Posted on 04/15/2013 4:15:32 AM PDT by dennisw

Daily investment & finance & thread (4-15-13 edition) Freepers lets make some cash

Trying to focus on the markets for today and each day and the economic news

This is where you can impart some investment wisdom to your fellow freepers. You can vent about the big one that got away. You can

chime in how Obama is out to wreck American capitalism.

If you see another FR economic thread you like and want to link to it here, please do

Post your favorite economic site links. Your favorite economic blogs and precious metals blogs and sites

Apmex.com is a solid place with good reputation to buy precious metals and has great presence on ebay for easy quick impulse buys

such as a gift for a college boy's graduation. College Girls too! Even high scoool.

Kitco is the best site for gold and silver charts and other precious metals information

Ping list -- on or off let me know here or via freep-mail. If I missed you then Freep-mail me

I might ping you to other interesting economic threads a few times a week. One per day maybe

Sites that posters have recommended ------ zerohedge turdferguson

pong

OUCH!

gold at 1413 silver at 23.77

Time to buy metals.

Haynes - Gold & Silver Buyers (physical metals) Outpacing Sellers 50 to 1

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/4/13_Haynes_-_Were_On_The_Verge_Of_Major_Gold_%26_Silver_Shortages.html

Falling knives are also made of metal. The current overcorrection may soon end and then gold may rebound back to $1500 or so. But it will take months to for the charts to register some sort of support and there will be ample buying opportunity, just maybe not at firesale prices.

Do any of you know about the pros and cons of putting 401k money in foreign bond funds? I am looking to at least try to preserve what I can of my 401k and have no confidence in the stock market. Would this be a sensible option? If not, what would be better?

I have not used them but EVERBANK has foreign alternatives you might like. New Zealand, Australia etc. CDs etc https://www.everbank.com/currencies

If anyone has time to help me out with some advice on buying silver (physical metals delivered to me), I'd appreciate the info. What I want to avoid is the +5 dollar premium on buy Eagles. Do any of you know a reliable source for bulk amounts that is a bit more reasonable?

Buying bags of old US Silver coins is pretty easy and they are conveniently denominated for future use.

NYSE Morning Update:

