Skip to comments.

Racketeering and Money Laundering Lawsuit Seeking Return of $43 Trillion to the U.S. Treasury

Spire-law ^

| 11/12/12

Posted on 11/12/2012 4:14:34 AM PST by chrisnj

http://spire-law.com/in-the-news/ 43 trillion dollars lawsuit against gov officials and major banks

TOPICS: Crime/Corruption

KEYWORDS: lawsuit; moneylaundering; obama; racketeering

Major Banks, Governmental Officials and Their Comrade Capitalists Targets of Spire Law Group, LLP’s Racketeering and Money Laundering Lawsuit Seeking Return of $43 Trillion to the United States Treasury

NEW YORK, Oct. 25, 2012 /PRNewswire/ — Spire Law Group, LLP’s national home owners’ lawsuit, pending in the venue where the “Banksters” control their $43 trillion racketeering scheme (New York) – known as the largest money laundering and racketeering lawsuit in United States History and identifying $43 trillion ($43,000,000,000,000.00) of laundered money by the “Banksters” and their U.S. racketeering partners and joint venturers – now pinpoints the identities of the key racketeering partners of the “Banksters” located in the highest offices of government and acting for their own self-interests.

In connection with the federal lawsuit now impending in the United States District……

(for more go to the link.)

1

posted on

11/12/2012 4:14:38 AM PST

by

chrisnj

To: chrisnj

I’ve heard of ambulance chasing, but jeez!

To: All

FOURTEEN TRILLION DOLLARS Behind The Real Size of Obama's Wall Street Bailout; A guide to the abbreviations, acronyms, and obscure programs that make up the $14 trillion federal bailout.SOURCE motherjones.com

Mon Dec. 21, 2009 12:23 PM PST

The price tag for the Wall Street bailout is often put at $700 billion—the size of the Troubled Assets Relief Program. But TARP is just the best known program in an array of more than 30 overseen by Treasury Department and Federal Reserve that have paid out or put aside money to bail out financial firms and inject money into the markets.

To get a sense of the size of the real $14 trillion bailout, see our chart at web site. Below, a guide to the pieces of the puzzle:

Treasury Department bailout programs

(Remember that Obama's Treasury Dept was controlled by his then-COS Rahm Emanuel---a savvy, connected G/S lobbyist in the WH)

Money Market Mutual Fund: In September 2008, the Treasury announced that it would insure the holdings of publicly offered money market mutual funds. According to the Special Inspector General for the Troubled Asset Relief Program (SIGTARP), these guarantees could have potentially cost the federal government more than $3 trillion [PDF].

Public-Private Investment Fund: This joint Treasury-Federal Reserve program bought toxic assets from banks and brokerages—as much as $5 billion of assets per firm. According to SIGTARP, the government's potential exposure from the PPIF is between $500 million and $1 trillion [PDF].

TARP: As part of the Troubled Asset Relief Program, the Treasury has made loans to or investments more than 750 banks and financial institutions. $650 billion has been paid out (not including HAMP; see below). As of December 21, 2009, $117.5 billion of that has been repaid.

Government-sponsored enterprise (GSE) stock purchase: The Treasury has bought $200 million in preferred stock from Fannie Mae and another $200 million from Freddie Mac [PDF] to show that they "will remain viable entities critical to the functioning of the housing and mortgage markets."

GSE mortgage-backed securities purchase: Under the Housing and Economic Recovery Act of 2008, the Treasury may buy mortgage-backed securities from Fannie Mae and Freddie Mac. According to SIGTARP, these purchases could cost as much as $314 billion ---SNIP---.

LONG READ---go to web site to read more and checkout the shocking financial charts.

SOURCE http://motherjones.com/politics/2009/12/behind-real-size-bailout

3

posted on

11/12/2012 4:19:33 AM PST

by

Liz

("Come quickly, I'm tasting the stars," Dom Perignon)

To: chrisnj

Holder, Valerie Jarrett, Robert Bauer, Anita Dunn, Geitner....

4

posted on

11/12/2012 4:22:22 AM PST

by

chrisnj

To: All

The Stimulus Bombshell MyGovCost.org | 1/24/12 | Craig Eyermann

FR Posted Jan 31, 2012 by GSWarrior

Stunning.

That’s really the only word we can use to describe the release of a “sensitive and confidential” 57 page memo, written by then soon-to-be US Treasury Secy Larry Summers in December 2008, about what became President Obama’s signature economic program in the first year of his presidency: the “stimulus package”.

