Posted on 06/30/2020 12:58:19 PM PDT by SkyPilot

You may be wondering why, over the last few months, the state pension problem – normally not a subject of widespread discussion – has been in the news.

In fact, you may be wondering just what the state pension problem is.

The problem – and it’s a big one – is that many of the public employee pension plans run by states don’t have enough money in them to make upcoming pension payments to retired state workers.

The first time the subject came up recently was toward the end of February. That’s when teachers in Kentucky called a sick-out and protested various pension changes advocated by the state legislature.

Kentucky’s public pension plans are among the worst-off financially of all the state systems, with only enough money in them to cover 34% of future pension payments as of 2017.

Then, in late April, five GOP senators wrote to the president to say they didn’t want the federal government to give additional aid to states hard-hit by COVID-19. “We believe additional money sent to the states … will be used to bail out unfunded pensions, reward decades of state mismanagement, and incentivize states to become more reliant on federal taxpayers,” they wrote.

The senators’ sentiments were echoed by many in the Senate Republican leadership, including Senate Majority Leader Mitch McConnell, who said, “There’s not going to be any desire on the Republican side to bail out state pensions by borrowing money from future generations.”

The problem has been a long time coming, but COVID-19 may make it into a crisis.

(Excerpt) Read more at theconversation.com ...

This will also have profound impacts on U.S. economy as a whole, and millions of lives.

"In 2017, total pension liabilities for all states was US$4.1 trillion and assets were $2.9 trillion. That means collectively, state pension funds would need $1.3 trillion to be able to make payments to everyone promised a pension. This represents about 9% of the U.S. GDP...….The combination of the failure to contribute the state portion into pension funds, the reduced pension contributions from fewer full-time workers, and lower rates of return on investment over the next several years will turn the pension problem into a fiscal crisis for states. States will be obligated to pay pensions, but won’t have the money to pay for them."

We are in the eye of the storm. The other side is economic.

That doesn’t actually sound too bad, depending how far out the payments are and what the rate of return on invested capital is. For example, at an interest rate of 6%, $2.9 trillion would be worth $4.11 trillion in six years.

Of course, they are already paying out money right now, and they may or may not be able to get 6%. But some of the payments are 20 or 30 years in the future.

I suspect the problem is in individual plans, not in the overall situation. Many states are fully funded, but the ones that aren’t are way behind.

No workers, no checks, no FICA, no SS.

We're old and incapable of fighting clean and many are completely dependent on SS, so you'd better get your acts together politicians ... we will not die because you starved us out .... we will die filling the streets with your blood.

He anticipates even more state layoffs and firings are in order to cope with this. The Lord knows none of us will shed a tear at the loss of more diversity consultants and other useless employees. However, when your local fire and police department finally do go under so that the pension checks keep flowing, we are talking about some serious implications for society.

...in late April, five GOP senators wrote to the president to say they didn’t want the federal government to give additional aid to states hard-hit by COVID-19. “We believe additional money sent to the states … will be used to bail out unfunded pensions, reward decades of state mismanagement, and incentivize states to become more reliant on federal taxpayers,” they wrote. The senators’ sentiments were echoed by many in the Senate Republican leadership, including Senate Majority Leader Mitch McConnell, who said, “There’s not going to be any desire on the Republican side to bail out state pensions by borrowing money from future generations.”

I have a small retirement from a state agency. My state is a red “flyover state.” Our fund is 97% funded, which makes it sound under any actuarial definition.

Of course, it is not at all as generous as those retirements in the blue states where they pay and promise the moon, all to be figured out later.

some governments may take the opportunity to weaponize COVID to strike at those that may be enjoying the benefits of those public pensions—taking the chance of placing sick individuals among the population that is most vulnerable and most likely to be on a pension. hmmm. NY nursing home much?

Well. we’ve already decided that police departments aren’t needed, so at least there’s that. /s

For example, in our plan both employees and employer pay into the plan. Not like those plans that require no contributions from employees. Also, we have none of those crazy formulas that permit members of other plans to retire early with 100% of their salaries. I will soon have 30 years of service, and if I retire then my benefit will equal just over 60% of the average of my highest 36 consecutive months. And finally, our plan changed their assumed return on investment several years ago from the then-common 8% to a lower number (I don’t recall right now the new percentage - I think it’s either 5% or 6%).

I mention all that to point out that even with our pension plan taking the above measures that are at least more conservative than other plans out there, they have had to increase the contribution level every year for many years now to try to keep the pyramid somewhat stable. At least they’ve been smart enough to do that, rather than just ignoring the problem as many have.