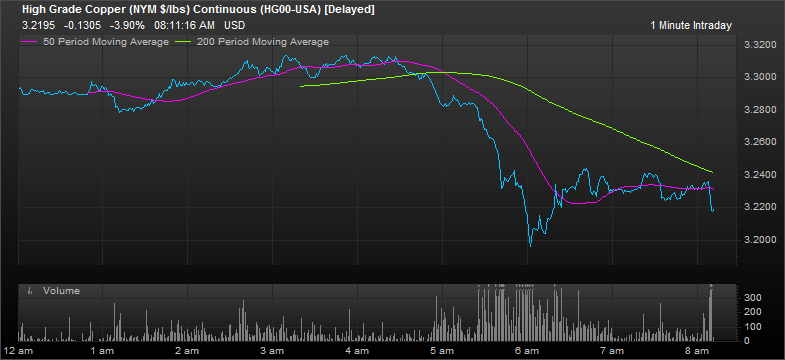

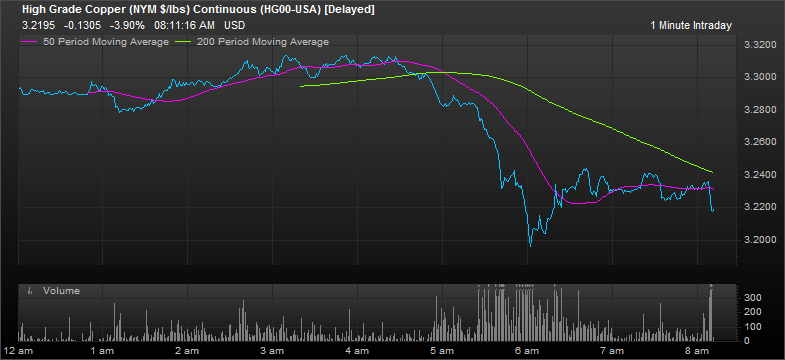

Ahead of the Bell: Dow futures are trading down 49 points and S&P futures are trading down 7 points after China reported weaker than expected GDP data for the first quarter of 2013 and the euro zone posted lower imports. The second largest economy in the world stumbled in the first three months of the year and only grew 7.7% verses expectations of 7.9% on slowing factory output and weak industrial production. The price of commodities, including crude oil, copper, wheat and corn fell sharply, as investors forecast diminishing demands from China. According to EU statistic office, Eurostat, the 17 member block showed a surplus for the region in February, but the increase was helped by lower demand for imports rather than growth.

• On the economic calendar today, Empire state manufacturing survey for March will be out prior to the opening bell, 7.50 is forecasted versus 9.24 for February. The housing market index for March will be out after the market opens and it is anticipated to 45 compared with 44 for February.

• The dollar is up against the major currencies. Gold is trading at $1,410. Crude oil is currently trading at $88 a barrel.

• Last week, the bulls returned and the major indices soared on global central bank easy monetary policy. The Dow and S&P 500 both hit fresh new all-time highs, despite euro zone troubles. For the week, the Dow climbed 2.06% and the S&P 500 rose 2.29%. Alcoa kicked off first quarter earnings season and beat analysts’ expectations. JPMorgan and Well Fargo both reported better earnings, but revenues were slightly below forecast. The economic data for the week was mixed, as retail sales were up; however, the colder weather continues to keep demand down. The NFIB small Business Optimism Index was down, impacted by higher payroll taxes earlier in the year and regulations. Mortgage applications were down, but refinancing applications were higher for the prior week. The Labor Department reported applications for unemployment benefits fell more than forecast last week, easing concern the labor market was taking a turn for the worse. Jobless claims fell 42K to 346K in the week ended April 6 from a revised 388K. The Federal Reserve which inadvertently issued the minutes of its last meeting a day earlier to some members of congress said the central bank should begin tapering its quantitative easing program later this year and stop it by the end of 2013.

• The week ahead; many professional traders are anticipating a pullback in equities. The week will be all about first quarter earnings. According to Thompson Reuters, S&P 500 companies are expected to grow a modest 1.1% in the first quarter, down from a January forecast of more than 4%. This week 74 of the S&P 500 companies, from across all sectors are expected to report earnings, including American Express, Goldman Sachs, Bank of America, Citigroup Inc, Google, Yahoo, Johnson & Johnson, Coca-Cola, McDonald’s, and General Electric. On the economic calendar, there are a few key pieces of economic data that investors will focus on, such as regional manufacturing data from New York and Philadelphia Federal Reserve banks, consumer inflation, housing starts, the Fed’s Beige Book, and weekly jobless claims. The claims data will be in the spot light, particularly since it dropped significantly the prior week. There are a number of Federal Reserve officials on the speaking circuit this week, both hawks and dovish members. Fed watchers will be looking for clues about when the agency plans to end its bond-buying program. The central bank is currently purchasing $85 billion in treasury securities a month. Recent minutes from the FOMC’s last meeting showed Fed members are hinting at tapering the agency’s easy money policy by the end of 2013.

• On CNBC today, Bob Doll, Nuveen Asset Management, talked about the recent selloff in gold and other commodities. Doll said it’s been an incredible run for gold as it has been at this level for a while. He believes that it’s a sign the world is healing and investors are questioning why they should hold so much gold. The risk is some deflationary concerns now, as the Federal Reserve continues its easy monetary policy. Traders have been waiting for a turn in the gold market for a while. Doll believes the weakness in China is driving the selloff in commodities, including gold. He feels that a big move in commodities is not great news for stocks.

• Today is the deadline for filing 2013 taxes with Uncle Sam.

• Happy Monday and have a wonderful week!

