Posted on 05/28/2014 9:29:58 AM PDT by blam

May 28, 2014 - 06:02 PM

Investment_U

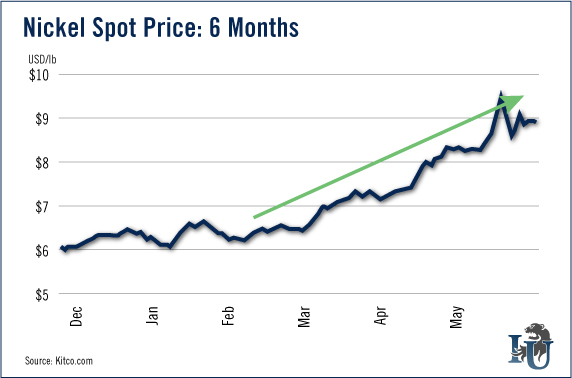

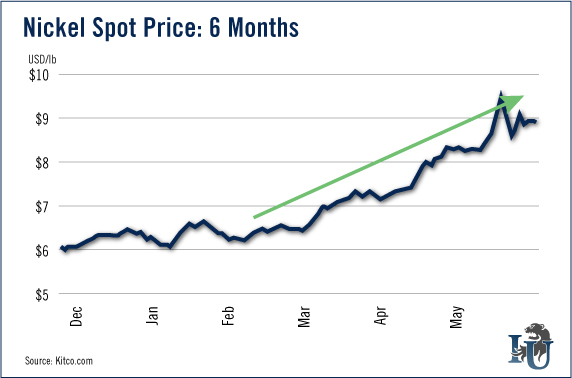

Back in January, I wrote a column explaining the supply-demand squeeze in nickel.

One way I suggested to play the nickel squeeze, the iPath Dow Jones-AIG Nickel Total Return Sub-Index ETN (NYSE: JJN), is up 38% from my recommendation.

Did you buy that fund? Well, if you didn't, there's no need to kick yourself.

The nickel run isn't over.

In fact, if anything, the supply/demand squeeze powering nickel's surge is likely to get stronger. The biggest user of nickel is China. Nickel is used to make stainless steel, and China makes a lot of it. Stockpiles of nickel in China are falling. According to Deutsche Bank, China's nickel stockpile is now down to one month's supply, a drop of 26% in just a month.

A big supply crunch is coming for China.

What's more, the global nickel market will swing to a deficit of 132,200 tons next year from a surplus of 13,800 tons this year, according to Citigroup.

What will that do to prices? The price of nickel was recently $8.91 per pound, or $19,615 per metric ton. Citi forecasts nickel prices to rise to more than $30,000 per metric ton next year. That's a rise of more than 50%!

The Source of the Problem

Indonesia's ban on nickel ore exports has removed close to a third of the world's supply. Indonesia's raw nickel exports have gone to zero. Everybody thought there would be relief to this thanks to an election in April, but that didn't work out.

Now Indonesia says it is furiously building nickel smelters to fix the supply crunch. And that's a good idea, except for one thing: power.

The government is talking up the number of planned smelters.

(snip)

(Excerpt) Read more at marketoracle.co.uk ...

I was stationed in the Azores in the early 70s. It seemed like the entire nickel supply on the island was form coinage that came and stayed there from WWII...most nickels were from the early 40s.

Huge deposits of Nickle in N. Mn but try to mine it - good luck.

How about the good old Jefferson nickel? They cannot legally be melted down, but any obvious benefit to hanging on to some?

Nickle squeeze?

Has anyone checked Minn?

Sheesh.

5.56mm

Think Sudbury

Well....I have 25K of them in storage.

And, billionaire Kyle Bass bought 20 million of them.

So....(they'll always be worth a nickel.)

I remember there was a shortage of nickles for about a year or so in the early 70’s. I remember it was during Nixon’s wage-price freeze.

I think technology has improved so that we don’t need to create another Sudbury to get at it.

I did a quick check on JJN. Its average daily volume over the past 90 days has been less than 16,000 shares. Over the past 10 days, it has been under 39,000 shares.

Any stock with an average daily volume of under 100,000 traded shares is considered to be illiquid. In other words, it can be a bit expensive to purchase shares, and a real challenge when you want to sell them. The spread between the Bid and Ask price on stocks like this one is quite wide. Right now, the Bid is $26.40 and the Ask is $26.47. That is a wide spread.

So, if anyone is thinking about making some easy money on this stock (JJN) be careful. Stocks with such a low daily volume and move both up can DOWN in quantum leaps very quickly.

I have a plan. Get a dump truck, fill it with nickels, drive to Canada and sell them for scrap.

Go to a Canadian bank, fill your truck with nickels, drive to US and sell them for scrap.

Repeat until you're rich.

Sulfide ores wouldn’t pass the enviro’s squeeze on the EPA and even oxide ore would be difficult to permit.

To: blam

How about the good old Jefferson nickel? They cannot legally be melted down, but any obvious benefit to hanging on to some?

Except for the storage cost, it’s a great investment.

Note the old Moa Nickel Plant in Cuba...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.