Skip to comments.

There will be another crisis. It’s just a question of when

The Telegraph ^

| 16 Feb 2016

| Ben Wright

Posted on 02/17/2016 3:51:40 AM PST by expat_panama

Financial bubbles are inevitable and their pathologies virtually identical. The only variable is timing. This is why financial crises appear so obvious in hindsight yet remain frustratingly difficult to predict... ...Markets are, Harding argues, human constructs. As such, they are prey to every human foible. His comprehensive chronicle of speculative mania and panics was meant to hammer home the point...

...Such financial crises tend to occur every two to three years on average, according to Danske Bank, which helpfully points out that the last one, the European sovereign debt crisis, ended more than three years ago.

The pattern is always the same. Cheap money floods the financial system. In 19th century Japan it was compensation payments...

...money flows into the less risky assets and pushes their yield (which moves inversely to price) down. Investors get greedy and start searching for higher yields among riskier assets. They also start borrowing money to make these investments. This drags in the banks. Leverage builds up. Bubbles start to inflate.

So where might this currently be happening? Where to begin? Emerging market debt is a good candidate...

...we have still got London house prices, government bonds, and energy companies (especially US shale producers), to name but a few frothy assets...

...all eyes are trained on the meeting of G20 finance ministers and central bank governors in Shanghai, appropriately enough, on February 26 and 27 to see how they will respond.

Bubbles always burst. But some grow a little larger and float a touch longer on the breeze before they do. The question, therefore, is not "if" but "when". One wrong step by the world's central banks and that could be sooner rather than later.

(Excerpt) Read more at telegraph.co.uk ...

TOPICS: Business/Economy; Foreign Affairs; News/Current Events

KEYWORDS: crisis; economy; goldbug; goldbugs; investing; tinfoiledagain

To: expat_panama

I’m getting that weird feeling, like we’re coming to an intersection and I want to scream, “HARD RIGHT! HARD RIGHT!”

To: expat_panama

The break will occur in the junk bond (”High yield”) market. Some of these are now unpayable due to collapsed oil revenues that have just become unhedged. Other yields bumped up nearly 3% when the Fed raised to 0.25.

This crash or default in bonds will crush the earnings of Pension funds. Government will print to the moon to ensure Government pensions get paid.

Fiat currency will unravel, plummeting to its true value.

Buy Silver, Gold and make the usual Freeper preps.

3

posted on

02/17/2016 4:23:05 AM PST

by

agere_contra

(Hamas has dug miles of tunnels - but no bomb-shelters.)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

To: Read Write Repeat

want to scream, "HARD RIGHT! HARD RIGHT!"Yeah, that cliff's bothering you, me, and a lot of people.

To: expat_panama

There will be another crisis? This is not rocket science. Just look at history, and the answer will always be yes.

Just like asking, will there be another war?

This article is just full of nothingness.

6

posted on

02/17/2016 4:34:13 AM PST

by

redfreedom

(Voting for the lesser of two evils is still voting for evil.)

To: agere_contra

Fiat currency will unravel, Yelling a four-letter word beginning w/ 'F' may be great at a New Hampshire rally but in the adult world we try to make sense. Reality is that all money is set by gov't fiat. If it's not gov't fiat it's bartering. When someone pretends and insists that his gold or his silver or his palladium is some how "real" money and my dollar bills are not --it's well, delusional.

To: expat_panama

I am venturing a guess that the number 21 trillion as the trigger. We as the base of this house of cards will fall. Based on CBO projections, that will be what about 2020?

8

posted on

02/17/2016 4:41:48 AM PST

by

catfish1957

(I display the Confederate Battle Flag with pride in honor of my brave ancestors who fought w/ valor)

To: expat_panama

Yeah, that cliff's bothering you, me, and a lot of people. Cliff's in all three forward directions now. We have painted ourselves into the proverbial corner.

9

posted on

02/17/2016 4:44:00 AM PST

by

catfish1957

(I display the Confederate Battle Flag with pride in honor of my brave ancestors who fought w/ valor)

To: expat_panama

Please add me to your ping list.

To: catfish1957

...21 trillion...What, national debt?

To: Gadsden1st

To: expat_panama

13

posted on

02/17/2016 4:49:40 AM PST

by

catfish1957

(I display the Confederate Battle Flag with pride in honor of my brave ancestors who fought w/ valor)

To: expat_panama

“Yeah, that cliff’s bothering you, me, and a lot of people.”

We went over the cliff a long time ago.

Now the question is how long till we hit the bottom?