Even so, between employee and employer contributions, 25% of our salaries is now being contributed, and what funded level has that generated? 67%. That really shows how difficult it is to prop up these pensions, even when it’s done pretty responsibly. Our fund may be OK in the long run, but I can’t see how those full-pay at age 55 pensions out there can survive much longer.

Fixed-income recipients hardest hit by inflation.

Printing trillions correlating with rising prices and shrinking packaging at the market.

5lb bag of sugar is now 4lb.

Tomato sauce used to be 28 oz.

Spaghetti was $1/box, now $1.50.

So far, no wage/price spiral being reported AFAIK

The lesson?

Don’t believe the lies of the Democrat Party and their con men politicians.

You don't rally believe that? The Feds will create money by fiat to pay SS.

They have had plenty of warning but I doubt we are going to get through this without some federal aid for states that have had many decades of bad decision making. The price for that help should be a complete halt to rewarding corrupt officials and a cap on pension payouts that does not touch the average powerless schmuck but does cut off the people who should have known better from drawing six-figure annual retirement payouts. The alternative is the current generation paying for the screwups of decades before, and mass economic destruction. It is what it is, but there needs to be a completely transparent reckoning so that people don’t keep doing the same things all over again.

Current inflation is so depressing! Even Aldi has recently had significant price increases. Since retiring, my “hobby” is finding the best food prices and shopping at several different stores each week. I have spreadsheets and lists galore. Oh, what a fun hobby! /s. I was sidelined for a while with the quarantine and was only picking up orders at Walmart, but now I’m back in business with mask and gloves.

“pensions must be paid, come hell or high water”

Horshiite.

No Money. No Pay. Start writing rubber checks.

If nobody is there to pay the taxes, there will be no money in the til.

Civil actions to force sale of state assets.

I tend to agree. The problem is the courts just "rule" that the pension bonanza has to continue. But if this sparks the kind of financial collapse that it has the potential to do.....well, then hold onto your butts.

COVID-19 will turn the state pension problem into a fiscal crisis

s/b

DNC's Plannedemic was intended to turn the state pension problem into a fiscal crisis

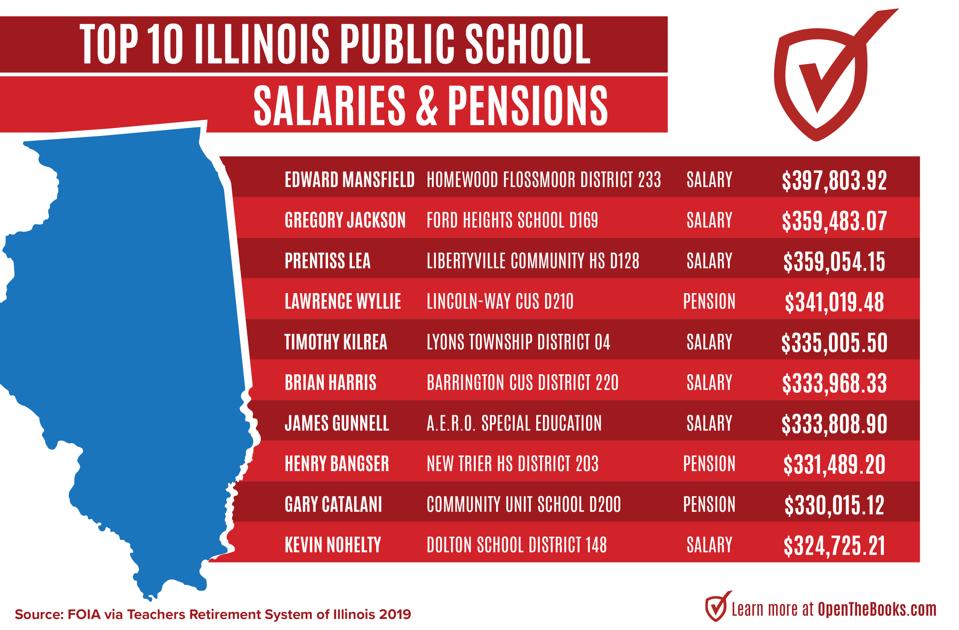

Look at Illinois.

Why Illinois Is In Trouble – 109,881 Public Employees With $100,000+ Paychecks Cost Taxpayers $14B

Other corrupt states have people collecting pensions inflated even more because they illegally held more than one state job (NJ is horrible for this).

Yup

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.