Posted on 12/14/2014 7:43:31 AM PST by expat_panama

So while nobody knows the future we still need to know what to expect from the week's two big headlines, even though our view can easily (and will probably) be muddied w/ other factors. So we deal with an unknown future by checking the historical record for clues on at what the news means to our future investment returns.

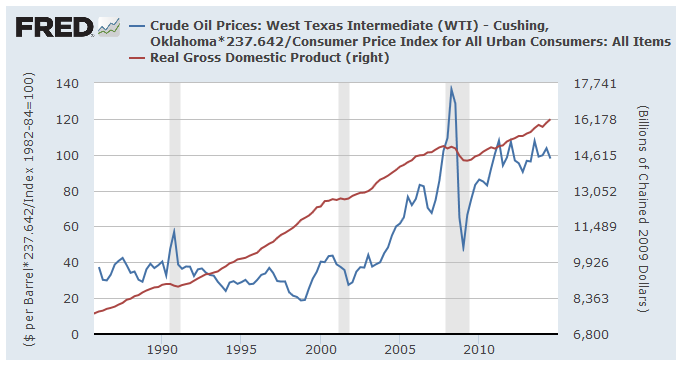

What oil bargains do: namely, what's it doing to the economy and to investments; here's what tanking oil's done in the past (ya gotta LOVE the fed's data site) and how real oil prices (2014$ per barrel) track real GDP--

[click to enlarge]

--and what we got is that it's the oil price surge that precedes a recession while crashing oil is what comes to the rescue afterword. True, there's more to econ growth than oil (wars and stuff) and sometimes econ growth can launch oil prices right back into orbit. Just the same, cyclical economic patterns come and go. We deal with it.

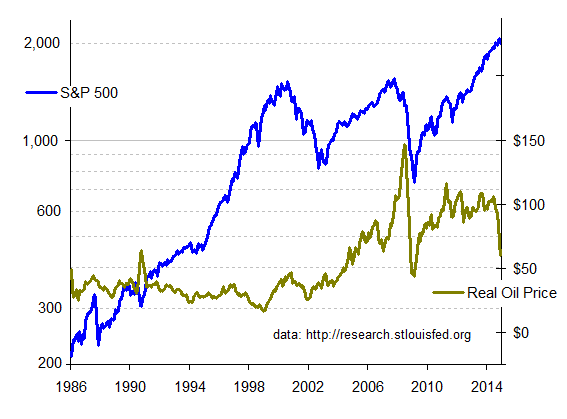

I n the mean time right now we got $60 oil and we're wondering about what that means for our 2015 investment returns. That track record's next on the right:

n the mean time right now we got $60 oil and we're wondering about what that means for our 2015 investment returns. That track record's next on the right:

Someone please tell me if they're seeing something that I'm missing, but I believe I'm getting the same thing for stocks as w/ GDP. Namely, that a price surge is what tanks stocks and an oil price plunge (or prolonged era of low prices) does quite well thank you.

My first glance made me sing the old "...but this time is different..." tune because of how "this time" we've just been having several years of rising stock prices. My problem is that I'd been looking at this graph --with the S&P on a linear plot. In stocks we care about our gains --what percent we're doing now. A log plot shows percent increases better, so using the log plot at the right we can ask what a few years of $40 oil will do, and look at the long term oil price decline from Reagan thru Clinton. It made great gains even better.

Until the '99 oil rally that is, and then we had a dot.com bust. Still, I personally wouldn't mind another five years of super gains, even w/ another dot.com at the end.

More tax'n'spending: --and the other big headline being the fact that the House caved and gave the budget busters everything they wanted and the big question is what has this done in the past.

Answer: nothing.

OK, so why nothing? The answer is that (w/ few rare exceptions) the extreme left has controlled taxes & spending pretty much continuously for decades and that there's no way of seeing how a few years of budget restraint could have affected GDP and stocks. Sure, we know that big tax cuts (for those that remember that far back) did wonders for our personal lives and our ability to save and invest. We also know how increased investment w/ lower costs affect business activity. It might happen in the future and we can simply agree it would be great. It's not happening now, it hasn't happened before, and we're still here. We need to remember the enormous economic power of the American people and how we can build and prosper even during loooong stretches of abysmal government leadership.

In the meantime right now stocks are crashing ("market under pressure") and metals are continuing a month of solid gains. That can change.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

h/t to Lurkina.n.Learnin for asking us this question (here).

