Skip to comments.

Investment & Finance Thread (Father's Day edition)

Daily investment & finance thread ^

| June 15, 2014

| Freeper Investors

Posted on 06/15/2014 7:10:42 AM PDT by expat_panama

Happy Father's Day!

Seems there's no shortage of ideas out there on fathers and investing, there's an entire series of books (Rich Dad’s Rich Kid Smart Kid, etc.) but (imho) the ideas can be boiled down into a short list (from here):

- Children all have different learning styles and parents need to understand what that child’s unique style is an help them harness it so they can form a successful life plan

- Trying to force a child into a style they will not be successful in leads to frustration and substandard results.

- Formal schooling under serves non academic learning styles and financial education principles.

- Parents must fill in the gaps and help their children find their correct learning style, build a life plan around it, and teach basic financial principles that lead to success. This needs to start early in life and according to Kiyosaki the ages 9-15 are especially critical.

- The concept of making your money work for you vs. working for your money is the critical idea that is repeated. Teaching the difference between income producing assets vs. things that depreciate in value and cost money is critical to creating the mindset of the rich.

FWIW, my favorite on the list is the last one...

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-45 next last

To: Wyatt's Torch

Thanks for posting. I now have a new strategy thanks to this enlightening article. The bad side of town is swarming with fat kids.

/s

To: BipolarBob

Perfect! Let me know some good stock tips after you sit on them ;-)

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

To: Wyatt's Torch

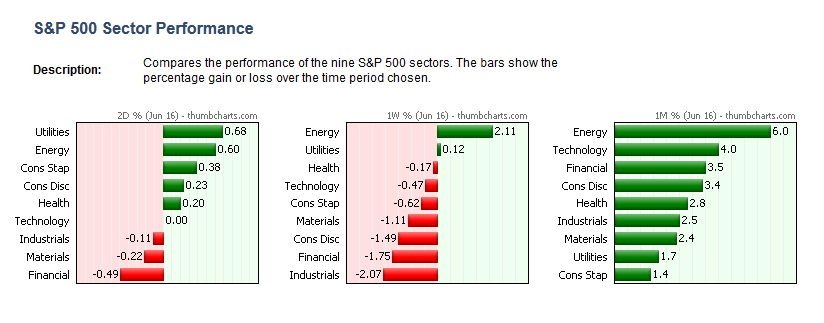

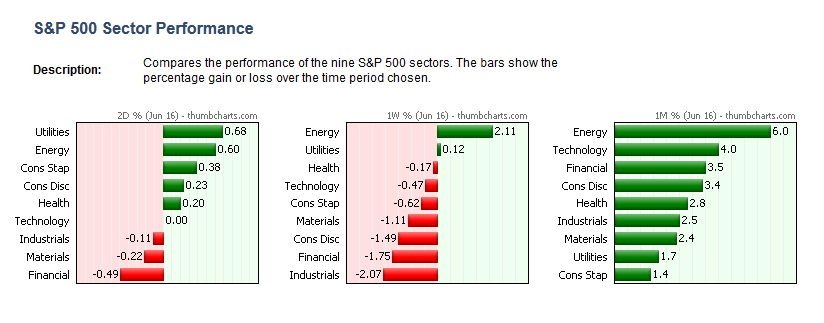

tx fer the sector chart; where did u say that came from?

Interesting that it's got the s&p down, this other site breaks down the s&p into its own sectors w/ an aplet for time frames; this is what I was looking at (from here) for a day/week/month:

To: expat_panama

Got it from a trader on Twitter

Housing starts miss, Permits miss, CPI miss

To: Wyatt's Torch

Yeah, no I remember.

Dang, the rpts all disappointed; index futures tanking...

To: expat_panama

In the for what it’s worth department truckers are shipping more

“ATA Truck Tonnage Index Increased 1% in May

Arlington, Va. — American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 1% in May, following a revised 0.9% gain the previous month. In May, the index equaled 129.7 (2000=100) versus 128.3 in April. The index is off just 1% from the all-time high in November 2013 (131.0).

Compared with May 2013, the SA index increased 3.4%, down from April’s 4.2% year-over-year gain, but is the second largest increase in 2014. Year-to-date, compared with the same period last year, tonnage is up 2.9%.”

http://www.trucking.org/article.aspx?uid=7e9648a1-c98b-4cf1-aee1-df3d18d644c4

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

To: Lurkina.n.Learnin

truckers are shipping moreTx fer the headsup, and shipping growth seems to be longer term:

After my morning coffee it'd be nice to see if the numbers go back a decade or two and what happened after.

To: expat_panama

To: Lurkina.n.Learnin; expat_panama

http://www.investopedia.com/terms/d/djta.asp

Definition of ‘Dow Jones Transportation Average - DJTA’

A price-weighted average of 20 transportation stocks traded in the United States. The Dow Jones Transportation Average (DJTA) is the oldest U.S. stock index, compiled in 1884 by Charles Dow, co-founder of Dow Jones & Company. The index initially consisted of nine railroad companies - a testament to their dominance of the U.S. transportation sector in the late 19th and early 20th centuries - and two non-railroad companies. In addition to railroads, the index now includes airlines, trucking, marine transportation, delivery services and logistics companies.

Railroad Union Pacific is the only one of the original DJTA components to continue in the index.

The Dow Jones Transportation Average is closely watched to confirm the state of the U.S economy, especially by proponents of Dow Theory. This theory maintains that as the industrials make and the transports take, the DJTA should confirm the trend of the Dow Jones Industrial Average (DJIA), with a divergence indicating a potential reversal of the trend. In other words, if the DJIA is climbing while the DJTA is falling, it may signal economic weakness ahead, since goods are not being transported at the same rate at which they are being produced, suggesting a decline in nationwide demand.

31

posted on

06/18/2014 4:17:44 AM PDT

by

abb

To: abb

To: abb; Lurkina.n.Learnin

TX! Interesting how the two indexes work together (

graph DJTI + Truck Index).

Kind of looks like the stocks are a leading indicator for production as usual, but production in the services is so hard to really measure, especially shipping. Usually measured in "ton-miles" but if some shipper runs a super computer program that reroutes trucks so as to increase deliveries and cut miles then production numbers fall while profits soar and customers are ecstatic.

Another question I got is how come if you send something by land it's called a "shipment" but if you send it by sea it's called a "cargo"?

To: expat_panama

Post Fed reaction:

To: Wyatt's Torch

To: Lurkina.n.Learnin

I think Jonny Manziel is in there somewhere...

To: Wyatt's Torch

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

To: expat_panama

Gold rallied with the market yesterday.

ORCL looks interesting below $40/shr.

40

posted on

06/20/2014 4:26:11 AM PDT

by

BipolarBob

(Obama - The Scandal a Week President.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-45 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

Good Morning!

Good Morning!