Posted on 06/05/2014 5:33:02 AM PDT by ckilmer

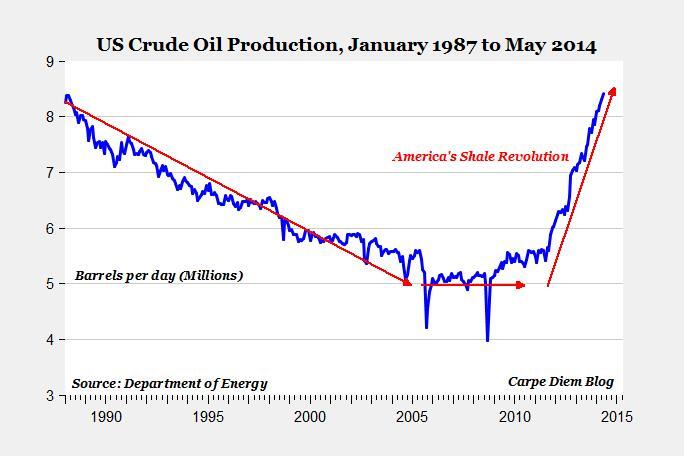

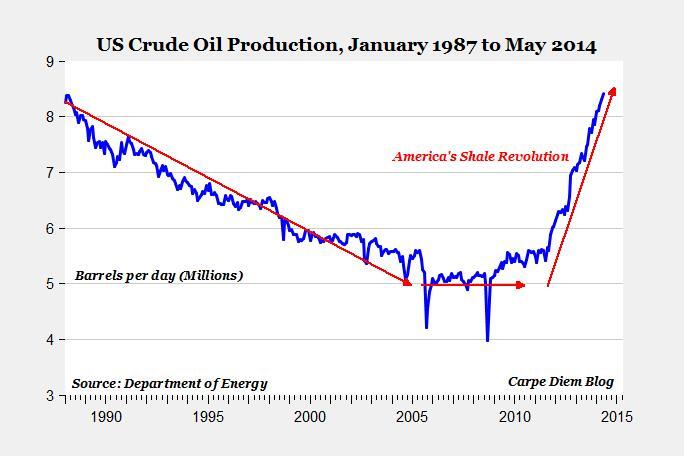

We recently declared that the fracking debate was over. Despite clear evidence of the shale boom's local environmental effects, it's probably added about 50 basis points to GDP, shrunk the trade deficit, and created tens of thousands of jobs.

Despite all that, Goldman Sachs believes America has left tons of figurative barrels and cubic feet on the table by not more aggressively investing in spurring demand. While the U.S. share of global upstream (that is, production) investment outpaced funds into Saudi Arabia and Russia by 10:1, the rest of the world outspent the U.S. on demand-side investment — places to put all those resources — by 15:1.

(Excerpt) Read more at businessinsider.com ...

an interesting argument against exporting natural gas.

Obama is blowing the shale revolution. This thing put a serious crimp in his plans to reduce the power of this country. He’s fighting it in any way he can.

Imagine where we would be if there were no shale revolution.

Seriously.

This is a very long story, short on important facts.

For those who want to see a video showing how horizontal drilling and fracking is done, Northern Gas and Oil has a great one. It’s 6 minutes.

It includes a visual piece on how fresh water aquifers are protected from contamination.

http://www.northernoil.com/drilling-video

“To successfully develop domestic gas demand over the longer term, business and government leaders need to work together to solidify the confidence that is required to attract capital over the next 30 years,” they write.

as the United States has lagged other countries in generating the demand – and the high-value manufacturing jobs that come along with this demand

- - - - - -

Greatly disagree with this statement. We have had billions of dollars recently invested with ethane crackers and other petrochem investment to take advantage of the increased supply.

Also I see no mention of the fact the Natural Gas Liquids (NGL, ethane, propane, etc) are the primary feedstocks to the petrochem industry, not the methane used in LNG. Exporting LNG, which increases the demand for methane, results in greater domestic production of NGLs from wet gas wells.

The reason for that debacle is the fact that the enviro-nazis keep stalling new pipeline construction. They DO NOT want cheap gas for anyone.

This is what the Russian government thinks, as it whistles by the graveyard.

Now, being outspent on the infrastructure side could have several causes. One, the US is simply better at fracking. Two, the US is more efficient in building what it needs. Three, the US is (still, yet?) less corrupt than the other countries, keeping our costs lower.

Now, the US is unique in that private property owners have mineral rights. So, it's easier to get approvals to drill, frack, etc., because the locals have skin in the game. There's zillions of cubic feet of gas and oil on the table, because the Federal Government is stopping drilling on Federal lands in order to meet the Greenies religious obligation of hating fossil fuels, development, prosperity and civilization. This also links up the Obama's goal of weakening America.

That’s what I was wondering after watching that fracking video above...seems like it would be awfully expensive to extract.

Shakeout threatens shale patch as frackers go for broke

http://fuelfix.com/blog/2014/05/27/shakeout-threatens-shale-patch-as-frackers-go-for-broke/

May 27, 2014

The U.S. shale patch is facing a shakeout as drillers struggle to keep pace with the relentless spending needed to get oil and gas out of the ground.

Shale debt has almost doubled over the last four years while revenue has gained just 5.6 percent, according to a Bloomberg News analysis of 61 shale drillers. A dozen of those wildcatters are spending at least 10 percent of their sales on interest compared with Exxon Mobil Corp.’s 0.1 percent.

“The list of companies that are financially stressed is considerable,” said Benjamin Dell, managing partner of Kimmeridge Energy, a New York-based alternative asset manager focused on energy. “Not everyone is going to survive. We’ve seen it before.”

Some investors are already bailing out. On May 23, Loews Corp. (L), the holding company run byNew York’s Tisch family, said it is weighing the sale of HighMount Exploration & Production LLC, its oil and natural gas subsidiary, at a loss.

HighMount lost $20 million in the first three months of the year, after being unprofitable in 2013 and 2012, Loews said it its financial reports. As with much of the industry, HighMount has shifted its focus to oil after natural gas prices plunged and has struggled to find sites worth developing, company records show.

Mary Skafidas, a spokeswoman for Loews, declined comment.

In a measure of the shale industry’s financial burden, debt hit $163.6 billion in the first quarter, according to company records compiled by Bloomberg on 61 exploration and productioncompanies that target oil and natural gas trapped in deep underground layers of rock. And companies including Forest Oil Corp. (FST), Goodrich Petroleum Corp. (GDP) andQuicksilver Resources Inc. (KWK) racked up interest expense of more than 20 percent.

Production declines

Quicksilver acknowledges the company is over-leveraged, said David Erdman, a spokesman for Quicksilver. The company’s interest expense equaled almost 45 percent of revenue in the first quarter. “We have taken concrete measures to reduce debt,” he said.

Drillers are caught in a bind. They must keep borrowing to pay for exploration needed to offset the steep production declines typical of shale wells. At the same time, investors have been pushing companies to cut back. Spending tumbled at 26 of the 61 firms examined. For companies that can’t afford to keep drilling, less oil coming out means less money coming in, accelerating the financial tailspin.

More at link...

This Chicken Little Bloomberg stringer obviously doesn’t know his way around a financial statement, much less the petroleum industry. He picked the most troubled companies to interview. Why didn’t he call Harold Hamm?

While the U.S. share of global upstream (that is, production) investment outpaced funds into Saudi Arabia and Russia by 10:1, the rest of the world outspent the U.S. on demand-side investment — places to put all those resources — by 15:1.

.............

I think that this is a key take away from the article.

What it means is that there is enough worldwide demand for oil to absorb US oil production increases without materially affecting the price of oil.

The EIA currently expects the USA to add 1 million barrels@ day in 2014 and 2015.But then the EIA foresees production flattening after that.

Will flattening USA oil production increases in 2017 and beyond pressure oil prices upwards? Beats me. But a nice thought for speculative drillers

I think the market has clearly shown that over the last couple years.

The author, whose background is in history and journalism, quotes a Goldman Sachs report. The author says we don't invest enough in energy intensive industries which, he says, is due to a "failure of ambition and foresight on the both public and private sides". Toward the end, we discover that both he a Goldman favor a (continued) ban on both oil and LNG exports. That's right, punish the O&G industry with lower prices because industry isn't consuming as much of their product as you wish. He forgets that this will cause lower E&P. Forget the author; he's a nanny-stater if not worse. The quotes from GS seem bad enough, but they may be selective, so let's review the full GS report, not the Business Insider (Democrat) spin on the topic.

There is no story here. U.S. industry is adapting to lower natural gas prices as any prudent business would. For example, new refineries are financed over twenty+ years, not on the basis of spot NG prices.

Let's keep the government out of the O&G industry to the greatest extent possible; and Business Insider off FR

First “major independent” I grabbed to look at was Devon.

http://phx.corporate-ir.net/phoenix.zhtml?c=67097&p=irol-reportsAnnual&leftnav=6

2013 Annual Report

Page 51

CONSOLIDATED COMPREHENSIVE STATEMENTS OF EARNINGS

In millions

Total operating revenues 10,397

Total operating expenses 9,776

Operating income 621

Net financing costs 417

Restructuring costs 54

Other nonoperating items 1

Earnings from continuing operations before income taxes 149

Income tax expense 169

Net earnings (loss) $ (20)

They had a lot of revenue, but wound up for a $20 million loss for the year.

>> the rest of the world outspent the U.S. on demand-side investment

Because the a-hole is intentionally undermining advances in US energy production.

ping for some real world shale production numbers.

... and the next would be Chesapeake. Now you're being selective.

The author wants to pin the problem on decline rates, which were fully anticipated. The cause of low earnings is lower than expected natural gas prices.

Debt is common to most of these companies. That's smart; better than giving away equity. That is Hamm's approach. The difference is that the oil explorers did well by oil prices and the natural gas explorers were beaten up by natural gas prices.

I'm sure you agree. My quarrel is with the media that puts a negative spin on an industry they don't like politically, by emphasizing decline rates, for example, and then tries to get the government meddling and keeping export controls in place. I "consider the source", ignoring as appropriate.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.