I think you could be right, a reduction in the total price of oil produced --even if more barrells of it actually go on the market-- cranks out to a negative for the GDP. imho this is a bad thing for using the GDP, but not a bad thing for the economic well-being of the American people. Kind of like the way a big hurricane can destroy all kinds of property and kill thousands, and then in the end all that money spent on rebuilding gets translated into an increased GDP.

We're only talking what "could be" though, and it's not what's happened every time the price of oil dropped in the past.

There are now two separate companies, Marathon Petroleum Corp and Marathon Oil Corp. Each represents a play on different aspects of the US oil market.

Ah yes MRO and MPC...its hard to keep up!

Just sell energy stocks and move the money in to consumer stocks and 2015 will be a good year for your returns. Yes it is this simple.

Lower asoline price seems to be a real psychological boost. Was a at a local restaurant last night, the owner told me their increase in volume the last two months vs previous year was real solid. This is a place that’s been around for 20+ years and hasn’t changed much.

Sure we can.

Economy is jobs --almost all jobs are for corporations --mostly by publicly traded corporations. Right now there's about $20T in stocks and that's what's hired about 125 million employees --that's a $160,000 portfolio hiring each new worker.

When stocks go up just one percent it means over a million people get hired. OK so it can take a half a year but that's why stocks are a leading indicator and jobs is a lagging indicator. They're still good indicators though.

Don't know which policies you're talking about, they stopped buying mortgages and T-bills long ago.

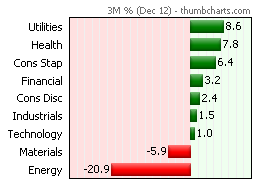

--the idea being that even though the drillers are hurting they're customers aren't.

True. It's also why (imho) over the past 3 months utilities have been on the roof even while the energy sector's been in the sub-basement.

Really? Sell the stocks that are low and buy the ones that are high?

I think we have different investing styles. Oil is where I’m looking now. BP is paying 6.62% and trading at 10 times next year’s consensus estimate.

Sell the stocks that are low and buy the ones that are high?

No. it's the idea of selling stocks that are falling and buying what's going up --re the graph in post 28. True, there are differing styles, but while some toot the 'contrarian' line others say "the trend is your friend".

“Forget Dollars, Start Buying Rubles”

What has gotten into you - Normally you are a very sane contributor on FR

I’m merely posting the articles. But I do think the writer makes a point, namely contrarian investing. In other words, “buy low, sell high.”

Put in the words of J. Paul Getty, who obviously knew what he was doing when it came to all things money: “Buy when everyone else is selling and hold until everyone else is buying. This is not merely a catchy slogan. It is the very essence of successful investments.”

The ruble has really taken a beating the past few months, and it WILL go back up. Maybe tomorrow, maybe later on.

I don’t do currencies or commodities, but I do invest in equities, and along those lines, last week I picked up some shares of BP awful cheap.

U.A.E. Sees OPEC Output Unchanged Even If Oil Falls to $40

One of the first things I learned, when I first started investing as a contrarian investor in the early 90s, is that there are some companies that really are bad. They have fallen for a reason, and will continue to fall.

The sweet spot is the grade B large cap that can improve its performance if it has to. The excellent companies don’t fall enough to be worthwhile, and the bad companies keep going down as they get into more and more trouble.

http://thenewsnigeria.com.ng/2014/12/14/nigerias-oil-workers-begin-total-strike/

Nigeria’s oil workers begin total strike

Dec 14 2014 - 6:25pm

This was a factor on my BP buy.

http://www.washingtonpost.com/wp-dyn/content/article/2010/06/03/AR2010060303805.html

BP’s Deepwater oil spill hurts British pensioners, investors

By Karla Adam

Friday, June 4, 2010

snip

Thousands of Britons are invested in the British oil giant through pension funds — analysts estimate that about 1 pound in every 7 pounds paid in dividends to British pension funds comes from BP.

snip

http://eaglefordtexas.com/news/id/142212/north-dakota-oil-production-hits-lull/

North Dakota oil production hits a lull

DAVID SHAFFER | Star Tribune

North Dakota’s steep climb in oil production growth is hitting a lull as oil drillers retrench amid plummeting crude oil prices.

State officials said Friday that oil production in October declined by about 4,000 barrels per day to 1.18 million daily barrels compared with September, the first decline in eight months. Drilling for new wells also declined and is expected to decline even more in 2015.

Lynn Helms, director of the North Dakota Mineral Resources Department, said oil prices in North Dakota are down 44 percent since September, far more than ever expected.

“I honestly did not see them this soft,” Helms said in a conference call with reporters. “That is going to have a significant impact.”

