Posted on 08/03/2014 2:06:47 PM PDT by expat_panama

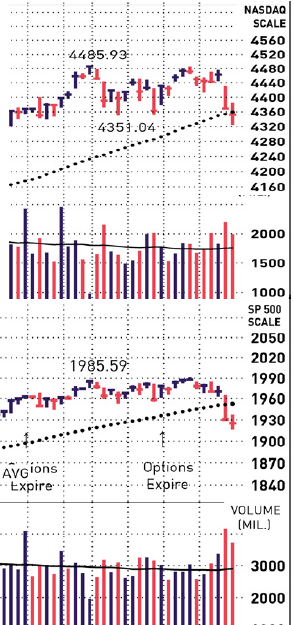

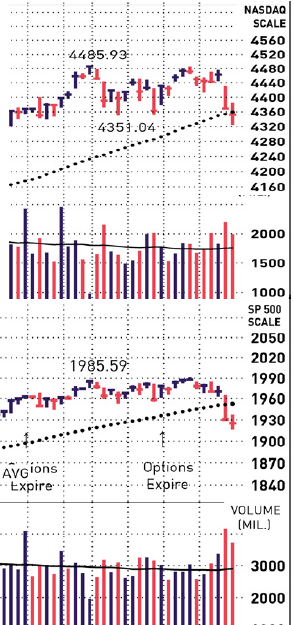

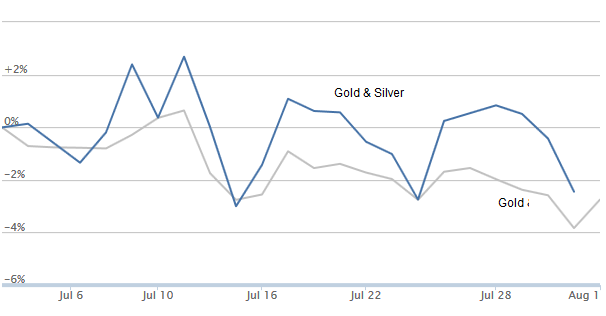

Yo! What we got this past week is the economy's officially in terrific shape and both stocks and metals are tanking.

Now, while it's never good to be too convinced about what we think is going to happen next in the future, I personally am having a hard time trying to decide what I think is happening right now. Somehow the more I know about what's going on the less I know about what's going on.

Oh yeah, IBD says stocks are still in an 'up-trend'.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

--and a joyouus weekend wrap-up to all!

Well? Will bond yield rates be raised (and bond prices lowered)? Will the real casino fun begin?

What about other metals?

I was reading something that suggested graphite and lithium.

Glad you brought this up. I admittedly don’t understand the bond market but I have been wondering how you would invest in a rising rate market to make money off of it.

I wish we had more participants on this thread weekly;

Recommend: Things That May You Go Hmmm newsletter

ZeroHedge blog; put MadMoney on mute.

My take this week: low volume choppiness with some fear...possible big sell off day, say, 600 pts in one day. Tech and Consumer goods sell off continues...

Gold and Silver and Platinum continue to TRY to go up...these are heavily manipulated by the big banks and hedges (Morgan Stanley and the like). Banks may continue to downtrend.

Casinos have been doing fine for years, and the way to get rich at a casino is to own the casino:

Interest rates otoh make no sense at all. I mean low rates are supposed to mean excess liquidity --too much money looking for too few borrowers. So now rates are so low we got lenders that are paying people to borrow their money --and yet borrowing rates are at record lows.

What are we missing here?

Floating rate funds or high quality short term bond funds might be something to look at but only if they are suitable for your personal objectives and tolerance for risk. Always do your own due diligence and be extremely careful about chasing yields. Make sure you understand anything you invest in and be prepared for losses should they occur. We are in a very hazardous investing environment in my opinion.

http://online.wsj.com/news/articles/SB10001424052702303393804579308490476037048

I reckon we’ll see bond yields up and what will happen soon enough. Has the debt regime already gone too far?

An investor would need to either have control of a very large fund or have a very good manager.

I am somewhat undecided as to whether that would be a smart move or not. The chart says this has potential. However, I would state two cautions: 1: The number of folks who have destroyed themselves thinking the last 2-4 years would be an easy bond short is large. 2: If rates really rose, and rose to anything near traditional levels, most world economies would detonate. Therefore, you would fighting the largest forces on earth.

