP is about the worst measure of economic activity there is. Look at Industrial Production, Construction Spending and other similar measures to really see what is going on. GDP is a poor lagging indicator.

7

posted on

04/02/2013 5:35:53 AM PDT

by

Wyatt's Torch

(I can explain it to you. I can't understand it for you.)

To: dennisw

NYSE Morning Update:

Ahead of the Bell: Dow futures are trading up 59 points and S&P futures are trading up 6 points. Modest factory activity data from the euro zone and expectations of further monetary easing by global central banks is temping investors to jump back into equities. The Japanese yen is gaining ground against the US dollar ahead of the Central Bank of Japan’s policy meeting; investors are hoping the central bank will provide more monetary easing. A euro zone Manufacturing Purchasing Manager’s Index showed level of factory activity was in line with expectations, which has halted a 20-month contraction. The Reserve Bank of Australia has kept interest rates unchanged.

• On the economic calendar today, motor vehicle sales for March will be out prior to the opening bell, 12.1 M is forecasted compared with the same reading for the month prior. Factory order for February will be out after the market opens, it is expected to be 2.9% compared with -2.0% for January.

• The dollar is up against the euro and British pound and down against the Japanese yen. Gold is trading at $1,596. Crude oil is currently trading at $96 a barrel.

• Yesterday, stocks retreated, following disappointing manufacturing data from the US, as investors await a slew of central bank meetings later in the week. Most major markets were closed for the Easter Holidays.

• On CNBC today, Scott Minerd, chief investment officer at Guggenheim Partners, talked about the Federal Reserve, the housing market, and equities. Minerd said it will be a tricky situation when the Federal Reserve finally decides to wind down its monetary policy. He feels the road ahead for the central bank is difficult and he is not sure they can pull it off. The Fed could be behind themselves on the inflation curve. On the housing sector, he believes homes prices will appreciate about 50% in the next few years. He added, it is premature to think there is a bubble in the housing market. On the equity market, Minerd is bullish on equities; he is forecasting a 30% to 35% increase in the next three years, although a 5% to 10% pull back is possible.

Monday’s Close

DJIA down 5.69 pts/-0.04%/ 14,572.85

S&P down 7.02 pts/-0.45%/ 1,562.17

Nasdaq down 28.35 pts/-0.87%/ 3,239.17

Tuesday’s Futures

Dow Futures up 59.27 pts/+0.41%

S&P Futures up 6.50 pts/+0.40%

Nasdaq Fut up 18.25 pts/+0.66%

Overseas Markets

FTSE +1.15%

CAC 40 +1.16%

NIKKEI 225 -1.08%

HANG SENG +0.31%

Overseas: World stock markets are mixed today. European markets are up on better than expected manufacturing data. Asian markets are down as investors await the Central Bank of Japan policy meeting later this week.

Economic Reports: Motor Vehicle Sales expected to be 12.1M and Factory Orders expected to be 2.9% at 10:00 a.m.

Top Headlines:

• Homebuilder Taylor Morrison Home Corp plans to raise approximately $524 million in an IPO. The company is backed by Oaktree Capital Management, TPG Global and JH Investments Inc.

• Goldman Sachs (GS) has registered a fund that invests in risky credit products as a publicly traded business development company, a way to avoid regulation that limits business activity.

• Hess Corporation (HES) plans on selling its Russian unit to Lukoil for about $2.05 billion as the company reshape its energy business.

Commodities/Currency:

Gold: down $3.60 to $1,596.80

Oil: down 0.09 to $96.08

EUR/USD 1.2832 -0.0011

USD/JPY 94.2410 +0.0595

GBP/USD 1.5174 -0.0050

Volatility Index (VIX): As of the close of business Monday, April 1, the VIX is up 0.88 at 13.58

Companies Reporting Quarterly Earnings:

McCormick reports Q1 EPS 57c, vs. Est 56c and Q1 revenue $934.4M, vs. Est $922.66M.

Affymax reports Q4 EPS ($1.85), vs. Est (61c) and Q4 revenue $14.80M, vs. Est $14.81M.

Today’s Opening and Closing Bells:

Autism Speaks — Highlighting World Autism Awareness Day will ring the opening bell.

U.S. Soccer Federation – Celebrating 100th Anniversary will ring the closing bell.

8

posted on

04/02/2013 5:37:40 AM PDT

by

Wyatt's Torch

(I can explain it to you. I can't understand it for you.)

To: MichaelCorleone

From Bill McBride at Calculated Risk:

Update: Recovery Measures

by Bill McBride on 4/01/2013 05:44:00 PM

By request, here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that some major indicators are still below the pre-recession peaks.

GDP Percent Previous Peak

This graph is for real GDP through Q4 2012.

Real GDP returned to the pre-recession peak in Q4 2011, and hit new post-recession highs for five consecutive quarters.