14

posted on

02/17/2016 4:56:14 AM PST

by

Kozak

(ALLAH AKBAR = HEIL HITLER)

To: expat_panama

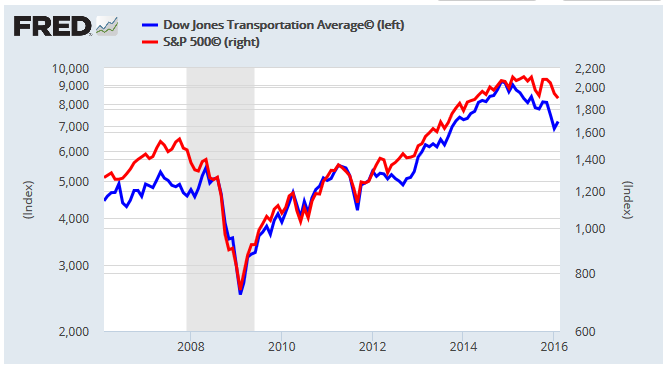

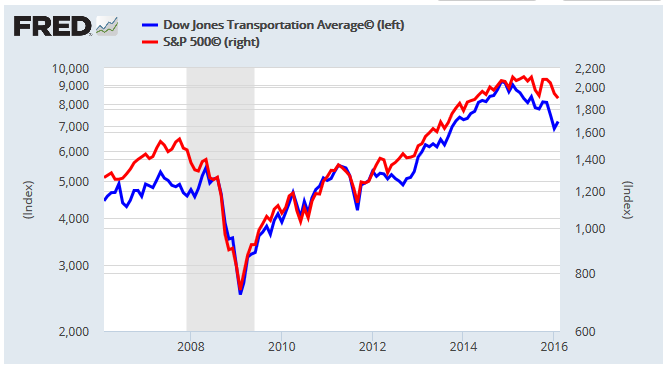

http://www.marketwatch.com/story/what-the-curiously-strong-dow-transports-say-about-stocks-2016-02-17?dist=beforebell

Opinion: What the curiously strong Dow Transports say about stocks

By Mark Hulbert

Published: Feb 17, 2016 5:24 a.m. ET

The Transports and the broader Dow Industrials are diverging, which is a bullish sign

CHAPEL HILL, N.C. (MarketWatch) — One of the most bullish sub-surface developments in the stock market is the surprising strength of the Dow Jones Transportation Average.

Whereas the broader Dow Jones Industrial Average DJIA, +1.39% has fallen 1.6% in February, the Dow Transports DJT, +2.28% are sitting on a 4.4% gain. (See the chart at the top of this column.) It’s unusual for a divergence this large — 6 percentage points — to materialize over so short a period.

One reason this divergence is bullish: The Transports tend to be a decent leading indicator. A recent case in point came in mid-December: That’s when I wrote that the Transports were “unusually weak.†As we know now, the broad market at that time was about to suffer a 10%-plus correction.

This is just one data point, of course, but there is more systematic evidence that supports the notion that the transportation sector is a good leading indicator. Consider a study conducted by the Bureau of Transportation Statistics in the U.S. Department of Transportation, titled “The Freight Transportation Services Index as a Leading Economic Indicator.†The study’s authors concluded that this index over the past three decades “led slowdowns in the economy by an average of four to five months.â€

snip

15

posted on

02/17/2016 6:21:49 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

Your dollar bills are not real money.

Dollar bills are currency. Like any other Fiat currency they have no value in themselves. If you hold dollars you are completely at the mercy of the issuer.

If the issuer creates trillions of dollars (or pounds, yen etc) and that Fiat finds its way into circulation, then your purchasing power is destroyed.

But real money retains its value. That is one of the attributes of money - that it has an intrinsic value that provides its purchasing power. It has no counter-party risk.

Don't believe me? Then just hang on a few months. A lot of monetary delusions are going to be dispelled this year.

16

posted on

02/17/2016 9:58:30 AM PST

by

agere_contra

(Hamas has dug miles of tunnels - but no bomb-shelters.)

To: agere_contra

...dollar bills are not real money. Dollar bills are currency. -- and when we're on a philosophy or religion thread we can say "currency" is not money. This is an econ thread and words mean things.

From Mrriam-Webster:

Definition of money

plural moneys or mon·ies \ˈmə-nēz\

-

1 : something generally accepted as a medium of exchange, a measure of value, or a means of payment: as a : officially coined or stamped metal currency b : money of account c : paper money

What is 'Money'

An officially-issued legal tender generally consisting of currency and coin. Money is the circulating medium of exchange as defined by a government. Money is often synonymous with cash, including negotiable instruments such as checks. Each country has its own money, or currency, that is used as a medium of exchange within that country (some countries share a type of currency, such as the euro used by the European Union).

To: abb

the curiously strong Dow Transports

The data the article posted was just this month, but historically I'm seeing a lot of minor divergence and never w/ no particular signal lurking.

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson