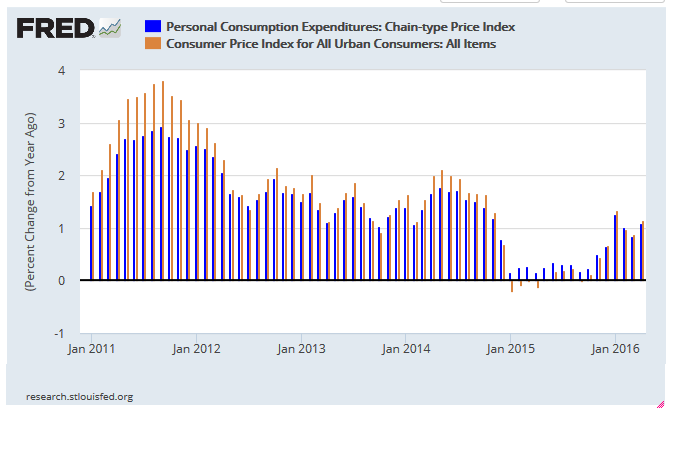

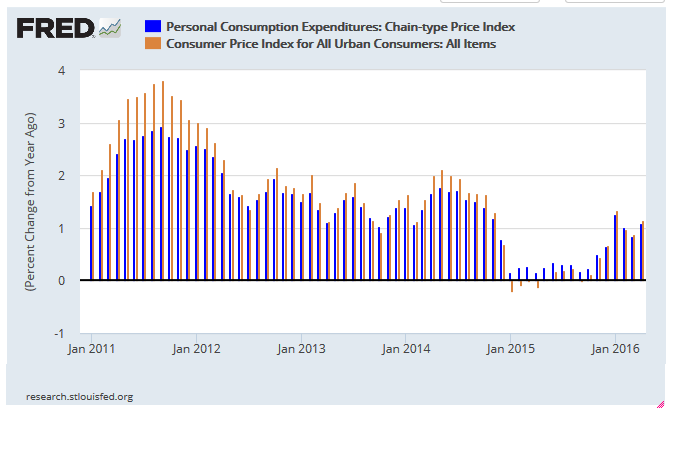

OK so it's up a tad this year but add a rate hike and we fall right back into the deflation we've had in the recent past --and that's when we really see an econ collapse.

Posted on 06/02/2016 4:43:24 AM PDT by expat_panama

The economy is still stuck in low gear, new data on manufacturing, construction and auto sales showed Wednesday. Yet even as the Federal Reserve itself described economic growth as “modest” in its new beige book, the report noted that tight labor markets were widespread.

The upshot is that even a slow-growing economy is close enough to the Fed’s low speed limit to allow for a July rate hike.

The headline Institute for Supply Management manufacturing survey index for May rose 0.5 point to 51.3, above the neutral 50 level and topping expectations. But the details offered a less-than-ideal combination: slowing growth, falling employment and higher prices.

Meanwhile, U.S. auto sales flattened out...

The ISM production index eased to 52.6 from 54.2 in April. Meanwhile, the employment index held steady at 49.2, indicating a sixth straight month of declining factory jobs. The real sign of strength came in the index of input prices, which rose to 63.5, the highest since June 2011, as 13 industries reported paying higher raw material prices, with just 3 seeing lower prices.

“Prices are the main story...

Auto production, which has been a bright spot for U.S. manufacturing, faces demand headwinds. General Motors reported an 18% sales drop...

Ford (F) sales sank 5.9%...

Fiat Chrysler...

April construction spending was weak...

...Jefferies fixed income economists summed it up like this: “The labor market and inflation continue to develop in a manner consistent with the Fed’s goals, though the tone across various districts remains mixed. The reports in the Beige Book do not present any evidence that the FOMC should delay a rate hike in June.”

(Excerpt) Read more at investors.com ...

OK so it's up a tad this year but add a rate hike and we fall right back into the deflation we've had in the recent past --and that's when we really see an econ collapse.

--and a top 'o the Thursday morning to all! Major stock indexes plodded up +0.1% in shrinking trade as our uptrend contends w/ this year's upside resistance ceiling. Likewise it seems for gold/silver, still just perched atop their 2016 base. Futures traders today see metals going down a half % and stock indexes up 1/4%. This week's econ stat flood continues--

7:30 AM Challenger Job Cuts

8:15 AM ADP Employment Change

8:30 AM Initial Claims

8:30 AM Continuing Claims

10:30 AM Natural Gas Inventories

11:00 AM Crude Inventories

--and there's no end of op-ed's that need posting:

