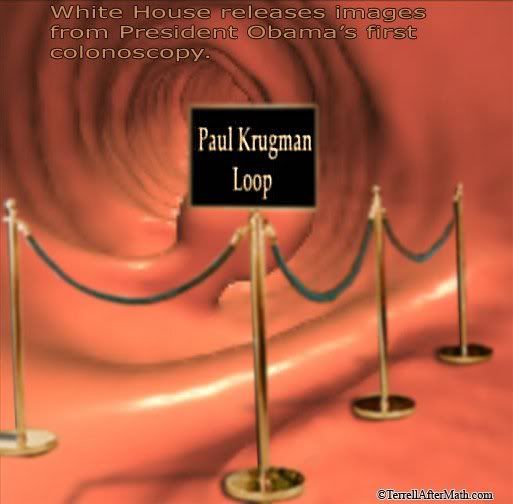

This was written by a Nobel prize winning economist without a trace or sarcasm, irony or humor. It is excerpted, and presented without commentary.

From the New York Times:

Debt Is Good

... the point simply that public debt isn’t as bad as legend has it? Or can government debt actually be a good thing?

Believe it or not, many economists argue that the economy needs a sufficient amount of public debt out there to function well. And how much is sufficient? Maybe more than we currently have. That is, there’s a reasonable argument to be made that part of what ails the world economy right now is that governments aren’t deep enough in debt.

I know that may sound crazy. After all, we’ve spent much of the past five or six years in a state of fiscal panic, with all the Very Serious People declaring that we must slash deficits and reduce debt now now now or we’ll turn into Greece, Greece I tell you.

But the power of the deficit scolds was always a triumph of ideology over evidence, and a growing number of genuinely serious people — most recently Narayana Kocherlakota, the departing president of the Minneapolis Fed — are making the case that we need more, not less, government debt.

Why?

One answer is that issuing debt is a way to pay for useful things, and we should do more of that when the price is right. The United States suffers from obvious deficiencies in roads, rails, water systems and more; meanwhile, the federal government can borrow at historically low interest rates. So this is a very good time to be borrowing and investing in the future, and a very bad time for what has actually happened: an unprecedented decline in public construction spending adjusted for population growth and inflation.

Beyond that, those very low interest rates are telling us something about what markets want. I’ve already mentioned that having at least some government debt outstanding helps the economy function better. How so? The answer, according to M.I.T.’s Ricardo Caballero and others, is that the debt of stable, reliable governments provides “safe assets” that help investors manage risks, make transactions easier and avoid a destructive scramble for cash.

* * *

[L]ow interest rates, Mr. Kocherlakota declares, are a problem. When interest rates on government debt are very low even when the economy is strong, there’s not much room to cut them when the economy is weak, making it much harder to fight recessions. There may also be consequences for financial stability: Very low returns on safe assets may push investors into too much risk-taking — or for that matter encourage another round of destructive Wall Street hocus-pocus.

What can be done? Simply raising interest rates, as some financial types keep demanding (with an eye on their own bottom lines), would undermine our still-fragile recovery. What we need are policies that would permit higher rates in good times without causing a slump. And one such policy, Mr. Kocherlakota argues, would be targeting a higher level of debt.

* * *

Now, in principle the private sector can also create safe assets, such as deposits in banks that are universally perceived as sound....

* * *

* * *

At this point we stopped reading.