Helms, whose agency regulates the oil industry, said he expects the 183 current drilling rigs to be down by 40 to 50 rigs by mid-2015. “That means it will be a month-to-month struggle to see production increases — if they come at all,” Helms said.

Oasis Petroleum, one of the large operators in North Dakota, announced Wednesday that it would drop from 16 drilling rigs to six rigs. On Friday, stock prices for the 10 largest publicly traded oil companies with North Dakota operations were down by an average of 51 percent over three months.

In North Dakota, production from the Bakken and Three Forks shale plays has risen nearly sixfold in the past five years, and the state in October had a record 11,892 oil wells. Production has declined just seven times in five years, usually in the winter when it can be tough to complete wells.

“This is a blip in the long-term scheme of things,” Helms said.

Related: North Dakota crude production declines

North Dakota officials’ outlook was more gloomy than the U.S. Energy Information Administration’s. The agency on Friday issued a report reiterating that it expects U.S. crude oil production to increase 700,000 barrels per day in 2015 compared with this year. That estimate is down from an earlier projection, however.

New North Dakota regulations to reduce flaring, or wasteful burning, of natural gas at wellheads contributed to the decline in output, Helms said. After drilling wells, operators increasingly are deciding not to immediately complete them.

That step, called hydraulic fracturing, pumps water, chemicals and sand into the shale layer to release the oil. The number of wells in this uncompleted stage rose by 40, to 650 in October as many awaited construction of gas pipelines so they can avoid flaring, Helms said.

The price drop is driven by weak world demand for oil in Europe and China, whose economies have weakened, the growth in U.S. domestic shale production and decisions by Middle East and other oil producers not to reduce output.

“Everybody seems to be sharing the view that crude oil is in a free fall,” said Walt Breitinger, president of Breitinger & Sons, a commodities futures trading firm in Valparaiso, Ind. “Right now, it appears that demand is continuing to wane.”

Amid the turmoil in markets, the growth in crude oil shipping by rail hasn’t slowed. North Dakota officials said 60 percent of the state’s crude oil was shipped on trains, on par with recent levels.

The state’s Industrial Commission on Tuesday approved new crude oil conditioning regulations, a safety measure that takes effect April 1. The rules likely will require a $20 million investment by North Dakota producers, and add 10 cents per barrel in operating costs, Helms said. The investment, he said, is mainly for vapor-recovery systems to heat crude oil at the wellhead and extract gases that otherwise condense back into liquids, posing risk during transportation.

Rail safety concerns

Such volatile components have been a concern of rail safety advocates after a series of oil train disasters. On Friday, a La Crosse, Wis.-based group, Citizens Acting for Rail Safety, criticized the new regulations as insufficient to reduce the explosive risk of oil trains.

Updated rail traffic reports obtained by the Star Tribune indicate even more Bakken oil trains now cross Minnesota, with most shipments passing through the Twin Cities.

On the Canadian Pacific Railway through the Twin Cities, the average number of oil trains has risen to nine per week, compared with four in June, according to a Dec. 1 report filed by the railroad with Minnesota authorities and released under the state Data Practices Act.

Bakken oil trains, typically of 100 tank cars or more, carry at least 1 million gallons of crude oil each. Many are destined for refineries on the East Coast or eastern Canadian provinces.

BNSF Railway, an even bigger hauler of North Dakota crude, reported in November a change in traffic patterns for oil trains, running fewer trains through far southwest Minnesota. But the traffic levels — a range of 37 to 52 oil trains per week — remained unchanged, the report said. Up to 39 BNSF oil trains pass through the Twin Cities per week, the railroad reported.

Actually, the U.S. Dollar is made stronger when we create more items we can successfully sell on the world market. Such items create demand for our dollars and cause more of our dollars to be spent here.

Oil coming from unexpected places in the US is just that sort of paradigm shifter.

Our production of ANYTHING marketable more than could have been anticipated does this. The same thing would be true if our food production magically doubled or our electricity prices shot downward.

Amazing. 37 posts so far and no one has touched on the second part of discussion on this thread, what effect will the cowardly, gutless, spineless, opportunists in DC have. AS far as I’m concerned it is SNAFU (situation normal all F’ed up). One thing I’m pretty sure of is the slime ball ruling class, being the opportunists they are, will try to take advantage of the dip in fuel costs to increase fuel taxes. That is not just in DC but state houses all around the country. Here in California we have ‘carbon taxes” taking effect on the first of the year. Our only saving grace was these passed when prices were high. I shudder to think what they would have been if they had foreseen this opportunity.

Gross Says Fed May Become ‘Dovish’ as Oil Prices Plunge

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.