James Pethokoukis has summarized some of the most significant aspects of the memo, which we’ve excerpted below, and which reveals the Obama administration’s thinking behind what became an over 821 billion dollar boondoggle. The bold text represents Pethokoukis’ summary of that thinking, which is directly followed by a supporting quotation from Larry Summers’ memo:

1. The stimulus was about implementing the Obama agenda. The short-run economic imperative was to identify as many campaign promises or high priority items that would spend out quickly and be inherently temporary.... The stimulus package is a key tool for advancing clean energy goals and fulfilling a number of campaign commitments.

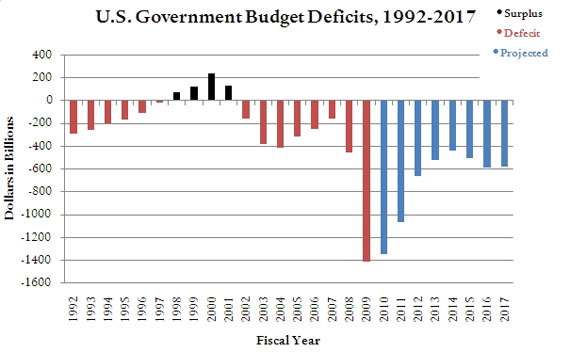

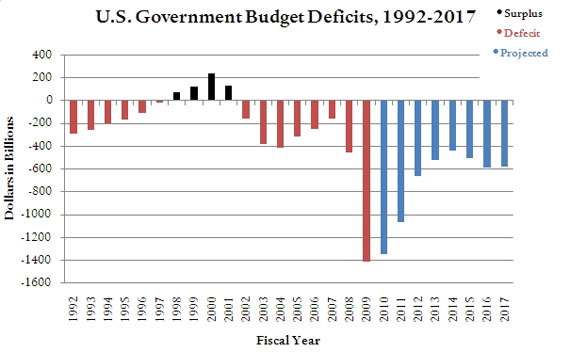

2. Team Obama knows these deficits are dangerous (although it has offered no long-term plan to deal with them). Closing the gap between what the campaign proposed and the estimates of the campaign offsets would require scaling back proposals by about $100 billion annually or adding new offsets totaling the same. Even this, however, would leave an average deficit over the next decade that would be worse than any post-World War II decade. This would be entirely unsustainable and could cause serious economic problems in the both the short run and the long run.

3. Obamanomics was pricier than advertised. Your campaign proposals add about $100 billion per year to the deficit largely because rescoring indicates that some of your revenue raisers do not raise as much as the campaign assumed and some of your proposals cost more than the campaign assumed.... Treasury estimates that repealing the tax cuts above $250,000 would raise about $40 billion less than the campaign assumed....The health plan is about $10 billion more costly than the campaign estimated and the health savings are about $25 billion lower than the campaign estimated.

4. Even Washington can only spend so much money so fast. Constructing a package of this size, or even in the $500 billion range, is a major challenge. While the most effective stimulus is government investment, it is difficult to identify feasible spending projects on the scale that is needed to stabilize the macroeconomy. Moreover, there is a tension between the need to spend the money quickly and the desire to spend the money wisely. To get the package to the requisite size, and also to address other problems, we recommend combining it with substantial state fiscal relief and tax cuts for individuals and businesses.

5. Liberals can complain about the stimulus having too many tax cuts, but even Team Obama thought more spending was unrealistic.

As noted above, it is not possible to spend out much more than $225 billion in the next two years with high-priority investments and protections for the most vulnerable. This total, however, falls well short of what economists believe is needed for the economy, both in total and especially in 2009. As a result, to achieve our macroeconomic objectives—minimally the 2.5 million job goal—will require other sources of stimulus including state fiscal relief, tax cuts for individuals, or tax cuts for businesses.

6. Team Obama thought a stimulus plan of more than $1 trillion would spook financial markets and send interest rates climbing. To accomplish a more significant reduction in the output gap would require stimulus of well over $1 trillion based on purely mechanical assumptions—which would likely not accomplish the goal because of the impact it would have on markets.

==========================================

2008 Candidate Barack Obama told us on the campaign trail: " The problem is, that the way Bush has done it over the last eight years is to take out a credit card from the Bank of China in the name of our children, driving up our national debt from $5 trillion for the first 42 presidents, # 43 added $4 trillion by his lonesome so that now we have over $9 trillion of debt that we are going to have to pay back, $30,000 for every man woman and child. That’s irresponsible. It’s unpatriotic."

