[click pix to enlarge]

[click pix to enlarge]Posted on 10/19/2014 11:18:38 AM PDT by expat_panama

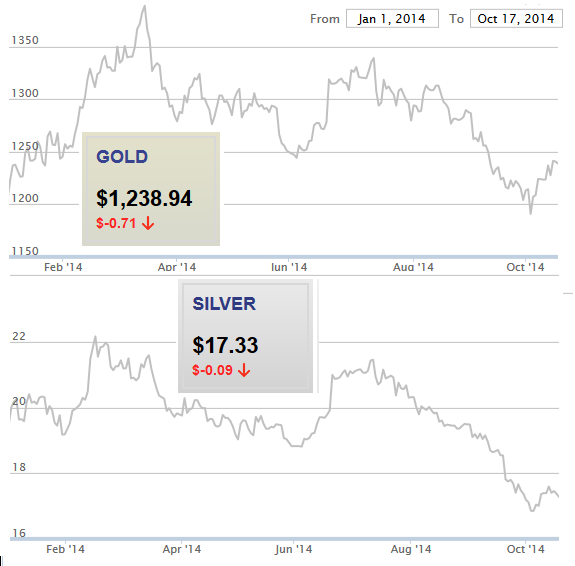

This past week saw upside reversals across the board coming out with prices holding steady in spite of the hammering we had over the past month or two.

The October metals rally held on to its gains, in fact market prices show gold's just about clawed back to break-even for 2014. That's said, metals' role in price trends ahead is become increasingly controversial (re Gold And Silver - Financial World: House Of Cards Built On Sand) even while many see a bright tomorrow with other commodities (We Maintain Our Outlook For Higher Prices For Commodities).

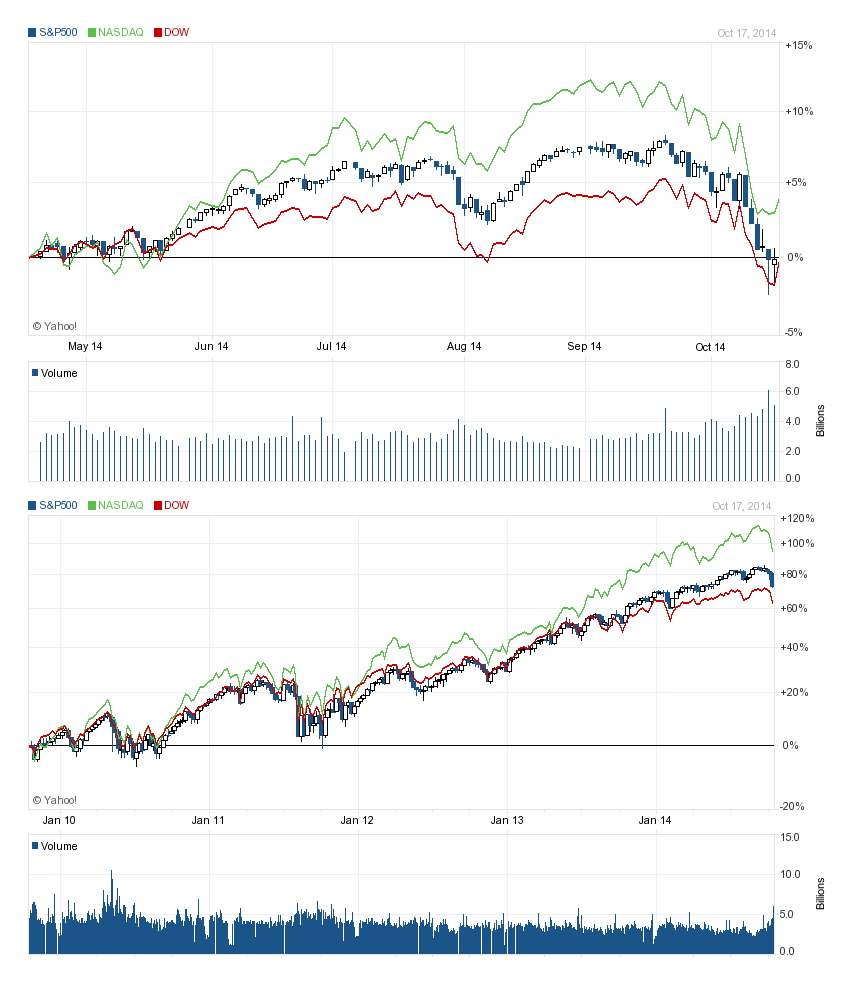

Stocks. OK, so IBD won't call it an "uptrend" (the follow-through has got to be no earlier than the fourth day of the rebound or it ain't official), but the upside surge was led by leading stock leaders. They call them 'leading' stocks for a reason. Well, sometimes they call 'em 'bellwether' stocks but the term makes me nervous 'cause a bellwether is often the animal trained to lead the mindless unquestioning herd into the meat packing plant.

