Skip to comments.

Investment & Finance Thread (week July 6 - July 12 edition) [my title: The Economy Looks Great!]

Weekly investment & finance thread ^

| July 6, 2014

| Freeper Investors

Posted on 07/06/2014 10:24:34 AM PDT by expat_panama

|

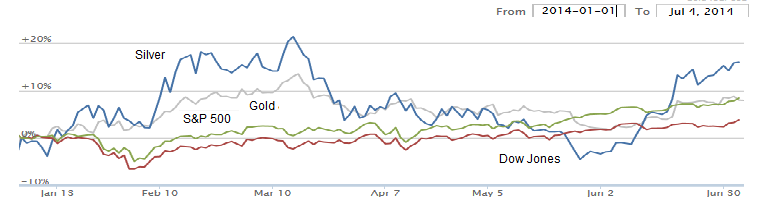

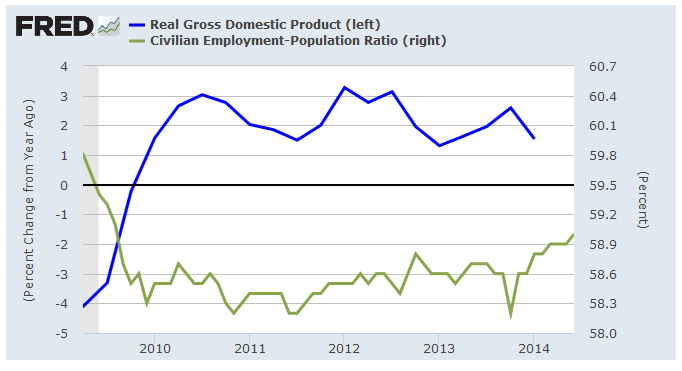

Huh. Huh. While coming into the second half of 2014 we just had the GDP and employment rpts, and what happened is we got what seemed to be contradictory -2.7% and +6.3 bombshells. On the other hand (Truman hated economists saying that) a look at the year over year GDP return along with the employment/population ratio puts the two together. [click to enlarge] The reason GDP growth looks solid is because that -2.7% was just one Qtr to the next, so last week's rpt tells us more about how good Q4 was than it does about how bad Q1 turned out. Something else is the fact that over this past 1/2 year employment/population is finally making a move --a move we've not seen since the "recovery" began in '09. |

|

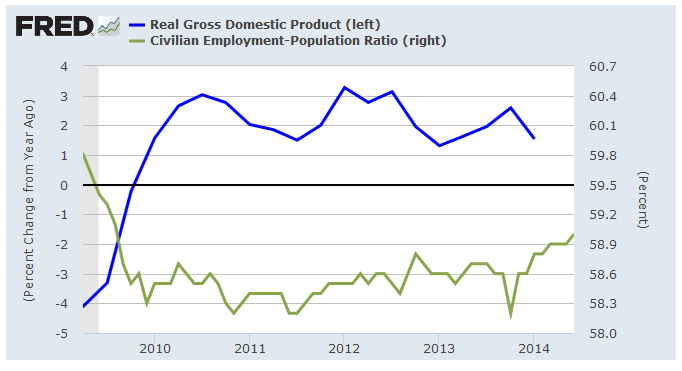

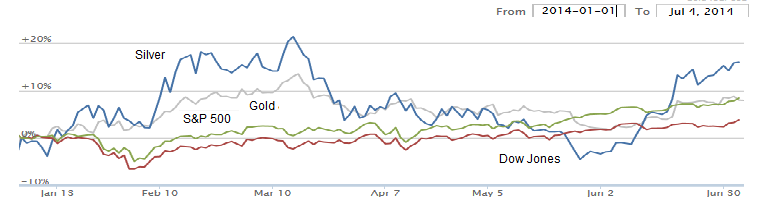

OK, so last week I said "IMHO we're in an economy where we can still make money but it's just going to take more effort", but judging how stocks'n'metals are now rising up from this year's base there's reason to think that it may not take as much effort after all... |

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-73 next last

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

—so there’s nothing to have worried about after all ping.

To: expat_panama

3

posted on

07/06/2014 10:30:34 AM PDT

by

GOPJ

(Why no outrage over IRS targeting? Same reason Pravda didn't make a stink about gulags.FREnterprise)

To: Wyatt's Torch; Chgogal

So this means I take back what I said in

last week's post #88 here, and I'm glad I'm just trying to take back last week's words and not last week's trades...

To: GOPJ

To: expat_panama

Business events scheduled for the coming week

http://finance.yahoo.com/news/business-events-scheduled-coming-week-185317628.html

e

Personal Finance

CNBC

Compare Brokers

Business events scheduled for the coming week

Business events and economic reports scheduled for the coming week

By The Associated Press

July 3, 2014 1:58 PM

All times are Eastern.

MONDAY, July 7

BERLIN — Germany’s Economy Ministry releases May industrial production figures for Europe’s biggest economy.

TUESDAY, July 8

WASHINGTON — Labor Department releases job openings and labor turnover survey for May, 10 a.m.; Federal Reserve releases consumer credit data for May, 3 p.m.

BERLIN — Germany’s Federal Statistical Office releases export and import data for May.

Alcoa Inc. reports quarterly financial results after the market closes.

WEDNESDAY, July 9

WASHINGTON — Federal Reserve releases minutes from its June interest-rate meeting.

THURSDAY, July 10

WASHINGTON —Labor Department releases weekly jobless claims, 8:30 a.m.; Freddie Mac, the mortgage company, releases weekly mortgage rates, 10 a.m.; Commerce Department releases wholesale trade inventories for May, 10 a.m.

NEW YORK — Selected chain retailers release June sales comparisons.

FRIDAY, July 11

WASHINGTON — Treasury releases federal budget for June, 2 p.m.

Wells Fargo & Co. reports quarterly financial results before the market opens.

To: expat_panama

What? Great? Then why is gas higher? And what about groceries higher too?

The economy is not great.

7

posted on

07/06/2014 11:54:32 AM PDT

by

Salvation

("With God all things are possible." Matthew 19:26)

To: expat_panama

So I don’t have to look this up myself, has the macro econ metric MV, ever went negative in the last 70 years?

5.56mm

8

posted on

07/06/2014 12:09:01 PM PDT

by

M Kehoe

To: Salvation

The economy is not great. Wall Street may not accurately reflect discretionary income. But the sound you hear is the sound of the middle class being squeezed. Take a deep breath. Say to yourself in meditation "One world government. One world standard of living. One world religion". Then everything will seem all right.

9

posted on

07/06/2014 12:40:35 PM PDT

by

BipolarBob

(Obama - The Scandal a Week President.)

To: BipolarBob; Salvation

The economy is not great.Wall Street may not accurately reflect discretionary income

lol!! --this reminds me of back when I was a civil engineer I'd get rich every time there was some big natural disaster for me to build new dams and roads. Now I'm working in the capital markets and I get rich when things in the labor markets have been horrible but are finally beginning to turn up.

Let's get together on what the facts are; five years ago ten million people lost their jobs and are still jobless. That's bad. What we got now is that the American people seem to have finally gotten the situation under control and it really does look like we're making it right. That's good.

To: M Kehoe

has the macro econ metric MV, ever went negative in the last 70 years?Please help me out here, I'm not following how the money supply or velocity could be less than zero.

To: expat_panama

I’m sorry, it was a rhetorical question.

5.56mm

12

posted on

07/06/2014 1:40:42 PM PDT

by

M Kehoe

To: M Kehoe

a rhetorical question.Ah, that explains it; I never get those right. I'm good at T/F or multiple choice but I always screw up on the essays and rhetoricals.

To: expat_panama

And there’s about $12 TRILLION in money sitting on the sidelines, waiting to come in with the right policies. A conservative (not Republican) Congress could unleash that capital flow as occurred in the 1990s under Schlickmeister.

14

posted on

07/06/2014 4:39:34 PM PDT

by

LS

('Castles made of sand, fall in the sea . . . eventually.' Hendrix)

Comment #15 Removed by Moderator

To: expat_panama

Last night I saw on Bloomberg TV Steve Forbes taking questions regarding money in general (he apparently just published a new book).

He mentioned that after the Nov elections in ‘14 the Feds are going to be ‘sticking their claws’ into mutual funds, money funds, etc., and ‘anything that moves’. But that was it - no follow-up, no outrage, no suggestions on what to do about it - he just seemed resigned to the fact that it's going to happen.

Assuming this comes to pass, what will it mean for the markets, the fund management business, and the average Joe's retirement money, in your estimation?

16

posted on

07/06/2014 7:52:00 PM PDT

by

MichaelCorleone

(Jesus Christ is not a religion. He's the Truth.)

Comment #17 Removed by Moderator

To: MichaelCorleone; Wyatt's Torch

What say you about the Feds ability to stick “their claws’ into mutual funds, money funds, etc., and anything that moves”?

18

posted on

07/06/2014 10:13:11 PM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

Comment #19 Removed by Moderator

To: Chgogal

What say you about the Feds ability to stick “their claws’ into mutual funds, money funds, etc., and anything that moves”?

I would give my thoughts but my comment would probably be removed also.

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-73 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson