Posted on 04/22/2017 11:01:48 AM PDT by SeekAndFind

By age 50, your golden years are just around the corner.

To be financially ready to retire by 67, retirement-plan provider Fidelity Investments says you should aim to have eight times your salary saved by age 60.

Are Americans on track?

According to a report from the Economic Policy Institute (EPI), many Americans have some catching up to do. The mean retirement savings of a family between 50 and 55 years old is $124,831. For families with members between 56 and 61, the mean retirement savings is $163,577.

But those numbers aren't representative of the state of American retirement. Since so many families have zero savings and since super-savers can pull up the average, the median savings, or those at the 50th percentile, may be a better gauge than the mean.

The median for families between 50 and 55 is only $8,000. For families between 56 and 61, it's $17,000.

(Excerpt) Read more at cnbc.com ...

I’ll be able to retire when they carry my corpse away from my desk. I can easily see that that’s how it’s going to be.

I’m not worried. I will have Social Security...

I know I know. I couldn’t stop laughing either.

Me? I plan to work until I have enough money to last me the rest of my life.

I figure I should be able to retire when I’m 80...

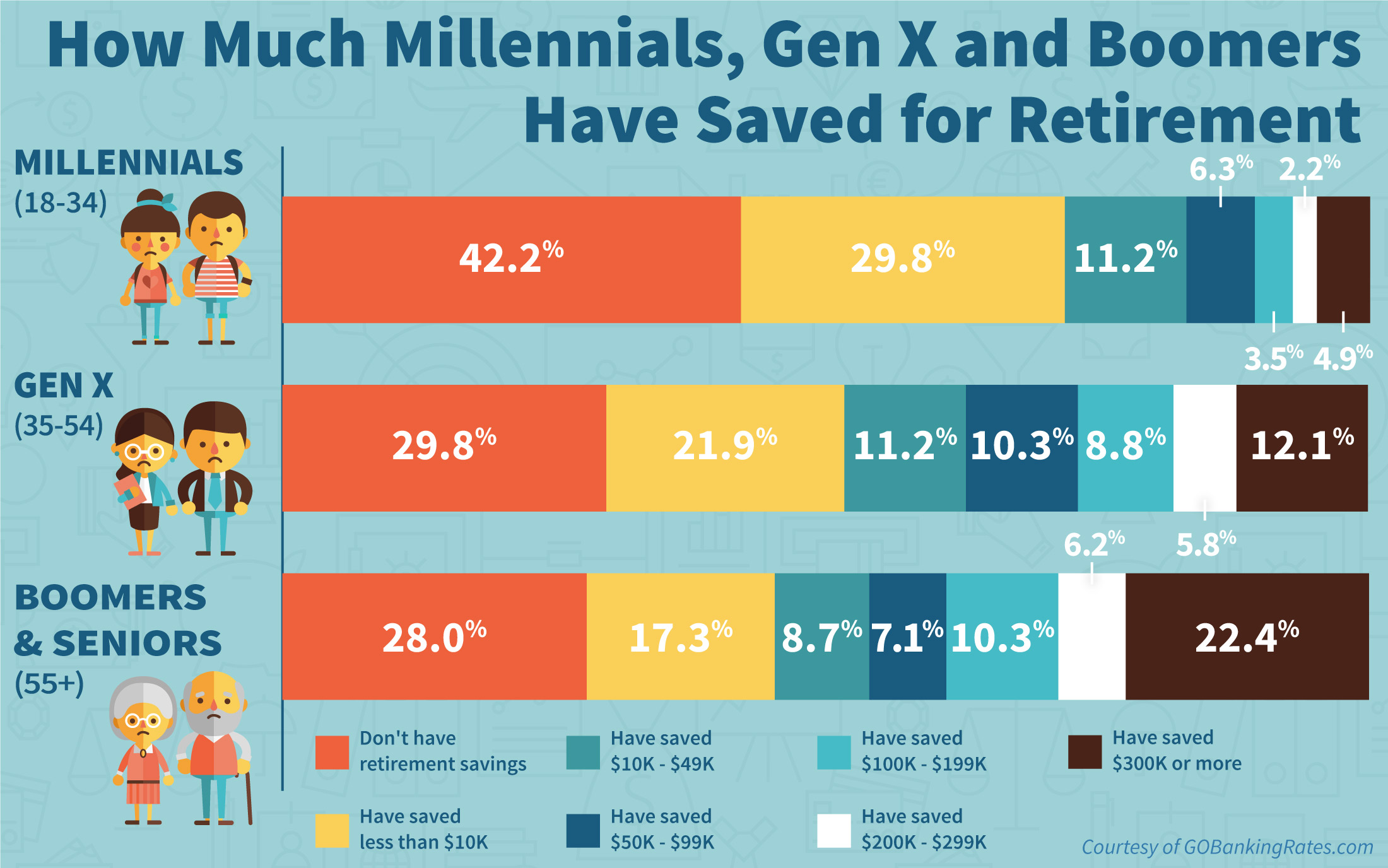

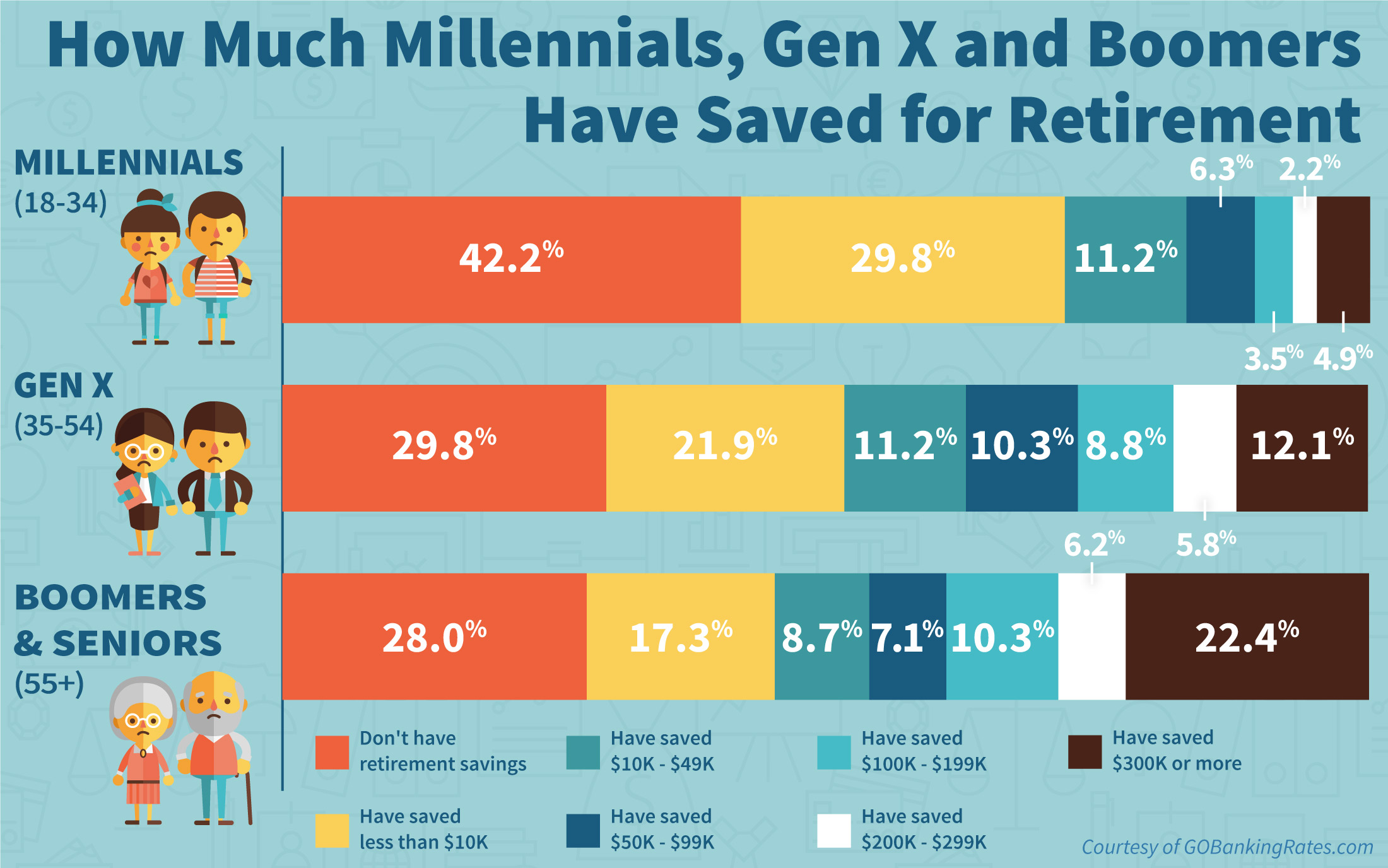

This chart is a progressives wet dream. All those greedy rich people with savings to tax on one side to give to the non-saver majority on the other side. Everyone must be equal. It’s not fair that others have more than anyone else.

But folks approaching age 60 now and everyone younger: The house was a piggy bank, constantly remortgaged or accruing new debt with second mortgages. Career-long jobs are rare, so very few families have had a chance to build up savings without debt. All of that is why these numbers are meaningless: What is the real amount of available wealth adding or subtracting for home equity and subtracting all debt? I'd wager than an incredibly small number of folks getting near retirement are in acceptable financial shape by that standard.

I could easily retire today. I work because I choose to.

hey..don’t knock it.

I’m there and I didn’t think it would be here.

so, keep working so I can continue to collect my check....

Good news my FRiends.

Applied for a job, thought I aced the phone interview. Then they asked for an in-person this coming week.

Can’t wait to donate to FR. I’m excited and nervous.

Been hopin and changin for the past 8yrs, independent contractor can’t live on but better than nothing.

Will be quite a transition but I need to make some money.

An entire population class too old to work and too poor to support themselves.

Watch for the 'bail-in', or whatever they call it when they convert your savings/401k into the failing Social Security funds. Because 'it's needed'.

The best thing to own at retirement age is going to be a gun to defend yourself from leftists.

I bet one could count on one hand the number of middle-class workers who have that much saved away. Even without a Regressive government chipping away at our earnings with both fists it would be next to impossible to save that much.

They must be talking about lotto winners...

My Dad worked everyday until he was 91 and had a stroke. Mentally he is all there would go back to work if he could physically. He saved and invested to where he didn’t need to work after age 70 but that was not in his genes.

I will be the same way. I am a business owner and have saved and invested well enough to take care of my needs and my Kids lives. Have no debt but will work like my Dad as long as I am healthy. I fall into the Boomer range of having saved 300K or more. More is the key word for me.

Ever hear the song? ‘ I dont wanna work, I just want to bang on the drums all day’. At age 61 now I’m wanting to ditch the working on a job and work on things I wanna do. Hopefully I’ve gathered enough acorns or need to switch to another source of legal revenue.

When I was 50, I actually had 10.64 times my then annual salary in hard-dollar savings. By the time I retired at age 61, I had 24.45 times my final salary.

But it is very tough to save this much, I’m probably the only one here who did it.

Good luck on the in-person.

I went through a few years of it until about 4.5 years ago. It was tough at times. Depressing usually.

During the Obama recession, I got laid off twice. Wiped out my retirement to pay bills and stay afloat, so at 52, I am having to start all over.

Thank you Obama

I considered myself pretty well set going into 2007 - 2008 but unfortunately cannot say that any longer. I’ve got 15 to 20 years to correct the situation or will need to work until I die. That, or depend solely on Social Security and a very small pension assuming it survives. I suspect many are in the exact same situation.

Congrats and nicely done. At age 61 I’m about 1/2 the results you had. Not bad but you’re an Ace.

The secret is compounded earnings. If you save aggressively when you are young, the compounded growth is amazing. Just the growth of my investments last year was over 4 times my annual salary.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.