Skip to comments.

The Fate of the Fed's Exit Strategy Is In Foreign Hands

Real Clear Markets ^

| May 22, 2015

| Jeffrey Snider

Posted on 05/22/2015 5:46:26 AM PDT by expat_panama

In all this talk about whether the economy will be strong enough to support the first policy change of this cycle, and how utterly sad it is to even have to argue about it, the larger issues about the exact operational framework remain largely unexamined. The intent of the FOMC is to undergo an orderly transition from extraordinary policy positions toward a setting more like normal. To go from A to B is not as simple as plugging in a new number, a fact that Federal Reserve officials are very quietly dealing with. The Fed has a repo problem, one that has been around since August 2007, which only more recently has that been recognized; and even then...

[snip]

...The fate of the Fed's very own exit strategy is almost completely in the hands of foreign banks and their willingness to further supply "dollar" flow to even US counterparts. It is an ironic upending of the panic paradigm, as the only real source of liquidity ability is the very place where crisis the last time began. And I think that is the central point of LIBOR rising in 2015, especially after December 1 last year (ask the Russians and Swiss about "dollar" liquidity in the first weeks of last December), that in this skeleton process there is just nothing else left. Federal funds is dead and repo can barely absorb an increase without devolving to a heap of fails and disrepute. The Fed hung the eurodollar market out to dry in 2008, and now that is all that is left as they try to pretend everything is back to what it was. LIBOR's uptrend is gentle now, but it still puts emphasis on the fact of what little has changed and how much needs to be.

(Excerpt) Read more at realclearmarkets.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: centralbanks; economy; fed; financial; investing

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Good read, tho maybe I should've started the day w/ Bubble trouble? Why frothy markets may not be ready to pop because right now futures have metals +0.10% and stock indexes +0.05%. Not that the Fed controls the market (yeah, everyone says it does) but today's CPI day and that affects both.

Good morning all!

To: expat_panama

Without a proper monetary anchor, the dollar has become a twisted agent of wholesale nothingness, into which not even those charged with defending and regulating it have much if any idea about what it is and how it actually works. A rather weighty article which I don't pretend to fully understand. But, perhaps I know my limits of knowing; unlike the elites running the Fed who don't know that they don't know.

3

posted on

05/22/2015 6:14:01 AM PDT

by

Flick Lives

("I can't believe it's not Fascism!")

To: Flick Lives

There are lots and lots of folks running things at the Fed and some are idiots and most are good people. Nevertheless while the Fed's supposed to control the amount of dollars, most dollars are created outside the U.S. (Eurodollars) where the Fed has no say.

Meanwhile Europeans have the same problem 'cause while the US is just 1/20th of the world's people, it's also a third the world's economy and half the world's wealth. Bottom line, the fate of the world's econ strategy is in American hands...

To: expat_panama

Sounds like the Sorcerer’s Apprentice. Only the there is no Sorcerer to return at the end and save the day.

5

posted on

05/22/2015 6:40:08 AM PDT

by

Flick Lives

("I can't believe it's not Fascism!")

To: Flick Lives

That's one way of looking at it, but my thinking was more along the lines of "The Emperor Has No Clothes". The reason the Fed hasn't had much luck w/ money supply/velocity is that the control is simply not there.

The good news is that prices are stable. For now...

To: expat_panama

7

posted on

05/22/2015 8:11:21 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: expat_panama

The head of the Boston Fed admitted a couple of weeks ago that there is no exit strategy.

8

posted on

05/22/2015 8:23:52 AM PDT

by

Georgia Girl 2

(The only purpose o f a pistol is to fight your way back to the rifle you should never have dropped.)