I digress.

So we've been in "market in correction" for a while and we punched down through the famous 200-day moving average, so for 2014 it really is a big deal. Maybe that says more about how spoiled we've been getting lately. I mean the earlier swings over the past half decade kind of make these past two years seem well, nice.

[click pix to enlarge]

The big question of course is whether stock indexes are right now 'over priced' or not, and for that I like to compare say, the S&P500 to total U.S. corp. net worth. Someone correct me if they see anything I don't but I honestly think they've been tracking together since the last decade's high. Not only that, but recent growth seems actually subdued --check out this 1950-2014 plot showing total corp networth and how the trend in raising business capital has been more and more turning away from bonds over into stocks.

Also on that note. Please forgive my broken record but it has got to mean something that historic American growth for corp net worth has always been over 7% yearly, but since 2007 growth has only averaged a paltry one percent.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

Buying-opportunity ping.

What could the ebola scare do to the markets? Would metals or mining stocks be safer than consumer related stocks?

Buy, sell or short the TVIX for some real excitement - just try to follow the headlines and beat the computers to the trade - lotsa luck ...

The bounce back came following reporting on the Fed that it will not likely retreat now from its QE agenda - meaning it will continue to dump money into Wall Street and Wall Street will continue to not lend it but buy stocks with it, again, until they are again willing to admit the long term folly of that and sell again to get some cash out before the lemmings start to get in on their sell off.

The small investor has been taken for a ride by the Fed and the Wall Street banks, and the Fed and the big banks will keep doing it until the Fed is finally forced to raise interest rates; at which time there will be another sell-off before the unwinding of QE starts raising the interest rates & the inflation rate.

Yellen et all are screwing especially many of “the elderly” with money put away in savings and other things with fixed returns based on today’s low interest rates. The same citizens will again get screwed when the unwinding of the Fed’s QE hits and inflation begins to eat, from its direction, at the value of what “the elderly” have put away. What the elderly have saved is being made worth less (growing less) by what the Fed is doing now and the inflation that will result from the unwinding of the Fed’s QE will make what the elderly have left to spend worth less.

Recently Yellen made a speech about “inequality” in our economy, and she tried to say it was a cause of poor economic performance. Her argument is false and she doesn’t have a moral leg to stand on on that point, given the losers in our economy the Fed’s programs are creating.

Come to think of it, that's the key question that we keep asking and really belongs up at the top only I haven't a clue as for any good answers. We started hashing it out on this thread when certain drug stocks soared (and loony left press called 'em "greedy"(As Ebola spreads, drug stocks surge) and then airline stocks tanked (Airlines Stocks Are Getting Crushed And Traders Are Blaming Ebola), and then the patient died (Drug Stock Tanks After Ebola Patient Treated With Its Drug Dies (Note timing)) and then almost daily we hear from the pundits: Face Mask And Hazmat Stocks Are Crashing, Global stocks down on recovery, Ebola worries.

My take is we got a lot more opinions than facts, so in the short term (personally) I'm ignoring it except for the fact that the longer term sure does look bleake...

Of interest to investors who use an asset allocation strategy keyed to age and individual circumstances.

Amid Tumult, Bonds Prove Steady

OCT. 17, 2014

By JAMES B. STEWART

This week’s stock market drop and wild gyrations may have been wrenching for investors, but they can’t really be called a surprise. After 27 months with no significant decline and with many valuation measures signaling caution, a chorus of pundits has been predicting a stock market pullback and higher volatility.

But along with the turmoil, there was a surprise: On Wednesday, the yield on the 10-year United States Treasury note hit 1.85 percent, its lowest level since May 2013, extending a yearlong Treasury bond market rally that almost no one predicted.

snip

The recent volatility of stocks and the unpredictability of interest rates is a potent reminder to most investors to have a diversified mix of stocks and bonds and stick to a simple asset allocation plan. “What happened this week isn’t unusual, and it isn’t abnormal,” said Francis Kinniry, a principal in Vanguard’s investment strategy group. “Stocks are a high-risk, high-return asset.”

snip

Given recent strength in the United States economy, the decline in the unemployment rate and the Fed’s repeated intention to tighten monetary policy over the next year, no wonder hardly anyone anticipated this year’s bond market rally. But there were a few lonely voices. In his list of “15 Surprises for 2014,” issued in January, Douglas Kass, president of Seabreeze Partners Management (and a widely followed market pundit), predicted “slowing global growth” (surprise No. 1); “stock prices decline” (surprise No. 3); and “bonds outperform stocks” (surprise No. 4).