At the worst point - in Q2 2009 - real GDP was off 4.7% from the 2007 peak.

Personal Income less TransferThis graph shows real personal income less transfer payments as a percent of the previous peak through the February report.

This measure was off 11.2% at the trough in October 2009.

Real personal income less transfer payments returned to the pre-recession peak in December, but that was due to a one time surge in income as some high income earners accelerated earnings to avoid higher taxes in 2013. Real personal income less transfer payments declined sharply in January, and were 3.7% below the previous peak in February.

Industrial Production The third graph is for industrial production through February 2013.

Industrial production was off over 17% at the trough in June 2009, and has been one of the stronger performing sectors during the recovery.

However industrial production is still 1.2% below the pre-recession peak. This indicator will probably return to the pre-recession peak in 2013.

Employment The final graph is for employment and is through February 2013. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Payroll employment is still 2.2% below the pre-recession peak.

All of these indicators collapsed in 2008 and early 2009, and only real GDP is back to the pre-recession peak (personal income returned to the previous peak in December due to a one time increase in income). At the current pace of improvement, industrial production will be back to the pre-recession peak later this year, personal income less transfer payments late in 2013, and employment in late 2014. Read more at http://www.calculatedriskblog.com/2013/04/update-recovery-measures.html#lrMLtuUiiEYVAeJa.99

9

posted on

04/02/2013 5:42:51 AM PDT

by

Wyatt's Torch

(I can explain it to you. I can't understand it for you.)

To: Wyatt's Torch

10

posted on

04/02/2013 5:53:03 AM PDT

by

Son House

(The Heath Care Recovery Never Gets Here, Like The Economic Recovery, Easily Predictable.)

To: taildragger

Yes, certainly a decrease in small business is observable, an upscale oil change/car wash place(can’t remember the name) that built a nice new building in the last few years is has now sold out and a pool/spa business moved in.

11

posted on

04/02/2013 5:57:58 AM PDT

by

Son House

(The Heath Care Recovery Never Gets Here, Like The Economic Recovery, Easily Predictable.)

To: Son House

Corporate Profits After-Tax:

Is the US Stock Rally a Bubble?

ETF Database | Mar. 28, 2013, 6:00 PM

US stocks are off to one of their best starts in years. Most indices are up 10% year to date, prompting many investors to ask: “Are we in another bubble?”

The answer is no, at least when it comes to equities. Here are three reasons why:

- Most metrics suggest US stock valuations are at or below their long-term average. US large cap companies are trading at 2.25x book value and 15x trailing earnings, both valuations below the historical average.

- Not only are valuations below average, they are well below peaks reached in 2000 and 2007. By way of comparison, US equity markets were trading for 3x book value in 2007 and 5x in 2000.

- On a relative basis, even after the recent rally, US stocks still look cheap. The earnings yield on the S&P 500 is at a 30-year high relative to the yield available on an investment grade bond index. While this is more a function of bonds being expensive rather than of stocks being particularly cheap, the relative play still favors stocks.

However, while US stock valuations are far from bubble territory, US earnings and book value are both being flattered by a multi-year period of exceptional corporate profitability. In other words, US corporations are experiencing an earnings bubble of sorts.

Corporate profits are currently nearly 10% of US gross domestic product, above a 60-year average of 8.2%, as US companies have benefited from the economy’s slow-growth recovery. The economy has been growing just fast enough to support companies’ topline growth but just slow enough to keep a lid on firms’ wage and interest costs.

The upshot for US stocks: They look more expensive when you consider that earnings aren’t likely to levitate at today’s levels indefinitely. One valuation metric that reflects this is the Shiller price-to-earnings ratio, which uses a 10-year average of earnings rather than a one-year average. According to this measure, US stocks are trading at 22x real 10-year trailing earnings, versus a long-term average of around 16.5x.

This suggests that while US stocks may still outperform bonds, further gains are likely to be more muted and returns over the long term are unlikely to be in double-digit territory.

The good news is that valuations look much more reasonable outside of the United States. Currently, US stocks trade at a 45% premium, based on a price-to-book calculation, to other developed markets. Emerging markets are cheaper still. As such, for long-term investors, the best opportunities may lie outside the United States and in less extended parts of the US market such as in mega caps, and in the energy and technology sectors.

These asset classes are accessible through the iShares S&P 100 Index Fund (OEF), the iShares Dow Jones U.S. Energy Sector Index Fund (IYE) and the iShares Dow Jones US Technology Sector Index Fund (IYW).

Source: Bloomberg

Russ Koesterich, CFA, is the iShares Global Chief Investment Strategist and a regular contributor to the iShares Blog.

12

posted on

04/02/2013 6:01:26 AM PDT

by

Wyatt's Torch

(I can explain it to you. I can't understand it for you.)