To: Georgia Girl 2

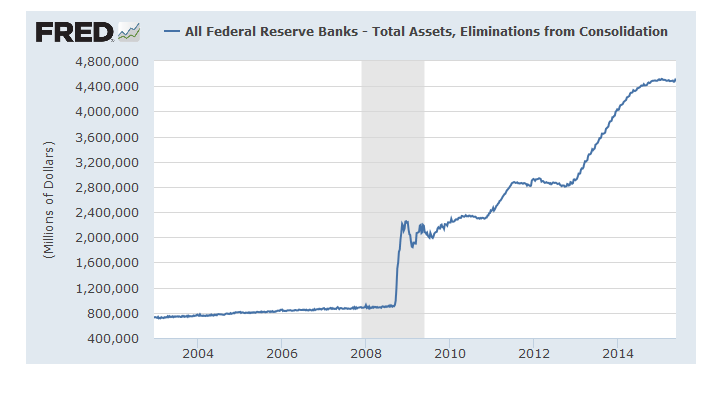

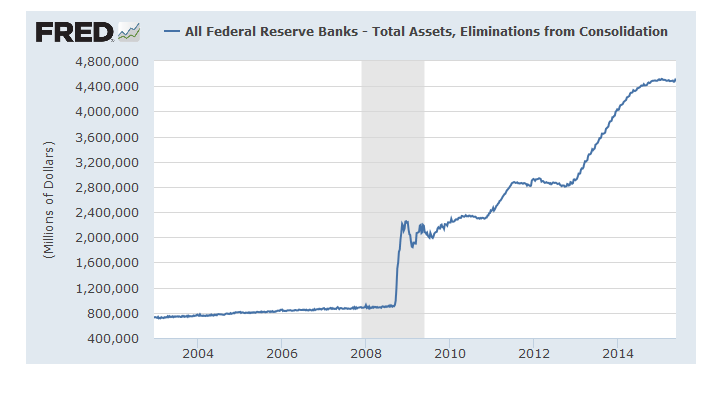

There are 11 other fed bank heads w/ exit strategies. My bet is they got at least two dozen of 'em that they like and Yellen's probably following most of 'em for at least a day at a time. In the mean time it's up to us to decide what we want because w/o our picking something then we can't complain after that they didn't do what we wanted. So QE is that since '08 when the fed' first bought a trillion of debt to stop the implosion--

--we're now pushing $5T and still counting.

To: expat_panama

In Europe the Governments there own between 45-51 percent of major companies like the utilities, or they have the final say for other big business decisions in their economies. Our FED purchased a lot of stock. It will sell that stock after driving up the price and make a huge profit on the dollar cost averaging by selling even past the point where they start to lose money - the FED is not mandated to own Stocks per say, so they will have to eventually sell off their “investments” and get the cash back - - - what will they do with the cash, e.g., will they delete it from the data bits and put it in the bit bucket, or will they let the markets tank destroying the digital bucks or will they let the new money lessen the value of the dollar in your pocket?

10

posted on

05/22/2015 7:45:21 PM PDT

by

Jumper

To: Jumper

Our FED purchased a lot of stock. They bought debt, not stock.

11

posted on

05/30/2015 4:04:37 PM PDT

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Toddsterpatriot

Thanks fore keeping me correct... the Federal Government and Federal Reserve are too cozy for comfort. While the USG owned GM stock, the Fed Reserve buys the Debt or Treasury Notes issued by the USG in essence ensuring that from an American Interest the markets can absorb enough US Treasury Notes to not make the issue of the all mighty T-Bills excessive.

Can you clear something up? When foreign governments buy US Treasury Notes, is it their Central Bank or is it their Government?

Hence my confusion as one can easily be led to conclude the USG buys Treasury Notes/Debt from Japan, or China buys Debt from the USG or vice versa. But where actually is the money held? If other Governments are buying debt (any nation's from one another).

Executive Order 12631 signed by Ronald Reagan on March 18, 1988 created what is frequently called the The Plunge Protection Team which was created to make financial and economic recommendations to various sectors of the economy in times of economic turbulence. The team consists of the Secretary of the Treasury, the Chairman of the Board of Governors of the Federal Reserve, the Chairman of the SEC and the Chairman of the Commodity Futures Trading Commission. It is supposed that in the bowels of the FED that they may have secretly intervened in limited stock purchased, but this would allow hedge fund (managers) to make a killing too, thus many have argued against the possibility of this. Nothing would surprise me.

12

posted on

05/30/2015 9:13:13 PM PDT

by

Jumper

To: Jumper

the Federal Government and Federal Reserve are too cozy for comfort. Since the Fed is part of the government, that makes sense.

When foreign governments buy US Treasury Notes, is it their Central Bank or is it their Government?

Do they pay from the right pocket, or the left?

It is supposed that in the bowels of the FED that they may have secretly intervened in limited stock purchased, but this would allow hedge fund (managers) to make a killing too,

Hedge funds wouldn't sell to the government?

13

posted on

05/30/2015 9:17:20 PM PDT

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Toddsterpatriot

However, you were technically and factually correct - the Federal Reserve is not supposed to trade private stocks, however, they might be coordinating that activity. I was completely off in my line of thinking and people at FR like you keep the integrity of the forum. Thanks for correcting a long misconception in my own mind on this subject.

14

posted on

06/01/2015 6:20:36 AM PDT

by

Jumper

To: Jumper

There was a rumor that the Fed placed a large order for XMI futures on Oct 20th,1987, to turn around the markets. Did they? Maybe. I take the claims they're constantly trading stocks with a big grain of salt.

15

posted on

06/01/2015 8:15:55 AM PDT

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson