Posted on 08/03/2014 2:06:47 PM PDT by expat_panama

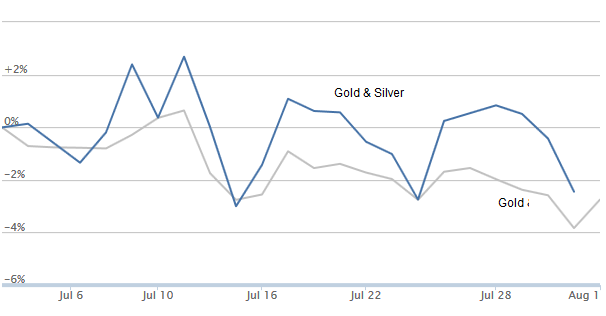

Yo! What we got this past week is the economy's officially in terrific shape and both stocks and metals are tanking.

Now, while it's never good to be too convinced about what we think is going to happen next in the future, I personally am having a hard time trying to decide what I think is happening right now. Somehow the more I know about what's going on the less I know about what's going on.

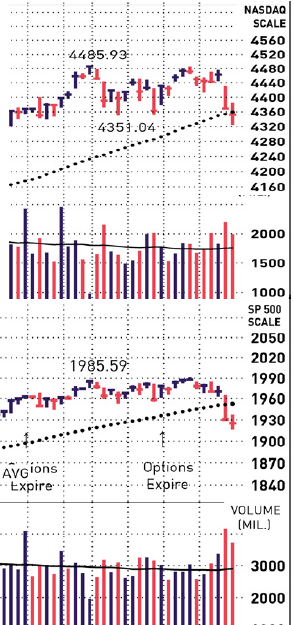

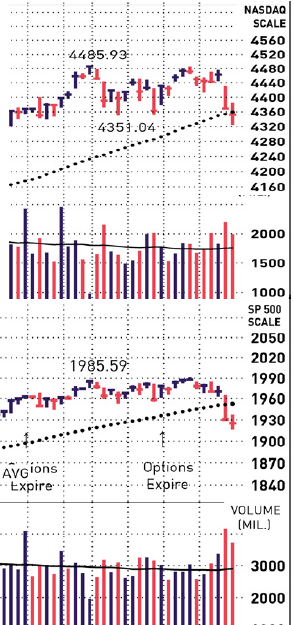

Oh yeah, IBD says stocks are still in an 'up-trend'.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

We are in municipal bond funds. we just realized we need to sell before the balloon pops.

.

That is because the long term policies make no sense but because Americans do what they can short term stats are doing OK. For example, how can things work out if the US marginal corporate tax rate is the highest in the world? How can the labor force be competitive when full time work is defined as 30 hrs./week? How can the US compete with emerging markets when US businesses are over regulated and over taxed?

Hitting the ground running on this beautiful Monday morning we got futures markets upbeat on both metals and stocks. Of course, most of the pundits are warning about crashing markets, but that's usually a bullish sign; that plus the fact that previous drops were in weakening trade. The Econ Calendar says reports (what there are) are only for Tues-Fri. Morning news.

- Warning: That plunge in stocks is just the beginning The S&P 500 suffered its biggest weekly drop in two years. This is how investors are responding. MarketWatch

- Wall Street seen higher after last week's rout U.S. stock index futures take their lead from Europe and show signs of recovery following last week's global stock market rout. CNBC

- A wild card in Fed's rate hike timing The U.S. economy is leaking. In the first half of this year, America's trade deficit subtracted 1.14 percentage points while the U.S. economy just managed to eke out a 1 percent increase in its gross domestic ... CNBC

- Has The S&P 500 Topped Out Michael Seery - Seery Futures - Sat Aug 02, 12:10PM CDT I am sitting on the sidelines (full story)

- Is Long-Term Unemployment Returning to Normal? - Jeff Dorfman, RCM

- Jobs Reveal Keynesian Cluelessness - Louis Woodhill, Unconventional Logic

- After China port fraud probe, messy legal fight chills metal trade By Polly Yam and Fayen Wong HONG KONG/SHANGHAI (Reuters) - As global banks and trading houses fire off lawsuits over their estimated $900 million exposure to a suspected metal financing fraud in China, the tangled legal battle to recoup losses is set to drag on for years and hinder a swift recovery… Reuters

- Bartiromo: Questions remain on the economy A string of strong economic reports aren't enough to calm nervous nerves on Wall Street USA TODAY

- How To Join The Successful Investors Club - Investing CaffeineAssociated Press

- Stocks tempered by Argentina default, Portugal World stock markets were mostly higher Monday after a sixth month of healthy employment growth in the U.S., but gains were tempered by jitters over Argentina's debt default and a Portuguese bank bailout.

BUMP for later. Thanks!

“and the way to get rich at a casino is to own the casino”

Meyer Lansky said something very similar. He never gambled at the tables.

Economic reality. Eventually the amphetamines wear off and you need to sleep.

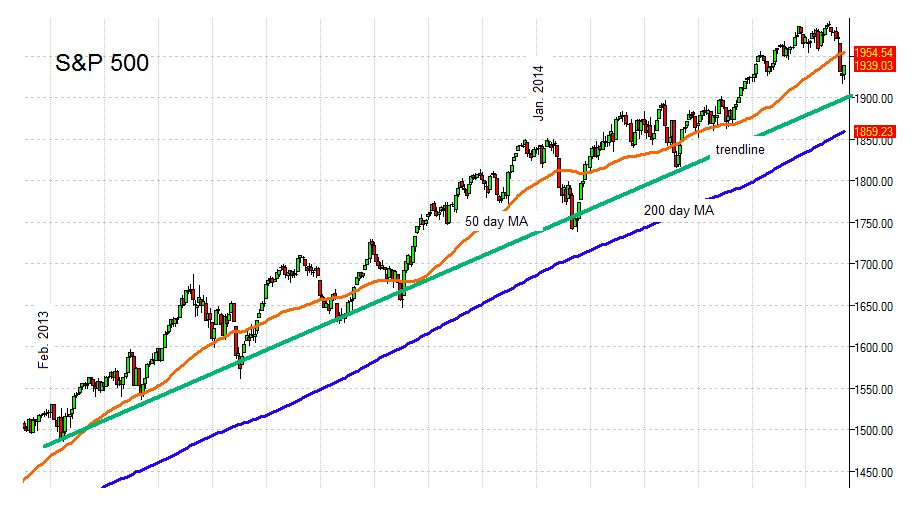

You bet! This morning I got a late start so I'd already added it to the morning ping but having you notice it was a good confirmation. Ordinarily seeing a major index cross the 50-day moving average is a sell signal, in this case trade volume's already beginning to fall. Impossible to say of course, stock futures this AM are upbeat but on the other other hand they're less up beat right now than they were an hour ago...

Crossing 50DMA is no huge deal. When the 50DMA crosses the 200DMA (the Death Cross) it’s time to get worried.

Or maybe we're saying pain killers fail as we opt for major surgery...

--is when we're glad we're 100% cash...

Meanwhile 10YUST yield close to hitting 52-week low...

So much for the “spiking interest rates” theory of people who don’t understand money.

The stock market's "Wolf" moment might finally be here.

In his latest technical strategy note, Jonathan Krinsky, chief market technician at MKM Partners, uses the parable of the boy who cried wolf to describe the past year and a half of action in the stock market.

His takeaway? The wolf might finally be here.

Krinsky writes:

In the 2013 playbook, which saw every minor dip provide a springboard for new highs, such oversold scenarios created excellent buying opportunities. While we think a short-term bounce should materialize soon, there has also been enough of a change in character over the last few weeks that a bounce in the SPX might, for the first time in a long-time, fail to make a new high. Should that occur, we would most certainly be seeing a major change in character; i.e., the Wolf may finally be coming.

Krinsky breaks down a number of technical indicators in his note (he is, after all, a technical analyst), but the main takeaway is that when the S&P 500 hits 1900, we'll really know what kind of market we're looking at. Does the market break down further, or is it just another bounce on the way to S&P 2000?

Here's Krinsky's chart that shows the S&P 500's impending showdown with a number of technical indicators. Krinsky S&P 500 levels

MKM Partners

I suspect that almost all of the QE has been largely offset by terrible fiscal policy. At some point you have to let things reset to market normal. It's like coming down with a 24 flu, but having the government intervene to prevent vomiting and diarrhea. When do you truly recover and how long will it take?

What, you own stocks and you have "a fairly narrow vision"? Your neighbor said he owns stocks and as a FNV? Or is this one of those "in general" things like Latinos are noisy and Italians are gangsters and the Chinese are so inscrutable that they haven't been unscrewed but centuries...

That may turn out to be a pipedream as support continues to solidify a bit above that--

--although the trend from the past 18 months is down at 1900. We're only talking a couple percent here...

Do your investment decisions hinge on whether the government makes the correct economic policy or on how whatever policy government makes will affect the investment?

Serious investors have to pay attention to changes in policy. Sure, we’re buying companies and we’re not buying policy. Just the same gov’t policies have an enormous impact on those companies’ ability to function.

Long run sure. Short run more a function of fundamentals and sentiment.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.