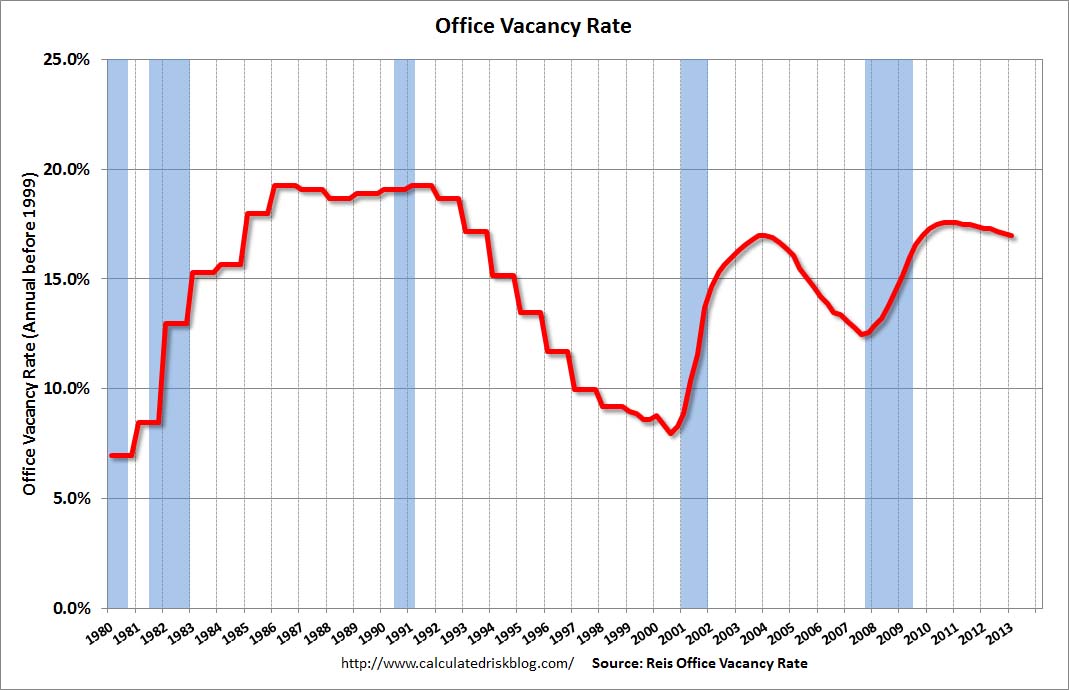

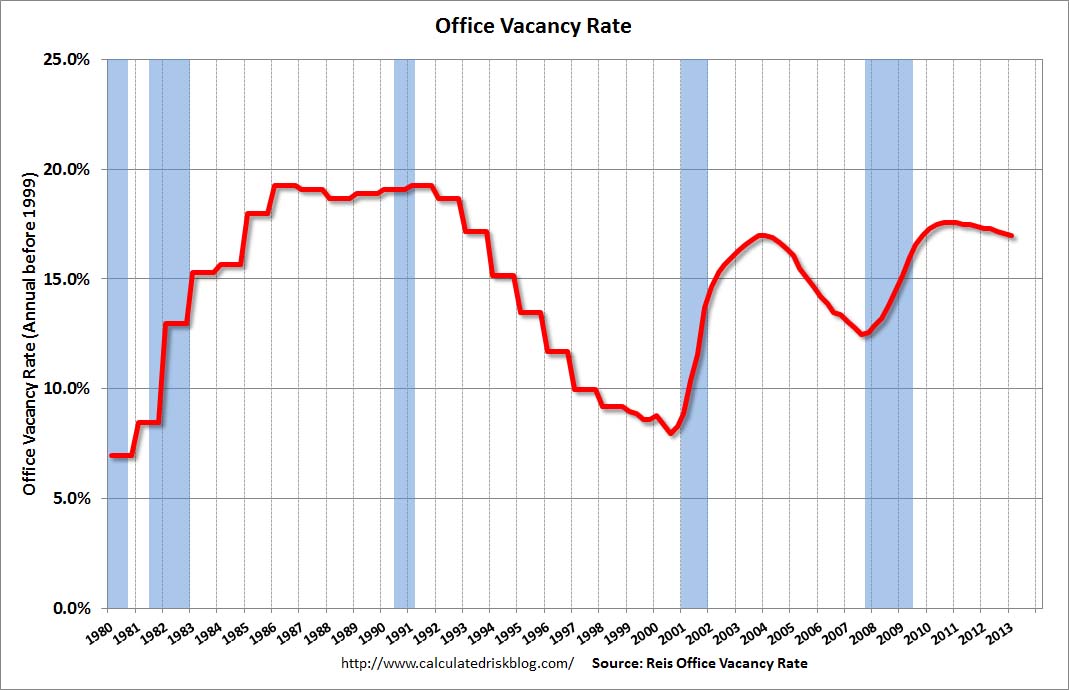

To: taildragger

Office vacancy just came out this morning. Here's a chart from Calculated risk:

13

posted on

04/02/2013 6:06:57 AM PDT

by

Wyatt's Torch

(I can explain it to you. I can't understand it for you.)

To: Wyatt's Torch

Corporate profits are currently nearly 10% of US gross domestic product, above a 60-year average of 8.2%,GDP is about the worst measure of economic activity there is.

Well then here they'll have to find a different measure.

14

posted on

04/02/2013 6:19:35 AM PDT

by

Son House

(The Heath Care Recovery Never Gets Here, Like The Economic Recovery, Easily Predictable.)

To: dennisw

Maybe this has been addressed here, and I missed it...

..if so, maybe one of you financial types here could enlighten me, or straighten out my thinking...

....banks "raw material" is money..

...given the present FED actions, the banks' cost for their raw material is near zer0, so are they using the money in the stock market instead of lending it into the private sector?..

.. would this perhaps be the main reason for the stock market rally?

I know that if I was in the ice cream business, and my cost of milk was near zero, even I could make a killing....

....what will happen if the FED is unable to hold the interest rate at such a low level, and it rises 3 or 4 points?

15

posted on

04/02/2013 6:32:59 AM PDT

by

B.O. Plenty

(Give war a chance........)

To: Wyatt's Torch

Thanks for the reality check, marginally better, but the question begs what is the sampling. We are no where near the Clinton boom years or even the Bush years, but a positive movement none the less..

16

posted on

04/02/2013 6:34:43 AM PDT

by

taildragger

(( Tighten the 5 point harness and brace for Impact Freepers, ya know it's coming..... ))

To: B.O. Plenty

Another question, is the Fed Reserve’s electronic money transfers coming with strings attached or instructions on how to spend it? I’ve heard it was being spent in the stock market, but where is the evidence or proof?

17

posted on

04/02/2013 6:51:36 AM PDT

by

Son House

(The Heath Care Recovery Never Gets Here, Like The Economic Recovery, Easily Predictable.)

To: dennisw; SomeCallMeTim

Ping to Tim. Read your comments on the 3/28 thread RE: “Investment-wise?? I’d recommend LYB, or WLK...” and thought you might be interested in this:

“LyondellBasell Industries NV (LYB) is a Dutch-based chemicals company and the world’s largest producer of polypropylene. It pays a dividend yield of 2.5% on a payout ratio of 26%. The stock has returned 56.4% over the past 12 months. Its beta is 2.53, which implies that the stock’s return could be 2.53 times the market’s return. Improving global economic environment has had a positive effect on the company’s performance. Last year, the company’s EBITDA and EPS expanded by 5% and 32%, respectively. Analysts forecast the firm’s long-term EPS CAGR at 10.4%. LYB is positive about its outlook, expecting to benefit from low ethane and propane costs and the positive momentum in U.S. ethylene, propylene, and polyethylene segments. With robust free cash flow, LYB has been returning excess cash to shareholders through special dividends and share buybacks. The firm plans to seek approval to repurchase 10% of its issued share capital. LYB’s prudent financial management is also noteworthy, as the company has reduced its total debt by 40% since 2010. This and the company’s growth and cash flow records have earned it an investment-grade rating. Given the stock’s forward P/E of 10.4x, it can be considered a good value investment. The stock is popular with Tiger Cub hedge funder Rob Citrone.”

From article: 5 High-Beta Dividend Stocks To Try To Beat The Market

http://seekingalpha.com/article/1314181-5-high-beta-dividend-stocks-to-try-to-beat-the-market

To: LuvFreeRepublic

Thanks... I agree.

LYB was BANKRUPT just a few years ago... it’s been a long climb back. I think that is still part of the reason they have been undervalued.

They are a money printing machine in the USA. My only concern about them is... they do still have significant assets in Europe, which.. is a basket case in chemicals. Even though THEY also have abundant shale gas available. The green-euro-weenies won’t let them get it.

Westlake will likely have a poor quarter in the 1st.. since they had one Ethylene plant down for three months for an expansion... and, a new chlorine plant under construction. Could be a little buying opportunity coming...if they drop on earnings announcement.

19

posted on

04/02/2013 8:11:14 AM PDT

by

SomeCallMeTim

( The best minds are not in government. If any were, business would hire them)

To: MichaelCorleone

If the economy were to “roar back†it wouldn’t be a good thing anyway. The Fed has printed so much imaginary money, an overheating economy would be accompanied by vary nasty inflation.

20

posted on

04/02/2013 8:12:18 AM PDT

by

BenLurkin

(This is not a statement of fact. It is either opinion or satire; or both)

Navigation: use the links below to view more comments.

first 1-20, 21-27 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson