Posted on 11/11/2010 6:33:21 AM PST by blam

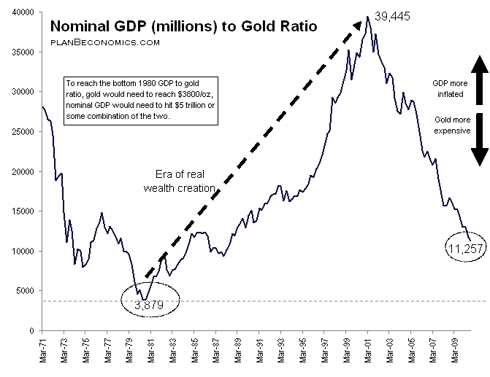

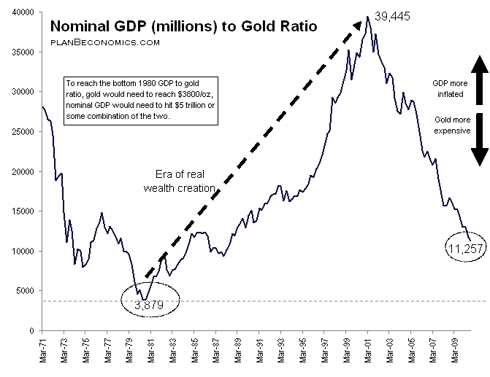

Gold At $3,800/Oz, Or Nominal GDP At $5 Trillion? Take Your Pick

by: Plan B Economics

November 11, 2010

| By popular request (well, sort of) I've created another chart to help look at gold prices in the framework of relative valuations. There are so many ways to do this and all lead to a variety of answers (i.e. there is no 'right' answer). However, this type of analysis can help investors determine if an asset is in extreme oversold or overbought conditions.

My previous article compared the S&P 500 to gold prices and suggested that to match the 1981 peak gold valuation, gold would need to reach $7800/oz (or the S&P 500 would have to fall to 220).

A number of people have emailed me asking what this looks like when using GDP instead of the S&P 500, so I created the chart below.

Conclusion: using nominal GDP as a relative comparison, gold will not match the 'bubble' valuations of the early 1980s until it hits $3800/oz or nominal GDP falls to $5 trillion. However, as some have astutely pointed out, gold is not at extremely oversold levels either (like it was in early 2001).

Note: the numbers on the left axis don't represent an absolute value or price. They simply reflect the ratio.

The writer is assuming that the US economy will stagnate for years and NOT RETURN to normal growth levels at all.

Anyone here willing to bet their money that this will happen?

Why should anyone bet money; if they win they get paid with worthless dollars. How about the same offer in gold?

Not on gold. However, I do firmly believe that an economic collapse of epic proportions is coming, followed shortly thereafter by a societal collapse. I really don't even see how it is avoidable at this point. They might be able to slow the train down some, but the wreck is going to happen regardless. What they (the Fed and the Federal gubmint) are doing now is equivalent to throwing the entire contents of the tender car into the fire box.....IOW, we're gaining steam, rather than venting steam.....and it's deliberate.

“””Anyone here willing to bet their money that this will happen?”””

Yea and verily, been 95% PM since early 2008 and my net worth has almost doubled and missed the market crash. Not really any richer just have not lost any purchasing power.

took us a generation to get into this mess, going to take a generation to get out of it.

Only if the necessary changes in fiscal policy are adopted and now! I look for a lot more hand wringing to be done at great expense to the taxpayers with little or no improvement. It is far more likely that the powers that be will continue to dance around the edges giving lip service to appease the voters while they wait (meanwhile padding their own pockets) until the collapse is so imminent that it will be too late to do anything about it......

What do you recommend for someone who knows the value of gold but doesn’t want to pile up thousands of dollars in gold coins? Who can you trust as an honest broker who won’t rip you off? I have about 50K I’d like to put in to gold but am totally clueless.

Free advice: Find a stock or etf where the physical gold is in their vault. I have found a couple from Canada. They are traded on the open market. Do your due diligence.

This is a false dilemma. There is no sane reason why GDP can’t be twice that and gold remain under $5,000 per ounce, that is unless you have a President who is hell bent and determined to cut GDP in half so that America can catch up with the rest of the world.

If you want more leverage, try the mining stocks.

There are gold ETF’s - and gold funds - Franklin Templeton has a nice Gold Fund - Year to Date return as of November 5th was 46.3%.

Vanguard has a Precious Metals Fund - Year to Date return was 31.3%. It’s never a good idea to put all your eggs in one basket... but both these funds strike me as trustworthy. I’m invested in both of them...

“”What do you recommend for someone who knows the value of gold but doesn’t want to pile up thousands of dollars in gold coins? Who can you trust as an honest broker who won’t rip you off? I have about 50K I’d like to put in to gold but am totally clueless.””

I have some physical and also own GTU and CEF Unlike GLD and SLV they have actual bullion that’s audited on a regular basis and are considered closed end funds so are Taxed at the capital gains rate and not the collectible rate. The bullion is held in Canada so might be an advantage or disadvantage depending on how you feel about it.

Sprott Has two funds that also hold Physical and will send it to you on request. Canadian also.

New energy sources will be slow to come online and maybe better long term I like oil MLP’s at the moment and may convert some PM’s there.

Hard call’s but I believe hard assets in things that people need are obvious for wealth preservation. Trick is timing and asset choice

There are gold ETF’s - and gold funds - Franklin Templeton has a nice Gold Fund (FGADX)- Year to Date return as of November 5th was 46.3%.

Vanguard has a Precious Metals Fund (VGPMX) - Year to Date return: 31.3%. It’s never a good idea to put all your eggs in one basket... but both these funds strike me as trustworthy. I’m invested in both of them...

Here’s a nice site to check out mutual funds:

Such an investment would be a good hedge against inflation while still being somewhat liquid (and excluding gold, silver, lead and real estate).

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.