Posted on 08/29/2009 9:17:47 AM PDT by george76

Arguably, today investors face the polar opposite of conditions that existed only a few months ago, with economic optimism, improving valuations and positive sentiment.

To most investors, today the fear of being in has now been eclipsed by the fear of being out as the animal spirits are in full force. Bears are now scarce to nonexistent in the face of steady price gains in equity and credit prices.

As if the movie is now being shown in reverse, the bull is persistent, stock corrections are remarkably shallow, cash reserves at mutual funds have been depleted, and hedge funds hold their highest net long positions in many moons.

Cost cuts are a corporate lifeline and so is fiscal stimulus, but both have a defined and limited life.

The credit aftershock will continue to haunt the economy.

Commercial real estate has only begun to enter a cyclical downturn.

Municipalities have historically provided economic stability -- no more.

(Excerpt) Read more at thestreet.com ...

I am of the belief that any rally the stock market has is a superficial temporary one. Once the financial markets and all the economic indicators look at the unsustainable government spending of this administration, I believe you will see investors leave the stock market in order to protect themselves against the coming inglationary period. Therefore I believe at some future time and maybe not that far away, the stock market will crash and we will enter a true 1930’s style depression unless moral fiscal and financial responsibility and accountability begin immediately by the government including all state governments as well. I believe consumer and investor confidence is flatlining and will probably remain so for a long time. The government is doing nothing to create jobs except in the govenrment sector which is unsustainable over a long period of time because of wages and benefits that must be paid to these individuals not to mention the unions that will guard their governmment jobs for them.

I am of the belief that any rally the stock market has is a superficial temporary one. Once the financial markets and all the economic indicators look at the unsustainable government spending of this administration, I believe you will see investors leave the stock market in order to protect themselves against the coming inglationary period. Therefore I believe at some future time and maybe not that far away, the stock market will crash and we will enter a true 1930’s style depression unless moral fiscal and financial responsibility and accountability begin immediately by the government including all state governments as well. I believe consumer and investor confidence is flatlining and will probably remain so for a long time. The government is doing nothing to create jobs except in the govenrment sector which is unsustainable over a long period of time because of wages and benefits that must be paid to these individuals not to mention the unions that will guard their governmment jobs for them.

Translation = Dow 10,000 next week

Won’t happen without a fair, free press. One that will accurately report what the government is doing and how it affects people.

I have been trying to fund that since 2006. No takers.

We certainly can't rely on the MSM to accurately report on financial hazards, but others around the world are watching closely. You can fool all of the countries some of the time, and some of the countries all of the time, but you can't fool all of the countries all of the time.

Maybe, but the market is still levitating on thin air. How can you have a healthy market with an economy that's carrying a massive debt load, 10 - 16 percent unemployment and facing higher taxes and inflation?

“I believe you will see investors leave the stock market in order to protect themselves against the coming inglationary period.”

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

I think so too! Monetary inflation coupled with increasing glaciation is very scary 80)

Also, when these commercial real estate loans start trying to get refinanced, they are going be up sh!t creek without a paddle. The commerical real estate issue is a ticking time bomb that is waiting to explode and drop the bottom out of the market.

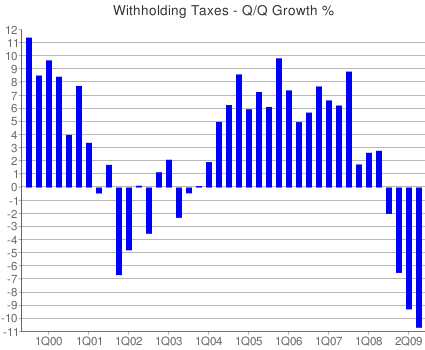

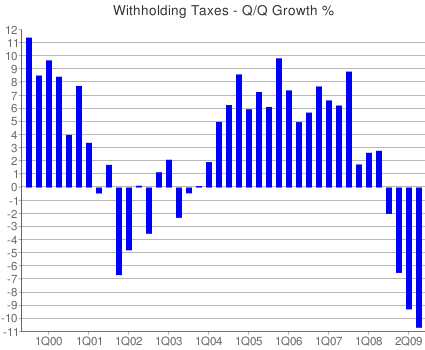

Very interesting and alarming chart, which clearly indicates the Dems will be overly utilizing ‘other’ sources to tax and tax and tax again.

We have more information available to us now than ever before.

bump

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.