Posted on 12/02/2017 1:37:52 AM PST by Kaslin

FINAL UPDATE - The votes are in, and the ayes have it. After a marathon evening of debating and considering amendments, the US Senate has approved the GOP's tax reform bill, which would simplify the tax code and cut taxes for the vast majority of American households, small businesses and corporations. Every Republican voted yes, except for Tennessee's Bob Corker. Democrats uniformly voted no. This is a big legislative victory for the GOP, which overcame a great deal of ferocious opposition -- much of it rooted in misinformation -- to pass the legislation. Up next, a conference committee with the House. But here's your summary for tonight:

FINAL: With Vice President Pence presiding, the US Senate approves a major tax cut & simplification package, 51-49. The bill will now head to a conference committee, where it will be merged with the House-passed bill.— Guy Benson (@guypbenson) December 2, 2017

UPDATE III - It's now looking official: Senate Republicans have the votes to pass tax reform. Arizona's Jeff Flake announced he's jumping on the bandwagon, and the finalized legislation includes a (paid for) amendment sought by Maine's Susan Collins that mirrors the House-passed SALT (state and local tax deduction) compromise. That strongly suggests that she'll be a "yes," too. Add it up, and that's 51, negating the need for Vice President Pence to break a potential tie. Depending on Bob Corker's mood in a few hours, McConnell might even get all 52 GOP votes. But all he really needs is 50-plus-one, and he says he's got 'em:

BREAKING: McConnell walks onto the floor and tells reporters: “We have the votes.”— Frank Thorp V (@frankthorp) December 1, 2017

ORIGINAL POST - The Republican-held House of Representatives did its part by passing a tax overhaul earlier this month, with zero Democrats supporting the effort. That bill cut taxes and boosted after-tax incomes, on average, across every income group in the country, and is projected by nonpartisan analysts to grow the US economy and create close to one million new full-time jobs. It would also lower the tax burden on job-creating small businesses (key small business advocacy groups have endorsed the Republican push), and make America's extremely high statutory and effective corporate tax rates far more competitive internationally. But we've seen this movie before. With the "resistance" in full demagogic throat, and Democrats bound in lockstep opposition, will the GOP's narrow Senate majority fumble the ball, as they did on Obamacare? We'll know soon enough, and tea leaves are mixed. A vote is expected later today. As we brace what's next, let's first note three developments from yesterday (see update) that may portend a successful outcome (see update II) for Mitch McConnell's conference:

(1) John McCain is a committed "yes." As the Senator who more or less single-handedly killed his party's "repeal and replace" efforts in July, having him clearly on board is a huge boon to Republican leadership. McCain's official statement touted the expected benefits of the bill -- acknowledging concerns about it, but ultimately determining that the legislation's upside was strong enough to secure his support:

After careful consideration, I have decided to support the Senate #TaxReform bill. Though not perfect, this bill will deliver much-needed reform to our tax code, grow the economy & provide long overdue tax relief for American families. https://t.co/BeWZAT0SjM pic.twitter.com/6qwYhmyE5p— John McCain (@SenJohnMcCain) November 30, 2017

He even specifically addressed and endorsed the proposal's provision that would repeal Obamacare's tent pole, the federal individual mandate tax: "I have also argued that health care reform, which is important both to the well-being of our citizens and to the vitality of our economy, should proceed by regular order. This bill does not change that. As a matter of principle, I’ve always supported individual liberty and believe the federal government should not penalize Americans who cannot afford to purchase expensive health insurance. By repealing the individual mandate, this bill would eliminate an onerous tax that especially harms those from low-income brackets. In my home state of Arizona, 80 percent of people who currently pay the individual mandate penalty earn less than $50,000 per year," he wrote.

(2) The nonpartisan Joint Committee on Taxation released its "dynamic scoring" analysis that the Senate bill would add less than $1 trillion to deficits over a decade, as opposed to the on-paper $1.4 trillion figure reached under "static scoring." The reason for this is that JCT anticipates the tax relief package would add nearly one percentage point to GDP growth over the next ten years, resulting in new revenues. Many supporters will argue that JCT underestimates the economic benefits of tax reform, but their report still offers two positive data points:

Jt Tax Cmte forecasts tax bill will increase GDP "by about 0.8 percent on average over the 10- year budget window. That increase in income would increase revenues, relative to the conventional estimate of a loss of $1,414 billion..by $458 billion over that period."— Chad Pergram (@ChadPergram) November 30, 2017

(3) For what it's worth:

Just spoke w/ Senate leadership source who I'd characterize as hopeful but never quite confident on the "repeal & replace" whip count over the summer. Sounds *much* more confident on tax reform today, despite some issues still being ironed out. #fwiw— Guy Benson (@guypbenson) November 30, 2017

