Posted on 05/13/2013 10:11:18 AM PDT by 1rudeboy

American investment banks dominate global finance once more. That’s not necessarily good for America

FOR a few tense weeks in 2008, as investment-bank executives huddled behind the imposing doors of the New York Federal Reserve, Wall Street seemed to be collapsing around them. Lehman Brothers filed for bankruptcy, Merrill Lynch collapsed into the arms of Bank of America. American International Group (AIG) and Citigroup had to be bailed out and the rot seemed to be spreading. Hank Paulson, the treasury secretary at the time, recalled in his memoir that: “Lose Morgan Stanley and Goldman Sachs would be next in line—if they fell the financial system might vaporise.”

Across the Atlantic, European politicians saw this as the timely comeuppance of American capitalism. Angela Merkel, Germany’s chancellor, blamed her peers in Washington for not having regulated banks and hedge funds more rigorously. European banks saw the crisis as their chance to get one up on the American banks that had long dominated international finance. Barclays quickly pounced on the carcass of Lehman Brothers, buying its American operations in what Bob Diamond, the head of its investment bank at the time, called “an incredible opportunity” to gain entry to the American market. Deutsche Bank, a German giant, also expanded to take market share from American rivals. The dominance that American firms had long exerted over global capital markets seemed to have come to an abrupt end.

Almost five years on it is Europe’s banks that are on their knees and Wall Street that is resurgent.

(Excerpt) Read more at economist.com ...

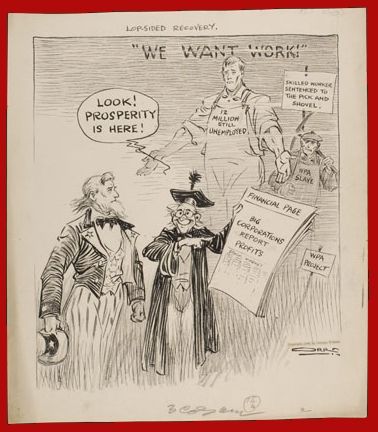

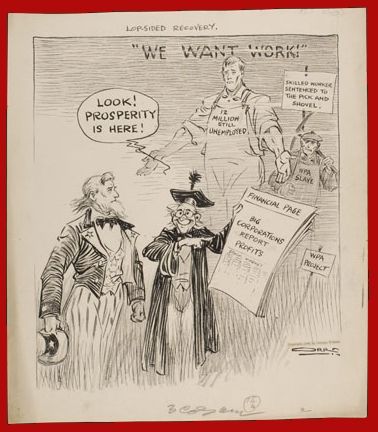

A “resurgent Wall Street”, hm?

The question is, how does The Street lure back the small investors? Because they sure ain’t buying stocks like they used to!

Should this be titled “Wall Street is Back”, or “Big Daddy Government is Now Sleeping on the Couch!”

“Wall Street,” in the context of this column, means “investment banking.” It’s a little surprising that few people get it.

It’s amazing what $20 trillion or so in taxpayer money can do.

$20 trillion? Wow, talk about inflation.

” Should this be titled “Wall Street is Back”, or “Big Daddy Government is Now Sleeping on the Couch!””

Goldman Sachs i.e. The White House, is doing fine, so all is well : )

Watch this video-”electronic run on the banks”-Kanjorski-2009.

https://www.youtube.com/watch?v=pD8viQ_DhS4

At about the 2:15 point in the video, Kanjorski talks about a “tremendous draw-down of money market accounts”-550 BILLION dollars, in less than an hour.

Remember when Hussein and McCain came back from the campaign trail when this happened?

Pres. Bush looked scared to death, McCain looked very concerned, and Hussein looked bored. (thanks, soros-fool us once...)

Someone is trying to bait the little guy back into the market—NONE for me!

Sell! Sell! Sell!

We do want big players to be healthy, but we don’t want it at the expense of the average Joe. And as for as U. S. Government investments in Wall Street, hell no.

Wall Street is back? Did it bring back my money?

This whole idea of an 'investment banker' on 'Wall St' is a crock. In real life the term 'investment banker' can refer to anyone working in the capital markets, but in the Economist/loony-left/Obamafaction world it's the evil exploiting pin stripe capitalist yadda yadda. Even the idea of a Wall St. is bogus. OK, so maybe 50 years ago something actually physically happened there but capital markets have long since gone electronic; even the NYC financial offices have moved uptown. All that's left on south Manhattan is the image:

What toxic debt?

Taxpayer money? Where?

That was funny. And inaccurate.

The Economist was always squishy. In the recent past, it has become more so. I agree. I still look in on it now and then.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.