snip

Mr. Kass expects the bond rally to continue and is among those who suspect the Fed will delay raising rates. “People are losing sight of the fact that the Fed hasn’t raised rates since June 2006,” he said. “I don’t see them raising rates for two or three more years. That will be another surprise for the markets.”

snip

In keeping with its longstanding approach, Vanguard is urging investors to stick to a simple, low-cost asset allocation model divided between stocks and high-quality bonds and not try to time markets. “Many investors make the mistake of looking at bonds as stand-alone investments with low expected returns,” he said. “But they’re really there to complement the equity risk. We’ve looked at this in depth over long periods. And when equities are under stress, the only assets with positive returns have been very high-grade government bonds, high-quality municipals and high-grade corporate bonds. Everything else — hedge funds, private equity, real estate, high-yield bonds — has gone down.”

My recommendation is to invest in knee brace manufacturers. When we get done with our collective knee jerks over ebola they will be in demand.

Yeah, they somewhat sort of kinda happened together so folks decided that U.S. gov't (total annual spending $3.8T) is supposed to be in control of the all the buying and selling of corp. stocks (total annual trade volume: $22.5T). OK, so people really really want to think that the gov't is more powerful than the free market but I honestly can't believe it works that way.

Yellen made a speech about “inequality”

Right! The speech was "Perspectives on Inequality and Opportunity from the Survey of Consumer Finances" and I got my hopes up that since her salary was four times the U.S. median household income that she was about to share w/ me but I checked out the speech and all she said was--

I cannot offer any conclusions about how much these factors influence income and wealth inequality. I do believe that these are important questions, and I hope that further research will help answer them.

There is only one thing to know about the market bounce. The Fed announced it is going to keep buying with “created” money.

--but the Fed's always announcing things, sometimes stocks go up, sometimes down, and sometimes they stay flat. Here's the Fed announcement website. Seriously, there was no 'buying' that the fed announced before the bounce that was all that different than before or since. In fact, we were joking about how this time Fed action has been replaced by Fed 'talk', or Verbal Easing that replaced Quantitive Easing.

...with “created” money.

What, you mean as apposed to some kind of organic "natural" type money?

You are obviously to the FED- What liberals are to big government. I learned along time ago- Don’t waist my time arguing with defenders who are ignorant of whats going on. I am sure that you have seen it all. And that in your mind we are the ignorant ones.

More.

http://online.wsj.com/articles/rally-in-treasurys-makes-a-longstanding-bet-look-good-1413754652

Rally in Treasurys Makes a Longstanding Bet Look Good

Texas’s Hoisington Investment Management Has Been Wagering for More Than a Decade That Yields Will Fall

By Tom Lauricella

Oct. 19, 2014 5:37 p.m. ET

The roaring rally in government bonds has thrown Wall Street for a loop, but it comes as no surprise to a group of veteran money managers in Austin, Texas.

Van Hoisington, president of Hoisington Investment Management Co., and Lacy Hunt, its chief economist, have been wagering for more than a decade that bond yields in the U.S. will fall, thanks to rising debt that they say inhibits economic growth, retards inflation and pushes down interest rates.

In recent weeks, Hoisington, which manages $5.4 billion invested mostly in long-term U.S. Treasury securities, has looked especially prescient, as the potential for economically damaging deflation in Europe has become a serious concern for investors.

The yield on 10-year government bonds has tumbled below 1% in Germany for the first time ever and below 2% in the U.S. for the first time in more than a year, a surprisingly low level at a time of healthy employment gains in the U.S. Prices rise when yields fall.

snip

Excellent post. The market goes straight up folks can not even see the correlation between the Fed and market valuations. You are rational. The market is rational. The Fed is a freaking disaster. Interest rates can never again be rational because the debt is so huge that we can not service it at rational market rates. The Fed can not unwind squat. Think Japan and you’ll know where we are headed.

Don’t know what will come of this but sounds pretty good.

Wal-Mart’s new everyday low price: A $40 doctor visit

http://www.freerepublic.com/focus/f-news/3217213/posts

This past week the FED said they will continue to print money. That was all Wall Street needed to hear to keep the “rigged show” going.

Where have I heard that

Elizabeth Warren: Obama’s economic team chose Wall Street over ‘families

http://www.freerepublic.com/focus/f-news/3214624/posts

Ah, help me out a sec. When was there a time that the Fed did not print money?

When was there a time the fed did not print money?

Before 1913?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.