That was the state of play late yesterday afternoon, with my well-placed source telling me McConnell and company were in a "really good place" in terms of corralling the requisite 50-plus-one votes. The source stopped short of guaranteeing passage at the time, but described potential holdouts as playing an active and "constructive" role in shaping the bill throughout the process, carried out through regular order. Susan Collins is said to be in a decent spot, and McConnell's "substitute amendment" (effectively the bill that was formally debated on the floor) was co-sponsored by...Lisa Murkowski. The three squeakiest wheels, I was told, were outgoing Tennessee Senators Bob Corker and Jeff Flake (who want a deficit-related "backstop" to reduce the tax cuts if economic growth falls short of targets), and Wisconsin's Ron Johnson. Johnson been characterized as a "hard no" in the media, but he's a pro-business, low-tax conservative at heart. I'm not so sure he's still in the 'nay' column, considering his evolving posture (this was from Wednesday evening-- and see update below):

We still have work to do, but I have been working with the administration and Senate leadership to make progress toward a better bill. - rj #taxreform— Senator Ron Johnson (@SenRonJohnson) November 29, 2017

The bigger challenges appear to stem from the other two Senators, who emerged at the center of some floor drama last evening, which bubbled to the surface in full view of reporters. (My source quoted above still sounds optimistic, but last evening was a setback). Relevant parties spent the overnight hours seeking to hammer out an accommodation to address Corker and Flake's deficit concerns after the Senate parliamentarian ruled that a proposed "trigger" mechanism compromise did not pass procedural muster under reconciliation rules. Might that eleventh-hour wrinkle cause the upper chamber GOP to once again face-plant? Stay tuned for the yeas and nays, which may again blow up in embarrassing fashion -- or could result in a big policy and political win for Republicans. In the meantime, the Left is shouting as loudly as possible to kill the bill. Some of their biggest claims are false. Equip yourself with the facts, and help educate others. The empirically-supportable truth is that the vast majority of taxpayers stand to benefit from tax reform. Nevertheless, every single Senate Democrat marched along to Chuck Schumer's beat and voted against even debating the proposal, some of whom defended their decision with nonsensical explanations like this:

I voted against the motion to proceed on the Republican #taxreform plan because I haven’t seen a final bill. I’m still trying to work w/ my R colleagues & @realdonaldtrump to find a bipartisan way forward.— Senator Joe Manchin (@Sen_JoeManchin) November 29, 2017

He couldn't vote to advance a debate over how the final bill would look because he...hadn't seen the final bill, or something. Got it. I'll leave you with a parting thought for Mssrs. Corker and Flake:

Think very carefully, Sens Flake & Corker.

If you jointly jeopardize tax reform, it would (a) risk defeating your own long-held policy goal, (b) reek of anti-Trump pettiness, & (c) reinforce idea that GOP should prioritize personal loyalty to Trump in primaries. Lose-lose-lose.— Guy Benson (@guypbenson) December 1, 2017

UPDATE - As I predicted above, Johnson is now a 'yes,' and despite last night's worrisome snag, my sources are telling me that things are again looking good. They stopped short of an airtight guarantee, but both said they expect a successful vote at some point today:

?? Sen. Ron Johnson tells Milwaukee radio WISN 1130 minutes ago he is a "yes" vote https://t.co/b0eJAzNIJL— J.D. Durkin (@jiveDurkey) December 1, 2017

"The question seems to be, how many Republican votes are they going to get? Is it going to be 50, 51, or 52? But, at this point...it would be really shocking if they didn't get to 50 which is what they need." - @guypbenson— America's Newsroom (@AmericaNewsroom) December 1, 2017

This is what I've heard within the last hour, having spoken w/ several plugged-in sources. Sounding like 49 locked-in 'yes' votes, w strong likelihood that at least 1 more comes into the fold. Leadership optimistic about a vote later today. https://t.co/59dtanMrcl— Guy Benson (@guypbenson) December 1, 2017

UPDATE II - It looks like this is happening (or maybe not?):

BREAKING: Second-ranking Senate Republican, John Cornyn of Texas, says GOP has the votes to pass sweeping tax overhaul.— The Associated Press (@AP) December 1, 2017

New: Sen. Bob Corker tells @siobhanehughes the bill will probably pass:

https://t.co/wspkmPMJ0H via @WSJ— Richard Rubin (@RichardRubinDC) December 1, 2017

Big potential problem for GOP leaders: Susan Collins disputes Cornyn’s claim that they have her support for the GOP tax bill. (They see her as their 50th and pivotal vote)

“I can’t imagine why Senator Cornyn is speaking for me,” she told me. “I speak for myself”— Laura Litvan (@LauraLitvan) December 1, 2017

Great news!

The corporatist entities are getting something here and some people will end up paying higher taxes.

Big business wants cheap labor in this country plus a welfare state us little folks pay for just like the folks in Canada have to do right now.

I support Trump on his immigration views and expect delivery down the road on keeping cheap labor out of the USA.

I’m willing to accept this “deal” that the “deal maker” in the White House has come up with.

But I am not willing to accept cheap labor importation front door through DACA or other means or back door through H1 visas or any other “work permits” etc. etc. etc.

Still not a done deal. The House and Senate bills are different and need to be reconciled.

I guess that makes it official.. I will be paying more in taxes according to their tables. I am subsidizing the uber wealthy, as usual and thise people with six kids.

When their six kids have grown, they will just love subsidizing, or will they?

Punished for being truly middle class,,

What table are you looking at?

The published tables on the senate site. After reconciliation who knows! I don’t have a lot of faith in the process.

Yup - you and other families that are losing the Personal Exemption.

"Doubling" the Standard Deduction is not "double" because of that.

The GOPe destroyed or capped almost every measly tax deduction we had (mortgage interest, SALT taxes, medical expenses, student loans, employment tuition benefits, etc.) all so the GOPe donors and corporations could make out like bandits. And someone had to "pay for" their huge tax cut in a revenue neutral budget - you and me. They soaked the middle class.

Those deductions (some like SALT have been in the Tax Code since 1913 to prevent double taxation) are not gone - FOREVER! We will never get them back. Taxes, however, can and will go up at the will of our Federal Masters.

Thanks a ton. MAGA is dead to me.

not = now

Thanks for posting. I got a lot of hateful comments from other Freepers because they like being subsidized.

I did like parts of the plan, but it’s truly spenderiffic. No wonder the senate supported it. If they can steal and spend, it’s gonna happen.

He is celebrating the market going nuts in anticipation of the corporates getting their tax break on the backs of middle and upper middle class taxpayers.

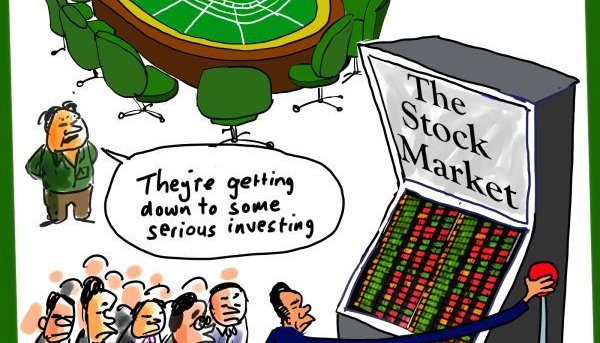

The flawed assumption of this entire enterprise is that by giving the corporations a massive tax break from 35% to 20%, they will "reinvest" that money.

Maybe some of it - but I believe most corporations will simply use it to buy back their own stock (as they have historically done).

The Goldman Sachs snake oil agents who wormed their way into the White House did their job.

The casino will pay out big - until it doesn't.

"We will massively cut taxes for the middle class, the forgotten people, the forgotten men and women of this country, who built our country....Tax relief will be concentrated on the working and middle class taxpayer. They will receive the biggest benefit and it won't even be close."**

Donald Trump, Scranton PA, Oct 2016

**Except for you middle class in NY, NJ, CA, IL, CT, WA, MA, and other states....and except for you middle class who deduct medical expenses, and except for large families who rely on the Personal Exemption, and except for you young people who deduct student loan interest, and except for you middle class who deduct mortgage interest, and except for you men who have to pay alimony, and except for you school teachers who deduct paying for school supplies out of your own pocket, and except for graduate students, and except for college students who get tuition benefits from parental employment, and...

I have never seen Free Republic so divided on any one issue as this tax bill.

The GOPe could have simply cut taxes for everyone or made the tax cut more fair.

They chose instead to pick "winners" and "losers."

Those of us losing, and who dared object, have been derided and called every name in the book, including "Communists", "A$$holes", "Stupid", etc.

The GOP will probably lose the House in 2018. The campaign commercials about Republicans raising taxes on many families so that corporations could get massive tax cuts will write themselves. And the democrats don't even need to lie this time.

Looking at the new brackets and rules for Child Tax Credit - it looks like we temporarily avoid a huge increase until each child ages out at 18.

In 2007 & 2008 we saw how the housing industry affects our overall economy. I wonder what ripple affect there will be now.

It certainly would be helpful to have more discussion on what a “subsidy” really is. Holy moly.

Yes, that is hand scrawling in the margins with last minute changes.

McConnell was so eager to jam this garbage bill through that they staffers didn't even have time to go into Microsoft Word and change the verbiage before they sent it to the copiers.

And this legislation will affect our nation for decades to come.

I thought we used to scream bloody murder when the Democrats did this with ObamaCare and other bills - jamming them through without even knowing what was in the final bill?

Oh well, what are standards if they can't be double standards?

GO TAKE SOME EFFING MEDICINE! There isn’t a tax bill yet. You’re beginning to pi$$ me off with your nutball ranting! SKY PILOT, BS, SKY IS FALLING PILOT!

The people who are "winners" in this bill already screamed at us what a "subsidy" is. If we have to pay higher taxes so they get lower taxes, then we are losing our deductions - and they were "subsidizing" us all along.

Like we were on welfare or something by claiming tax deductions that allowed us to keep more of our own money from Washington.

The House and Senate have both passed their bills. It's all over now but the crying.

The two bills have to go to Conference - or not. There is talk of Ryan simply allowing the passed Senate bill to go to the House floor for a vote as early as next week.

Even if it goes to Conference - there is going to be a bill along the framework that is in both of them - and at this point the bills are very, very similar. Both of them cut the corporate rate and send the tab to the middle class by destroying or capping our deductions.

Sorry you are SO UPSET AND SCREAMING AT ME IN CAPITOL LETTERS!

But both the House and Senate (now passed) bills are pieces of garbage that betrays many of us.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.