REALITY CHECK Obama presided over the biggest political heist in US history. The Obamanations (insiders and politicians) sucked up trillions under the guise of inheriting the "Bush financial crisis."

THIS MADE ME LAUGH OUT LOUD Obama COS Rahm Emanuel "suddenly" discovered he wanted to be Chicago's mayor---the little turn went before the mics and announced his campaign "raised $10 million in just a few weeks." Rahm also controlled the US Treasury as COS.

======================================

In a fair accounting, Pres Obama is responsible (along with the then-Dem Congress) for the $1.3 trillion in deficit spending in 2010 and the estimated $1.6 trillion in 2011. Obama should not get credit for the $149B in TARP (Troubled Asset Relief Program) repayments made in 2010 and 2011 to cover most of the $154B in bank loans that remained unpaid at the end of the 2009 fiscal year—--loans that count against Pres Bush’s 2009 deficit tally.

Treasury says all but $5B of the TARP bank loans have been repaid. The portion of repayments for loans issued in 2009 should be deducted from Bush’s deficit tally, not credited to Obama as deficit savings. There is some astounding number crunching here, and a chart of a modern day president’s “average annual deficit spending” ........a frightening conclusion of what happens if Obama has an 8- year term.

5

posted on

11/12/2012 4:22:48 AM PST

by

Liz

("Come quickly, I'm tasting the stars," Dom Perignon)

To: Liz

Nonsense. Bankster loving Freepers have told me repeatedly that Wall Street paid back their bailout.

6

posted on

11/12/2012 4:25:18 AM PST

by

Wolfie

To: chrisnj

Sign me up! (cough, wheeze) and my neck hurts, too.

7

posted on

11/12/2012 4:32:20 AM PST

by

P.O.E.

(Pray for America)

To: Wolfie

8

posted on

11/12/2012 4:32:40 AM PST

by

Liz

("Come quickly, I'm tasting the stars," Dom Perignon)

To: Nachum; TigersEye; Impy

9

posted on

11/12/2012 4:38:47 AM PST

by

Arthur Wildfire! March

(George Washington: [Government] is a dangerous servant and a terrible master.)

To: mkmensinger

I’ve heard of ambulance chasing, but jeez! Is Gloria Allred involved in this?

10

posted on

11/12/2012 4:40:29 AM PST

by

SMM48

To: Liz

11

posted on

11/12/2012 4:46:06 AM PST

by

1rudeboy

To: chrisnj

USA Mortgage and Housing Facts (4th Quarter 2009)

130,159,000 Total housing units:

91,241,000 Total housing units for single detached and mobile homes:

79,918,000 Total occupied year round:

129.9 million housing units in the United States

90,000,000 single family homes in the United States

17.2 million or 20% of housing units owned “free and clear”

68.8 million or 80% of housing units with debt underlying the ownership

4,000,000 or 9% of mortgages considered to be “at risk”

44,444,444 Total mortgages in the US:

How much is the average mortgage amount in the us?

As of the end of the fourth quarter of 2009, there was approximately

$14.3 trillion in outstanding mortgage debt (combined residential and non-residential)

$2.5 trillion non-residential debt

$11.8 trillion residential mortgage debt

$172,000 average mortgage balance

10% of the population have mortgages outstanding of over $250,000

12

posted on

11/12/2012 5:20:35 AM PST

by

meadsjn

To: chrisnj

Don’t omit the head honchos at Fannie and Freddie. They hauled away tons of money. It would be interesting to learn what percentage of that money found its way, under the table, to Dodd and Frank.

13

posted on

11/12/2012 6:29:36 AM PST

by

Tucker39

To: Tucker39

“Don’t omit the head honchos at Fannie and Freddie.”

Especially Franklin Raines ( one of Holder’s People). When you compare him to a corkscrew, the corkscrew looks straight!

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

Major Banks, Governmental Officials and Their Comrade Capitalists Targets of Spire Law Group, LLP's Racketeering and Money Laundering Lawsuit Seeking Return of $43 Trillion to the United States Treasury (via PR Newswire)

Major Banks, Governmental Officials and Their Comrade Capitalists Targets of Spire Law Group, LLP's Racketeering and Money Laundering Lawsuit Seeking Return of $43 Trillion to the United States Treasury (via PR Newswire)