I *do* think (here's the opinion section) one could see a smallish, shorter termish, profitable trade from TBT. But it would be more in the nature of a trade and not something you leave on and walk away from. Maybe a 2-week-6-week trade. For one thing, TBT (as is TLT, the inverse) are double 2x funds, which means they can suffer from erosion over time, and 2, if the Fed and other world banks saw they were creating various forms of havoc in the financial markets, they would IMHO revert to their ZIRP policies. I do not think it is a particularly *dangerous* trade at all, I *do* think the potential profits outwieght the downside. But IMO you'd have to watch it. I trade TBT & TLT on occasion. They are tricky, but not imposdsibly so. Timing an entry I have found tough.

I remember back in the early eighties my brother had some CDs that were paying a phenomenal rate. His trailer later burnt down so he built a house. He went to BofA to borrow money and out of the goodness of their hearts the offered to let him cash in his CDs penalty free. He ended up keeping them and borrowing at a lot smaller rate. It would seem now we are in the opposite situation.

There are some ETF’s (exchange traded funds) that move up when rates go up, but they’re not a great long-term investment because they tend to migrate down in price over time when the long-term interest rate is stable.

So, if you buy one for, say, $10,000 when long rates are 3.5%, and hold it for six months or so, and rates are still 3.5%, your $10,000 might have dropped to $9,000. However, they will really move over the period that rates are actually increasing. You just shouldn’t treat them as a long term holding. That makes them quite speculative because they only work if you catch a near-immediate rise in rates after you buy them.

The main issue to understand about bonds is that they appreciate when rates fall, and depreciate when rates rise. The reason is fairly obvious. Why would you buy a 4% bond at par (face value, usually $1,000) when rates have moved to 5%? You wouldn’t, because you could buy a 5% coupon for that same $1,000. So to induce you to buy the old 4% bond instead, the price is reduced, and reduced enough so that you’re indifferent between paying $1,000 for the 5% bond or, say $900 for the 4% bond. (That yields 4.44%, but remember it will mature at $1,000, so you’ll make another $100 on maturity.) There are bond calculators that figure the fair price to make you indifferent.

The opposite happens when rates fall. People are obviously more willing to pay up for the 5% bond if rates have fallen to 4%.

Shorting would be out of the question for me. But I will keep an eye on TNT. Thanks. I was just looking for ideas if interest rates do start climbing.

Should you buy TBT, you own the fund long, just you would "normally" with any stock or etf. >>IT<< is what is short. If bond prices fall (eg; rates rise) then the value of TBT would rise. It's an inverse fund. You buy it expecting the market price of TBT to rise, which it WILL if rates rise. However it manages to do that, you don't need to care about. (It's done with futures, but you need not care about that. These are VERY liquid and widely traded etfs.

Quite the difference there. Thanks. I’ll watch *TBT*

I do see that QE 4 or whatever would be a danger.

What is kind of tricky about this form of bond “investing” (and it is probably a misnomer to call it “investing” because these 2x instruments should only be held short term.) is that they reflect not only a secular rise or fall in rates, but investor panic or complacency. When the stock market falls, many investors reflexively rush into bonds. THAT drives the prices up which HAS THE SAME EFFECT as if a rate rise had actually occurred. Think about that for a minute. We had a crappy end to last week. Stocks fell, investors/speculators rushed into bonds, driving prices higher. That is bad for TBT which is SHORT bonds.

At the same time, arguably it is a plausible buying oppty for TBT. The 52-week range of TBT is 57.61 - 82.80. Here is TBT at 58.72, very near its low for the year...(52 week year, not from 1/1/14)

I’d be willing to bet that one could buy TBT and sell October 61 calls against it and take in 1.45 of premium and have a very, very low risk trade IMO. If TBT is over 61 circa Oct 20, you are called out at 61 and the trade makes (61- 58.72 + 1.45)/58.72 = 3.73 /58.72 = 6.3% for 45 days. Much better would be to wait a little, have TBT rise, and maybe take in $2 or more of premium by waiting a bit to sell the calls. More like 7%. Very plausible trade, I might do that one.

TBT is really at a multi-year low here. I’d have to consider it low risk. And this is a real item, it trades ~~4 MM shs/day.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.