Monday’s Close

DJIA down 0.08 pts/-0.01%/ 14,865.06

S&P down 4.52 pts/-0.28%/ 1,588.85

Nasdaq down 5.21 pts/-0.16%/ 3,294.95

Friday’s Futures

Dow Futures down 49.27 pts/-0.43%

S&P Futures down 7.50 pts/-0.49%

Nasdaq Futures down 12.25 pts/-0.43%

Overseas Markets

FTSE -1.15%

CAC 40 -1.00%

NIKKEI 225 -1.55%

HANG SENG -1.43%

Overseas: World stock markets are down today. European and Asian stocks are trading down on weak GDP data from the China and lower import data from the euro zone.

Economic Reports: Empire State Manufacturing Survey expected to be 7.50 at 8:30 a.m. and Housing Market Index expected to be 45 at 10:00 a.m. later in the week Consumer Price Index, Housing Starts, Industrial Production, Beige Book, Jobless Claims, Philadelphia Fed Survey, and Fed Balance Sheet.

Top Headlines:

• Dish Network (DISH) announced it is offering to buy Sprint Nextel (S) in a $25.5 billion deal to challenge a bid by Japan’s Softbank Corporation. Sprint shareholders would receive $7 a share, consisting of $4.76 in cash and stock representing about 32% of the combined company.

• Thermo Fisher Scientific (TMO) said it is acquiring Life Technologies Corporation (LIFE) for $76.00 in cash per common share, or approximately $13.6 billion, plus the assumption of net debt at close ($2.2 billion as of year end 2012).

• General Motor Corporation (GM) and Ford Motor Company (F) have agreed to jointly develop a new line of vehicles to boost fuel economy and increase performance.

Commodities/Currency:

Gold: up $91.70 to $1,410.50

Oil: down 2.50 to $88.54

EUR/USD 1.3067 -0.0001

USD/JPY 97.8105 -0.5745

GBP/USD 1.5331 -0.0001

Volatility Index (VIX): As of the close of business Friday, April 12, the VIX is down 0.48 at 12.36

Companies Reporting Quarterly Earnings:

Citigroup reports Q1 EPS $1.29 ex-CVA/DVA, vs. Est. $1.17 Reports Q1 EPS $1.23 including CVA/DVA and 1Q ADJ. REV $20.8B, EST. $20.17B

First Republic Bank reports Q1 EPS 72c ex-items, vs. Est. 73c and Q1 revenue $370.3M, vs. Est. $320.04M.

Today’s Opening and Closing Bells:

Second Annual Energy Sector Roundtable will ring the opening bell.

Financial Capability: Empowering Girls and Women will ring the closing bell.

Depends on your time horizon, non-retirement asset allocation, etc.

With domestic bond funds, you are taking interest rate risk and credit risk. With foreign bond funds, you are adding currency risk as well.

Personally, I assume that if there is a dollar collapse there will also be haircuts to those “captive” accounts such as 401(k) and IRA plans. So I don’t, for instance, hold gold or other inflationary hedges in those accounts.

Furthermore, if the dollar weakens against other currencies, I would probably want the capital gains tax treatment.

Just my opinion of course. I’d be interested in hearing others’ opinions too.

Sorry, my question was poorly worded... I’m specifically looking for US Eagles

http://www.apmex.com/Category/160/Silver_Eagles___Uncirculated_2013__Prior.aspx

A local coin dealer might give you a deal...but APMEX usually is as good as it gets plus APMEX store on ebay

Will the winds of deflation carrying across the precious metals, copper, oil, gasoline and commodities carry over to the US stock markets? We will find out

How about a daily list of links, aka, TBI, ZeroHedge etc.

Here are some new ones to my world...

http://www.amazon.com/This-Time-Different-Centuries-Financial/dp/0691152640/ref=cm_cr_pr_product_top

If you post a list of 10-20-30 links *by category* that you like I will copy it to my computer and post them every day at the top of the thread..... and I’ll add a few myself

Thanks! Do you have the link to that chart? Where you got it from?

I use FactSet (buy-side platform) to pull these quotes so I can’t link them. Sorry. Let me know if you want any other charts as I’m happy to pull them.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.