Days of China Inc Always Having the Money Ending - Derek Scissors, RCM

The Cost of Austerity in Greece is Human Misery - Yanis Varoufakis, NYT

Re: Puerto Rico, Get Over Your 'Principled Opposition' - Marc Joffe, RCM

Curbing Our Excitement Over Rising Home Prices - Justin Fox, Bloomberg

How President Clinton's Welfare Fixes Failed - Jordan Weissmann, Slate

Worst Mistake You Can Make When Market Corrects - Paul Katzeff, IBD

How a Rate Hike Could Upend the S&P - Wallace Witkowski, MarketWatch

There's Bull Market Forming Right Now in Complacency - Doug Kass,RM

Trump's Protectionism Is Gravely Wrong - Jon Hartley, National Review

If Not 1%, Who Does Productive Work Today? - Michael Bernick, Forbes

A Clear Explanation In Favor of Ending the Fed - Steve Parkhurst, Big Jolly

The final hand in “FUNdemental transformation” is about to be played. Raising interests rates will put maintenance of the national debt costs above military spending. Social welfare programs will consume most all revenue, and the rest will be payback to the fed for 8 years of QE. Welcome to Zimbabwe.

When Volker did this a long time ago, he managed to expand the money supply dramatically, to monetize Carter's and Nixon's debt while increasing interest rates dramatically to cut off the formation of new debt. That works with fixed rate debt, but there is a lot of variable rate stuff out there now and so that option is foreclosed. Either liquidate debt with massive inflation or widespread default - those are the choices.

One day the economic “geniuses” that run the economy will realize that the only way out of this mess is an across the board import tariff of abut 20%. That will immediately balance the budget. Will an import tariff cause inflation - yes, but not that much and there are no other alternates anyway. There will be pain followed by economic recovery that will rival anytime ever seen as industry repatriates and America goes back to work.

You're probably right but in no way would it be because the people at the Fed are serious, focused, goal oriented, and clever. Like, hey guy these are gov't employees we're talking about. The reason they probably won't do anything is because there probably won't be any need for action. Then again, they may just up and decide to be irratic, fad driven, and irresponsible like they were last December. That would be more true to form actually....

As for all the hype and spin the pop meme w/ the left is that the econ's just roaring along and really really needs to be kept in check it's so hot. Kind of like global warming. They all say it's true but nobody ever takes it seriously enough to spend their own money on it.

I dont’ think they have a clue what to do. Your graph of the growth rate skidding sideways for a decade can’t be changed but by a sweeping change that may be too late.

Nobody wants a 30 to 50K job with taxes and FUTA SUTA and all that rot when they can get enogh to get by and not do a thing.

The other “good” jobs are too few to make a difference.

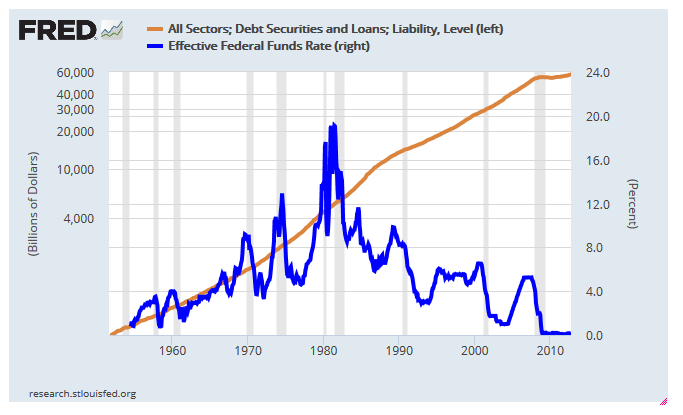

This idea that American debt expanded w/ the fed's low interest rates is what everyone says,  but the facts (Download Data) disagree.

but the facts (Download Data) disagree.

For six decades the total investment/savings/loaning/and bond sales (aka "debt") grew in America at an average of 9 per year. Then in 2009 the left took over and investment/debt growth collapsed to two percent yearly and it's been like that ever since.

As much as the crazy Bernie/O/Hill crowd wants to blame it all on the Fed we need to realize that the record low rates came in after the left wrecked everything.

The Fed has been playing this game for years now. They truly rely on suggestions of rate hikes to do all the hard work for them. To actually do it will as you said cause enormous damage.

With the dog of a jobs report this morning June is off...

The question now is whether the members of the FOMC will think "now only 4.7% --go Clinton!!!" or will they realize that while 26K job openings may have been filled, the population grew by 205,000 and 664,000 left the workforce altogether.

The other factor is that wages continue to increase

Statistic For Actual Briefing Forecast Market Expects Prior Revised From Nonfarm Payrolls May 38K 170K 155K 123K 160K Nonfarm Private Payrolls May 25K 175K 160K 130K 171K Unemployment Rate May 4.70% 4.90% 4.90% 5.00% -- Hourly Earnings May 0.20% 0.30% 0.20% 0.40% 0.30% Average Workweek May 34.4 34.5 34.5 34.4 34.5 Trade Balance Apr -$37.4B -$42.5B -$41.6B -$35.5B -$40.4B Factory Orders Apr 1.90% 1.30% 1.60% 1.70% 1.10% ISM Services May 52.9 55.5 55.4 55.7 -

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.