Skip to comments.

Opinion: Here’s evidence the Fed is unlikely to hike rates before Election Day

Market Watch ^

| Aug 19, 2016 8:19 a.m. ET

| Mark Hulbert

Posted on 08/22/2016 3:35:02 AM PDT by expat_panama

Edited on 08/22/2016 7:02:02 AM PDT by Sidebar Moderator.

[history]

Does the Federal Reserve play politics? You could just as well ask if the Pope is Catholic.

Investors should be wondering about the Fed

(Excerpt) Read more at marketwatch.com ...

TOPICS: Business/Economy; News/Current Events; Politics/Elections

KEYWORDS: economy; election; investing

Some say the fed never gets involved w/ politics, others say they're always in there as our dedicated political enemy. What we know for sure is that life is complex and that and both can be true at the same time.

To: expat_panama

When rates on 30 year fixed rate mortgages go back above 6 percent, the housing market will be crushed.

2

posted on

08/22/2016 3:43:37 AM PDT

by

fso301

To: expat_panama

If Trump.is.elected they will raise rates and gleefully blame Trump for the economic downturn.

But what will happen if Hillary is elected? They cannot delay an increase forever. How will they explain an economic collapse under Hillary? Especially if Obamacare is imploding at the same time?

To: Cowboy Bob

If it looks like Trump is winning they will raise rates significantly on November 2nd.

4

posted on

08/22/2016 4:05:26 AM PDT

by

wastoute

(Government cannot redistribute wealth. Government can only redistribute poverty.)

To: fso301

While an increase in mortgage rates certainly wouldn’t help matters, in my area (northeastern NJ/NYC metro) mortgage rates of 1% wouldn’t help sell homes nobody wants. The property tax burdens, coupled with a horrible job market, prevent any Americans (except public employees) from gambling on buying a home. Childless workers following jobs around like Okies in “The Grapes of Wrath” have no use for 30 year commitments to a bank and municipality.

5

posted on

08/22/2016 4:06:00 AM PDT

by

kearnyirish2

(Affirmative action is economic warfare against white males (and therefore white families).)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Alcibiades; Aliska; alrea; ...

A very happy Monday morning to all as the 'eye of the storm' seems to remain calm. Even this morning's stock futures are still flat --after a month of tight trading.

Precious metals however are giving up their 'safe haven' status as silver drops to $19.03 --off it's cozy base it was trying to establish. Futures for all metals this morning are a bearish -0.97%.

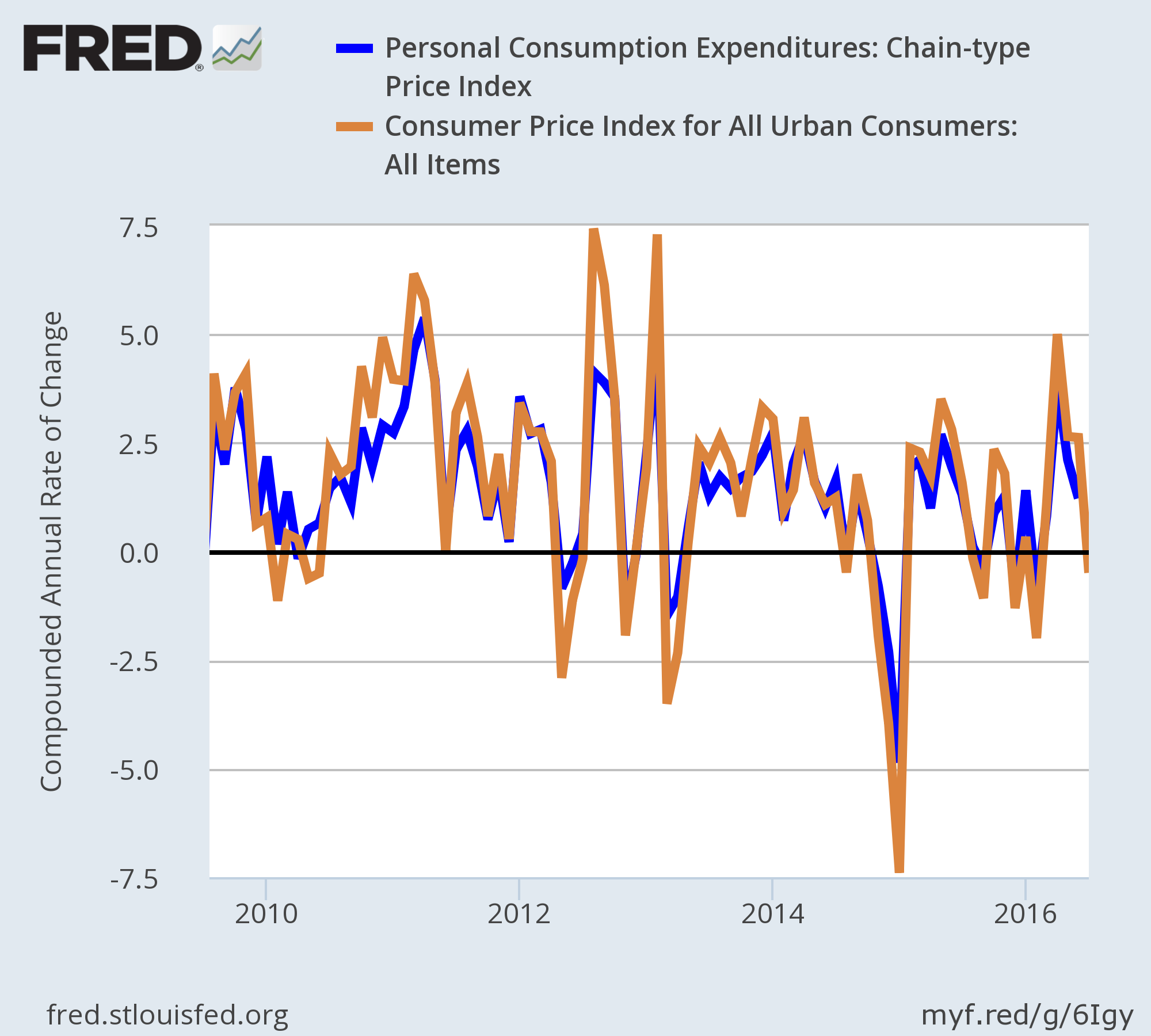

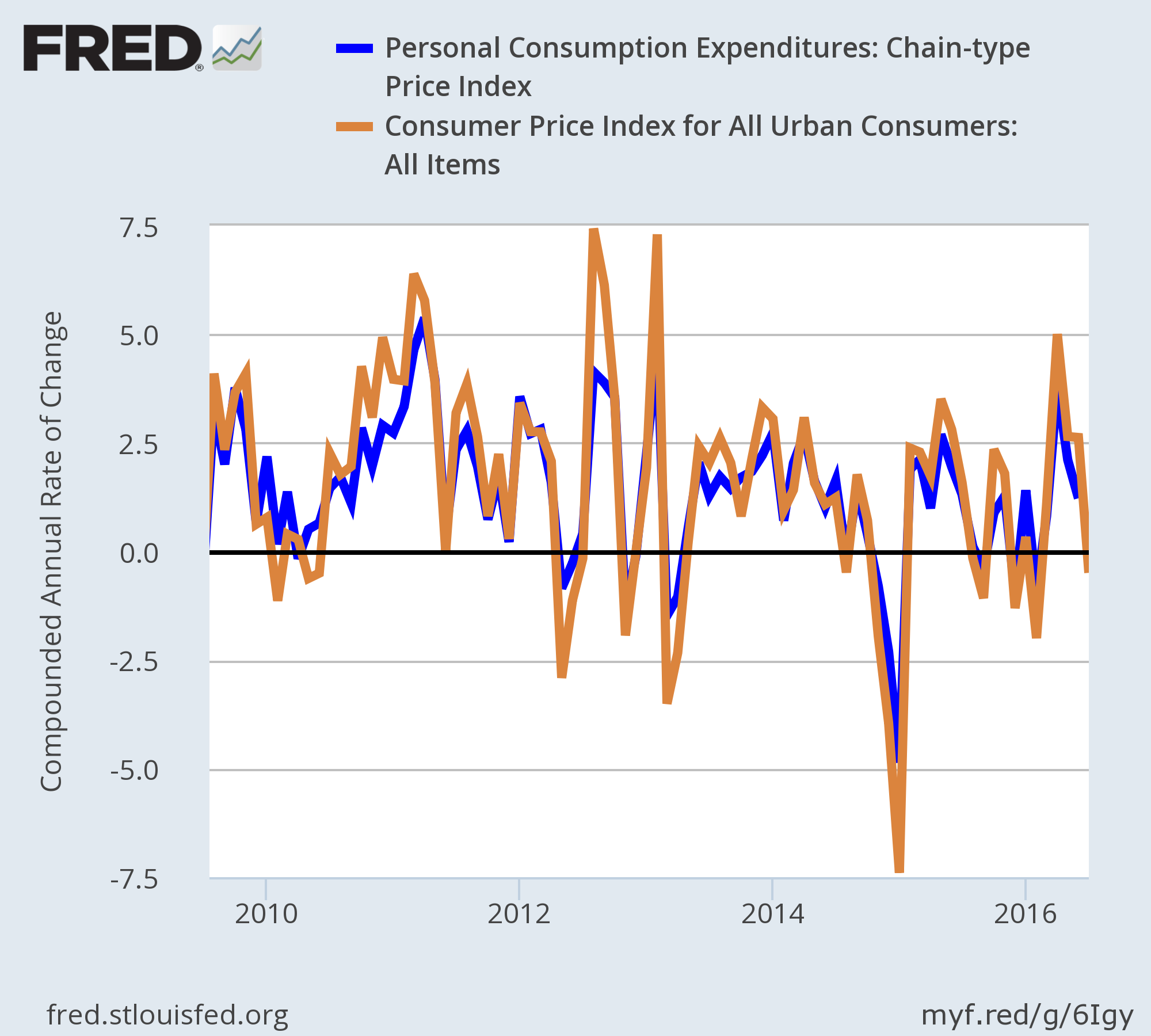

No econ reports today, later this week we get GDP and next week's the Fed favorite inflation gage, the PCE.

Over coffee:

To: Cowboy Bob

We can expect, with 100% certainty, that November 7 through January 19 is going to be disastrous for We the People, when Trump wins. Look at some of the probable things we’ll get hit with:

* If Social Security increases, increased Medicare will wipe it out. Seniors have less money.

* Gun control edicts supported by Congress.

* Environmental regulations will cripple the economy.

* Manufactured violence will explode; but only in warmer areas.

* 24/7 blame Trump in all propaganda outlets.

* All out effort to bribe and/or threaten electors to vote against Trump.

* Articles of Impeachment introduced.

7

posted on

08/22/2016 4:25:57 AM PDT

by

NTHockey

(Rules of engagement #1: Take no prisoners. And to the NSA trolls, FU)

To: expat_panama

Does the Federal Reserve play politics? You could just as well ask if the Pope is Catholic. So then, used to be, but not anymore?

8

posted on

08/22/2016 4:37:04 AM PDT

by

BykrBayb

(Lung cancer free since 11/9/07. Colon cancer free since 7/7/15. PTL ~ Þ)

To: NTHockey

We can expect many things in the Lame Duck time period. Trump wins..TPP, immigration legislation passed and Supreme Court nominee approved. Clinton wins...Same scenario. Dems win one or both houses then more is approved between Jan 3 and Jan 20. I do not think our masters are done dealing with us. Trump wins with Repubs or Dems in control, they shut him down for 2 years and then say you are finished. I have a difficult time seeing any positive scenario for our American future.

