Skip to comments.

Weekly Investment & Finance Thread (August-2013 5-9 edition)

Daily investment & finance thread ^

| August 5, 2013

| dennisw's thread

Posted on 08/05/2013 3:55:38 AM PDT by expat_panama

click here to read article

Navigation: use the links below to view more comments.

first 1-20, 21-35 next last

To: abb; Abigail Adams; abigail2; Aliska; Aquamarine; B.O. Plenty; BenLurkin; bert; BipolarBob; ...

A happy Monday morning to all! Futures are flat, let's all go back to bed.

Reuters - 9 hours ago

By Richard Hubbard. LONDON | Mon Aug 5, 2013 4:29am EDT. LONDON (Reuters) - The dollar softened and European shares edged up to a two-month high on Monday after last week's batch of U.S.

To: expat_panama

Almost all of the petroleum storage facilities are full to the max, yet crude prices are still high. It’s the new economics. Someone behind the scenes decides what prices will be for everything and damn supply and demand. Same thing with the market — it’s all rigged. No real economy exists to support this market and yet it marches on.

3

posted on

08/05/2013 4:53:13 AM PDT

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: MeneMeneTekelUpharsin

Weird, it's amazing how often we hear that because it never

NEVER works that way in real life. If people need something and are willing to pay more, the price goes up and if not, the price goes down; sellers have the same affect. Anyone else --government, cartel, whatever can pretend but it always has to come back to reality.

To: expat_panama

5

posted on

08/05/2013 5:27:08 AM PDT

by

underbyte

(TEOTEWAKI)

To: underbyte

tx, [adding to htm file] There,

howzatt?

To: expat_panama

There has been a subtle but perceptible shift in the market since Friday’s bad employment numbers. Though the market is still making marginal gains, ease of movement is now to the downside, and resistance has shifted to the sell side on the bid/ask and size. We may be nearing a short term top.

7

posted on

08/05/2013 7:35:59 AM PDT

by

Free Vulcan

(Vote Republican! You can vote Democrat when you're dead...)

To: Free Vulcan

Looking at the volume+price combos we’ve been having with the S&P500 I’d agree; there are indicators that say we’re in for a downdraft as the first part of a several month bear market.

Of course, the indicators are wrong sometimes...

To: expat_panama

http://blogs.marketwatch.com/thetell/2013/08/05/investors-poured-40-3-billion-into-stocks-in-july-trimtabs/

Investors poured $40.3 billion into stocks in July: TrimTabs

August 5, 2013, 2:10 PM

Surprise!

Investors have been pouring money into stocks.

U.S. equity mutual funds and ETFs saw a record inflow of $40.3 billion in July, according to data from TrimTabs. More than three-fourths of that went into U.S. equity ETFs, while the remainder went into mutual funds.

Bond funds saw $21.1 billion in outflows in July, following on the record $69.1 billion in June.

But cash remains even more popular than equities, with a combined inflow to savings deposits and retail money market funds of $143.4 billion, for the eight-week period ending July 22.

– Tom Bemis

9

posted on

08/05/2013 1:24:09 PM PDT

by

abb

To: abb

That’s pretty interesting. Some pretty good discussion in the comments.

10

posted on

08/05/2013 3:58:39 PM PDT

by

Lurkina.n.Learnin

(If global warming exists I hope it is strong enough to reverse the Big Government snowball)

To: Lurkina.n.Learnin

One of the classic signs of a market top is when all the money is committed. All the bets are in, so to speak. When that happens, then there are no more buyers to make it go up further.

11

posted on

08/05/2013 4:23:31 PM PDT

by

abb

To: abb

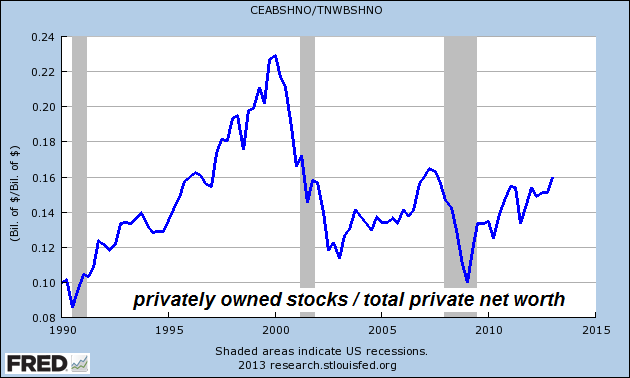

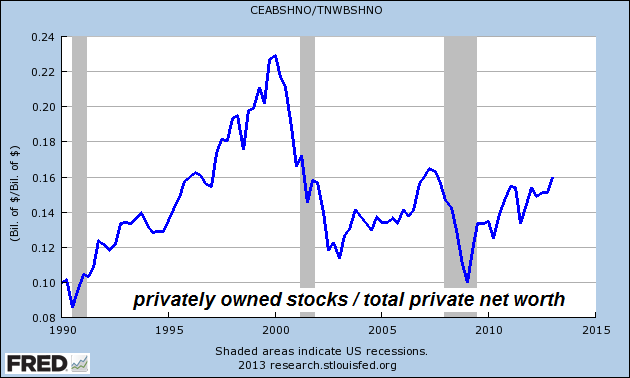

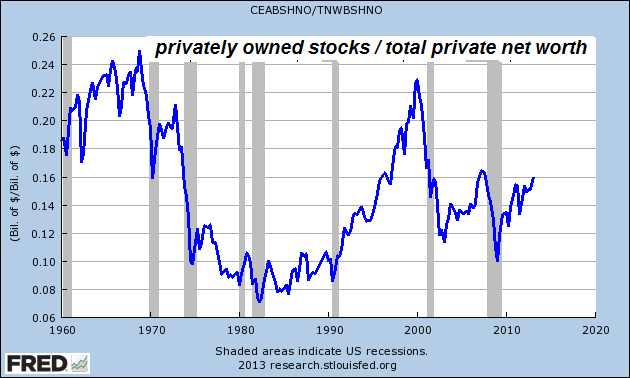

...signs of a market top is when all the money is committed...--and when all active traders are 100% in, then the only trades that happen are when all the active traders start selling to part time/inactive traders. We're no where near that; here's stocks % net worth since 1990:

The percent's only average, no where near "all the money is committed".

To: expat_panama

That last dip on that chart scared a lot of people off. I know some swore they would never own stocks again. It was sad really. One friend watched it go all the way to the bottom and then panicked and pulled it out after his 401k was destroyed. If he had left it alone he would have been OK but instead he moved to cash and watched it go back up. I wonder if the years of basically nothing returns have changed his mind and he went back in. I know now doesn’t seem like a good time to bail back in.

13

posted on

08/05/2013 7:54:03 PM PDT

by

Lurkina.n.Learnin

(If global warming exists I hope it is strong enough to reverse the Big Government snowball)

To: abb; Abigail Adams; abigail2; Aliska; Aquamarine; B.O. Plenty; BenLurkin; bert; BipolarBob; ...

At three hours before opening stock & metal futures are flat, but things keep happening:

Nasdaq Ekes Out Another Gain As Market Catches Its Breath08/05/2013 06:53 PM ET - The major indexes closed mixed in narrow-ranged trading Monday as volume cooled. But growth stocks continued to move in the right direction for the bulls. Sellers held the upper hand at the open, as all of the key averages started the day with losses. But, as often seen during a healthy uptrend, the tide turned after a half hour's worth of trading. The ..

Obama to urge Congress in speech to shutter Fannie Mae and Freddie Mac

Fox News - 9 hours ago President Obama will urge Congress to shutter Fannie Mae and Freddie Mac, the mortgage-giants bailed out by the government in 2008, as part of a strategy to buffer taxpayers from future housing market downturns.

Economists favor Yellen for Fed chair

CNNMoney - 25 minutes ago Female economists aren't the only ones who want Janet Yellen to be the new Federal Reserve chair. A CNNMoney survey of 21 economists -- mostly male -- showed lots of support for Yellen and virtually none for the other frontrunner, former Treasury ...

To: Lurkina.n.Learnin

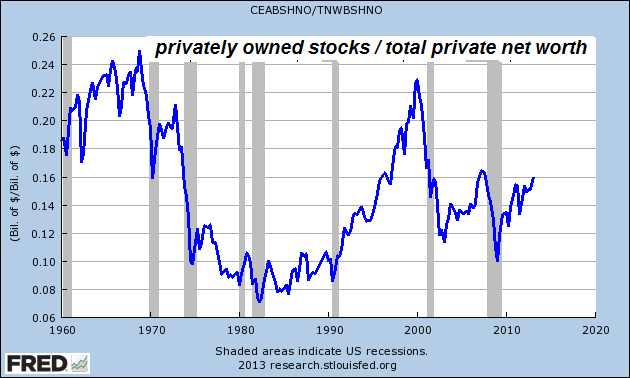

watched it go all the way to the bottom and then panicked and pulled it out after his 401k was destroyed.Supposedly the manager of the Harvard endowment did that and the college lost billions. For me one of the lessons here is never act on emotion, and the other is to always watch the long run. That big dip in '09 was big but not as low and long as the malaise daze. That was followed by a tripling of money buying stocks:

To: expat_panama

For me one of the lessons here is never act on emotion, and the other is to always watch the long run. Money and wealth for individuals is very much an emotional function. If it were just a bookkeeping exercise, wealth accumulation would be a snap.

16

posted on

08/06/2013 4:21:23 AM PDT

by

abb

To: All

If someone will just give me a weeks notice before the next BIG selloff, would be much appreciated.

/jk . . . maybe

To: abb

Exactly, and the fact it’s so natural and the extent that overcoming it is so hard is why the returns are huge for those of us that are willing to put in the extra effort.

To: expat_panama; abb

FEAR and GREED are the enemies.

To: Lurkina.n.Learnin

That last dip on that chart scared a lot of people off. I was fortunate enough to almost completely miss the 2000 crash... and, was given excellent timing information from a newsletter guy, Bob Brinker, to get back in the market in March 2003. Perfect!

In 2008, I was actually OUT of the market in May through August... misseed the 20% sell-off. Then, I convinced myself that the worst was over, and moved back in... :-(

The worst was NOT over... it had just started. By October, I was mostly OUT... and, stayed out for longer than I should. In fact, I've NEVER been fully in the market since. But, I have been able to catch a good deal of the upside in the past year and a half.

I'm about 50% in cash now... every instinct I have wants me to put MORE in the market... but, this is August. And, feel a LOT like I did in 2008. I keep thinking I'll wait for a pullback... but, the pullbacks have been few, and weak.

So... I'm stuck.. sitting here paralyzed.. trying to just not worry about anything.

20

posted on

08/06/2013 6:17:11 AM PDT

by

SomeCallMeTim

( The best minds are not in governm<p>ent. If any were, business would hire them f)

Navigation: use the links below to view more comments.

first 1-20, 21-35 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson