Posted on 12/03/2017 8:24:12 AM PST by 4Liberty

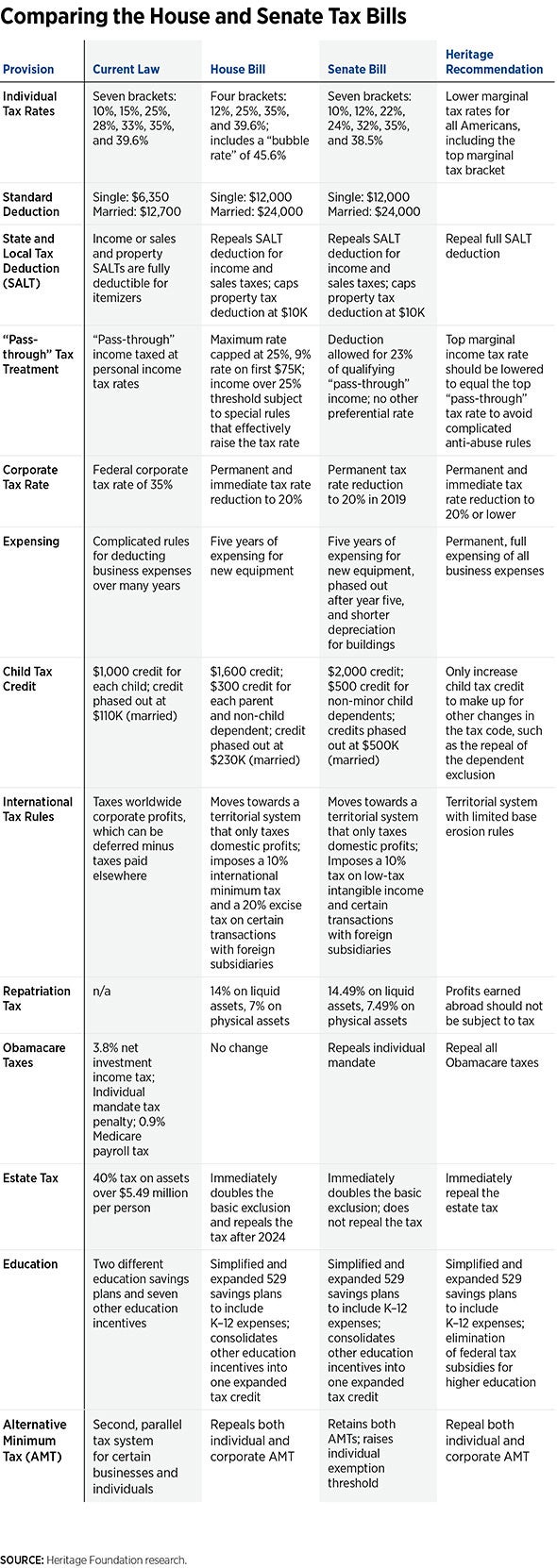

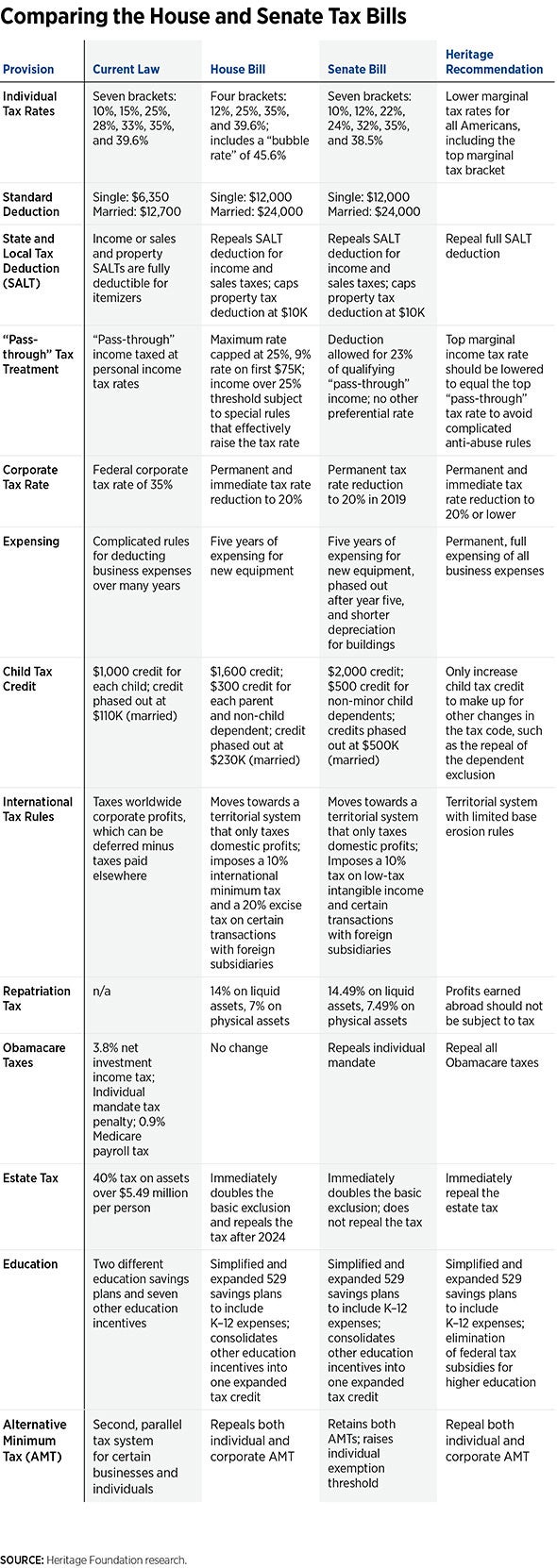

The House and Senate have now each passed different versions of Tax Cuts and Jobs Act...The bills now head to a conference committee where a unified bill will be crafted. Here are some of the major differences you need to know about.

(Excerpt) Read more at dailysignal.com ...

Oops, article is already posted here — http://www.freerepublic.com/focus/f-news/3610087/posts

It will never happen but I like the Heritage recommendations.

I thought the Senate version no longer did away with the SALT deductions.

I do not see where the Personal exemption goes away on the chart. Is that information elsewhere perhaps?

bump

The Senate version delays it but not the House version!!

Everyone Tweet POTUS to get them NOT to delay the 20% Corporate Tax rate!!!

I doubt that Mitch McDonnell has ant intention of passing a meaningful tax cut bill. Several of the Rino prima donnas will find some reason to reject it.

and what's this about lowering tax rates in the House version...they boost the 10% rate up to 12%.

Yours is the most URGENT ACTION we can take at this critical time. The last thing we need now is a 2018 RECESSION going into the 2018 election where we have the opportunity to elect more American Patriot Senators & Representatives. Those “reinforcements” are vitally needed to help wrest effective control of Congress from the ‘RAT/RINO Axis powers.

nor the additional deduction for 65 or blind.

Plus there’s no mention regarding disaster loss deduction

Collins’ amendments passed, which restored some SALT deductions:

‘Collins detailed in her statement how the caucus was able to gain her support. Four amendments Collins introduced were added to the tax bill. One would allow taxpayers to deduct up to $10,000 in state and local property taxes, and another would increase the medical expense deduction.’

http://m.washingtonexaminer.com/susan-collins-will-vote-for-the-gop-tax-bill/article/2642322

I don’t see how Capital Gains is handled in either bill

they couldn’t ever “double” the standard deduction like they said they were going to ....doubling 12,700 is $25,400 not $12,000.””

Read it again-—follow the lines straight across...

except for the child tax credit recommendation - not smart and not consistent with their stand on 529 for K-12.

I guess the question is what is the House’s strongest play that will be accepted by the Senate?

I don’t think delaying it will matter that much. This tax bill is actually pretty good for the Middle Class because it should expand job opportunities and lower the cost of living through the lowering of taxes on corporations.

I think the House should push for whatever improvement it can get and then support it fully. We can’t let perfection be the enemy of the good. Another way to look at it is which of these tax cuts would we get if Democrats were in power. That’s right - ZERO. The Democrats are the party of tax increases.

http://money.cnn.com/2017/11/02/news/economy/house-tax-reform-bill-individuals/index.html

Eliminates personal exemptions: Today you're allowed to claim a $4,050 personal exemption for yourself, your spouse and each of your dependents. The House bill eliminates that option.

For families with three or more kids, that could mute if not negate any tax relief they might enjoy as a result of other provisions in the bill.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.