9

posted on

08/22/2016 4:38:52 AM PDT

by

taterjay

To: expat_panama

They’re not going to raise rates ever.

They can’t afford to sell any of their bond assets, because those assets are junk.

When the Bond market finally implodes, rates will spike up then. But it won’t be the Fed doing it.

10

posted on

08/22/2016 4:54:57 AM PDT

by

agere_contra

(Hamas has dug miles of tunnels - but no bomb-shelters.)

To: Cowboy Bob

If Trump.is.elected they will raise rates and gleefully blame Trump for the economic downturn. That's what they did with Reagan. However, raising rates helped the economy after the sharp but very short recession. It may do so again although this time there is less overt inflation and more distortion from the prior low rates that will have to be rectified sooner or later.

11

posted on

08/22/2016 6:05:07 AM PDT

by

palmer

(Net "neutrality" = Obama turning the internet over to foreign enemies)

To: agere_contra

I agree. Rates should have been raised a decade or more ago. Instead we have so much distortion (speculation instead of investment) the economy cannot recover and rates cannot be raised without some major pain. If we had leaders we would raise then, but we do not.

12

posted on

08/22/2016 6:07:20 AM PDT

by

palmer

(Net "neutrality" = Obama turning the internet over to foreign enemies)

To: expat_panama

if Trump wins I imagine gas prices will shoot to $12 a gallon and the press will flip and start talking about how bad the economy is every 3-4 minutes. It will be 24 hour doom and gloom.

To: taterjay

“Trump wins..TPP, immigration legislation passed and Supreme Court nominee approved.”

Nonsense. None of that will happen if Trump wins. IF Trump wins, he will have one hell of a big popular mandate that the Democrats and the Democrat National Media won’t be able to overcome.

If Clinton wins, they will wait and try to pass all the above and more after her coronation.

14

posted on

08/22/2016 8:17:48 AM PDT

by

citizen

(Sanctuary cities: Illegals move in for free stuff, residents move out b/c they can't pay the taxes.)

To: expat_panama

There is no need to hike before the election based on actual evidence. December at the earliest.

To: Wyatt's Torch

...no need to hike before the election based on actual evidence...If the idea that rate hikes are for controlling inflation, then what we do is we look at inflation--

--and when we see that the cpi is falling (deflation) and the PCE is about one %, we say we don't need rate hikes. For now. fwiw, July's PCE comes out in a couple weeks...

To: expat_panama

That’s certainly a huge part of their formula (PCE is the FOMC’s preferred index) but also wage growth is the other key factor.

To: Wyatt's Torch

Wage growth? Really? Sure it makes a lot of sense but somehow everyone overlooks wages when they talk inflation and by considering PCE ("consumption") I'd thot that the Fed was following suit. I'm glad; we can't be looking at inflation w/ the overall economy w/o considering wages too. Even better of course would be the GDP deflator but that only comes out quarterly --w/ a delay and w/ revisions. PCE + wages sounds best.

Ever notice how freepers just looove to say we got 'runawayhyperinflation' and when I ask if their incomes are soaring they say say wages have nothing to do w/ inflation. Rush was saying that too --"...we got horrible inflation and stagnant wages..." and that's when I switch back over to Dennis Prager.

To: expat_panama

Right. It’s the lack of strong wage growth that is the key indicator as to why there is zero reason to tighten.

If you remember all last year I said there wasn’t reason to tighten but the Fed would in December just to show they would when necessary. Nothing has changed since then. Ditto for 16.

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

A very happy Monday morning to all as the 'eye of the storm' seems to remain calm. Even this morning's stock futures are still flat --after a month of tight trading.

A very happy Monday morning to all as the 'eye of the storm' seems to remain calm. Even this morning's stock futures are still flat --after a month of tight trading.